South America Industrial Automation Services Market Size, Share, Growth Trends, Industry Analysis, Key Players, Investment Opportunities and Forecast (2025-2032)

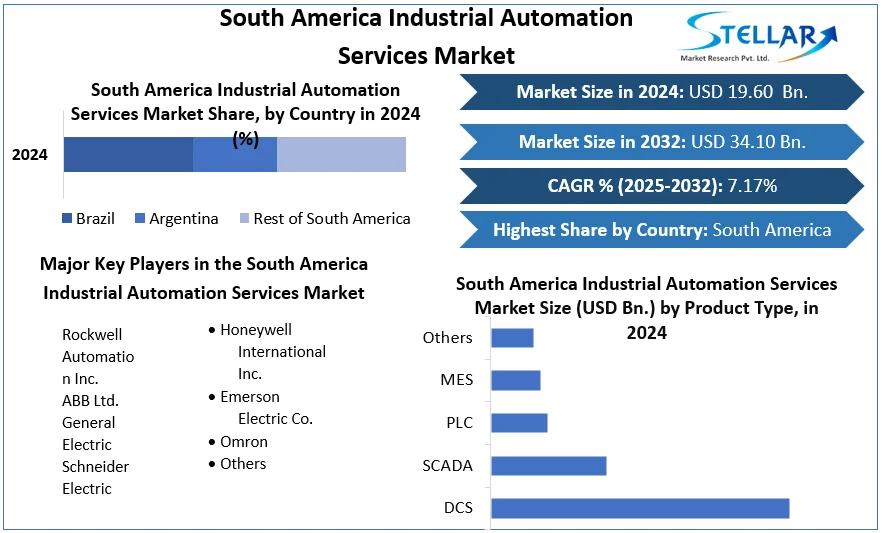

South America Industrial Automation Services Market is estimated to grow at a CAGR of 7.17% and is expected to reach at US$ 34.10 Bn. by 2032.

Format : PDF | Report ID : SMR_262

South America Industrial Automation Services Market Overview & Dynamics:

The continual demand for effective automated systems is a major growth-inducing element for the South American Industrial Automation Services Market. As a result, a number of businesses are investing to help with research and development for these services. Aside from that, the necessity to automate repetitive work and optimise company processes has grown across all industries as a result of increased industrialization and urbanisation.

To get more Insights: Request Free Sample Report

The integration of digital and physical parts of manufacturing has always revolutionised the automation sector, with the primary goal of offering maximum performance. Furthermore, the market's growth has been aided by an emphasis on zero waste production and shorter time to market. Manufacturing companies in South America are increasingly prioritising investments in technology related to the Industry 4.0 trend. Because of the increased acceptance of automation technologies in the manufacturing sector, Mexico is predicted to have a large adoption of factory automation and industrial control systems as part of the South America area. The implementation of Industry 4.0 and smart factory rules across the region's manufacturing sector has also contributed to the increase.

South America Industrial Automation Services Market Segmentation:

The report covers all segments in the South America industrial automation services market such as type of service, product type, and end user. Based on End User, Discrete Industries is estimated to grow at a CAGR of 8.10% over 2025-2032 thanks to growing adoption of automation across the packaging, automotive, and electronics & semiconductor industries in South American economies.

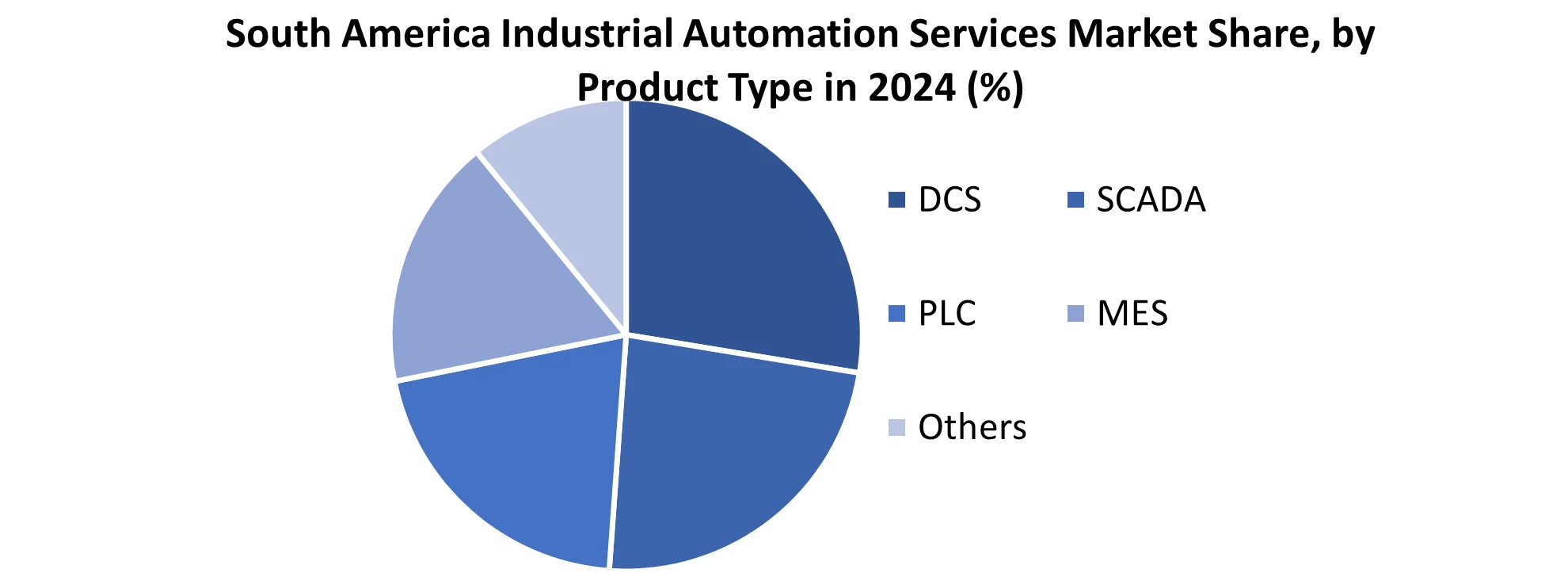

In 2024, SCADA segment was valued US$ XX Bn. Data can be transferred between a central host system and a number of remote terminal units (RTUs), PLCs, and operator terminals using SCADA (Supervisory Control and Data Acquisition) systems. These systems are utilised in process automation for applications such as power distribution, natural gas distribution, and water pipeline distribution, where remote data must be collected via potentially unreliable or intermittent low bandwidth/high-latency networks. These systems are used to automate complex industrial procedures where human control is not feasible.

Likewise, the report will provide an accurate prediction of the contribution of the various segments to the growth of the South America industrial automation services market size.

South America Industrial Automation Services Market Country-wise Analysis:

Brazil is the largest South American market, and it economically and commercially dominates the neighbouring regions. With a market value of US$XX Bn in 2024, Brazil held the greatest market share; the market is predicted to grow at a CAGR of 10.25 percent from 2025 to 2032. The manufacturing industry in the country is the third-largest in the Americas. Manufacturing contributes significantly to Brazil's industries, which account for one-third of the country's GDP. The south and southeast of the country are home to the majority of the country's main manufacturing companies. To complete sales, automation firms in the country usually work through a local distributor, agent, or integrator.

Brazil plans to take advantage of robotics' benefits as both a business and a consumer. Brazilian robotics imports are expected to rise in the next years, expanding the adoption of industrial automation and control systems, according to the International Federation of Robotics. Brazil also had 4,000 industrial robots deployed, with the automotive industry accounting for roughly half of all industrial robots sold in the country.

South America Industrial Automation Services Market Competitive Landscape:

In recent years, major players in the industrial automation services market have taken several strategic measures, such as facility expansions and partnerships. For Example:

- Rockwell Automation Inc. and PTC announced Factory Insights as a Service in June 2020, a turnkey cloud solution that allows manufacturers to achieve unprecedented impact, speed, and scale with their digital transformation initiatives.

- Emerson Electronics Co. introduced a new line of RXi industrial display and panel PC devices in January 2020, with the goal of lowering lifecycle costs and improving production processes in the life sciences, electricity and water, metals and mining, manufacturing, and equipment industries.

The objective of the report is to present a comprehensive analysis of the South America Industrial Automation Services Market to the stakeholders in the industry. The report provides trends that are most dominant in the South America Industrial Automation Services Market and how these trends will influence new business investments and market development throughout the forecast period. The report also aids in the comprehension of the South America Industrial Automation Services Market dynamics and competitive structure of the market by analyzing market leaders, market followers, and regional players.

The qualitative and quantitative data provided in the South America Industrial Automation Services Market report is to help understand which market segments, regions are expected to grow at higher rates, factors affecting the market, and key opportunity areas, which will drive the industry and market growth through the forecast period. The report also includes the competitive landscape of key players in the industry along with their recent developments in the South America Industrial Automation Services Market. The report studies factors such as company size, market share, market growth, revenue, production volume, and profits of the key players in the South America Industrial Automation Services Market.

The report provides Porter's Five Force Model, which helps in designing the business strategies in the market. The report helps in identifying how many rivals are existing, who they are, and how their product quality is in the Market. The report also analyses if the South America Industrial Automation Services Market is easy for a new player to gain a foothold in the market, do they enter or exit the market regularly if the market is dominated by a few players, etc.

The report also includes a PESTEL Analysis, which aids in the development of company strategies. Political variables help in figuring out how much a government can influence the Market. Economic variables aid in the analysis of economic performance drivers that have an impact on the Market. Understanding the impact of the surrounding environment and the influence of environmental concerns on the South America Industrial Automation Services Market is aided by legal factors

South America Industrial Automation Services Market Scope:

|

South America Industrial Automation Services Market |

|

|

Market Size in 2024 |

USD 19.60 Bn. |

|

Market Size in 2032 |

USD 34.10 Bn. |

|

CAGR (2025-2032) |

7.17% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

By Type of Service

|

|

By Product Type

|

|

|

|

By End User

|

|

|

By Country

|

South America Industrial Automation Services Market Major Players:

- Rockwell Automation Inc.

- ABB Ltd.

- General Electric

- Schneider Electric

- Honeywell International Inc.

- Emerson Electric Co.

- Omron

- Others

Frequently Asked Questions

Total CAGR expected to be recorded for the Industrial Automation Market in Brazil is 7.17%

Major competitors of the market are Emerson Electric Co., Rockwell, and Omron.

The market size of the South America Industrial Automation Market in 2024 is US$ 19.60 Bn.

The market size of the South America Industrial Automation Market by 2032 is US$ 34.10 Bn.

1. Research Methodology

1.1 Research Data

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. South America Industrial Automation Services Market Executive Summary

2.1. Market Overview

2.2. Market Size (2024) and Forecast (2025 – 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments and Country

3. South America Industrial Automation Services Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Business Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2024)

3.2.7. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

3.4.1. Strategic Initiatives

3.4.2. Mergers and Acquisitions

3.4.3. Collaborations and Partnerships

3.4.4. Developments and Innovations

4. South America Industrial Automation Services Market: Dynamics

4.1. South America Industrial Automation Services Market Trends

4.2. South America Industrial Automation Services Market Drivers

4.3. South America Industrial Automation Services Market Restraints

4.4. South America Industrial Automation Services Market Opportunities

4.5. South America Industrial Automation Services Market Challenges

4.6. PORTER’s Five Forces Analysis

4.6.1. Intensity of the Rivalry

4.6.2. Threat of New Entrants

4.6.3. Bargaining Power of Suppliers

4.6.4. Bargaining Power of Buyers

4.6.5. Threat of Substitutes

4.7. PESTLE Analysis

4.7.1. Political Factors

4.7.2. Economic Factors

4.7.3. Social Factors

4.7.4. Technological Factors

4.7.5. Legal Factors

4.7.6. Environmental Factors

4.8. Technological Roadmap

4.9. Regulatory Landscape

5. South America Industrial Automation Services Market: Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

5.1. South America Industrial Automation Services Market Size and Forecast, by Type of Service (2024-2032)

5.1.1. Project Engineering and Installation

5.1.2. Maintenance and Support Services

5.1.3. Consulting Services

5.1.4. Operational Services

5.2. South America Industrial Automation Services Market Size and Forecast, by Product Type (2024-2032)

5.2.1. DCS

5.2.2. SCADA

5.2.3. PLC

5.2.4. MES

5.2.5. Others

5.3. South America Industrial Automation Services Market Size and Forecast, by End User (2024-2032)

5.3.1. Discrete Industries

5.3.2. Process Industries

5.4. South America Industrial Automation Services Market Size and Forecast, by Country (2024-2032)

5.4.1. Brazil

5.4.2. Argentina

5.4.3. Rest of South America

6. Company Profile: Key Players

6.1. Rockwell Automation Inc.

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.3. Financial Overview

6.1.3.1. Total Revenue

6.1.3.2. Segment Revenue

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

6.2. ABB Ltd.

6.3. General Electric

6.4. Schneider Electric

6.5. Honeywell International Inc.

6.6. Emerson Electric Co.

6.7. Omron

6.8. Others

7. Key Findings

8. Analyst Recommendations

8.1. Strategic Recommendations

8.2. Future Outlook