South America Bike Sharing Market Industry Overview, Size, Share, Growth Trends, Research Insights and Forecast (2025–2032)

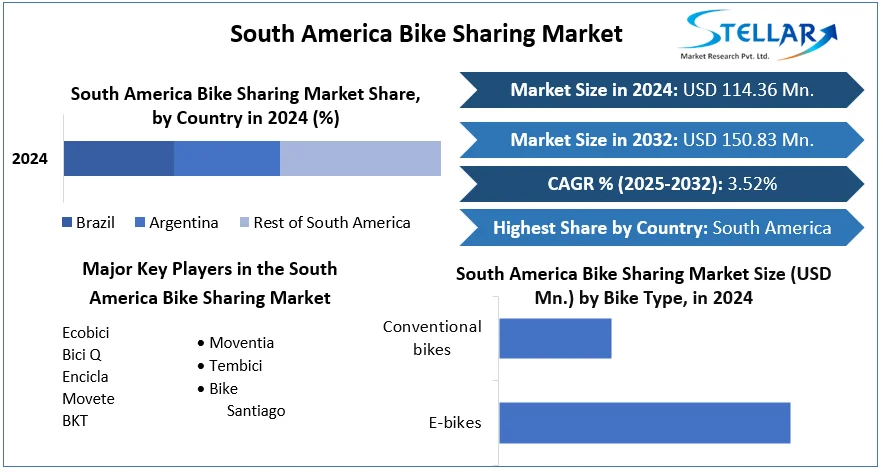

South America Bike Sharing Market size was valued at US$ 114.36 Million in 2024 and the total Latin America Bike Sharing Market revenue is expected to grow at 3.52% through 2025 to 2032, reaching nearly US$ 150.83 Million.

Format : PDF | Report ID : SMR_70

South America Bike Sharing Market Overview:

The region have 92 public bike sharing systems operational in 11 Latin American countries by the end of 2024. With 42 systems, Brazil leads the way, followed by Colombia and Latin America with 18 and 15 systems, respectively. The systems were mostly implemented in cities with populations of more than one million people. Cities with populations of 250 to 500 thousand people also have a large number of BSS in operation.

South America Bike Sharing Market Dynamics:

The majority of the systems (72.83%) are dock-based, and they are either located in megacities like So Paulo and Mexico City, or little towns like Quimbaya, Colombia, with a population of less than 30 thousand people. In 2008, Rio de Janeiro became the first Latin American city to introduce a bike share scheme. This system, known as SAMBA, consisted of 19 stations and a fleet of 190 bicycles. The number of bike sharing systems grew in the following years, with a surge from 2017 to 2020, when 25 dockless systems and 28 new dock based systems went live. New systems evolved throughout the course of more than a decade after the first BSS was implemented, and some systems were restructured or shut down. In the month of December 2020, 92 systems in Latin America were fully operational. Some systems have modified their infrastructure throughout time by extending their fleet and stations, altering technology, and enhancing their performance in order to meet the expectations and needs of the general public. It's worth noting that over this time, 19 of the examined systems went through a restructuring process.

BSSs can be used in conjunction with mass transit systems to aid with the "last-mile" problem. To do this, bike sharing systems are expected to be installed near transit stops, allowing for quick and easy access to bikes. Integrated, high-quality, and easily accessible transit networks are critical for encouraging people to switch from private to public transportation. Lack of coordination, institutional governance, and transportation subsidies, which directly affects low-income groups, is a big problem for citizens, governments, and operators are the factors considered to restrain the growth of the Bike sharing market.

To get more Insights: Request Free Sample Report

System operations in Latin America:

The majority of the systems are operational seven days a week, at various times, mainly between 5 a.m. and 12 a.m. There are 18 systems that are operational 24 hours a day, with some BSSs operating at varying hours on weekends. There are 48 different operators offering their services, with a great majority of private enterprises operating the systems across Latin America. There are 29 free systems, and many of them provide daily, monthly, or annual payment plans, accepting a variety of payment methods such as credit or debit card. For non-compliance with the usage regulation, at least 70 of the systems impose a penalty or charge an additional price. Many of the systems are supported by government agencies, indicating the government's attempts to improve BSS adoption. It's also worth noting that a sizable portion of the systems are backed by financial and healthcare firms.

• Tembici, the largest station-supported bike sharing scheme in Latin America, was developed in collaboration with local bank Ita-Unibanco. Although the scheme began in Brazil (in 18 cities as of January 2019), Stage Intelligence, an artificial intelligence (AI) platform provider, is planning to roll it out in Santiago and Buenos Aires soon.

• Since the second semester of 2017, the London-based AI firm has collaborated with Central American bike sharing operator BKT biciplica (BKT) in Mexico. It is collaborating with BKT and its MIBICI bike sharing system in Guadalajara, the state capital of Jalisco, using its BICO platform.

• Stage Intelligence recently signed an agreement with CityBike Per, a subsidiary of Moventia, a Spanish transportation and mobility provider. In Lima, the two are establishing a 50-station bike plan, with a fleet of 500 bicycles to begin with.

Bikesantiago and Bici Las Condes in Santiago, Ecobici in Buenos Aires and Mexico City, Encicla in Medellin, Movete in Montevideo, and Bici Q in Quito are among the various dock-based programmes in Latin America. Station-based bicycles are less vulnerable to vandalism and theft since they are not at risk of being left in potentially unsafe neighbourhoods if they are not tied to a station. It is also less hard logistically because they always have a station to travel to, but you will need a well-organized management system, such as the BICO platform, to ensure that your bikes are docked in proper spots.

Dockless bike sharing is a little more difficult to come by, but it is a rapidly expanding scheme that is being used in an increasing number of locations around Latin America. Yellow, a Brazilian bike and scooter sharing business, is one of the region's most popular options. It formed Grow Mobility, a last-mile mobility group, with Mexican electric scooter sharing startup Grin in late January.

Between October 2018 and January 2019, the company, which operates 135,000 automobiles in six Latin American nations, raised US$259 million in secured funding (2019). It will, however, have to compete with multinationals such as Mobike and Ofo, both of which are based in China. While a dock-based system makes it easy to find a bicycle, it can be inconvenient when it comes to parking at the arrival site because a nearby station may not be accessible.

A dockless bike is the polar opposite of a docked bike. While cyclists can arrive at their destination and simply park their bike nearby, finding a free-floating bike in a remote location can be difficult. However, if you live in a very business zone or in a better neighborhood, this is unlikely to be an issue. A few defensive actions can reduce the risk of damage and theft described before. In addition to each bike having a sophisticated tracking mechanism, Yellow Bike incorporates unusual bike parts.

South America Bike Sharing Market Scope:

|

South America Bike Sharing Market |

|

|

Market Size in 2024 |

USD 114.36 Mn. |

|

Market Size in 2032 |

USD 150.83 Mn. |

|

CAGR (2025-2032) |

3.52% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

By Bike Type

|

|

By Model

|

|

|

By Sharing System

|

|

|

Country Scope |

Brazil Argentina Rest of South America |

South America Bike Sharing Market Players

• Ecobici

• Bici Q

• Encicla

• Movete

• BKT

• Moventia

• Tembici

• Bike Santiago

Frequently Asked Questions

Brazil and Columbia region have the highest growth rate of 4.5% and 4% respectively in the Latin America Bike Sharing market

Ecobici, Bici Q, Encicla, Movete, BKT, Moventia, Tembici, Bike Santiago are the key players in the Latin America Bike Sharing market.

Argentina, Brazil, Columbia, Mexico and Ecuador are the top regions in the Latin America bike sharing market in terms of system installations.

Latin America Bike Sharing Market report helps with the PESTEL, PORTER, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period.

1. South America Bike Sharing Market: Research Methodology

1.1 Research Data

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Up Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. South America Bike Sharing Market Executive Summary

2.1. Market Overview

2.2. Market Size (2024) and Forecast (2025 – 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments

3. South America Bike Sharing Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Service Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2024)

3.2.7. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

4. South America Bike Sharing Market: Dynamics

4.1. South America Bike Sharing Market Trends

4.2. South America Bike Sharing Market Drivers

4.3. South America Bike Sharing Market Restraints

4.4. South America Bike Sharing Market Opportunities

4.5. South America Bike Sharing Market Challenges

4.6. PORTER’s Five Forces Analysis

4.7. PESTLE Analysis

4.8. Technological Roadmap

4.9. Regulatory Landscape

5. South America Bike Sharing Market: Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

5.1. South America Bike Sharing Market Size and Forecast, by Bike Type (2024-2032)

5.1.1. E-bikes

5.1.2. Conventional bikes

5.2. South America Bike Sharing Market Size and Forecast, by Model (2024-2032)

5.2.1. Free-floating

5.2.2. P2P

5.2.3. Station-based

5.3. South America Bike Sharing Market Size and Forecast, by Sharing System (2024-2032)

5.3.1. Dockless

5.3.2. Docked

5.3.3. Hybride

5.4. South America Bike Sharing Market Size and Forecast, by Country (2024-2032)

5.4.1. Brazil

5.4.2. Argentina

5.4.3. Rest of South America

6. Company Profile: Key Players

6.1. Ecobici

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.3. Financial Overview

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

6.2. Bici Q

6.3. Encicla

6.4. Movete

6.5. BKT

6.6. Moventia

6.7. Tembici

6.8. Bike Santiago

7. Key Findings

8. Analyst Recommendations

8.1. Strategic Recommendations

8.2. Future Outlook