Shredder Blades Market- Global Industry Analysis and Forecast (2025-2032)

The Shredder Blades Market size was valued at USD 471.36 Mn. in 2024 and the total Global Shredder Blades revenue is expected to grow at a CAGR of 5.2% from 2025 to 2032, reaching nearly USD 707.11 Mn. by 2032.

Format : PDF | Report ID : SMR_2164

Shredder Blades Market Overview

Shredder blades are crucial components used in industrial shredders for effectively cutting and processing various materials such as metals, plastics, and paper. The report offers an in-depth analysis of market trends, challenges, and opportunities, emphasizing key segments and regional dynamics. The shredder blades market is growing because of increasing industrial activities, the growth of recycling initiatives, and the need for effective waste management solutions. The Asia Pacific region, in particular, is experiencing robust growth driven by rapid industrialization and stringent environmental regulations. Investing in companies getting higher in recycling facilities capitalizes on the high recycling rates in Japan and South Korea, exceeding 70%, indicating a strong Shredder Blades market for shredding equipment.

Companies developing eco-friendly shredding solutions that comply with environmental regulations are also attractive, as China’s ban on foreign waste imports increases domestic recycling efforts and demand for efficient technologies. Emerging markets like India, Vietnam, and Indonesia offer opportunities in Shredder Blades, with India’s waste management market driven by urbanization and initiatives like the Clean India Mission. Companies investing in R&D for new blade materials and designs see up to 25% higher efficiency, enhancing profit margins.

Fluctuating raw material costs significantly impact the shredder blade market. High-strength steel and alloys, costing $800 to $1,200 per ton, influence production expenses, affecting profit margins and pricing strategies. Increased material costs lead to higher blade prices, potentially reducing demand and squeezing manufacturers' profits. Supply chain disruptions add to the uncertainty, complicating long-term investment and R&D efforts. Competitive advantage goes to those with efficient production and robust supply chains. Companies also explore alternative materials to mitigate cost volatility, driving innovation and potentially reshaping Shredder blade industry dynamics.

To get more Insights: Request Free Sample Report

Shredder Blades Market Dynamics

Global rise in waste generation

The global rise in waste generation, driven by population growth and increased consumption, underscores the crucial role of shredder blades in managing waste effectively. Shredder blades are essential in reducing waste volume, thereby facilitating easier recycling and disposal processes as global waste production rises, the demand for effective waste management solutions intensifies. Shredder blades are crucial for processing diverse materials like plastics, metals, and organics, reducing their volume for easier handling and recycling.

Technological advancements in shredder blade design enhance durability, efficiency, and versatility to meet the growing diversity and volume of materials processed. These innovations support efficient waste management practices worldwide. Additionally, stringent environmental regulations drive industries to adopt shredders for compliance with waste reduction and recycling mandates, further improving Shredder Blades market growth as businesses prioritize sustainable waste management solutions.

- Increased investments in waste management infrastructure and technologies, including shredder blades, were observed globally, driven by rising urbanization and industrialization

- Growing awareness of environmental sustainability further increased the adoption of shredders, particularly in regions tightening waste disposal regulations.

Choosing the right material for shredder blades is Crucial

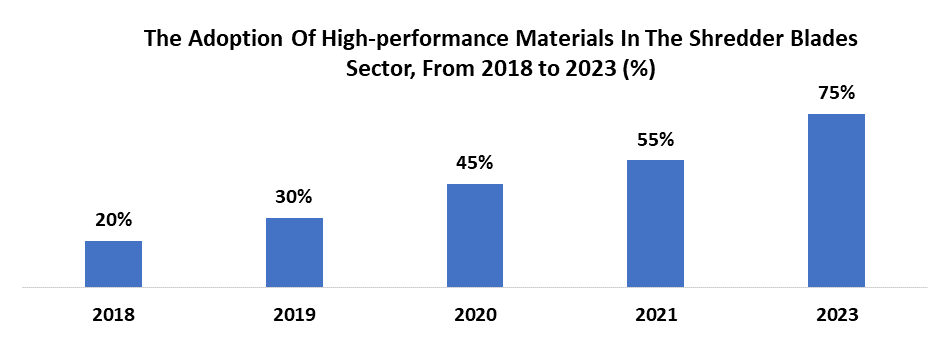

Choosing the appropriate material for shredder blades is crucial for their performance and durability. Shredder blades are subjected to high stress and wear during operation, especially in industries such as recycling, waste management, and manufacturing. The material must maintain sharpness and structural integrity over extended periods to ensure efficient shredding operations. The adoption of these advanced materials has also brought challenges related to cost. High-performance materials are often more expensive to procure and manufacture, impacting the overall cost structure of shredder blades.

The cost consideration has driven market players to innovate in material sourcing and manufacturing processes to maintain competitive pricing. Technological advancements in metallurgy and materials science have played a crucial role in addressing these challenges. For example, advancements in powder metallurgy techniques have enabled the production of complex geometries and enhanced material properties, thereby improving the performance of shredder blades.

Shredder Blades Market Segment Analysis

By Blade Material, Carburizing steel, also referred to as low alloy steel, undergoes a carburizing process where carbon is diffused into the surface layer of the steel. The process enhances the hardness and wear resistance of the material while maintaining a tough core. Carburizing steel blades are commonly used in various shredding applications due to their balanced properties of durability, toughness, and cost-effectiveness. Carburizing steel blades are famous for their durability under high stress, maintaining sharp edges over extended periods, which reduces downtime and maintenance costs.

Their affordability compared to advanced alloys like tool steels ensures accessibility across diverse industries such as recycling, agriculture, and manufacturing, where cost-efficiency is paramount. These blades exhibit versatility in shredding various materials from plastics to metals, enhancing their appeal in different applications. Their balanced performance and cost-effectiveness have secured a significant Shredder blade market share, favored by manufacturers and users for reliability, low maintenance needs, and overall lifecycle cost benefits.

Shredder Blades Market Regional Insights

The Asia Pacific region is experiencing significant Shredder blade market growth due to increasing industrial activities, rising urbanization, and the need for efficient waste management solutions in 2023. Countries like China, India, Japan, and South Korea are major contributors to this growth. The Shredder Blades Market demand is driven by the increasing manufacturing sector, coupled with stringent environmental norms encouraging recycling and waste reduction. In the Asia Pacific region, companies are innovating with high-strength alloys and advanced manufacturing techniques to produce more durable and efficient shredder blades.

The technological advancement enhances blade lifespan and performance. Additionally, the expansion of recycling facilities in countries like China and India drives demand for high-quality shredder blades. China’s strict waste import policies have spurred the growth of domestic recycling industries, further enhancing the Shredder Blades market. The focus on improving recycling infrastructure and adopting advanced shredding technologies underlines the region's commitment to efficient waste management and environmental sustainability.

Export Trends and Analysis of Shredder:

- Shredder worth $9,156,100 have been exported

- Shredder was exported to 64 countries

- Djibouti was the largest importer of shredders accounting for 21.05% of the total exports of shredder

Shredder Blades Market Competitive Landscape

Technological advancements are leading the Shredder Blades market towards more efficient and sustainable solutions, accelerating the adoption of advanced shredding equipment. Shredder Blades Market growth is driven by innovative products providing specific needs like waste-to-energy and metal recycling, resulting in higher demand. End-users benefit from a broader range of shredding solutions, enabling them to select products that best fit their operations. The focus on energy efficiency and durability translates to cost savings and enhanced productivity.

- In October 2023, Fornnax Technology, an innovatives Indian company, launched the R4000-HD shredder, designed to revolutionize profitability in the tire recycling industry. This high-performance model is noted for its superior efficiency in secondary shredding and steel separation, featuring a hydraulically operated hopper and screen, durable grindable blades, an optimized feed rate function, and a quick screen replacement system.

- In August 2023, EvoQuip introduced the Caiman 150, its first shredder, engineered with Terex expertise. This machine excels in various recycling applications, including construction and demolition (C&D), asphalt, skip waste, green waste, wood, and household waste like mattresses. It enhances output while reducing operational costs, underscoring EvoQuip's commitment to environmental sustainability.

- In June 2023, Polystruder launched the Polystruder GR PRO, a cutting-edge plastic shredder incorporating AI technology to optimize recycling efficiency for both industrial and private use. Featuring the proprietary ShredAI algorithm, this shredder dynamically assesses material characteristics and boasts 19 reversible stainless steel blades, offering longevity and reduced maintenance while accommodating different shredding needs.

|

Shredder Blades Market Scope |

|

|

Market Size in 2024 |

USD 471.36 Mn. |

|

Market Size in 2032 |

USD 707.11 Mn. |

|

CAGR (2025-2032) |

5.2% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Blade Material Carburizing Steel Tool Steel Case Hardened Chromium Low Alloy Steel |

|

By Blade Design Hook Square |

|

|

By Application Plastic Rubber Metals Wood E-waste Paper & Cardboard Other |

|

|

By End User Waste Management & Recycling Food Industry Pharmaceuticals Other |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key Player in the Shredder Blades Market

- Kamadur Industrial Knives B.V.

- Saturn Machine Knives Ltd.

- MIHEU D.O.O

- BKS Knives

- Fordura China

- Povelato SRL

- ACCU GRIND

- Wanrooe Machinery Co. Ltd.

- Multech Machinery Corp.

- Shred Tools India

- Servo International

- American Cutting Edge

- Shree Vishwakarma Industries

- Harsons Ventures Pvt. Ltd.

- Wiscon Envirotech Inc

- Anhui Yafei Machine Tool Co. Ltd

- BKS Knives

- Fernite of Sheffield Ltd.

- KAMADUR industrial knives B.V

- Miheu d.o.o.

- Nanjing Huaxin Machinery Tool Manufacturing Co., Ltd.

- SATURN MACHINE KNIVES LTD

- XXX Inc.

Frequently Asked Questions

Shredder blades are utilized across a wide range of industries including recycling, waste management, manufacturing, plastics processing, metal processing, and agriculture.

Shredder blades contribute to environmental sustainability by reducing waste volume, facilitating the recycling of materials that would otherwise end up in landfills, and promoting resource conservation.

The Market size was valued at USD 471.36 Million in 2024 and the total Market revenue is expected to grow at a CAGR of 5.2% from 2025 to 2032, reaching nearly 707.11 Million.

The segments covered in the market report are Blade Material, Blade Design, Application, and End User.

1. Shredder Blades Market: Research Methodology

2. Shredder Blades Market: Executive Summary

3. Shredder Blades Market: Competitive Landscape

4. Potential Areas for Investment

4.1. Stellar Competition Matrix

4.2. Competitive Landscape

4.3. Key Players Benchmarking

4.4. Market Structure

4.4.1. Market Leaders

4.4.2. Market Followers

4.4.3. Emerging Players

4.5. Consolidation of the Market

5. Shredder Blades Market: Dynamics

5.1. Market Driver

5.1.1. Increasing Consumer Awareness

5.1.2. Innovation in Product Offerings

5.2. Market Trends by Region

5.2.1. North America

5.2.2. Europe

5.2.3. Asia Pacific

5.2.4. Middle East and Africa

5.2.5. South America

5.3. Market Drivers by Region

5.3.1. North America

5.3.2. Europe

5.3.3. Asia Pacific

5.3.4. Middle East and Africa

5.3.5. South America

5.4. Market Restraints

5.5. Market Opportunities

5.6. Market Challenges

5.7. PORTER’s Five Forces Analysis

5.8. PESTLE Analysis

5.9. Strategies for New Entrants to Penetrate the Market

5.10. Regulatory Landscape by Region

5.10.1. North America

5.10.2. Europe

5.10.3. Asia Pacific

5.10.4. Middle East and Africa

5.10.5. South America

6. Shredder Blades Market Size and Forecast by Segments (by Value Units)

6.1. Shredder Blades Market Size and Forecast, by Blade Material (2024-2032)

6.1.1. Carburizing Steel

6.1.2. Tool Steel

6.1.3. Case Hardened

6.1.4. Chromium Low Alloy Steel

6.2. Shredder Blades Market Size and Forecast, by Blade Design (2024-2032)

6.2.1. Hook

6.2.2. Square

6.3. Shredder Blades Market Size and Forecast, by Application (2024-2032)

6.3.1. Plastic

6.3.2. Rubber

6.3.3. Metals

6.3.4. Wood

6.3.5. E-waste

6.3.6. Paper & Cardboard

6.3.7. Other

6.4. Shredder Blades Market Size and Forecast, by End User (2024-2032)

6.4.1. Waste Management & Recycling

6.4.2. Food Industry

6.4.3. Pharmaceuticals

6.4.4. Other

6.5. Shredder Blades Market Size and Forecast, by Region (2024-2032)

6.5.1. North America

6.5.2. Europe

6.5.3. Asia Pacific

6.5.4. Middle East and Africa

6.5.5. South America

7. North America Shredder Blades Market Size and Forecast (by Value Units)

7.1. North America Shredder Blades Market Size and Forecast, by Blade Material (2024-2032)

7.1.1. Carburizing Steel

7.1.2. Tool Steel

7.1.3. Case Hardened

7.1.4. Chromium Low Alloy Steel

7.2. Shredder Blades Market Size and Forecast, by Blade Design (2024-2032)

7.2.1. Hook

7.2.2. Square

7.3. North America Shredder Blades Market Size and Forecast, by Application (2024-2032)

7.3.1. Plastic

7.3.2. Rubber

7.3.3. Metals

7.3.4. Wood

7.3.5. E-waste

7.3.6. Paper & Cardboard

7.3.7. Other

7.4. North America Shredder Blades Market Size and Forecast, by End User (2024-2032)

7.4.1. Waste Management & Recycling

7.4.2. Food Industry

7.4.3. Pharmaceuticals

7.4.4. Other

7.5. North America Shredder Blades Market Size and Forecast, by Country (2024-2032)

7.5.1. United States

7.5.2. Canada

7.5.3. Mexico

8. Europe Shredder Blades Market Size and Forecast (by Value Units)

8.1. Europe Shredder Blades Market Size and Forecast, by Blade Material (2024-2032)

8.1.1. Carburizing Steel

8.1.2. Tool Steel

8.1.3. Case Hardened

8.1.4. Chromium Low Alloy Steel

8.2. Europe Shredder Blades Market Size and Forecast, by Blade Design (2024-2032)

8.2.1. Hook

8.2.2. Square

8.3. Europe Shredder Blades Market Size and Forecast, by Application (2024-2032)

8.3.1. Plastic

8.3.2. Rubber

8.3.3. Metals

8.3.4. Wood

8.3.5. E-waste

8.3.6. Paper & Cardboard

8.3.7. Other

8.4. Europe Shredder Blades Market Size and Forecast, by End User (2024-2032)

8.4.1. Waste Management & Recycling

8.4.2. Food Industry

8.4.3. Pharmaceuticals

8.4.4. Other

8.5. Europe Shredder Blades Market Size and Forecast, by Country (2024-2032)

8.5.1. UK

8.5.2. France

8.5.3. Germany

8.5.4. Italy

8.5.5. Spain

8.5.6. Sweden

8.5.7. Austria

8.5.8. Rest of Europe

9. Asia Pacific Shredder Blades Market Size and Forecast (by Value Units)

9.1. Asia Pacific Shredder Blades Market Size and Forecast, by Blade Material (2024-2032)

9.1.1. Carburizing Steel

9.1.2. Tool Steel

9.1.3. Case Hardened

9.1.4. Chromium Low Alloy Steel

9.2. Asia Pacific Shredder Blades Market Size and Forecast, by Blade Design (2024-2032)

9.2.1. Hook

9.2.2. Square

9.3. Asia Pacific Shredder Blades Market Size and Forecast, by Application (2024-2032)

9.3.1. Plastic

9.3.2. Rubber

9.3.3. Metals

9.3.4. Wood

9.3.5. E-waste

9.3.6. Paper & Cardboard

9.3.7. Other

9.4. Asia Pacific Shredder Blades Market Size and Forecast, by End User (2024-2032)

9.4.1. Waste Management & Recycling

9.4.2. Food Industry

9.4.3. Pharmaceuticals

9.4.4. Other

9.5. Asia Pacific Shredder Blades Market Size and Forecast, by Country (2024-2032)

9.5.1. China

9.5.2. S Korea

9.5.3. Japan

9.5.4. India

9.5.5. Australia

9.5.6. Indonesia

9.5.7. Malaysia

9.5.8. Vietnam

9.5.9. Taiwan

9.5.10. Bangladesh

9.5.11. Pakistan

9.5.12. Rest of Asia Pacific

10. Middle East and Africa Shredder Blades Market Size and Forecast (by Value Units)

10.1. Middle East and Africa Shredder Blades Market Size and Forecast, by Blade Material (2024-2032)

10.1.1. Carburizing Steel

10.1.2. Tool Steel

10.1.3. Case Hardened

10.1.4. Chromium Low Alloy Steel

10.2. Middle East and Africa Shredder Blades Market Size and Forecast, by Blade Design (2024-2032)

10.2.1. Hook

10.2.2. Square

10.3. Middle East and Africa Shredder Blades Market Size and Forecast, by Application (2024-2032)

10.3.1. Plastic

10.3.2. Rubber

10.3.3. Metals

10.3.4. Wood

10.3.5. E-waste

10.3.6. Paper & Cardboard

10.3.7. Other

10.4. Middle East and Africa Shredder Blades Market Size and Forecast, by End User (2024-2032)

10.4.1. Waste Management & Recycling

10.4.2. Food Industry

10.4.3. Pharmaceuticals

10.4.4. Other

10.5. Middle East and Africa Shredder Blades Market Size and Forecast, by Country (2024-2032)

10.5.1. South Africa

10.5.2. GCC

10.5.3. Egypt

10.5.4. Nigeria

10.5.5. Rest of ME&A

11. South America Shredder Blades Market Size and Forecast (by Value Units)

11.1. South America Shredder Blades Market Size and Forecast, by Blade Material (2024-2032)

11.1.1. Carburizing Steel

11.1.2. Tool Steel

11.1.3. Case Hardened

11.1.4. Chromium Low Alloy Steel

11.2. South America Shredder Blades Market Size and Forecast, by Blade Design (2024-2032)

11.2.1. Hook

11.2.2. Square

11.3. South America Shredder Blades Market Size and Forecast, by Application (2024-2032)

11.3.1. Plastic

11.3.2. Rubber

11.3.3. Metals

11.3.4. Wood

11.3.5. E-waste

11.3.6. Paper & Cardboard

11.3.7. Other

11.4. South America Shredder Blades Market Size and Forecast, by End User (2024-2032)

11.4.1. Waste Management & Recycling

11.4.2. Food Industry

11.4.3. Pharmaceuticals

11.4.4. Other

11.5. South America Shredder Blades Market Size and Forecast, by Country (2024-2032)

11.5.1. Brazil

11.5.2. Argentina

11.5.3. Rest of South America

12. Company Profile: Key players

12.1. Kamadur Industrial Knives B.V. (China)

12.1.1. Company Overview

12.1.2. Financial Overview

12.1.3. Business Portfolio

12.1.4. SWOT Analysis

12.1.5. Business Strategy

12.1.6. Recent Developments

12.2. Saturn Machine Knives Ltd.

12.3. MIHEU D.O.O

12.4. BKS Knives

12.5. Fordura China

12.6. Povelato SRL

12.7. ACCU GRIND

12.8. Wanrooe Machinery Co. Ltd.

12.9. Multech Machinery Corp.

12.10. Shred Tools India

12.11. Servo International

12.12. American Cutting Edge

12.13. Shree Vishwakarma Industries

12.14. Harsons Ventures Pvt. Ltd.

12.15. Wiscon Envirotech Inc

12.16. Anhui Yafei Machine Tool Co. Ltd

12.17. BKS Knives

12.18. Fernite Of Sheffield Ltd.

12.19. KAMADUR industrial knives B.V

12.20. Miheu d.o.o.

12.21. Nanjing Huaxin Machinery Tool Manufacturing Co., Ltd.

12.22. SATURN MACHINE KNIVES LTD

12.23. XXX Inc.

13. Key Findings

14. Industry Recommendation