Satellite Propulsion System Market Industry Analysis and Forecast (2026-2032)

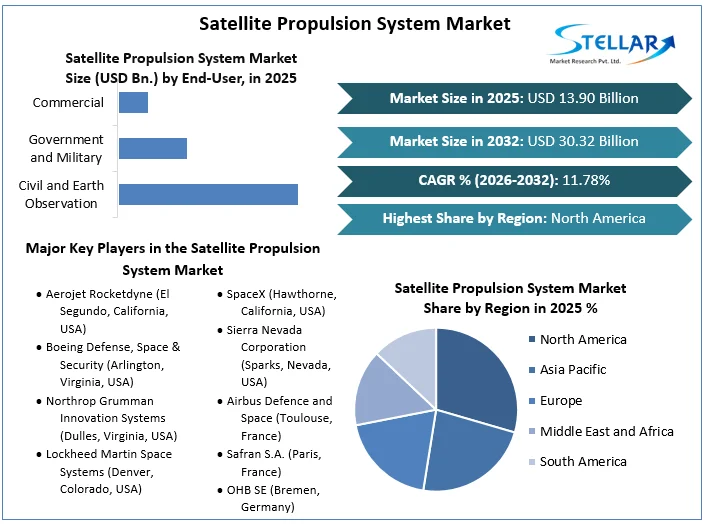

The Satellite Propulsion System Market size was valued at USD 13.90 Bn. in 2025 and the total Satellite Propulsion System revenue is expected to grow at a CAGR Of 11.78% from 2026 to 2032, reaching nearly USD 30.32 Bn. by 2032.

Format : PDF | Report ID : SMR_1924

Satellite Propulsion System Market Overview:

In the evolving landscape of satellite propulsion systems, the demand for highly reliable and readily available CubeSat propulsion solutions is on the rise, fueled by an expanding array of mission applications. The market increasingly favors commercial-off-the-shelf (COTS) solutions that are flight-ready. While the majority of propulsion systems are still in early development as of 2020-2024, there's a shift towards evaluating and applying chemical and electric propulsion systems for missions. Emerging technologies, including nuclear, electric, chemical, and solar propulsion, hold promise for revolutionizing Earth-centric space operations and interplanetary exploration in the foreseeable future. Nuclear propulsion, utilizing fission or fusion processes, offers immense potential for generating propulsion through the release of heat. However, their integration into mission architectures requires careful consideration alongside conventional propulsion methods to assess benefits, challenges, and investment implications effectively.

The reports offer complete insights into the developing landscape of the Satellite Propulsion System market, highlighting its remarkable growth driven by increasing military use and demand for visually appealing products and a growing emphasis on sustainability, efficiency, and cost-effectiveness throughout the supply chain. Reports give an accurate assess market segments, including Type, Class Of Orbit, protective level, and Regions, providing an all-inclusive view of the market landscape. By analyzing global trends, key drivers, challenges, and opportunities, the research sheds light on the industry's path. The future opportunity of the Satellite Propulsion System review report offers a detailed market size outlook across various types, Class Of Orbits, and regions worldwide, offering data-driven insights and actionable recommendations for companies operating in the Satellite Propulsion System sector.

To get more Insights: Request Free Sample Report

Satellite Propulsion System Market Dynamics:

Satellite Propulsion Systems Market Driven by Government and Private Sector Interest

The rapid development in its space capabilities. Countries like China, India, and Japan have made significant strides in space technology and satellite manufacturing, positioning themselves as formidable players in the global market. For instance, in May 2022, Kongtian Dongli, a Chinese satellite electric propulsion company, secured multi-million yuan angel round financing, reflecting the proliferation of Chinese constellation plans and the region's growing influence.

Collaboration in space exploration through organizations like the European Space Agency (ESA). ESA's partnerships with multiple member states have led to significant advancements in space technology, satellite manufacturing, and launch capabilities. In February 2023, IENAI SPACE, an in-space mobility provider based in Spain, received two ESA contracts under the General Support Technology Program to further develop ATHENA (Adaptable THruster based on Electrospray powered by NAnotechnology) propulsion systems. The continued investment and innovation by both governmental and private entities across these regions are expected to drive the growth of the global satellite propulsion systems market, making it a critical component of future space exploration and commercial satellite operations.

Growing Demand for Advanced Electric Propulsion Systems in Space Exploration

Electric propulsion, a cutting-edge technology in space propulsion, harnesses electrical power to accelerate propellants through various electric and magnetic means. By utilizing energy from nuclear reactors or solar power sources, electric propulsion systems ionize gases like xenon, which are then accelerated and expelled from the thruster. These systems present a cost-effective alternative to traditional chemical propulsion, offering the advantages of carrying more payload and consuming up to 90% less fuel. Additionally, electric propulsion systems require significantly less mass to achieve spacecraft acceleration. The expulsion of propellants at velocities up to 20 times greater than conventional chemical thrusters results in superior mass efficiency. Consequently, the performance of electric propulsion systems far surpasses that of traditional chemical thrusters.

Currently deployed in satellites and robotic missions, electric propulsion systems are a focal point for NASA's efforts to develop more robust versions suitable for human solar system exploration. In an initiative, NASA allocated $15 million in April 2021 to the Georgia Institute of Technology, 11 partner universities, and 17 researchers under the Joint Advanced Propulsion Institute (JANUS), a new Space Technology Research Institute (STRI). This investment aims to devise strategies and methodologies to overcome limitations in ground testing of high-power electric propulsion systems.

Anticipated advancements and rigorous testing of new electric propulsion technologies are poised to drive significant growth in the market during the forecast period. For example, in March 2022, SpaceLogistics, a subsidiary of Northrop Grumman specializing in satellite servicing, successfully tested the electric propulsion system designed for its Mission Extension Pods, slated for launch in 2024. The increasing demand and ongoing developments in electric propulsion systems are expected to create lucrative opportunities to develop the global space propulsion system market in the coming years.

The Challenge of Developing Next-Generation Propulsion Systems

The pursuit of next-generation propulsion systems that offer higher thrust or specific impulse, enhanced reliability, environmental sustainability, and cost-efficiency presents a multifaceted challenge in the aerospace industry. Achieving higher thrust and specific impulse is crucial for enabling longer missions and heavier payloads, essential for deep space exploration and commercial satellite operations. Traditional chemical propulsion systems, while effective, are limited by their relatively low efficiency and high fuel consumption. Electric propulsion systems, though more efficient, currently face limitations in thrust capabilities, necessitating significant advancements to meet the demands of future space missions.

The development of propulsion technologies that deliver substantial improvements in performance metrics. This includes increasing the specific impulse, which measures the efficiency of propellant use, and achieving higher thrust levels to support faster travel times and greater maneuverability in space. Research and development efforts must focus on innovative propulsion mechanisms, such as advanced ion thrusters, Hall effect thrusters, and plasma-based systems, which have the potential to offer superior performance compared to existing technologies.

Environmental sustainability and Cost reduction are increasingly becoming a priority, both for earthbound activities and space operations. Propulsion systems need to minimize harmful emissions and the ecological footprint associated with manufacturing and launching spacecraft. The use of green propellants and the development of technologies that reduce space debris are vital components of this sustainability drive. Developing advanced propulsion technologies entails substantial investment in research, testing, and manufacturing. Collaboration between government agencies, private sector entities, and academic institutions is essential to share the financial burden and accelerate technological advancements. Streamlining production processes, leveraging economies of scale, and fostering innovation through competitive funding opportunities help drive down costs.

Satellite Propulsion System Market Segment Analysis:

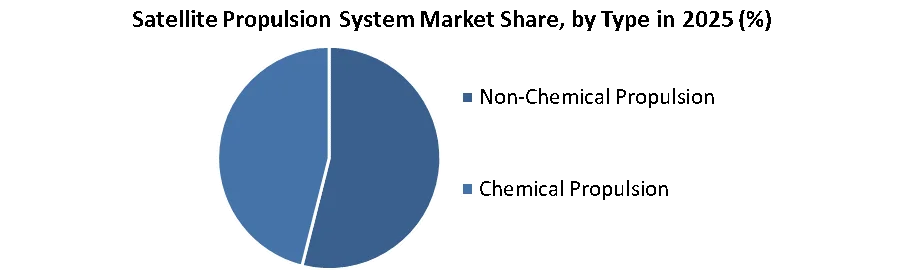

By Type, Non-Chemical Propulsion Types Lead Market Share in 2025 and during the Forecast Period. Non-chemical propulsion technologies are expected to dominate the market share during the forecast period. Solar propulsion, a cutting-edge technology, offers cost savings, enhanced safety, and superior propulsive power, making it ideal for a wide range of space exploration missions. This system utilizes solar cells to generate power efficiently.

In laser propulsion systems, spacecraft achieve velocity through two primary methods. The first method, foundational to solar sails and laser sails, involves transferring momentum via photon radiation pressure. The second technique employs lasers to facilitate mass removal from the spacecraft, similar to traditional rocket propulsion. Nuclear propulsion systems leverage nuclear reactions as their primary power source, providing a robust alternative to conventional propulsion methods. These advanced propulsion technologies are poised to revolutionize space travel, offering significant advantages in terms of efficiency, safety, and performance.

Satellite Propulsion System Market Regional Insight:

The growing interest of governments and private players in space exploration has fueled the development of the satellite propulsion systems market. The global Satellite Propulsion System market has witnessed robust growth in recent years, driven by the increasing demand for satellite deployments across various sectors.

North America has emerged as a dominant player in the global space propulsion market, largely due to the presence of established space agencies such as NASA and private companies like SpaceX, Blue Origin, and Boeing. These entities have undertaken ambitious space missions and satellite deployments, driving the demand for advanced propulsion systems. Notably, NASA's Solar Electric Propulsion project aims to extend the duration and capabilities of ambitious discovery and science missions, further boosting market growth.

Satellite Propulsion System Market Scope:

|

Satellite Propulsion System Market |

|

|

Market Size in 2025 |

USD 13.90 Billion |

|

Market Size in 2032 |

USD 30.32 Billion |

|

CAGR (2026-2032) |

11.78% |

|

Historic Data |

2020-2025 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2032 |

|

Segments |

By Type Non-Chemical Propulsion Chemical Propulsion |

|

By Class of Orbit Elliptical GEO LEO MEO |

|

|

By End-User Civil and Earth Observation Government and Military Commercial |

|

|

Regional Scope |

North America - United States, Canada, and Mexico Europe - UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific - China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Rest of the Middle East and Africa South America - Brazil, Argentina, Rest of South America

|

Satellite Propulsion System Market Key Players:

North America

- Aerojet Rocketdyne (El Segundo, California, USA)

- Boeing Defense, Space & Security (Arlington, Virginia, USA)

- Northrop Grumman Innovation Systems (Dulles, Virginia, USA)

- Lockheed Martin Space Systems (Denver, Colorado, USA)

- Rocketdyne (Canoga Park, California, USA)

- Ball Aerospace & Technologies Corp. (Broomfield, Colorado, USA)

- Maxar Technologies (Westminster, Colorado, USA)

- SpaceX (Hawthorne, California, USA)

- Sierra Nevada Corporation (Sparks, Nevada, USA)

Europe

- Airbus Defence and Space (Toulouse, France)

- Safran S.A. (Paris, France)

- OHB SE (Bremen, Germany)

- Thales Alenia Space (Cannes, France)

Asia-Pacific

- Mitsubishi Electric Corporation (Tokyo, Japan)

- IHI Corporation (Tokyo, Japan)

Frequently Asked Questions

Electric propulsion systems are more efficient than traditional chemical propulsion systems, consuming up to 90% less fuel and offering greater maneuverability and longer mission durations. They are generally less expensive in the long term due to lower fuel costs and reduced need for frequent refueling. However, electric propulsion systems typically provide lower thrust, which limitation for certain missions requiring rapid acceleration.

North America and Europe are leading the satellite propulsion system market due to the presence of established space agencies like NASA and ESA, as well as major private sector companies such as SpaceX, Boeing, Airbus, and Thales Alenia Space. These regions have robust space exploration programs and significant investments in satellite technology. Additionally, Asia-Pacific is rapidly expanding its market presence with significant contributions from countries like China, Japan, and India.

Manufacturers of satellite propulsion systems face challenges including the need for continuous innovation to enhance thrust and specific impulse, ensuring reliability and longevity in the harsh space environment, managing high development and production costs, and addressing environmental concerns such as reducing space debris and emissions. Additionally, regulatory compliance and the need for extensive testing add to the complexity.

The satellite propulsion system market is increasingly focusing on developing green propulsion technologies that minimize harmful emissions and environmental impact. This includes the use of non-toxic propellants, improving the efficiency of propulsion systems to reduce fuel consumption, and incorporating designs that mitigate space debris. Companies are also investing in research and development to create more sustainable manufacturing processes.

1. Satellite Propulsion System Market: Research Methodology

2. Satellite Propulsion System Market: Executive Summary

2.1. Study Assumption and Market Definition

2.2. Scope of the Study

2.3. Summary

2.4 Market Size (2025) & Forecast (2026-2032)

2.5 Market Size (USD Million) and Market Share (%) - By Segments, Regions and Country

3. Satellite Propulsion System Market: Competitive Landscape

3.1. Stellar Competition Matrix

3.2. Competitive Landscape

3.3. Key Players Benchmarking

3.3.1 Company Name

3.3.2 Headquarter

3.3.3 Product Segment

3.3.4 Sales Channels Segment

3.3.5 Revenue Details

3.4. Market Structure

3.4.1 Market Leaders

3.4.2 Market Followers

3.4.3 Emerging Players

3.5. Consolidation of the Market

3.5.1 Mergers and Acquisitions, Joint Ventures, Partnerships, etc. Details

3.5.2 Product Launch, Recent Development, Technological Advancements, Geographical Expansion, etc.

4. Satellite Propulsion System Market: Dynamics

4.1. Satellite Propulsion System Market Trends

4.2. Satellite Propulsion System Market Dynamics

4.2.1. Satellite Propulsion System Market Drivers

4.2.2. Satellite Propulsion System Market Restraints

4.2.3. Satellite Propulsion System Market Opportunities

4.2.4. Satellite Propulsion System Market Challenges

4.3. PORTER’s Five Forces Analysis

4.4. PESTLE Analysis

4.5. Technological Roadmap

4.6. Government Schemes and Initiatives for the Satellite Propulsion System Industry

4.7. Regulatory Landscape by Region

4.7.1. North America

4.7.2. Europe

4.7.3. Asia Pacific

4.7.4. Middle East and Africa

4.7.5. South America

5. Satellite Propulsion System Market Size and Forecast by Segments (by Value Units)

5.1. Satellite Propulsion System Market Size and Forecast, by Type (2025-2032)

5.1.1. Non-Chemical Propulsion

5.1.2. Chemical Propulsion

5.2. Satellite Propulsion System Market Size and Forecast, by Class Of Orbit (2025-2032)

5.2.1. Elliptical

5.2.2. GEO

5.2.3. LEO

5.2.4. MEO

5.3. Satellite Propulsion System Market Size and Forecast, by End-User (2025-2032)

5.3.1. Civil and Earth Observation

5.3.2. Government and Military

5.3.3. Commercial

5.4. Satellite Propulsion System Market Size and Forecast, by Region (2025-2032)

5.4.1. North America

5.4.2. Europe

5.4.3. Asia Pacific

5.4.4. Middle East and Africa

5.4.5. South America

6. North America Satellite Propulsion System Market Size and Forecast (by value Units)

6.1. North America Satellite Propulsion System Market Size and Forecast, by Type (2025-2032)

6.1.1. Non-Chemical Propulsion

6.1.2. Chemical Propulsion

6.2. North America Satellite Propulsion System Market Size and Forecast, by Class Of Orbit (2025-2032)

6.2.1. Elliptical

6.2.2. GEO

6.2.3. LEO

6.2.4. MEO

6.3. Satellite Propulsion System Market Size and Forecast, by End-User (2025-2032)

6.3.1. Civil and Earth Observation

6.3.2. Government and Military

6.3.3. Commercial

6.4. North America Satellite Propulsion System Market Size and Forecast, by Country (2025-2032)

6.4.1. United States

6.4.2. Canada

6.4.3. Mexico

7. Europe Satellite Propulsion System Market Size and Forecast (by Value Units)

7.1. Europe Satellite Propulsion System Market Size and Forecast, by Type (2025-2032)

7.2. Europe Satellite Propulsion System Market Size and Forecast, by Class Of Orbit (2025-2032)

7.3. Satellite Propulsion System Market Size and Forecast, by End-User (2025-2032)

7.4. Europe Satellite Propulsion System Market Size and Forecast, by Country (2025-2032)

7.4.1. UK

7.4.2. France

7.4.3. Germany

7.4.4. Italy

7.4.5. Spain

7.4.6. Sweden

7.4.7. Russia

7.4.8. Rest of Europe

8. Asia Pacific Satellite Propulsion System Market Size and Forecast (by Value Units)

8.1. Asia Pacific Satellite Propulsion System Market Size and Forecast, by Type (2025-2032)

8.2. Asia Pacific Satellite Propulsion System Market Size and Forecast, by Class Of Orbit (2025-2032)

8.3. Satellite Propulsion System Market Size and Forecast, by End-User (2025-2032)

8.4. Asia Pacific Satellite Propulsion System Market Size and Forecast, by Country (2025-2032)

8.4.1. China

8.4.2. S Korea

8.4.3. Japan

8.4.4. India

8.4.5. Australia

8.4.6. ASIAN

8.4.7. Rest of Asia Pacific

9. Middle East and Africa Satellite Propulsion System Market Size and Forecast (by Value Units)

9.1. Middle East and Africa Satellite Propulsion System Market Size and Forecast, by Type (2025-2032)

9.2. Middle East and Africa Satellite Propulsion System Market Size and Forecast, by Class Of Orbit (2025-2032)

9.3. Satellite Propulsion System Market Size and Forecast, by End-User (2025-2032)

9.4. Middle East and Africa Satellite Propulsion System Market Size and Forecast, by Country (2025-2032)

9.4.1. South Africa

9.4.2. GCC

9.4.3. Egypt

9.4.4. Rest of ME&A

10. South America Satellite Propulsion System Market Size and Forecast (by Value Units)

10.1. South America Satellite Propulsion System Market Size and Forecast, by Type (2025-2032)

10.2. South America Satellite Propulsion System Market Size and Forecast, by Class Of Orbit (2025-2032)

10.3. Satellite Propulsion System Market Size and Forecast, by End-User (2025-2032)

10.4. South America Satellite Propulsion System Market Size and Forecast, by Country (2025-2032)

10.4.1. Brazil

10.4.2. Argentina

10.4.3. Rest of South America

11. Company Profile: Key players

11.1. Aerojet Rocketdyne (El Segundo, California, USA)

11.1.1. Company Overview

11.1.2. Financial Overview

11.1.3. Product Portfolio

11.1.4. SWOT Analysis

11.1.5. Business Strategy

11.1.6. Recent Developments

11.2. Boeing Defense, Space & Security (Arlington, Virginia, USA)

11.3. Northrop Grumman Innovation Systems (Dulles, Virginia, USA)

11.4. Lockheed Martin Space Systems (Denver, Colorado, USA)

11.5. Rocketdyne (Canoga Park, California, USA)

11.6. Ball Aerospace & Technologies Corp. (Broomfield, Colorado, USA)

11.7. Maxar Technologies (Westminster, Colorado, USA)

11.8. SpaceX (Hawthorne, California, USA)

11.9. Sierra Nevada Corporation (Sparks, Nevada, USA)

11.10. Airbus Defence and Space (Toulouse, France)

11.11. Safran S.A. (Paris, France)

11.12. OHB SE (Bremen, Germany)

11.13. Thales Alenia Space (Cannes, France)

11.14. Mitsubishi Electric Corporation (Tokyo, Japan)

11.15. IHI Corporation (Tokyo, Japan)

12. Key Findings

13. Industry Recommendation