Safari Tourism Market - Global Industry Analysis and Forecast (2025-2032) by Product, Form, Source and Application

The Safari Tourism Market size was valued at US$ 29.34 Bn. in 2024 and the total Global Safari Tourism revenue is expected to grow at a CAGR of 7.5% from 2025 to 2032, reaching nearly USD 52.34 Bn. by 2032.

Format : PDF | Report ID : SMR_1665

Safari Tourism Market Overview

The Stellar report provides an in-depth analysis, of the Safari Tourism Market and examines the drivers, restraints, and opportunities that influence the Safari tourism market. It explores various factors driving market growth, including the rise in disposable income, heightened interest in wildlife experiences, and governmental initiatives aimed at promoting tourism. Growing demand for sustainable tourism due to growing environmental consciousness has opened up chances for eco-lodges and community-based initiatives. The market increase is expected to be driven by government support through investments in infrastructure, programs for responsible tourism, and animal protection. Utilizing technologies such as internet marketing, virtual reality for immersive experiences, and drones to prevent poaching increase conservation efforts and draw in new clients.

In addition, the advent of regions such as Asia Pacific that provide a wide range of wildlife experiences is expected to broaden the Safari Tourism Industry beyond conventional safari destinations, hence promoting the growth and long-term viability of the safari tourism sector. Long-term sustainability is ensured and the growing need for responsible tourism is met by funding community-based projects, eco-tourism initiatives, and sustainable safari lodges. Adapting to technical advancements like online booking platforms, drone-based conservation initiatives, and virtual reality experiences meets the changing demands of the market.

Reaching out to safari sites outside of the norm, particularly in the varied Asia-Pacific area, leverages growth possibilities in the region. In addition, catering to the affluent clientele with upscale lodgings, individualized guides, and exceptional animal interactions aims to attract a considerable amount of money for safari operators.

To get more Insights: Request Free Sample Report

Safari Tourism Market Dynamics

Rich Biodiversity and Unique Wildlife

Regions with diverse ecosystems and a wide range of wildlife species attract safari tourists. Destinations such as Africa (including countries like Kenya, Tanzania, Botswana, and South Africa), India, Costa Rica, and Australia offer a plethora of wildlife viewing opportunities, including the "Big Five" animals (lion, elephant, buffalo, leopard, and rhinoceros. Travelers are drawn in by the appeal of seeing a variety of wildlife in their natural settings, including the well-known "Big Five" and unusual species. This increases demand for safaris and boosts tourism earnings. In the cutthroat safari industry, varied wildlife offerings set different places apart and draw travelers looking for certain animal experiences.

Remarkable wildlife encounters encourage return business and positive word-of-mouth referrals, which increases the industry's attractiveness. In addition, the focus on sustainability and ecotourism, which is powered by the abundance of wildlife, appeals to environmentally concerned tourists, which helps the market grow and supports conservation efforts.

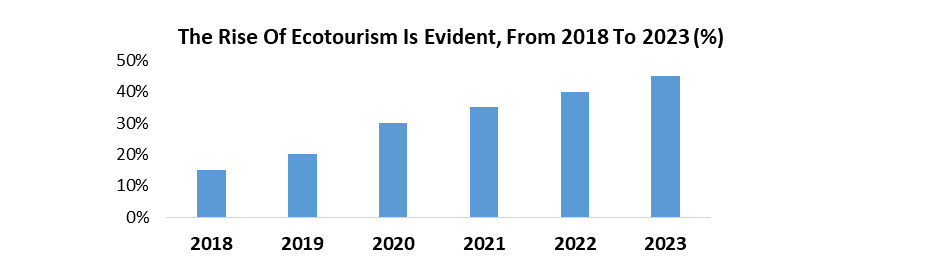

Adventure and Eco-Tourism

Safari operators need to focus on responsible tourism practices and provide immersive experiences to appeal to the growing market of eco-aware and adventure seekers. As travelers look for businesses that share their beliefs, sustainable practices and community involvement are essential for standing out from the competition and building brand loyalty. Encouraging conservation activities ensures the survival of the sector going forward in addition to protecting species. The long-term sustainability of safari tourism depends on healthy ecosystems and wildlife populations, which guarantees ongoing success in this rich industry.

Safari operators grow their clientele and appeal to a new generation of travelers with different priorities by offering services to adventure and eco-tourists. Providing ethical and environmentally friendly travel experiences frequently attracts premium pricing, which could increase profit margins. In addition, sustainability attracts favorable media attention, which boosts the industry's standing and draws in new customers

Environmental Impact

Amidst concerns about climate change, transportation particularly airplanes and safari vehicles contributes heavily to the industry's carbon emissions. As such, it is subject to increased scrutiny. If not appropriately managed, waste from tourism-related activities such as sewage and plastic pollution poses a hazard to ecosystems and species. The disturbance of habitat caused by off-road driving and crowded observation sites disturbs the behavior of animals and degrades flora, which in turn affects the health of ecosystems and wildlife populations. These problems are made worse by climate change, which presents risks including temperature increases and harsh weather that jeopardize animal populations and make some safari locations unsuitable. When taken as a whole, these elements highlight the necessity of sustainable safari tourism activities to reduce negative environmental effects.

Safari Tourism Market Segment Analysis

By Type, the couples segment led the global Safari Tourism market with the highest revenue share in terms of both value and volume in 2024. Couples are a significant source of income development in the safari tourism industry because they have a high spending potential and are willing to spend money on romantic touches, upmarket lodging, and unique experiences. To draw in couples and increase their market share, safari operators actively provide package discounts and customized honeymoon experiences.

Marketing campaigns use the romantic and adventurous appeal of safari vacations to appeal to couples, so influencing the industry's perspective and cultivating the impression that safari travel is the best option for romantic getaways. In addition to increasing the market's attractiveness, the deliberate concentration on serving couples highlights how adaptable the sector is to changing consumer tastes and desires for romantic, memorable safari experiences.

Safari Tourism Market Regional Analysis

The Asia Pacific region is poised for rapid growth in the safari tourism market, projected at a XX% CAGR until 2032. The demand is driven by factors including the emergence of a prosperous middle class with expendable income for travel, rising interest in adventure tourism and wildlife encounters, and enhanced connectivity and infrastructure development. Distinguished by its rich biodiversity, from tigers in India to orangutans in Indonesia and Komodo dragons in Komodo National Park, the region offers diverse wildlife experiences that appeal to tourists seeking unique encounters beyond Africa's traditional "Big Five" safaris. Safari operators are embracing more sustainable techniques, such as responsible waste management, eco-lodges, and community-based tourist programs.

For example, the government of Madhya Pradesh, India, started the "Green Corbett Mission" in 2022 to encourage ethical travel to Corbett National Park. While lessening their negative effects on the ecosystem, technological advancements like virtual reality experiences and drone-based wildlife monitoring are improving visitor experiences. Drone-based patrols against poaching were introduced by Nepal in 2021 in Chitwan National Park These developments guarantee a sustainable future for safari tourism by highlighting the industry's dedication to striking a balance between the growth of tourism and environmental conservation initiatives.

To protect threatened species and their habitats, governments are funding wildlife conservation initiatives, which in turn ensures the long-term viability of safari travel. As an illustration, Project Tiger in India has been essential to the survival of tigers Accessibility to national parks and protected regions is being improved by infrastructure upgrades in transportation and lodging, as demonstrated by the opening of eco-tourism lodges around Asia. Because of its abundant biodiversity, sophisticated safari infrastructure, and government support via programs like Project Tiger and eco-tourist circuits, India leads the Asia Pacific area in safari tourism.

Safari Tourism Market Competitive landscape

In January 2023, Gamewatchers Safaris (Kenya) unveiled a new luxury tented camp in Masai Mara National Reserve, promising guests an elevated safari experience amidst breathtaking views and up-close encounters with wildlife. March 2023 saw Rhino Africa (South Africa) acquire Imvelo Safari Lodges in Zimbabwe, increasing its collection of luxury safari accommodations and encouraging its presence in the region. By December 2023, &Beyond (South Africa) revealed plans to inaugurate a sustainable lodge in Kruger National Park, offering visitors a distinctive chance to immerse themselves in the park's diverse wildlife while prioritizing eco-conscious practices.

The safari tourism business has experienced increased competition due to the entry of new competitors and the growth of current ones. The rivalry is expected to lead to product diversification, innovation, and even cheaper prices. The opening of new lodges and experiences catered to a range of expenses and tastes, which appeal to a wider range of travelers and increase the market, is indicative of the market's expansion. Remarkably, a lot of recent releases have a high priority on sustainability, which influences industry norms and responds to growing consumer demand for ethical travel. The fierce competition highlights how the safari business has evolved to provide accessible, sustainable, and varied safari experiences in response to the shifting demands and expectations of travelers.

- The Phinda Forest Lodge, which is housed within the Phinda Private Game Reserve in KwaZulu Natal, South Africa, is undergoing renovations, as stated by Beyond in May 2023. Renovation plans make use of existing structures rather than completely rebuilding them to avoid disruption to its sensitive environment. It allows new design elements to be added while maintaining the "Zulu Zen" design of the original architecture.

- Singita debuted its newest wellness concept, "Wholeness," in April 2023. It offers specially designed spa treatments for summer visitors. On Singita Sabi Sand beach, locally sourced materials like riverbed sand are utilized to revitalize foot scrubs; visitors can anticipate additional plant-based options at lodges and camps; Mara River Tented Camp will undergo renovations and reopen with its brand-new look.

- In April 2023, Wilderness announced the establishment of Wilderness Mokete Tented Camp in Botswana's Mbabe Concession, covering 124,000 acres between Okavango Delta and Chobe National Park. This remote oasis is home to various forms of wildlife such as buffalos, elephants, hyenas, and even lions; making this camp unique as it features its region.

|

Safari Tourism Market Scope |

|

|

Market Size in 2024 |

USD 29.34 Bn. |

|

Market Size in 2032 |

USD 52.34 Bn. |

|

CAGR (2025-2032) |

7.50 % |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

By Type

|

|

By Booking Mode

|

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key Players in the Safari Tourism Market

- micato safaris

- globalrescue

- andbeyond

- scottdunn

- tuigroup

- butterfield

- singita

- micato safaris

- absolute Africa

- Wilderness

- Zicasso

- sunway-safaris

- micato

- africa-adventure

- tbltc

- naturalworldsafaris

- safarideal

- jacadatravel

- naturesafariindia

- travelweekly-asia

- asian-holidays

- classicsafaricompany

Frequently Asked Questions

Stakeholders are investing in sustainable practices such as eco-friendly lodges, responsible tourism initiatives, and community-based projects to align with growing traveler preferences and ensure long-term sustainability.

Technological innovations like virtual reality experiences, drone-based conservation solutions, and online booking platforms are enhancing the safari tourism experience and meeting evolving market needs.

The Market size was valued at USD 29.34 Billion in 2024 and the total Market revenue is expected to grow at a CAGR of 7.3% from 2025 to 2032, reaching nearly USD 52.34 Billion.

The segments covered in the market report are By Type, and Booking Mode.

1. Research Methodology

1.1 Research Data

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. Safari Tourism Market Executive Summary

2.1. Market Overview

2.2. Market Size (2024) and Forecast (2025 – 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments and Regions

3. Global Safari Tourism Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Service Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2024)

3.2.7. Profit Margin

3.2.8. Market Share

3.2.9. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

3.4.1. Strategic Initiatives and Developments

3.4.2. Mergers and Acquisitions

3.4.3. Collaborations and Partnerships

4. Safari Tourism Market: Dynamics

4.1. Safari Tourism Market Trends by Region

4.1.1. North America

4.1.2. Europe

4.1.3. Asia Pacific

4.1.4. Middle East and Africa

4.1.5. South America

4.2. Safari Tourism Market Drivers

4.3. Safari Tourism Market Restraints

4.4. Safari Tourism Market Opportunities

4.5. Safari Tourism Market Challenges

4.6. PORTER’s Five Forces Analysis

4.6.1. Intensity of the Rivalry

4.6.2. Threat of New Entrants

4.6.3. Bargaining Power of Suppliers

4.6.4. Bargaining Power of Buyers

4.6.5. Threat of Substitutes

4.7. PESTLE Analysis

4.7.1. Political Factors

4.7.2. Economic Factors

4.7.3. Social Factors

4.7.4. Technological Factor

4.7.5. Legal Factors

4.7.6. Environmental Factors

4.8. Technological Roadmap

4.9. Regulatory Landscape

4.9.1. Market Regulation by Region

4.9.1.1. North America

4.9.1.2. Europe

4.9.1.3. Asia Pacific

4.9.1.4. Middle East and Africa

4.9.1.5. South America

4.9.2. Government Schemes and Initiatives

5. Safari Tourism Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

5.1. Safari Tourism Market Size and Forecast, by Type (2024-2032)

5.1.1. Couples

5.1.2. Friends

5.2. Safari Tourism Market Size and Forecast, by Booking Mode (2024-2032)

5.2.1. Direct Bookings

5.2.2. Marketplace Booking

5.3. Safari Tourism Market Size and Forecast, by Region (2024-2032)

5.3.1. North America

5.3.2. Europe

5.3.3. Asia Pacific

5.3.4. Middle East and Africa

5.3.5. South America

6. North America Safari Tourism Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

6.1. North America Safari Tourism Market Size and Forecast, by Type (2024-2032)

6.1.1. Couples

6.1.2. Friends

6.2. North America Safari Tourism Market Size and Forecast, by Booking Mode (2024-2032)

6.2.1. Direct Bookings

6.2.2. Marketplace Booking

6.3. North America Safari Tourism Market Size and Forecast, by Country (2024-2032)

6.3.1. United States

6.3.2. Canada

6.3.3. Mexico

7. Europe Safari Tourism Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

7.1. Europe Safari Tourism Market Size and Forecast, by Type (2024-2032)

7.2. Europe Safari Tourism Market Size and Forecast, by Booking Mode (2024-2032)

7.3. Europe Safari Tourism Market Size and Forecast, by Country (2024-2032)

7.3.1. United Kingdom

7.3.2. France

7.3.3. Germany

7.3.4. Italy

7.3.5. Spain

7.3.6. Sweden

7.3.7. Austria

7.3.8. Rest of Europe

8. Asia Pacific Safari Tourism Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

8.1. Asia Pacific Safari Tourism Market Size and Forecast, by Type (2024-2032)

8.2. Asia Pacific Safari Tourism Market Size and Forecast, by Booking Mode (2024-2032)

8.3. Asia Pacific Safari Tourism Market Size and Forecast, by Country (2024-2032)

8.3.1. China

8.3.2. S Korea

8.3.3. Japan

8.3.4. India

8.3.5. Australia

8.3.6. Indonesia

8.3.7. Malaysia

8.3.8. Vietnam

8.3.9. Taiwan

8.3.10. Rest of Asia Pacific

9. Middle East and Africa Safari Tourism Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

9.1. Middle East and Africa Safari Tourism Market Size and Forecast, by Type (2024-2032)

9.2. Middle East and Africa Safari Tourism Market Size and Forecast, by Booking Mode (2024-2032)

9.3. Middle East and Africa Safari Tourism Market Size and Forecast, by Country (2024-2032)

9.3.1. South Africa

9.3.2. GCC

9.3.3. Nigeria

9.3.4. Rest of ME&A

10. South America Safari Tourism Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

10.1. South America Safari Tourism Market Size and Forecast, by Type (2024-2032)

10.2. South America Safari Tourism Market Size and Forecast, by Booking Mode (2024-2032)

10.3. South America Safari Tourism Market Size and Forecast, by Country (2024-2032)

10.3.1. Brazil

10.3.2. Argentina

10.3.3. Rest Of South America

11. Company Profile: Key Players

11.1. micato safaris

11.1.1. Company Overview

11.1.2. Business Portfolio

11.1.3. Financial Overview

11.1.3.1. Total Revenue

11.1.3.2. Segment Revenue

11.1.3.3. Regional Revenue

11.1.4. SWOT Analysis

11.1.5. Strategic Analysis

11.1.6. Recent Developments

11.2. globalrescue

11.3. andbeyond

11.4. scottdunn

11.5. tuigroup

11.6. butterfield

11.7. singita

11.8. micato safaris

11.9. absolute Africa

11.10. Wilderness

11.11. Zicasso

11.12. sunway-safaris

11.13. micato

11.14. africa-adventure

11.15. tbltc

11.16. naturalworldsafaris

11.17. safarideal

11.18. jacadatravel

11.19. naturesafariindia

11.20. travelweekly-asia

11.21. asian-holidays

11.22. classicsafaricompany

12. Key Findings

13. Analyst Recommendations

13.1. Strategic Recommendations

13.2. Future Outlook