Regional Jet Market - Global Industry Analysis and Forecast (2025-2032)

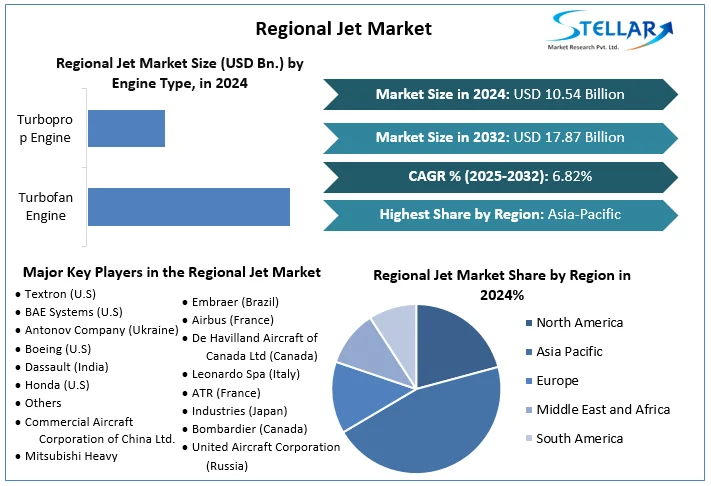

The Regional Jet Market size was valued at USD 10.54 Bn. in 2024 and the total Global Regional Jet revenue is expected to grow at a CAGR of 6.82% from 2025 to 2032, reaching nearly USD 17.87 Bn. by 2032.

Format : PDF | Report ID : SMR_2213

Regional Jet Market Overview

The regional jet market is a significant segment in the aviation industry, catering to medium-haul flight passengers. These jets typically accommodate 50 to 100 passengers and serve routes that connect smaller cities and towns to major hubs, thereby facilitating regional connectivity and easing travel for passengers who would otherwise face longer journeys or multiple transfers. driven by increasing air travel demand, technological developments in aircraft and the expansion of regional airline networks. The market dynamics of regional jets are driven by the growth in regional air travel, spurred by increasing population mobility and economic development in regions worldwide. Regional jets are utilized by airlines to efficiently link the regional markets, optimizing their networks and schedules to meet the demand of passengers effectively.

Technological advancements play a crucial role, aimed at enhancing fuel efficiency, reducing operating costs, passenger safety and comfort, and improving overall performance. The ongoing innovations include the incorporation of advanced materials, aerodynamic improvements, and more efficient engine designs. The development of hybrid-electric and hydrogen-powered aircraft is a promising opportunity for further enhancing the environmental sustainability and operational efficiency of regional jets. The regional jet market challenges include economic considerations, as the high costs for operating compared to larger aircraft affect the profitability of regional jet industries.

The Embraer, Bombardier, Mitsubishi Aircraft Corporation, and ATR are some of the top regional jet market players in the aviation industry, which specialize in both jet and turboprop regional aircraft. The emerging markets, particularly in Asia-Pacific and Latin America, are expected to grow and be significantly driven by increasing demand for regional connectivity, infrastructure development and increasing air travel demand from growing middle-class populations.

The report provides a comprehensive analysis of the global Regional Jet market, which includes the current market size, overall segmentation analysis (By Platform, Engine Type Seating Capacity, Function, and Regions), market trends, drivers, restraints, opportunities, scope, and key players.

To get more Insights: Request Free Sample Report

Regional Jet Market Dynamics

Increasing air travel demand and technological advancements influence the growth of the Regional Jet market:

The growing air passenger traffic, particularly in regional routes drives the demand for regional jets. As global travel is rising continuously, the need for efficient and convenient regional air travel options is also rising, this drives the growth of the global regional jet market. The regional jets typically with 80-125 seats are designed for shorter routes, making them ideal for connecting smaller cities and towns to larger hubs. The expansion of routes to underserved or unserved regions where aircraft are not economically viable stimulates the demand for regional jets. The improved regional connectivity fosters economic development and caters to a wider range of travellers, boosting demand for regional jets. Thus, the major airlines seek to invest in these routes to tap into new passenger bases and increase the overall regional jet market size.

Regional jets offer a balance between capacity and operational costs, making them economically viable for airlines operating shorter routes or serving less densely populated areas. Technological advancements are continuously improving the efficiency and attractiveness of regional jets. The development in aerodynamics, lightweight materials, and more efficient engines drive the growth of the regional jet market. The technology that lowers fuel consumption helps to reduce the operating costs for airlines and also aligns with the global sustainability goals. Enhanced avionics systems improve navigation precision and operational efficiency.

Emerging technologies such as electric and hybrid-electric propulsion systems are being explored for regional aircraft. These technologies promise reduced emissions and operating costs, potentially reshaping the future of regional air travel. Stringent environmental regulations and noise restrictions influence the design and operation of regional jets. The regional jet manufacturers must comply with these regulations while maintaining operational efficiency and passenger comfort.

High operating costs and stringent regulations are the major challenges that affect the growth of the Regional Jet market:

The growth of the regional jet market is hindered by several significant challenges such as economic factors, an unfavourable regulatory environment, limited infrastructural resources, and technology and innovation investments. Economic factors, such as high operating costs per seat and fluctuating fuel prices, pose financial hurdles for regional airlines. Regulatory requirements, including stringent safety standards and noise regulations, add complexity and costs to operations.

Infrastructure limitations at regional airports, such as runway length and maintenance facilities, restrict the efficient operation and expansion of regional jet fleets. Moreover, market dynamics, such as airline consolidation and competition from high-speed rail, further complicate the demand landscape for regional jets. These challenges necessitate strategic solutions and investments in technology, infrastructure, and regulatory support to sustain and enhance the growth prospects of the regional jet market.

Potential Opportunities for the Regional Jet Market:

The regional jet market presents significant opportunities for growth and innovation. For instance, advancements in regional jet technology continue to enhance fuel efficiency and operational capabilities, reducing operating costs and environmental impact. Regional jet manufacturers like Embraer and Bombardier are investing in next-generation regional jets, such as the Embraer E2 series and the Bombardier CRJ series, which offer improved performance and passenger comfort. These innovations align with the increasing demand for regional connectivity in emerging markets and underserved routes, where regional jets can provide economical and efficient transport solutions.

The expansion of regional airports and improvements in infrastructure support the viability of operations, opening new regional jet routes and enhancing connectivity. The strategic partnerships and collaborations between airlines and regional governments stimulate demand and foster sustainable growth in the regional jet sector, ensuring its role in the broader aviation ecosystem.

Regional Jet Market Segment Analysis

By Platform, the global regional jet market is segmented into commercial aircraft and military aircraft. The commercial segment held the largest market share in 2024 and is anticipated to dominate the market owing to rising demand from the airlines operating low-cost carriers. The segment has experienced significant evolution in terms of technological advancements and developments. The modern is lightweight and provides passenger comfort and safety as a high priority. The regional military jet segment is expected to grow significantly during the forecast period owing to the production rates for military jets being less compared to commercial jets.

The lower cost for regional jet maintenance, the greater efficiency and require shorter and non-concrete runways for take-off and landings are some of the extensive properties that make it more affordable. The segment brings some significant modifications in ongoing surveillance, electronic warfare activities, and VIP travel. For instance, The Italian Air Force has P-72A aircraft, which is based on the ATR72-600 twin turboprop regional airliners. The P-72A is a multi-role maritime patrol, electronic surveillance, and C4I aircraft.

By Engine Type, the global regional jet market is segmented into turboprop engines and turbofan engines. The turbofan engine segment holds the largest share market and is expected to dominate the market during the forecast period. This is attributed to high efficiency, low noise, aligned with stringent environmental regulations, and technological advancements leading the market demand. Turbofan engines, particularly found in modern regional jets like the Sukhoi Superjet 100, Mitsubishi SpaceJet, and Airbus A220, offer significant advantages in efficiency and maintenance.

The aircraft engines are developed by major OEMs such as General Electric and Pratt & Whitney and boast high bypass ratios which enhance fuel efficiency and reduce carbon emissions compared to turboprops. As the demand for modern regional aircraft continues to grow, the demand for turbofan engines is expected to increase due to their superior performance metrics and compliance with stringent environmental regulations. The turboprop engines segment is anticipated to grow significantly during the forecast period. Aircraft like the de Havilland Canada Dash 8 Q400 and ATR 72-600 are in production and incorporate noise reduction technologies to solve the noise level issues.

By Seating Capacity, the global regional jet market share is segmented into 15-80 seats and 80-125 seats. The regional jet with a seating capacity ranging from 80 to 125 seats held the largest market share and is anticipated to dominate the market during the forecast period. The seating capacity and arrangement are pivotal factors in the aviation operation. There is a growing demand for regional air travel connecting medium-density routes and regional hubs to larger airports. Regional jet airlines are increasingly focusing on right-sizing their fleets to match passenger demand on these routes. The jets in the 80-125 seat range strike a balance between capacity and operational efficiency, making them suitable for such routes where larger narrow-body aircraft might be too large and uneconomical.

Regional Jet Market Regional Analysis

North America held the largest global regional jet market share in 2024 and is expected to dominate the market during the forecast period. This owing to the presence of leading aircraft manufacturing players such as Havilland (Bombardier) along with major regional airline operators such as Delta and American, SkyWest Airlines, etc. The airlines in the region such as Delta and American Airlines hold the largest jet fleets, so the region also has vast assembly lines for all sizes of aircraft for various applications, thus leading to the regional jet market expansion.

The rising demand for aerial vehicles for commercial applications and increasing airline passenger traffic contribute to the rising regional jet market size in the region. Regulatory compliance with stringent Federal Aviation Administration (FAA) standards shapes both the design and regional jet operations in this market.

Asia-Pacific represented the fastest-growing market for regional jets, propelled by increasing urbanization, economic expansion and infrastructure development. Countries like China, Japan, South Korea, and India are witnessing substantial demand for regional connectivity as secondary cities and emerging markets seek efficient air links. Countries like China and India, with their burgeoning middle-class populations, are driving the demand for air travel within and between smaller cities.

This growth is bolstering the regional jet market as airlines seek efficient and cost-effective solutions to connect these expanding urban centres. In China, for instance, the Civil Aviation Administration has been actively promoting regional connectivity as part of its broader transportation infrastructure development initiatives. This has led to increased orders for regional jets from manufacturers like COMAC and international players looking to tap into China's growing regional air travel market.

The key manufacturers such as Mitsubishi and Embraer, alongside established players like Airbus and newer entrants from China, are vying for market share in this dynamic region. Regulatory challenges stem from diverse national regulations across jurisdictions, necessitating flexible strategies for market entry and operations. Competitive pressures from low-cost carriers and alternative modes of transport, such as high-speed rail, add complexity to the market landscape despite ongoing infrastructure investments.

Regional Jet Market Competitive Landscape

The regional jet market is highly competitive, characterized by a major key player and a diverse range of aircraft offerings tailored to different regional needs and operational requirements. The are Embraer, Airbus, De Havilland Aircraft of Canada Ltd, Leonardo Spa, ATR, Commercial Aircraft Corporation of China Ltd., etc. are the leading companies in the global regional jet market. The company dominates the market with their diverse offerings of regional jets tailored to various market segments.

For instance, Embraer's E-Jet family has gained traction globally, known for its efficiency and passenger comfort, while Bombardier's CRJ series has been a staple in regional aviation for decades, particularly in North America. These manufacturers continually innovate to stay competitive, developing new aircraft models that meet stringent environmental regulations and operational demands. Success in this dynamic landscape hinges on strategic differentiation, technological advancements, strategic alliances and collaborations between the industry, and responsiveness to evolving market trends.

For instance,

- Embraer has secured a major order for 133 aircraft from American Airlines Group Inc. to meet domestic demand in the United States. American has placed a firm order with Embraer for 90 E175s, with purchase rights for 43 additional jets. The aircraft will be delivered with 76 seats in America’s standard dual-class configuration. The deal, with all purchase rights exercised, is worth more than US$7bn at the list price, and the firm orders will be included in Embraer’s 1Q24 backlog.

- In July 2024, American Airlines announced that it has entered into a conditional purchase agreement with clean aviation innovator ZeroAvia for 100 hydrogen-electric engines intended to power regional jet aircraft with zero inflight emissions save for water vapour.

- In Nov 2023, American Airlines Group announced that the company aims to introduce high-speed Wi-Fi for their customers travelling in their regional jets. The company is focused on introducing richer cabin and flying experiences for its consumers.

|

Regional Jet Market Scope |

|

|

Market Size in 2024 |

USD 10.54 Billion |

|

Market Size in 2032 |

USD 17.87 Billion |

|

CAGR (2025-2032) |

6.82% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Platform Commercial Aircraft Military Aircraft |

|

|

By Engine Type Turbofan Engine Turboprop Engine |

|

|

By Seating Capacity 35-80 Seats 80-125 Seats |

|

|

By Maximum Take-Off Weight 20,000 Lbs To 80,000 Lbs. 81,000 Lbs To 1,60,000 Lbs. |

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key Player in the Regional Jet Market

- Embraer (Brazil)

- Airbus (France)

- De Havilland Aircraft of Canada Ltd (Canada)

- Leonardo Spa (Italy)

- ATR (France)

- Commercial Aircraft Corporation of China Ltd. (China)

- Mitsubishi Heavy Industries (Japan)

- Bombardier (Canada)

- United Aircraft Corporation (Russia)

- Textron (U.S)

- BAE Systems (U.S)

- Antonov Company (Ukraine)

- Boeing (U.S)

- Dassault (India)

- Honda (U.S)

- Others

Frequently Asked Questions

The top companies in the Regional Jet Market are Embraer, Airbus, De Havilland Aircraft of Canada Ltd, Leonardo Spa, ATR, Commercial Aircraft Corporation of China Ltd., etc.

The growth of the Regional Jet market is driven by increasing global air passenger traffic, particularly in regional routes, which creates demand for efficient and convenient air travel options between smaller cities and larger hubs.

Asia Pacific is the fastest-growing region in the Regional Jet market during the forecast period.

The segments covered in the market report are Platform, Engine Type Seating Capacity, Function, and Region.

1. Regional Jet Market: Research Methodology

1.1. Research Data

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Assumptions

2. Regional Jet Market: Executive Summary

2.1. Market Overview

2.2. Market Size (2024) and Forecast (2025– 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments and Regions

3. Regional Jet Market: Competitive Landscape

3.1. Stellar Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Product Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2023)

3.2.7. Profit Margin

3.2.8. Market Share

3.2.9. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

3.4.1. Strategic Initiatives and Developments

3.4.2. Mergers and Acquisitions

3.4.3. Collaborations and Partnerships

3.4.4. Product Launches and Innovation

4. Regional Jet Market: Dynamics

4.1. Market Trends by Region

4.1.1. North America

4.1.2. Europe

4.1.3. Asia Pacific

4.1.4. Middle East and Africa

4.1.5. South America

4.2. Market Drivers

4.3. Market Restraints

4.4. Market Opportunities

4.5. Market Challenges

4.6. PORTER’s Five Forces Analysis

4.6.1. Intensity of the Rivalry

4.6.2. Threat of New Entrants

4.6.3. Bargaining Power of Suppliers

4.6.4. Bargaining Power of Buyers

4.6.5. Threat of Substitutes

4.7. PESTLE Analysis

4.7.1. Political Factors

4.7.2. Economic Factors

4.7.3. Social Factors

4.7.4. Technological Factors

4.7.5. Legal Factors

4.7.6. Environmental Factors

4.8. Technological Roadmap

4.9. Value Chain Analysis

4.10. Regulatory Landscape

4.10.1. Market Regulation by Region

4.10.1.1. North America

4.10.1.2. Europe

4.10.1.3. Asia Pacific

4.10.1.4. Middle East and Africa

4.10.1.5. South America

4.10.2. Impact of Regulations on Market Dynamics

4.10.3. Government Schemes and Initiatives

5. Regional Jet Market Size and Forecast by Segments (by Value USD Million)

5.1. Regional Jet Market Size and Forecast, By Platform (2024-2032)

5.1.1. Commercial Aircraft

5.1.2. Military Aircraft

5.2. Regional Jet Market Size and Forecast, By Engine Type (2024-2032)

5.2.1. Turbofan Engine

5.2.2. Turboprop Engine

5.3. Regional Jet Market Size and Forecast, By Seating Capacity (2024-2032)

5.3.1. 35-80 Seats

5.3.2. 80-125 Seats

5.4. Regional Jet Market Size and Forecast, By Maximum Take-Off Weight (2024-2032)

5.4.1. 20,000 Lbs To 80,000 Lbs.

5.4.2. 81,000 Lbs To 1,60,000 Lbs.

5.5. Regional Jet Market Size and Forecast, by Region (2024-2032)

5.5.1. North America

5.5.2. Europe

5.5.3. Asia Pacific

5.5.4. Middle East and Africa

5.5.5. South America

6. North America Regional Jet Market Size and Forecast (by Value USD Million)

6.1. North America Regional Jet Market Size and Forecast, By Platform (2024-2032)

6.1.1. Commercial Aircraft

6.1.2. Military Aircraft

6.2. North America Regional Jet Market Size and Forecast, By Engine Type (2024-2032)

6.2.1. Turbofan Engine

6.2.2. Turboprop Engine

6.3. North America Regional Jet Market Size and Forecast, By Seating Capacity (2024-2032)

6.3.1. 35-80 Seats

6.3.2. 80-125 Seats

6.4. North America Regional Jet Market Size and Forecast, By Maximum Take-Off Weight (2024-2032)

6.4.1. 20,000 Lbs To 80,000 Lbs.

6.4.2. 81,000 Lbs To 1,60,000 Lbs.

6.5. North America Regional Jet Market Size and Forecast, by Country (2024-2032)

6.5.1. United States

6.5.2. Canada

6.5.3. Mexico

7. Europe Regional Jet Market Size and Forecast (by Value USD Million)

7.1. Europe Regional Jet Market Size and Forecast, By Platform (2024-2032)

7.2. Europe Regional Jet Market Size and Forecast, By Engine Type (2024-2032)

7.3. Europe Regional Jet Market Size and Forecast, By Seating Capacity (2024-2032)

7.4. Europe Regional Jet Market Size and Forecast, By Maximum Take-Off Weight (2024-2032)

7.5. Europe Regional Jet Market Size and Forecast, by Country (2024-2032)

7.5.1. UK

7.5.2. France

7.5.3. Germany

7.5.4. Italy

7.5.5. Spain

7.5.6. Sweden

7.5.7. Austria

7.5.8. Rest of Europe

8. Asia Pacific Regional Jet Market Size and Forecast (by Value USD Million)

8.1. Asia Pacific Regional Jet Market Size and Forecast, By Platform (2024-2032)

8.2. Asia Pacific Regional Jet Market Size and Forecast, By Engine Type (2024-2032)

8.3. Asia Pacific Regional Jet Market Size and Forecast, By Seating Capacity (2024-2032)

8.4. Asia Pacific Regional Jet Market Size and Forecast, By Maximum Take-Off Weight (2024-2032)

8.5. Asia Pacific Regional Jet Market Size and Forecast, by Country (2024-2032)

8.5.1. China

8.5.2. S Korea

8.5.3. Japan

8.5.4. India

8.5.5. Australia

8.5.6. Indonesia

8.5.7. Malaysia

8.5.8. Vietnam

8.5.9. Taiwan

8.5.10. Bangladesh

8.5.11. Pakistan

8.5.12. Rest of Asia Pacific

9. Middle East and Africa Regional Jet Market Size and Forecast (by Value USD Million)

9.1. Middle East and Africa Regional Jet Market Size and Forecast, By Platform (2024-2032)

9.2. Middle East and Africa Regional Jet Market Size and Forecast, By Engine Type (2024-2032)

9.3. Middle East and Africa Regional Jet Market Size and Forecast, By Seating Capacity (2024-2032)

9.4. Middle East and Africa Regional Jet Market Size and Forecast, By Maximum Take-Off Weight (2024-2032)

9.5. Middle East and Africa Regional Jet Market Size and Forecast, by Country (2024-2032)

9.5.1. South Africa

9.5.2. GCC

9.5.3. Egypt

9.5.4. Nigeria

9.5.5. Rest of ME&A

10. South America Regional Jet Market Size and Forecast (by Value USD Million)

10.1. South America Regional Jet Market Size and Forecast, By Platform (2024-2032)

10.2. South America Regional Jet Market Size and Forecast, By Engine Type (2024-2032)

10.3. South America Regional Jet Market Size and Forecast, By Seating Capacity (2024-2032)

10.4. South America Regional Jet Market Size and Forecast, By Maximum Take-Off Weight (2024-2032)

10.5. South America Regional Jet Market Size and Forecast, by Country (2024-2032)

10.5.1. Brazil

10.5.2. Argentina

10.5.3. Rest of South America

11. Company Profile: Key players

11.1. Embraer (Brazil)

11.1.1. Company Overview

11.1.2. Product Portfolio

11.1.2.1. Product Name

11.1.2.2. Product Details (Price, Features, etc.)

11.1.3. Financial Overview

11.1.3.1. Total Revenue

11.1.3.2. Segment Revenue

11.1.3.3. Regional Revenue

11.1.4. SWOT Analysis

11.1.5. Strategic Analysis

11.1.6. Recent Developments

11.2. Airbus (France)

11.3. De Havilland Aircraft of Canada Ltd (Canada)

11.4. Leonardo Spa (Italy)

11.5. ATR (France)

11.6. Commercial Aircraft Corporation of China Ltd. (China)

11.7. Mitsubishi Heavy Industries (Japan)

11.8. Bombardier (Canada)

11.9. United Aircraft Corporation (Russia)

11.10. Textron (U.S)

11.11. BAE Systems (U.S)

11.12. Antonov Company (Ukraine)

11.13. Boeing (U.S)

11.14. Dassault (India)

11.15. Honda (U.S)

11.16. Others

12. Key Findings

13. Industry Recommendations

13.1. Strategic Recommendations

13.2. Future Outlook