Plant Hormones Market- Global Industry Analysis and Forecast (2025-2032)

The Plant Hormones Market size was valued at USD 4.89 Bn. in 2024 and the total Plant Hormones Market size is expected to grow at a CAGR of 8.86% from 2025 to 2032, reaching nearly USD 9.66 Bn. by 2032.

Format : PDF | Report ID : SMR_2040

Plant Hormones Market Overview

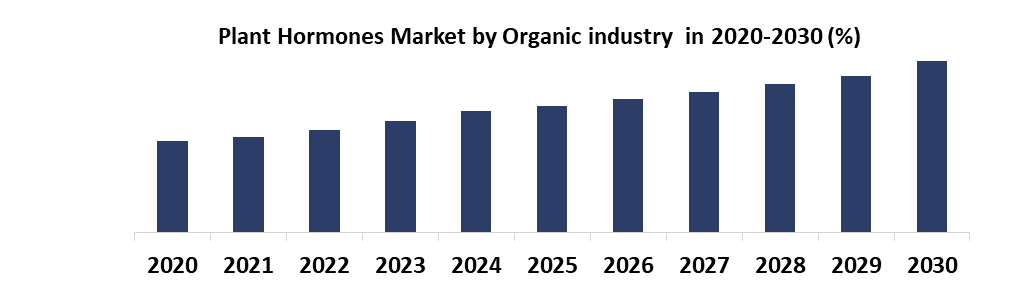

Plant hormones are chemicals found in plants at low concentrations that promote plant growth, aiding in cell division, root elongation, shoot, ripening, and flowering. Commercially available plant hormones include auxins, cytokines, ethylene, and gibberellins. The organic industry has rapidly expanded, with the development of crop-specific products as a strategy to penetrate the global market. Plant hormones control growth processes like leaf and flower formation, stem elongation, fruit development, and ripening. They have become an integral part of organic farming practices, particularly from algae, because of their natural origin. The use of natural hormones in organic fruit growing and cash crops has increased demand, making organic farming one of the fastest-growing industries globally.

Plant hormones interact with one another to affect the growth and development of plants. The five plant hormones that are considered classical are ethylene, gibberellins, auxins, cytokinins, and abscisic acid. These are small, diffusible molecules that pass through cells easily. Also, new clans of plant hormones, including salicylic acid, jasmonic acid, brassinosteroids, and numerous tiny proteins or peptides, have been identified. These hormones are important in regulating the growth and development of plants.

To get more Insights: Request Free Sample Report

Plant Hormones Market Dynamics:

The organic industry's growth is driven by the importance of sustainable agriculture and increased investment in developing countries. Farmers have better access to plant hormones because of better financial resources. Patent protection and exclusivity help companies recoup research and development costs, incentivizing future investments. Plant hormones have gained global status as they promote plant growth and spread. The main driver of market growth is the increased demand for agricultural products like fruits, vegetables, cereals, pulses, and other crops.

The demand for crop productivity-related products has also increased. Features such as the growth of the textile industry and the organic agriculture industry are expected to raise demand for plant hormones. High crop productivity associated with plant hormones encourages global sales. The enhancement of products and technological developments are major reasons for the growth of the plant hormones market.

Farmers are shifting from traditional practices, increasing demand for advanced technologies like plant hormones. These hormones promote seed germination, stem and root elongation, and plant growth, boosting adoption rates. Manufacturing companies are also producing innovative, high-quality products to attract larger consumer bases. These products, which contain high concentrations of Ascophyllum nodossum and Folic acid, enhance flowering, reduce flower drops, and improve flower and fruit, thus contributing to market growth.

The market of plant hormones is expected to grow, but there are several difficulties in the market. Commercialization and scalability are delayed by regulatory complications and restrictive approval procedures for new goods, which create obstacles to market access and innovation. Also, problems with human health and environmental sustainability require thorough risk assessment and mitigation plans, which raises manufacturing costs and market uncertainty. In addition, pricing tactics, brand distinctiveness, and market penetration are all restricted by market fragmentation and fierce rivalry among manufacturers and suppliers. To address these problems, collaborative efforts and market consolidation efforts are necessary.

The plant hormone market offers significant growth opportunities for stakeholders because of the increasing global population and food demand. Sustainable agricultural practices are being adopted to optimize crop production and resource utilization. Expansion into emerging markets like Asia-Pacific and Latin America presents available growth prospects. Advancements in precision agriculture and digital farming technologies provide opportunities for developing innovative, data-driven plant hormone products. The demand for organic products is rising because of concerns about synthetic chemicals, and developing countries are experiencing rapid progress and population growth. Advancements in biotechnology are advancing novel plant hormone-based products.

Plant Hormones Market Segment Analysis:

Based on Type, Cytokinins a type of plant hormone, are important for plant growth and development. They account for XX% of the global market share and are widely consumed because of their benefits, such as preventing leaf senescence and decaying plant aging. They are particularly abundant in germinating seeds, roots, sap streams, fruits, and tumor tissues. Cytokinins are naturally produced in various parts of plants, including root meristems, young leaves, fruits, seeds, and developing tissues. They enhance seed germination, especially in darkness, and work in combination with other plant hormones like gibberellins to break photo-dormancy in certain seeds. Synthetic cytokinins have also been developed for various purposes in plant research and agriculture.

- Cytokinins play a crucial role in cell division, elongation, and enlargement, contributing to the growth and development of plant tissues and organs. They stimulate cell division, resulting in new cell formation and tissue growth. They are widely used in tissue culture techniques to induce regeneration and growth of new plant tissues and organs. Cytokinins also regulate flowering and fruit development by controlling cell division, growth, and hormonal balance.

Plant Hormones Market Regional Insight:

The North American Plant Hormones Market had a XX% market share in 2024. Growing consumption, especially in the United States, of produce crops is driving the business in North America. Corn, cotton, fruit, tree nuts, soybean & oil crops, wheat, and pulses are the principal produce crops grown in the US. Canada is one of the biggest exporters of agricultural products globally, so it makes sense that demand for all PGRs is significantly rising. The agricultural sector in Western Canada has evolved all over time, both in terms of the crops grown and farmed. Gibberellin inhibitors and ethylene-releasing compounds are the two primary PGR types that are available commercially in Western Canada. Also, in the North American area, the market of plant hormones in the United States had the most market share, while the market in Canada was growing at the fastest rate.

Plant Hormones Market Competitive Landscape:

- May 14, 2024, FMC Corporation a leading global agricultural sciences company, today announced a collaboration with Optibrium, a leading developer of software and artificial intelligence (AI) solutions for small molecule discovery. The agreement is part of FMC's strategic plan to accelerate the discovery and commercialization of FMC's pipeline. Expanding FMC's Discovery process to include Optibrium's innovative Augmented Chemistry® AI technologies are help bring new solutions to growers faster. Machine learning and AI methods serve to identify promising compounds, optimize their properties, and continue the company’s focus on sustainable products.

- 3 May 2024, Rallis India Limited, a Tata enterprise and a leading player in the Indian Agri inputs industry, announces the establishment of an automated 8000 Metric Ton WSF plant in Akola, Maharashtra. This strategic initiative underscores Rallis' commitment to innovation, enhancing farm productivity, and advancing sustainable agriculture practices.

|

Plant Hormones Market Scope |

|

|

Market Size in 2024 |

USD 4.89 Bn. |

|

Market Size in 2032 |

USD 9.66 Bn. |

|

CAGR (2025-2032) |

8.86 % |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Type Auxins Cytokinins Ethylene Gibberellins Others |

|

By Formulation Solutions Granules Wet Powders Others |

|

|

By Function Growth Promoters Growth Inhibitors |

|

|

By Application Fruits & Vegetables Cereals & Pulses Oilseeds & Grains Others |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key Player in the Plant Hormones Market

- Nufarm Australia Ltd. (Australia)

- FMC Corporation (USA)

- Bayer (Germany)

- Adama Agricultural Solutions Ltd. (Israel)

- Valent BioSciences Corporation (USA)

- Dow Chemical Company (USA)

- BASF SE (Germany)

- Syngenta Group (Switzerland)

- Tata Chemicals Ltd. (India)

- UPL (India)

- Sumitomo Chemical Co., Ltd. (Japan)

- Nippon Soda Co., Ltd. (Japan)

- DHANUKA AGRITECH LTD (India)

- Sichuan Guoguang Agrochemical Co., (China)

- Zagro (Singapore)

- BioWorks Inc. (USA)

- Biowin Agro Research (Poland)

- WinField United (USA)

- Seipasa (Spain)

- XX.inc

Frequently Asked Questions

North America is expected to lead the Plant Hormones Market during the forecast period.

An analysis of profit trends and projections for companies in the Plant Hormones Market is included, offering insights into factors driving profitability, cost management strategies, and financial performance metrics.

The Plant Hormones Market size was valued at USD 4.89 Billion in 2024 and the total Plant Hormones Market size is expected to grow at a CAGR of 8.86% from 2025 to 2032, reaching nearly USD 9.66 Billion by 2032.

The segments covered in the market report are by Type, by Formulation, by Function, and by Application.

1. Research Methodology

1.1 Research Data

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. Plant Hormones Market: Executive Summary

2.1. Market Overview

2.2. Market Size (2024) and Forecast (2025 – 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments and Regions

3. Global Plant Hormones Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Product Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2024)

3.2.7. Profit Margin

3.2.8. Market Share

3.2.9. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

3.4.1. Strategic Initiatives and Developments

3.4.2. Mergers and Acquisitions

3.4.3. Collaborations and Partnerships

3.4.4. Product Launches and Innovations

4. Plant Hormones Market: Dynamics

4.1. Plant Hormones Market Trends by Region

4.1.1. North America

4.1.2. Europe

4.1.3. Asia Pacific

4.1.4. Middle East and Africa

4.1.5. South America

4.2. Plant Hormones Market Drivers

4.3. Plant Hormones Market Restraints

4.4. Plant Hormones Market Opportunities

4.5. Plant Hormones Market Challenges

4.6. PORTER’s Five Forces Analysis

4.6.1. Intensity of the Rivalry

4.6.2. Threat of New Entrants

4.6.3. Bargaining Power of Suppliers

4.6.4. Bargaining Power of Buyers

4.6.5. Threat of Substitutes

4.7. PESTLE Analysis

4.7.1. Political Factors

4.7.2. Economic Factors

4.7.3. Social Factors

4.7.4. Technological Factor

4.7.5. Legal Factors

4.7.6. Environmental Factors

4.8. Technological Roadmap

4.9. Regulatory Landscape by Region

4.9.1. North America

4.9.2. Europe

4.9.3. Asia Pacific

4.9.4. Middle East and Africa

4.9.5. South America

5. Plant Hormones Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

5.1. Plant Hormones Market Size and Forecast, by Type (2024-2032)

5.1.1. Auxins

5.1.2. Cytokinins

5.1.3. Ethylene

5.1.4. Gibberellins

5.1.5. Others

5.2. Plant Hormones Market Size and Forecast, by Formulation (2024-2032)

5.2.1. Solutions

5.2.2. Granules

5.2.3. Wet Powders

5.2.4. Others

5.3. Plant Hormones Market Size and Forecast, by Function (2024-2032)

5.3.1. Growth Promoters

5.3.2. Growth Inhibitors

5.4. Plant Hormones Market Size and Forecast, by Application (2024-2032)

5.4.1. Fruits & Vegetables

5.4.2. Cereals & Pulses

5.4.3. Oilseeds & Grains

5.4.4. Others

5.5. Plant Hormones Market Size and Forecast, by Region (2024-2032)

5.5.1. North America

5.5.2. Europe

5.5.3. Asia Pacific

5.5.4. Middle East and Africa

5.5.5. South America

6. North America Plant Hormones Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

6.1. North America Plant Hormones Market Size and Forecast, by Type (2024-2032)

6.1.1. Auxins

6.1.2. Cytokinins

6.1.3. Ethylene

6.1.4. Gibberellins

6.1.5. Others

6.2. North America Plant Hormones Market Size and Forecast, by Formulation (2024-2032)

6.2.1. Solutions

6.2.2. Granules

6.2.3. Wet Powders

6.2.4. Others

6.3. North America Plant Hormones Market Size and Forecast, by Function (2024-2032)

6.3.1. Growth Promoters

6.3.2. Growth Inhibitors

6.4. North America Plant Hormones Market Size and Forecast, by Application (2024-2032)

6.4.1. Fruits & Vegetables

6.4.2. Cereals & Pulses

6.4.3. Oilseeds & Grains

6.4.4. Others

6.5. North America Plant Hormones Market Size and Forecast, by Country (2024-2032)

6.5.1. United States

6.5.2. Canada

6.5.3. Mexico

7. Europe Plant Hormones Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

7.1. Europe Plant Hormones Market Size and Forecast, by Type (2024-2032)

7.2. Europe Plant Hormones Market Size and Forecast, by Formulation (2024-2032)

7.3. Europe Plant Hormones Market Size and Forecast, by Function (2024-2032)

7.4. Europe Plant Hormones Market Size and Forecast, by Application (2024-2032)

7.5. Europe Plant Hormones Market Size and Forecast, by Country (2024-2032)

7.5.1. United Kingdom

7.5.2. France

7.5.3. Germany

7.5.4. Italy

7.5.5. Spain

7.5.6. Sweden

7.5.7. Austria

7.5.8. Rest of Europe

8. Asia Pacific Plant Hormones Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

8.1. Asia Pacific Plant Hormones Market Size and Forecast, by Type (2024-2032)

8.2. Asia Pacific Plant Hormones Market Size and Forecast, by Formulation (2024-2032)

8.3. Asia Pacific Plant Hormones Market Size and Forecast, by Function (2024-2032)

8.4. Asia Pacific Plant Hormones Market Size and Forecast, by Application (2024-2032)

8.5. Asia Pacific Plant Hormones Market Size and Forecast, by Country (2024-2032)

8.5.1. China

8.5.2. India

8.5.3. Japan

8.5.4. South Korea

8.5.5. Australia

8.5.6. ASEAN

8.5.7. Rest of Asia Pacific

9. Middle East and Africa Plant Hormones Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

9.1. Middle East and Africa Plant Hormones Market Size and Forecast, by Type (2024-2032)

9.2. Middle East and Africa Plant Hormones Market Size and Forecast, by Formulation (2024-2032)

9.3. Middle East and Africa Plant Hormones Market Size and Forecast, by Function (2024-2032)

9.4. Middle East and Africa Plant Hormones Market Size and Forecast, by Application (2024-2032)

9.5. Middle East and Africa Plant Hormones Market Size and Forecast, by Country (2024-2032)

9.5.1. South Africa

9.5.2. GCC

9.5.3. Egypt

9.5.4. Rest of ME&A

10. South America Plant Hormones Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

10.1. South America Plant Hormones Market Size and Forecast, by Type (2024-2032)

10.2. South America Plant Hormones Market Size and Forecast, by Formulation (2024-2032)

10.3. South America Plant Hormones Market Size and Forecast, by Function (2024-2032)

10.4. South America Plant Hormones Market Size and Forecast, by Application (2024-2032)

10.5. South America Plant Hormones Market Size and Forecast, by Country (2024-2032)

10.5.1. Brazil

10.5.2. Argentina

10.5.3. Rest Of South America

11. Company Profile: Key Players

11.1. Nufarm Australia Ltd. (Australia)

11.1.1. Company Overview

11.1.2. Business Portfolio

11.1.3. Financial Overview

11.1.3.1. Total Revenue

11.1.3.2. Segment Revenue

11.1.3.3. Regional Revenue

11.1.4. SWOT Analysis

11.1.5. Strategic Analysis

11.1.6. Recent Developments

11.2. FMC Corporation (USA)

11.3. Bayer (Germany)

11.4. Adama Agricultural Solutions Ltd. (Israel)

11.5. Valent BioSciences Corporation (USA)

11.6. Dow Chemical Company (USA)

11.7. BASF SE (Germany)

11.8. Syngenta Group (Switzerland)

11.9. Tata Chemicals Ltd. (India)

11.10. UPL (India)

11.11. Sumitomo Chemical Co., Ltd. (Japan)

11.12. Nippon Soda Co., Ltd. (Japan)

11.13. DHANUKA AGRITECH LTD (India)

11.14. Sichuan Guoguang Agrochemical Co., (China)

11.15. Zagro (Singapore)

11.16. BioWorks Inc. (USA)

11.17. Biowin Agro Research (Poland)

11.18. WinField United (USA)

11.19. Seipasa (Spain)

11.20. XX.inc

12. Key Findings

13. Analyst Recommendations

13.1. Strategic Recommendations

13.2. Future Outlook