Packaging Market- Industry Analysis and Forecast (2025-2032)

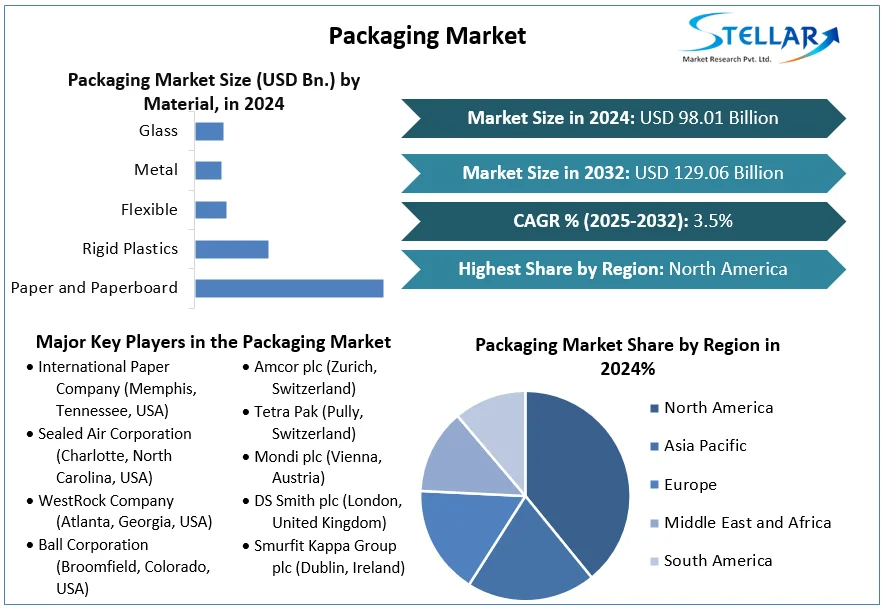

Packaging Market size was valued at USD 98.01 Bn. in 2024 and the total packaging revenue is expected to grow at a CAGR of 3.5% from 2025 to 2032, reaching nearly USD 129.06 Bn.

Format : PDF | Report ID : SMR_1869

Packaging Market Overview:

The global packaging industry is experiencing significant growth driven by megatrends such as urbanization, population growth, and evolving consumer behaviors. With the rise of food-on-the-go and the increasing prevalence of e-commerce, the demand for packaging solutions continues to surge. Consumers now prioritize sustainability and safety in packaging, expecting their favorite brands to align with environmentally friendly practices. Packaging serves diverse purposes in both consumer and industrial applications, facilitating product protection, marketing, and distribution across various sectors. Within the packaging market, several key types of packaging solutions dominate. Flexible plastic packaging offers versatility and convenience, catering to the needs of modern lifestyles.

Glass packaging, valued for its premium feel and recyclability, remains popular for food and beverage products. Metal packaging provides durability and shelf stability, particularly favored for canned goods. Board packaging, including cartons and boxes, is widely used across industries for its sturdiness and printability. Rigid plastic packaging, known for its strength and lightweight properties, finds applications in various sectors, from food packaging to healthcare products. As the packaging industry continues to evolve, innovation in Functions, design, and sustainability practices will remain essential drivers of growth and competitiveness.

To get more Insights: Request Free Sample Report

Packaging Market Dynamics:

The surge in bioplastics usage across all sectors is propelled by escalating demand for sustainable solutions Packaging Market

E-commerce packaging has become more important within the packaging industry as online shopping grows rapidly. Rigid packaging, such as corrugated packaging is expected to dominate the sector with its stable structure and sustainable qualities. Corrugated packaging provider DS Smith expects to see significant changes across the packaging spectrum, whether for e-commerce, FMCG or point of sale Functions. The focus on sustainability and plastic replacement is increasingly at the forefront of packaging market strategy for leading brands. Bioplastic alternatives are now available for almost every conventional plastic Function and corresponding application.

Bioplastics have the same properties as conventional plastics and offer additional advantages, such as a reduced carbon footprint or additional waste management options, such as composting. Bioplastics are used in an increasing number of markets, from packaging, catering products, consumer electronics, automotive, agriculture/horticulture, and toys to textiles and several other segments. Packaging Industry a debate is raging about the best ways to combine reduction, re-use, recycling and recovery of packaging market.

The momentum of e-commerce is profoundly impacting the packaging industry, fueled by the rapid expansion of online shopping. Rigid packaging, particularly corrugated packaging, is poised to dominate this sector due to its structural stability and sustainable attributes. DS Smith, a leading corrugated packaging provider, anticipates significant shifts across various packaging categories, including e-commerce, FMCG, and point-of-sale Functions. Sustainability and plastic replacement are emerging as central themes in packaging strategies adopted by major brands. In parallel, the rise of alternative Functions, notably bioplastics, is reshaping the packaging market.

Bioplastics offer similar properties to conventional plastics while presenting additional advantages such as reduced carbon footprint and enhanced waste management options like composting. These Functions are gaining traction across diverse markets, spanning packaging, catering products, consumer electronics, automotive, agriculture, textiles, and more. The surge in bioplastics usage across all sectors is propelled by escalating demand for sustainable solutions driven by both consumers and brands. Increased environmental awareness is underscoring the imperative for eco-friendly products, thus fostering the adoption of bioplastics as a driving force reshaping the packaging industry's trajectory.

The Rise of Eco-Friendly Packaging Innovations and Impacts Boost the Packaging Market

Recent advancements in bioplastics have led to innovations aimed at enhancing existing Functions. A notable example is the development of PEF (polyethylene furanoate), a novel polymer slated for market entry in 2023. PEF offers similarities to PET (polyethylene terephthalate) but boasts a 100% bio-based composition. Additionally, it possesses improved barrier and thermal properties, rendering it an optimal choice for packaging beverages, food items, and non-food products. As a result, PEF has the potential to progressively substitute larger portions of PET in packaging applications.

The most effective strategies for integrating reduction, reuse, recycling, and recovery of packaging Functions. In March 2020, the European Commission introduced a new Circular Economy Action Plan as a cornerstone of the European Green Deal, aligning with Europe's vision for sustainable development and growth. Globally, there is a trend toward banning plastic bags or implementing charges for their use. Consumer activism is compelling retailers to minimize packaging. Interestingly, developing countries, which often have less effective waste disposal systems, spearhead these efforts. Simultaneously, the rise of e-commerce is bringing transit packaging into sharper focus in households, raising awareness about issues such as empty spaces within boxes.

Reuse is becoming increasingly prevalent in metal packaging market due to the growing emphasis on extending the lifespan of finite resources through container reuse. Industrial metal packaging markets particularly benefit from efficient and established infrastructures, facilitating the reuse of products like reconditioned drums to maximize their usage. The aluminum cans boast higher recycling rates and contain more recycled content compared to other packaging types. Additionally, aluminum cans undergo a true "closed loop" recycling process, being recycled repeatedly, whereas glass and plastic are often "down-cycled" into lower-grade products such as carpet fiber or landfill liners.

Packaging Market Segment Analysis:

Based on Material, the market is divided into Paper and Paperboard, Rigid Plastics, Flexible, Metal, Glass, and Others. Paper and Paperboard witnessed the highest market share in 2024 and continue its dominance in the forecast period. The rising popularity of liquid packaging cartons like Tetra Packs and pouches is anticipated to drive growth in the paper-based packaging market. Corrugated paperboard packaging offers a versatile and cost-effective solution for safeguarding, preserving, and transporting a diverse array of products. This packaging serves key industries including processed foods, fresh produce, beverages, and electrical goods worldwide. With increasing demand for convenience foods amidst shifting consumer preferences, the processed food segment is poised to capture a significant market share.

Paper remains a dominant choice for various packaging applications such as fl, sugar, and certain soft cheeses. It continues to find extensive use in medical packaging, fast food wrapping, metalized paper cigarette bundling, and informal retail sectors in developing nations. Corrugated board packaging's biodegradable nature has notably contributed to its success, and vendors opting for alternative packaging solutions have faced consumer backlash. The surge in e-commerce adoption, particularly in developing economies like India, is positively impacting the market. Moreover, the COVID-19 pandemic has further accelerated the shift towards e-commerce as consumers increasingly rely on online platforms to purchase essentials.

Packaging Market Regional Insight:

North America witnessed the highest market share in 2024. Sustainable packaging is much bigger focus for the North American marketplace moving forward. In world, that means reducing the packaging Function content. ProAmpac has numerous examples to date of moving customers from a rigid plastic, glass, or metal format to a flexible packaging format that is 100 percent recyclable. For instance, in North America, government initiatives for stimulating eco-friendly packaging Functions, coupled with the efforts from CPA (The Corrugated Packaging Alliance), a corrugated industry initiative, to engage corrugated packaging are providing an added impetus to the growth of this market.

In North America, glass packaging growth is driven by the beverage industry, followed by the pharmaceutical industry which is driven by the growing aging population and rising number of chronic diseases. In North America, glass packaging growth is driven by the beverage industry, followed by the pharmaceutical industry which is driven by the growing ageing population and rising number of chronic diseases drives the packaging market growth.

Packaging Market Competitive Landscape:

On May 09, 2024, AstroNova, Inc. declared the acquisition of MTEX NS, S.A. for USD 26.24 million, with a potential USD 4.32 million earnout. This strategic move expands AstroNova's Product Identification segment, adding USD 8.64 million to USD 10.80 million in revenue this fiscal year. MTEX NS brings innovative industrial-grade products, including a breakthrough direct-to-film printer for diverse Functions and sustainable packaging capabilities. Headquartered in Porto, Portugal, MTEX NS operates an 81,000-square-foot facility with strong distributor networks across Europe, the Middle East, and the Americas. AstroNova President Greg Woods highlights the acquisition's potential to broaden market reach and enhance technical expertise.

|

Packaging Market Scope |

|

|

Market Size in 2024 |

USD 98.01 Billion |

|

Market Size in 2032 |

USD 129.06 Billion |

|

CAGR (2025-2032) |

3.5% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Material Paper and Paperboard Rigid Plastics Flexible Metal Glass Others |

|

|

By Function Cushioning Blocking and Bracing Void-fill Insulation Wrapping Others |

|

|

By Application Food Beverage Healthcare Cosmetics Industrial Others |

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key Players in the Packaging Market

North America

- International Paper Company (Memphis, Tennessee, USA)

- Sealed Air Corporation (Charlotte, North Carolina, USA)

- WestRock Company (Atlanta, Georgia, USA)

- Ball Corporation (Broomfield, Colorado, USA)

- Crown Holdings, Inc. (Philadelphia, Pennsylvania, USA)

- Packaging Corporation of America (Lake Forest, Illinois, USA)

- Sonoco Products Company (Hartsville, South Carolina, USA)

- Berry Global Group, Inc. (Evansville, Indiana, USA)

- Graphic Packaging Holding Company (Atlanta, Georgia, USA)

- Bemis Company, Inc. (Neenah, Wisconsin, USA)

- AptarGroup, Inc. (Crystal Lake, Illinois, USA)

Europe:

- Amcor plc (Zurich, Switzerland)

- Tetra Pak (Pully, Switzerland)

- Mondi plc (Vienna, Austria)

- DS Smith plc (London, United Kingdom)

- Smurfit Kappa Group plc (Dublin, Ireland)

- Huhtamäki Oyj (Espoo, Finland)

- Ardagh Group (Luxembg City, Luxembg)

- RPC Group (Rushden, United Kingdom)

Asia Pacific

- Rengo Co., Ltd. (Osaka, Japan)

- Oji Holdings Corporation (Tokyo, Japan)

- Orora Limited (Victoria, Australia)

- Visy Industries (Victoria, Australia)

- Nippon Paper Industries Co., Ltd. (Tokyo, Japan)

Frequently Asked Questions

The growth of the Packaging market is driven by factors such as increasing consumer awareness and demand for sustainable packaging solutions, the rise of e-commerce leading to higher demand for transit packaging, advancements in packaging technologies enabling greater product protection and shelf appeal, and the expansion of industries like food and beverage, healthcare, and cosmetics requiring efficient packaging solutions to meet evolving consumer needs.

Investors can capitalize on opportunities in the Packaging market by focusing on companies that are leading in innovation trends such as advanced treatment methods and personalized products. Additionally, investing in companies with strong distribution channels and a growing online retail presence can offer the potential for growth as the market expands globally.

The Packaging Market size was valued at USD 98.01 Billion in 2024 and the total Global Packaging revenue is expected to grow at a CAGR of 3.5% from 2025 to 2032, reaching nearly USD 129.06 Billion by 2032.

The segments covered in the market report are Material, Function, Application, and region.

1. Research Methodology

1.1 Research Data

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. Packaging Market Executive Summary

2.1. Market Overview

2.2. Market Size (2024) and Forecast (2025 – 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments and Regions

3. Global Packaging Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Product Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2024)

3.2.7. Profit Margin

3.2.8. Market Share

3.2.9. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

3.4.1. Strategic Initiatives and Developments

3.4.2. Mergers and Acquisitions

3.4.3. Collaborations and Partnerships

3.4.4. Product Launches and Innovations

4. Packaging Market: Dynamics

4.1. Packaging Market Trends by Region

4.1.1. North America

4.1.2. Europe

4.1.3. Asia Pacific

4.1.4. Middle East and Africa

4.1.5. South America

4.2. Packaging Market Drivers

4.3. Packaging Market Restraints

4.4. Packaging Market Opportunities

4.5. Packaging Market Challenges

4.6. PORTER’s Five Forces Analysis

4.6.1. Intensity of the Rivalry

4.6.2. Threat of New Entrants

4.6.3. Bargaining Power of Suppliers

4.6.4. Bargaining Power of Buyers

4.6.5. Threat of Substitutes

4.7. PESTLE Analysis

4.7.1. Political Factors

4.7.2. Economic Factors

4.7.3. Social Factors

4.7.4. Technological Factor

4.7.5. Legal Factors

4.7.6. Environmental Factors

4.8. Technological Roadmap

4.9. Regulatory Landscape

4.9.1. Market Regulation by Region

4.9.1.1. North America

4.9.1.2. Europe

4.9.1.3. Asia Pacific

4.9.1.4. Middle East and Africa

4.9.1.5. South America

4.9.2. Impact of Regulations on Market Dynamics

4.9.3. Government Schemes and Initiatives

5. Packaging Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

5.1. Packaging Market Size and Forecast, by Material (2024-2032)

5.1.1. Paper and Paperboard

5.1.2. Rigid Plastics

5.1.3. Flexible

5.1.4. Metal

5.1.5. Glass

5.1.6. Others

5.2. Packaging Market Size and Forecast, by Function (2024-2032)

5.2.1. Cushioning

5.2.2. Blocking and Bracing

5.2.3. Void-fill

5.2.4. Insulation

5.2.5. Wrapping

5.2.6. Others

5.3. Packaging Market Size and Forecast, by Application (2024-2032)

5.3.1. Food

5.3.2. Beverage

5.3.3. Healthcare

5.3.4. Cosmetics

5.3.5. Industrial

5.3.6. Others

5.4. Packaging Market Size and Forecast, by Region (2024-2032)

5.4.1. North America

5.4.2. Europe

5.4.3. Asia Pacific

5.4.4. Middle East and Africa

5.4.5. South America

6. North America Packaging Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

6.1. North America Packaging Market Size and Forecast, by Material (2024-2032)

6.1.1. Paper and Paperboard

6.1.2. Rigid Plastics

6.1.3. Flexible

6.1.4. Metal

6.1.5. Glass

6.1.6. Others

6.2. North America Packaging Market Size and Forecast, by Function (2024-2032)

6.2.1. Cushioning

6.2.2. Blocking and Bracing

6.2.3. Void-fill

6.2.4. Insulation

6.2.5. Wrapping

6.2.6. Others

6.3. North America Packaging Market Size and Forecast, by Application (2024-2032)

6.3.1. Food

6.3.2. Beverage

6.3.3. Healthcare

6.3.4. Cosmetics

6.3.5. Industrial

6.3.6. Others

6.4. North America Packaging Market Size and Forecast, by Country (2024-2032)

6.4.1. United States

6.4.2. Canada

6.4.3. Mexico

7. Europe Packaging Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

7.1. Europe Packaging Market Size and Forecast, by Material (2024-2032)

7.2. Europe Packaging Market Size and Forecast, by Function (2024-2032)

7.3. Europe Packaging Market Size and Forecast, by Application (2024-2032)

7.4. Europe Packaging Market Size and Forecast, by Country (2024-2032)

7.4.1. United Kingdom

7.4.2. France

7.4.3. Germany

7.4.4. Italy

7.4.5. Spain

7.4.6. Sweden

7.4.7. Austria

7.4.8. Rest of Europe

8. Asia Pacific Packaging Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

8.1. Asia Pacific Packaging Market Size and Forecast, by Material (2024-2032)

8.2. Asia Pacific Packaging Market Size and Forecast, by Function (2024-2032)

8.3. Asia Pacific Packaging Market Size and Forecast, by Application (2024-2032)

8.4. Asia Pacific Packaging Market Size and Forecast, by Country (2024-2032)

8.4.1. China

8.4.2. S Korea

8.4.3. Japan

8.4.4. India

8.4.5. Australia

8.4.6. Indonesia

8.4.7. Malaysia

8.4.8. Vietnam

8.4.9. Taiwan

8.4.10. Rest of Asia Pacific

9. Middle East and Africa Packaging Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

9.1. Middle East and Africa Packaging Market Size and Forecast, by Material (2024-2032)

9.2. Middle East and Africa Packaging Market Size and Forecast, by Function (2024-2032)

9.3. Middle East and Africa Packaging Market Size and Forecast, by Application (2024-2032)

9.4. Middle East and Africa Packaging Market Size and Forecast, by Country (2024-2032)

9.4.1. South Africa

9.4.2. GCC

9.4.3. Nigeria

9.4.4. Rest of ME&A

10. South America Packaging Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

10.1. South America Packaging Market Size and Forecast, by Material (2024-2032)

10.2. South America Packaging Market Size and Forecast, by Function (2024-2032)

10.3. South America Packaging Market Size and Forecast, by Application (2024-2032)

10.4. South America Packaging Market Size and Forecast, by Country (2024-2032)

10.4.1. Brazil

10.4.2. Argentina

10.4.3. Rest Of South America

11. Company Profile: Key Players

11.1. International Paper Company (Memphis, Tennessee, USA)

11.1.1. Company Overview

11.1.2. Business Portfolio

11.1.3. Financial Overview

11.1.3.1. Total Revenue

11.1.3.2. Segment Revenue

11.1.3.3. Regional Revenue

11.1.4. SWOT Analysis

11.1.5. Strategic Analysis

11.1.6. Recent Developments

11.2. Sealed Air Corporation (Charlotte, North Carolina, USA)

11.3. WestRock Company (Atlanta, Georgia, USA)

11.4. Ball Corporation (Broomfield, Colorado, USA)

11.5. Crown Holdings, Inc. (Philadelphia, Pennsylvania, USA)

11.6. Packaging Corporation of America (Lake Forest, Illinois, USA)

11.7. Sonoco Products Company (Hartsville, South Carolina, USA)

11.8. Berry Global Group, Inc. (Evansville, Indiana, USA)

11.9. Graphic Packaging Holding Company (Atlanta, Georgia, USA)

11.10. Bemis Company, Inc. (Neenah, Wisconsin, USA)

11.11. AptarGroup, Inc. (Crystal Lake, Illinois, USA)

11.12. Amcor plc (Zurich, Switzerland)

11.13. Tetra Pak (Pully, Switzerland)

11.14. Mondi plc (Vienna, Austria)

11.15. DS Smith plc (London, United Kingdom)

11.16. Smurfit Kappa Group plc (Dublin, Ireland)

11.17. Huhtamäki Oyj (Espoo, Finland)

11.18. Ardagh Group (Luxembg City, Luxembg)

11.19. RPC Group (Rushden, United Kingdom)

11.20. Rengo Co., Ltd. (Osaka, Japan)

11.21. Oji Holdings Corporation (Tokyo, Japan)

11.22. Orora Limited (Victoria, Australia)

11.23. Visy Industries (Victoria, Australia)

11.24. Nippon Paper Industries Co., Ltd. (Tokyo, Japan)

12. Key Findings

13. Analyst Recommendations

13.1. Strategic Recommendations

13.2. Future Outlook