North America Regional Jet Market- Global Industry Analysis and Forecast (2025-2032)

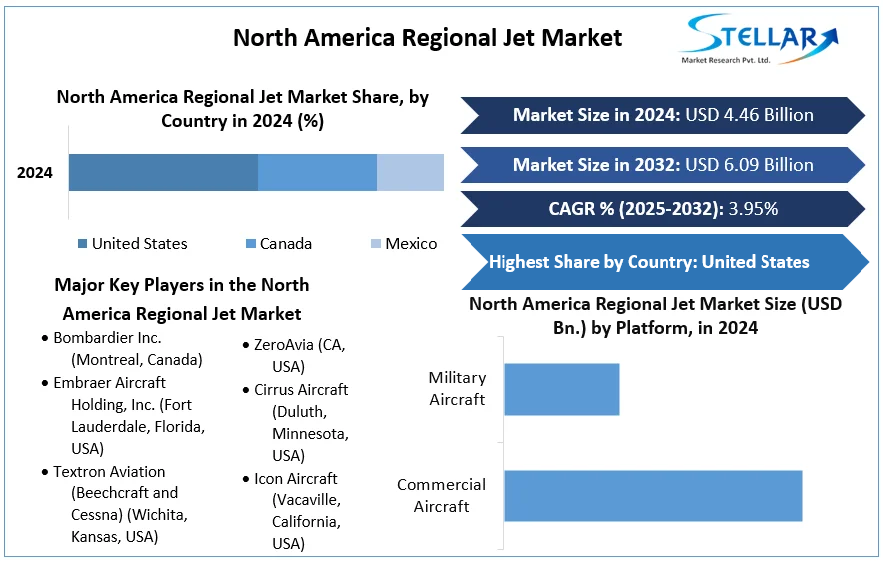

North America Regional Jet Market size was valued at USD 4.46 Bn. in 2024 and the total North America Regional Jet Market size is expected to grow at a CAGR of 3.95% from 2025 to 2032, reaching nearly USD 6.09 Bn. by 2032.

Format : PDF | Report ID : SMR_2279

North America Regional Jet Market Overview

The North America regional jet market encompasses the production, sale, and operation of jet aircraft typically seating between 70 and 100 passengers, used primarily for short to medium-haul routes. These jets serve as critical connectors between smaller cities and major airline hubs, facilitating regional connectivity and supporting the broader aviation network.

The North America regional jet market is characterized by robust demand and significant geographical reach, with regional jets serving numerous domestic and cross-border routes. The market benefits from a well-established aviation infrastructure and a strong network of regional airports. Major manufacturers, such as Bombardier Inc., Embraer Aircraft Holding, Inc., and Textron Aviation, dominate the market, leveraging their extensive production capabilities and technological advancements to meet market needs.

Key players like Bombardier and Embraer have reported strong financials, with Bombardier's aviation segment generating revenues of approximately $6 billion in 2024, and Embraer's commercial aviation revenue reaching around $3 billion in the same year. The market performance is buoyed by consistent demand from regional carriers like SkyWest Airlines and major airlines like Delta and American Airlines, which utilize regional jets to expand their network reach.

The production of regional jets is supported by advanced manufacturing facilities and a skilled workforce. The demand for regional jets remains steady, driven by the need for efficient and flexible air travel solutions. Consumption patterns show a strong preference for newer, more fuel-efficient models, with North America accounting for a significant portion of global regional jet deliveries.

The North America regional jet market is a vital component of the broader aviation industry, ensuring regional connectivity and supporting economic activity. The market is well-supported by key players with strong financials and advanced manufacturing capabilities. Demand remains robust, driven by the need for efficient air travel solutions, while supply chains and production processes are well-established to meet this demand. The regional jet market's ongoing evolution promises continued growth and innovation, further enhancing its role in the aviation sector.

To get more Insights: Request Free Sample Report

North America Regional Jet Market Dynamics

Driving Growth in North America's Regional Jet Market

The North American regional jet market is poised for significant growth, driven by several key factors. A major driver is the ongoing fleet modernization efforts by major airlines, such as American Airlines, which has recently placed substantial orders for new aircraft, including regional jets. This investment reflects a broader industry trend towards upgrading older fleets with more efficient, modern aircraft to enhance operational efficiency and passenger experience. Additionally, the recovery in air travel demand post-pandemic is fueling the need for increased regional connectivity, particularly in underserved markets.

The rise in premium travel segments and the focus on reducing carbon emissions are also pushing airlines to adopt newer, more eco-friendly regional jets. Furthermore, technological advancements in aircraft design and propulsion systems are making regional jets more attractive by offering improved fuel efficiency and lower operating costs. These drivers collectively support a robust growth trajectory for the North America regional jet market, aligning with the broader trends of fleet renewal and sustainable aviation practices.

Reducing Emissions and Enhancing Efficiency: Key Trends in North American Regional Jets

The North American regional jet market is witnessing a pronounced shift towards sustainability and operational efficiency, driven by increasing environmental concerns and advancements in aircraft technology. A key trend is the growing emphasis on reducing carbon emissions and enhancing fuel efficiency.

- For instance, ATR has emerged as a significant player in this transformation with its turboprop aircraft. ATR’s models, such as the ATR 42-600 and ATR 72-600, are noted for their remarkable efficiency, emitting 45% less CO2 than comparable regional jets. This makes them an appealing choice for airlines looking to meet environmental regulations while optimizing operational costs.

The company's turboprops are designed for maximum efficiency on regional routes. The ATR 72-600, for example, offers the lowest cost per seat and the most minimal fuel burn in its category. This efficiency is particularly crucial as airlines, including major carriers like American Airlines, seek to modernize their fleets and reduce their environmental footprint. American Airlines’ substantial order of new aircraft reflects this broader market trend towards newer, more efficient models that align with sustainability goals. These advancements underscore the ongoing shift in the regional jet market towards eco-friendly solutions. The emphasis on such technologies not only aligns with the global push towards carbon neutrality but also caters to the practical needs of airlines in terms of cost-effectiveness and operational flexibility.

Facing the Future: Overcoming Challenges in North America's Regional Aviation Market

The North American regional aircraft market is encountering several challenges as it navigates post-pandemic recovery and seeks to meet evolving demands. Historically, regional aviation played a pivotal role, accounting for over 12% of global ASK (available seat kilometres) and operating roughly 9,300 units before the pandemic. Despite its growth potential forecasted to increase by over 4.5% annually and demand more than 8,200 new regional aircraft over the next 20 years the market faces significant hurdles.

One major challenge is the aging fleet. With regional turboprops averaging 23 years and regional jets around 12 years, there is a pressing need for modernization. This is compounded by the dominance of non-European players in the market, with European manufacturers like ATR being notable exceptions. To reclaim global leadership, there's an urgent need for investment in new technologies to enhance efficiency, comfort, and environmental performance.

Another challenge is the integration of innovative technologies. While advancements such as hybrid-electric propulsion and improved cabin comfort are crucial, they must be affordable and practical to implement. This will not only boost the appeal of regional aircraft but also align with environmental regulations. Additionally, these innovations have the potential to benefit other sectors, creating a positive ripple effect across industries like automotive and rail.

North America Regional Jet Market Segment Analysis

By Engine Type, Turbofan Engines dominated the regional jet sector, accounting for approximately 70% of the market share in 2024. These engines are favoured for their efficiency and performance, particularly in commercial jetliners that require higher speeds and longer ranges. Turbofan engines are known for their ability to deliver greater thrust while maintaining fuel efficiency, making them ideal for modern regional jets. Key players such as Bombardier Inc. and Embraer Aircraft Holding, Inc. utilize turbofan engines in their popular CRJ and E-Jet series, respectively.

For instance, the Bombardier CRJ Series, equipped with the GE CF34 turbofan engine, is renowned for its reliability and performance on regional routes. Similarly, the Embraer E-Jet Series features the CF34-10E turbofan engines, enhancing fuel efficiency and operational flexibility. These examples highlight the prevalence of turbofan engines in meeting the demands of regional airlines for speed and efficiency.

Turboprop Engines, on the other hand, held about 30% of the market share in 2024. These engines are known for their versatility and are particularly suited for short-haul flights and operations on shorter runways. Turboprop engines are valued for their superior fuel efficiency at lower speeds and their capability to operate in and out of less developed airports. Textron Aviation, with its Beechcraft and Cessna brands, exemplifies the use of turboprop engines in the regional north America regional jet market. The Beechcraft King Air series, equipped with Pratt & Whitney PT6 turboprop engines, offers excellent performance for regional routes with shorter distances. The Cessna Caravan series also utilizes the PT6 engine, catering to both passenger and cargo operations in regional and remote areas. These aircraft are often chosen for their ability to access airports with shorter runways and provide cost-effective regional transport solutions.

North America Regional Jet Market Regional Analysis

The North America regional jet market is characterized by robust demand and significant investment, reflecting the region’s strategic importance in global aviation. In recent developments, American airlines has placed a substantial order for 206 new narrowbody and regional jets, making a major boost to its fleet plan. This move is indicative of the broader market trend towards fleet modernization and expansion.

American Airlines' massive order includes 85 Airbus A321neos, 85 Boeing 737 Max 10s, and 90 Embraer 175s, underscoring a strategic push to enhance fleet efficiency and capacity. This order not only highlights the airline's commitment to modernizing its fleet but also signifies a significant boost for the aircraft manufacturers involved—Airbus, Boeing, and Embraer. The addition of these jets will support American Airlines in expanding its premium seating and enhancing operational reliability. With this order, American Airlines aims to strengthen its domestic and short-haul international networks, retire older 50-seat regional jets, and introduce larger regional jets operated under its American Eagle brand. This aligns with the broader trend in the U.S. market, where airlines are investing heavily in new aircraft to improve service and operational efficiency.

- At the end of 2024, American Airlines’ fleet comprised 965 mainline and 556 regional jets, with a notable emphasis on modernizing and expanding its regional fleet. The orders are expected to further increase the number of premium seats across its network by more than 20% by 2026.

In Canada, companies like Bombardier Inc. continue to play a pivotal role in the regional jet market. Bombardier’s CRJ Series remains a significant player, especially with the recent acquisition of 85 new CRJ jets by various North American carriers. This indicates a strong regional demand for Bombardier’s reliable and efficient jets, reinforcing Canada's position as a key manufacturer in the regional jet segment.

Mexican airlines are also making strides in fleet modernization, though on a smaller scale compared to their U.S. counterparts. Regional airlines in Mexico are increasingly looking towards cost-efficient turboprop and regional jet solutions to expand their networks and improve service to less accessible destinations. This trend reflects a growing demand for versatile and economical regional aircraft in the country.

North America Regional Jet Market Competitive Landscape

In the North American regional jet market, competition remains dynamic and intense as established giants and emerging players vie for market share. Major players like Bombardier Inc. and Embraer Aircraft Holding, Inc. dominate the landscape with their extensive portfolios of regional jets, setting high standards for performance and technology. Bombardier's CRJ Series and Embraer's E-Jet family are prominent examples, known for their operational efficiency and broad market acceptance. Regional airlines and operators benefit from a diverse range of options that cater to various needs, from high-capacity regional jets to smaller, more versatile aircraft. The presence of new entrants and niche players further enriches the market, fostering innovation and driving advancements in technology and efficiency.

Bombardier Inc. and Embraer Aircraft Holding, Inc., both companies showcase their strengths in the regional jet market. Bombardier, headquartered in Montreal, Canada, has a robust lineup with its CRJ Series, known for reliability and fuel efficiency. Despite facing financial challenges in recent years, Bombardier's focus on high-performance and advanced technology has maintained its competitive edge. The company has been working on new innovations, including enhanced avionics and fuel-efficient designs, to stay relevant in a changing market.

In contrast, Embraer, based in Fort Lauderdale, Florida, USA, is renowned for its E-Jet series, which continues to gain popularity due to its versatility and cost-effectiveness. Embraer's strong financial performance is bolstered by its strategic partnerships and consistent revenue growth. The company recently expanded its E-Jet lineup with the E-Jet E2 series, which offers improved fuel efficiency and reduced operational costs. Embraer's commitment to innovation and customer satisfaction positions it strongly as an emerging leader in the regional jet market. As the market evolves, both companies are poised to play crucial roles in shaping the future of regional aviation, driven by their commitment to efficiency, innovation, and customer-centric solutions.

|

North America Regional Jet Market Scope |

|

|

Market Size in 2024 |

USD 4.46 Bn. |

|

Market Size in 2032 |

USD 6.09 Bn. |

|

CAGR (2025-2032) |

3.95 % |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Platform

|

|

By Engine Type

|

|

|

By Seating Capacity

|

|

|

By Maximum Take-Off Weight

|

|

|

Regional Scope |

North America- United States, Canada, and Mexico |

North America Regional Jet Market Key Players

- Bombardier Inc. (Montreal, Canada)

- Embraer Aircraft Holding, Inc. (Fort Lauderdale, Florida, USA)

- Textron Aviation (Beechcraft and Cessna) (Wichita, Kansas, USA)

- Mitsubishi Aircraft Corporation America (Renton, Washington, USA)

- Boeing (Chicago, Illinois, USA)

- Honda Aircraft Company (Greensboro, North Carolina, USA)

- Gulfstream Aerospace (Savannah, Georgia, USA)

- Sierra Nevada Corporation (Sparks, Nevada, USA)

- ZeroAvia (CA, USA)

- Cirrus Aircraft (Duluth, Minnesota, USA)

- Icon Aircraft (Vacaville, California, USA)

- Piper Aircraft, Inc. (Vero Beach, Florida, USA)

- Eclipse Aerospace (Albuquerque, New Mexico, USA)

- Aerion Supersonic (Reno, Nevada, USA)

- Quest Aircraft Company (A Daher Company) (Sandpoint, Idaho, USA)

- Mojave Air & Space Port (Mojave, California, USA)

- Delta and American (USA)

- SkyWest Airlines (USA)

- De Havilland Aircraft of Canada Ltd (Canada)

- BAE Systems (U.S)

- Others Players

For Global Scenario:

Regional Jet Market: Global Industry Analysis and Forecast (2024-2030)

Frequently Asked Questions

Challenges for the North America regional jet market include stringent environmental regulations and high operational costs, along with intense competition from low-cost carriers and alternative transportation modes like high-speed rail.

The Market size was valued at USD 4.46 Billion in 2024 and the total Market revenue is expected to grow at a CAGR of 3.95 % from 2025 to 2032, reaching nearly USD 6.09 Billion in 2032.

The segments covered are Platform, Engine Type, Seating Capacity, and Maximum Take- Off Weight.

1. North America Regional Jet Market: Research Methodology

2. North America Regional Jet Market: Executive Summary

3. North America Regional Jet Market: Competitive Landscape

3.1. Stellar Competition Matrix

3.2. Competitive Landscape

3.3. Key Players Benchmarking

3.4. Market Structure

3.4.1. Market Leaders

3.4.2. Market Followers

3.4.3. Emerging Players

3.5. Consolidation of the Market

4. North America Regional Jet Market: Dynamics

4.1. Market Trends

4.2. Market Drivers

4.3. Market Opportunities

4.4. Market Challenges

4.5. PORTER’s Five Forces Analysis

4.6. PESTLE Analysis

4.7. Strategies for New Entrants to Penetrate the Market

4.8. Regulatory Landscape

5. North America Regional Jet Market Size and Forecast by Segments (by Value USD Billion)

5.1. North America Regional Jet Market Size and Forecast, by Platform (2024-2032)

5.1.1. Commercial Aircraft

5.1.2. Military Aircraft

5.2. North America Regional Jet Market Size and Forecast, by Engine Type (2024-2032)

5.2.1. Turbofan Engine

5.2.2. Turboprop Engine

5.3. North America Regional Jet Market Size and Forecast, by Seating Capacity (2024-2032)

5.3.1. 35-80 Seats

5.3.2. 80-125 Seats

5.4. North America Regional Jet Market Size and Forecast, by Maximum Take-Off Weight (2024-2032)

5.4.1. 20,000 Lbs To 80,000 Lbs

5.4.2. 81,000 Lbs To 1,60,000 Lbs

5.5. North America Regional Jet Market Size and Forecast, by Country (2024-2032)

5.5.1. United States

5.5.2. Canada

5.5.3. Mexico

6. United States Regional Jet Market Size and Forecast (by Value USD Billion)

6.1. United States Regional Jet Market Size and Forecast, by Platform (2024-2032)

6.1.1. Commercial Aircraft

6.1.2. Military Aircraft

6.2. United States Regional Jet Market Size and Forecast, by Engine Type (2024-2032)

6.2.1. Turbofan Engine

6.2.2. Turboprop Engine

6.3. United States Regional Jet Market Size and Forecast, by Seating Capacity (2024-2032)

6.3.1. 35-80 Seats

6.3.2. 80-125 Seats

6.4. United States Regional Jet Market Size and Forecast, by Maximum Take-Off Weight (2024-2032)

6.4.1. 20,000 Lbs To 80,000 Lbs

6.4.2. 81,000 Lbs To 1,60,000 Lbs

7. Canada Regional Jet Market Size and Forecast (by Value USD Billion)

7.1. Canada Regional Jet Market Size and Forecast, by Platform (2024-2032)

7.1.1. Commercial Aircraft

7.1.2. Military Aircraft

7.2. Canada Regional Jet Market Size and Forecast, by Engine Type (2024-2032)

7.2.1. Turbofan Engine

7.2.2. Turboprop Engine

7.3. Canada Regional Jet Market Size and Forecast, by Seating Capacity (2024-2032)

7.3.1. 35-80 Seats

7.3.2. 80-125 Seats

7.4. Canada Regional Jet Market Size and Forecast, by Maximum Take-Off Weight (2024-2032)

7.4.1. 20,000 Lbs To 80,000 Lbs

7.4.2. 81,000 Lbs To 1,60,000 Lbs

8. Mexico Regional Jet Market Size and Forecast (by Value USD Billion)

8.1. Mexico Regional Jet Market Size and Forecast, by Platform (2024-2032)

8.1.1. Commercial Aircraft

8.1.2. Military Aircraft

8.2. Mexico Regional Jet Market Size and Forecast, by Engine Type (2024-2032)

8.2.1. Turbofan Engine

8.2.2. Turboprop Engine

8.3. Mexico Regional Jet Market Size and Forecast, by Seating Capacity (2024-2032)

8.3.1. 35-80 Seats

8.3.2. 80-125 Seats

8.4. Mexico Regional Jet Market Size and Forecast, by Maximum Take-Off Weight (2024-2032)

8.4.1. 20,000 Lbs To 80,000 Lbs

8.4.2. 81,000 Lbs To 1,60,000 Lbs

9. Company Profile: Key players

9.1. Bombardier Inc. (Montreal, Canada)

9.1.1. Company Overview

9.1.2. Financial Overview

9.1.3. Business Portfolio

9.1.4. SWOT Analysis

9.1.5. Business Strategy

9.1.6. Recent Developments

9.2. Embraer Aircraft Holding, Inc. (Fort Lauderdale, Florida, USA)

9.3. Textron Aviation (Beechcraft and Cessna) (Wichita, Kansas, USA)

9.4. Mitsubishi Aircraft Corporation America (Renton, Washington, USA)

9.5. Boeing (Chicago, Illinois, USA)

9.6. Honda Aircraft Company (Greensboro, North Carolina, USA)

9.7. Gulfstream Aerospace (Savannah, Georgia, USA)

9.8. Sierra Nevada Corporation (Sparks, Nevada, USA)

9.9. Cirrus Aircraft (Duluth, Minnesota, USA)

9.10. Icon Aircraft (Vacaville, California, USA)

9.11. Piper Aircraft, Inc. (Vero Beach, Florida, USA)

9.12. Eclipse Aerospace (Albuquerque, New Mexico, USA)

9.13. Aerion Supersonic (Reno, Nevada, USA)

9.14. Quest Aircraft Company (A Daher Company) (Sandpoint, Idaho, USA)

9.15. Mojave Air & Space Port (Mojave, California, USA)

9.16. Delta and American (USA)

9.17. SkyWest Airlines (USA)

9.18. De Havilland Aircraft of Canada Ltd (Canada)

9.19. BAE Systems (U.S)

9.20. Others Players

10. Key Findings

11. Industry Recommendation