North America Online Gambling Market- Industry Analysis and Forecast (2025-2032)

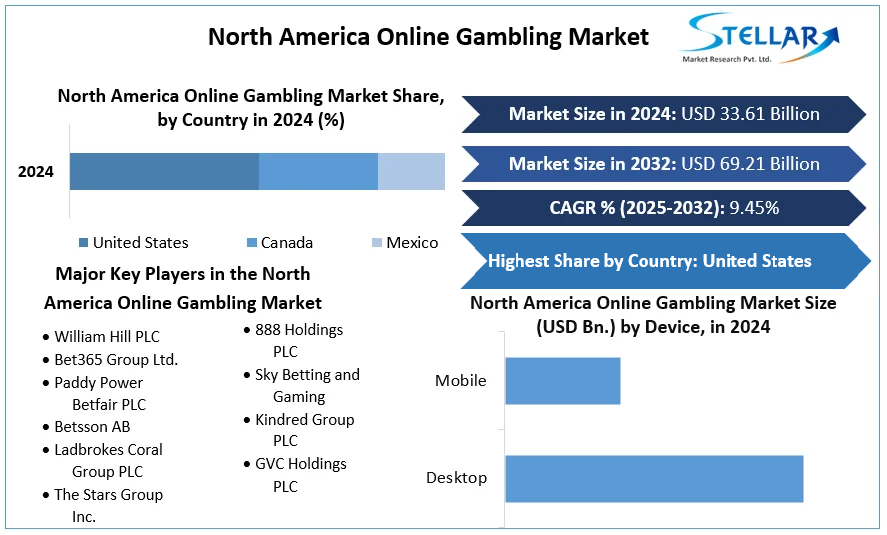

North America Online Gambling Market was valued nearly US$ 33.61 Bn. in 2024.Market size is estimated to grow at a CAGR of 9.45%.

Format : PDF | Report ID : SMR_233

North America Online Gambling Market Overview:

The market is majorly driven by rising internet penetration and increasing use of mobile phones by users to play online games from their homes & public places. Factors including simple access to internet gambling, legality & societal acceptance, corporate sponsorships, and celebrity endorsements are also driving market expansion. Market growth is expected to be aided by the increasing availability of low-cost mobile applications around the world.

The internet has evolved into a global communication platform that allows businesses to sell their goods and services in the digital marketplace. According to trends, service consumption in the global virtual market has climbed by 28.0 percent each year over the last decade. The popularity of the internet has led in a significant increase in the number of online casinos. Furthermore, rising consumer awareness of new technologies and rising disposable income are likely to drive market expansion.

The annual expansion of online casino corresponds to changes in the online space. These advancements are being made in order to acquire the necessary level of reputation in the gambling world. As a result, online casinos are concentrating their investments in information solutions that provide continuous support to gamblers, protect the operations' integrity, and combat illicit activities. Many online casinos are now giving a free play version of several of their games, which is fueling the market's growth.

From a technical & institutional standpoint, online gambling can be regarded a worldwide activity. Online gambling is a technologically advanced kind of gambling that takes place via the internet. In an organization, however, it works with several server locations located all over the world. On a worldwide basis, for example, more than 80 jurisdictions regulate some kind of gambling; nonetheless, they are clustered in only a few locations. Online gambling is being legalized in a number of nations because it creates jobs and generates cash. In India, for example, online gambling has been legalized in Sikkim and Goa. Furthermore, online gambling allows gamers to participate in gambling activities in real time via internet services. The demand for sports betting has been spurred by the expanding number of sports fans around the world. The majority of bets are put on sports such as boxing, baseball, football, and hockey, which drives the industry.

The industry's growth is also being fueled by the increased development of new technologies such as virtual reality and blockchain. This could be due to the fact that a number of organizations are now using blockchain technology into their online gambling operations. This allows them to maintain transparency in gambling activities while also providing a better user experience. Furthermore, blockchain-based gambling services are entirely decentralised and unaffected by external parties. On the contrary, cybercrime is rapidly expanding in the sector. Signal manipulation via bogus apps and app-based hacking are two main challenges that are impeding market expansion. App-based hacking is also becoming more common in the online gaming business. Furthermore, excessive gambling can have a negative impact on a person's health & personal relationships, leading to problems like despair and debt.

To get more Insights: Request Free Sample Report

Insights from COVID19

The market is expected to benefit from the COVID-19 epidemic. Countries all around the world have set restrictions and are advocating social separation in order to prevent the virus from spreading. People's movement restrictions are expected to have a severe impact on land-based casino operations. As a result of the ban on land-based gambling, many gamers are turning to internet gaming. However, the postponement of major sporting events around the world is having a negative influence on sports betting, limiting industry growth.

Main Causes of Expansion:

Increased smartphone usage, particularly among millennials, is one of the key reasons for the rise of online gambling. Playing online casino games is no different for them than normal gaming. And now, even more top companies are investing in the development of mobile apps that work across a variety of digital platforms. Furthermore, the use of Augmented Reality and Virtual Reality technologies allows online casinos to deliver a more immersive gambling experience, which is another appealing element for players. People who desire a gambling experience similar to that of traditional casinos can play at live casinos, which allow them to interact with real dealers. Legislation governing online gambling and sports betting, on the other hand, has played a significant role in the growth of online gambling. Following the Supreme Court's legalization of sports betting in 2018, more online gambling companies are expected to embrace sport betting alternatives in the United States.

This contributes to the market's expansion. Furthermore, online gambling is already allowed in more than 85 countries throughout the world. Many states are currently updating their gaming laws and making changes to their gambling prohibitions. According to our study report these number will continue to rise in the future, as it provides a high rate of employment and aids in revenue generating.

Cashless, secure payment options for players, availability of high-speed internet, corporate sponsorships, celebrity endorsements, and the rise of blockchain-based gambling platforms that are completely decentralised and free of third-party influence are all important factors that contribute to market growth.

Online poker has gotten a lot of attention, especially among college students. Due to the widespread popularity of online card games, the market is likely to grow at a high rate. Many sites accept deposits from major credit cards, online wallets, and even virtual currencies like Bitcoin, which has contributed to online poker's success over the years. The segment is further fueled by the large number of games available to players.

In 2019, the desktop segment dominated the market. When compared to mobile phones and other devices, PCs have a larger screen size, allowing gamblers to enjoy the game's aesthetics and fine features. On desktops, performance characteristics like screen clarity, sound volume, and storage capacity can also be tweaked for a better gaming experience. These reasons have aided in the expansion of the desktop market.

The objective of the report is to present a comprehensive analysis of the North America Online Gambling Market to the stakeholders in the industry. The report provides trends that are most dominant in the North America Online Gambling Market and how these trends will influence new business investments and market development throughout the forecast period. The report also aids in the comprehension of the North America Online Gambling Market dynamics and competitive structure of the market by analyzing market leaders, market followers, and regional players.

The qualitative and quantitative data provided in the North America Online Gambling Market report is to help understand which market segments, regions are expected to grow at higher rates, factors affecting the market, and key opportunity areas, which will drive the industry and market growth through the forecast period. The report also includes the competitive landscape of key players in the industry along with their recent developments in the North America Online Gambling Market. The report studies factors such as company size, market share, market growth, revenue, production volume, and profits of the key players in the North America Online Gambling Market.

The report provides Porter's Five Force Model, which helps in designing the business strategies in the market. The report helps in identifying how many rivals are existing, who they are, and how their product quality is in the Market. The report also analyses if the North America Online Gambling Market is easy for a new player to gain a foothold in the market, do they enter or exit the market regularly if the market is dominated by a few players, etc.

The report also includes a PESTEL Analysis, which aids in the development of company strategies. Political variables help in figuring out how much a government can influence the Market. Economic variables aid in the analysis of economic performance drivers that have an impact on the Market. Understanding the impact of the surrounding environment and the influence of environmental concerns on the North America Online Gambling Market is aided by legal factors.

North America Online Gambling Market Scope:

|

North America Online Gambling Market |

|

|

Market Size in 2024 |

USD 33.61 Bn. |

|

Market Size in 2032 |

USD 69.21 Bn. |

|

CAGR (2025-2032) |

9.45% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

by Type

|

|

by Device

|

|

|

Country Scope |

United States Canada Mexico |

Major Players operating in the North America Online Gambling Market are:

- William Hill PLC

- Bet365 Group Ltd.

- Paddy Power Betfair PLC

- Betsson AB

- Ladbrokes Coral Group PLC

- The Stars Group Inc.

- 888 Holdings PLC

- Sky Betting and Gaming

- Kindred Group PLC

- GVC Holdings PLC

Frequently Asked Questions

William Hill PLC, Bet365 Group Ltd., Paddy Power Betfair PLC, Betsson AB Ladbrokes Coral Group PLC, The Stars Group Inc., 888 Holdings PLC, Sky Betting and Gaming, Kindred Group PLC, GVC Holdings PLC.

Mobile segment is the dominating end use segment in the market.

The major factors for the growth of the North America Online Gambling market includes high internet penetration and increasing use of mobile phones among individuals for playing online games from their homes and public places.

1. Research Methodology

1.1 Research Data

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Up Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. North America Online Gambling Market Executive Summary

2.1. Market Overview

2.2. Market Size (2024) and Forecast (2025 – 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments and Country

3. North America Online Gambling Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Business Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2024)

3.2.7. Profit Magin

3.2.8. Market Share

3.2.9. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

3.4.1. Strategic Initiatives

3.4.2. Mergers and Acquisitions

3.4.3. Collaborations and Partnerships

3.4.4. Developments and Innovations

3.5. North America Online Gambling Industry Ecosystem

3.5.1. Ecosystem Analysis

3.5.2. Role of the Companies in the Ecosystem

4. North America Online Gambling Market: Dynamics

4.1. North America Online Gambling Market Trends

4.2. North America Online Gambling Market Drivers

4.3. North America Online Gambling Market Restraints

4.4. North America Online Gambling Market Opportunities

4.5. North America Online Gambling Market Challenges

4.6. PORTER’s Five Forces Analysis

4.6.1. Intensity of the Rivalry

4.6.2. Threat of New Entrants

4.6.3. Bargaining Power of Suppliers

4.6.4. Bargaining Power of Buyers

4.6.5. Threat of Substitutes

4.7. PESTLE Analysis

4.7.1. Political Factors

4.7.2. Economic Factors

4.7.3. Social Factors

4.7.4. Legal Factors

4.7.5. Environmental Factors

4.8. Technological Analysis

4.8.1. Blockchain

4.8.2. Real-time rendering

4.8.3. Technological Roadmap

4.9. Regulatory Landscape

4.9.1. Impact of Regulations on Market Dynamics

4.9.2. Government Schemes and Initiatives

5. North America Online Gambling Market: Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

5.1. North America Online Gambling Market Size and Forecast, by Type (2024-2032)

5.1.1. Sports Betting

5.1.2. Casinos

5.1.3. Poker

5.1.4. Bingo

5.1.5. Others

5.2. North America Online Gambling Market Size and Forecast, by Device (2024-2032)

5.2.1. Desktop

5.2.2. Mobile

5.2.3. Others

5.3. North America Online Gambling Market Size and Forecast, by Country (2024-2032)

5.3.1. United States

5.3.2. Canada

5.3.3. Mexico

5.3.4. Rest of North America

6. Company Profile: Key Players

6.1. William Hill PLC

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.3. Financial Overview

6.1.3.1. Total Revenue

6.1.3.2. Segment Revenue

6.1.3.3. Regional Revenue

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

6.2. Bet365 Group Ltd.

6.3. Paddy Power Betfair PLC

6.4. Betsson AB

6.5. Ladbrokes Coral Group PLC

6.6. The Stars Group Inc.

6.7. 888 Holdings PLC

6.8. Sky Betting and Gaming

6.9. Kindred Group PLC

6.10. GVC Holdings PLC

7. Key Findings

8. Analyst Recommendations

8.1. Strategic Recommendations

8.2. Future Outlook