Netherlands Fintech Market Industry Overview, Size, Share, Growth Trends, Research Insights and Forecast (2025–2032)

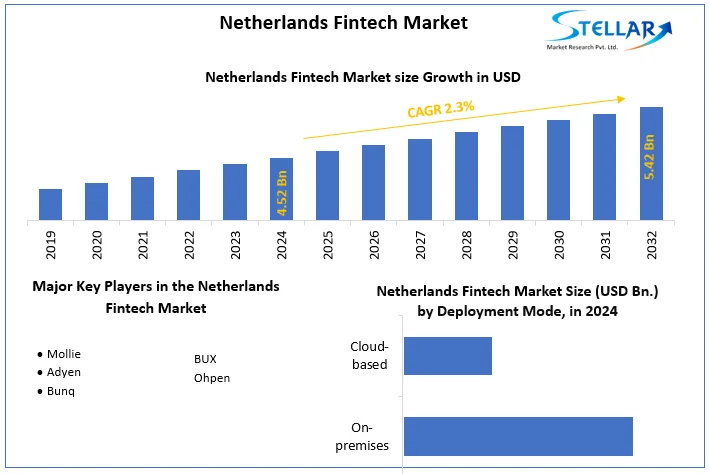

The Netherlands Fintech Market size was valued at USD 4.52 Bn. in 2024 and the total Netherlands Fintech size is expected to grow at a CAGR of 2.3 % from 2025 to 2032, reaching nearly USD 5.42 Bn. in 2032.

Format : PDF | Report ID : SMR_1696

Netherlands Fintech Market Overview

Fintech is the cutting-edge sector within finance that integrates technology into how individuals and businesses interact with money and financial transactions. It encompasses various sectors, including banking, payments, lending, investment, insurance, and regulatory technology (RegTech), and drives innovation in the finance industry.

The Report has covered various aspects that include dynamics, challenges, Restraints, and Opportunities in the Fintech Market in the Netherlands. The report analyzed the overall company’s market position with a SWOT analysis to identify strengths, weaknesses, opportunities, and threats. The report is built to complement strategic plans and help investors induce new tactics to fuel the sales volume and revenue. Implementing Innovative marketing models in fintech companies, market leaders have gained significant profit from the market. By leveraging AI in fintech in organizations, key Companies in the Netherlands have gained significant profit and are estimated to grow fast reaching targeted audiences.

AI in fintech focuses on a limited range of products that are not able to achieve funding synergies, regulatory compliance costs, and investments in brand recognition across a sufficiently large revenue base to be able to generate profits or fully compete on price with incumbents. Market concentration occurs in very few companies that dominate the AI Fintech market in the Netherlands. The business model of fintech relies on industry statistics that collect and analyze insights by utilizing consumer data.

To get more Insights: Request Free Sample Report

Netherlands Fintech Market Dynamics

The Rise of FinTech in the Netherlands

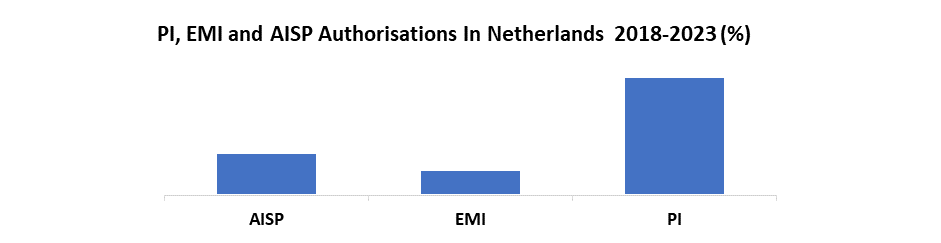

Regulations are an important part of the growing number of new entrants that have propelled the market growth in the Netherlands. For instance, New (European) legislation such as PSD2, the new privacy directive (GDPR), and the investment directive MiFID II are drivers behind an acceleration of innovation in the Fintech industry of the Netherlands. Finland, Sweden, Denmark, and the Netherlands certainly rank high in terms of the quality of their digital economy as a result the rise of FinTech companies operating in the Netherlands has spurred developments across the Financial Services sector. The increasing significance of digital payments and the adoption of cryptocurrencies have boosted the market growth of the Netherlands.

The finTech industry in the Netherlands has more than 100 FinTech companies and 79 Unicorns making it the largest sector with the most Unicorns increasing market growth. Growing Investment in Tech emerges as the top business model with 15 Unicorns in the Netherlands that has accelerated the market growth. Additionally, other business models with the most Unicorn activity are Cryptocurrencies, Banking Tech, and Payments, and finally, Finance & Accounting Tech has propelled the market.

Blockchain, AI, and Data Analytics Trends in the Netherlands FinTech Market

An industry trend that is expected to drive the market in the Netherlands is Blockchain technology, which has revolutionized the FinTech industry by offering secure and transparent transactions without intermediaries as it enables faster and more efficient financial processes, enhancing the capabilities of FinTech platforms. Emerging technologies such as artificial intelligence (AI), blockchain, and big data analytics pave the way for unprecedented innovation, spawning startups that challenge traditional financial institutions and global banks.

Fintech companies are harnessing the power of data analytics to provide valuable insights into customer behavior by offering customers more personalized services and recommendations. For example, Market key players such as Friss offers AI-based software that assesses risk during property transactions. Blue Dot identifies and calculates any eligible and qualified VAT spends. And BOTS provides smart assistants for investing in stocks, forex assets, and bonds.

Netherlands Fintech Market Segment Analysis

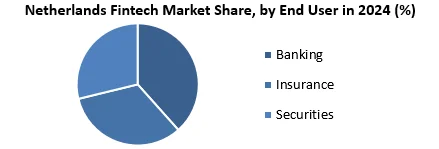

Based on End Users, the Banking segment held the highest number of shares with a growing CAGR during the forecast period. The fintech industry is reshaping traditional banking by offering innovative solutions that streamline processes, and enhance customer experience. Traditional banking and new-age financial services companies partnering to drive safe, efficient, and innovative products and solutions that help to drive the fintech industry in the Netherlands.

|

|

Netherlands Fintech Market Scope |

|

Market Size in 2024 |

USD 4.52 Bn. |

|

Market Size in 2032 |

USD 5.42 Bn. |

|

CAGR (2025-2032) |

2.3 % |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope

|

By Deployment Mode

|

|

By Application

|

|

|

By End User

|

Netherlands Fintech Market Key Players

Frequently Asked Questions

Regulatory Compliance is expected to be the major restraining factor for the Netherlands Fintech Market growth.

The Netherlands Fintech Market size was valued at USD 4.52 Bn. in 2024 and the total Netherlands AI in Fintech revenue is expected to grow at a CAGR of 2.3 % from 2025 to 2032, reaching nearly USD 5.42 Bn. By 2032.

1. Netherlands Fintech Market: Research Methodology

1.1. Research Data

1.1.1. Secondary Data

1.1.2. Primary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. Netherlands Fintech Market: Executive Summary

2.1. Market Overview

2.2. Market Size (2024) and Forecast (2025 – 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments

3. Netherlands Fintech Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. End-user Segment

3.2.4. Revenue (2024)

3.2.5. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Mergers and Acquisitions Details

4. Netherlands Fintech Market: Dynamics

4.1. Netherlands Fintech Market Trends

4.2. Netherlands Fintech Market Drivers

4.1. Netherlands Fintech Market Restraints

4.2. Netherlands Fintech Market Opportunities

4.3. Netherlands Fintech Market Challenges

4.4. PORTER’s Five Forces Analysis

4.5. PESTLE Analysis

4.6. Technological Roadmap

4.7. Regulatory Landscape

5. Netherlands Fintech Market: Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

5.1. Netherlands Fintech Market Size and Forecast, by Deployment Mode (2024-2032)

5.1.1. On-premises

5.1.2. Cloud-based

5.2. Netherlands Fintech Market Size and Forecast, by Application (2024-2032)

5.2.1. Virtual Assistants

5.2.2. Business Analytics and Reporting

5.2.3. Customer Behavioural Analytics

5.2.4. Fraud Detection

5.2.5. Quantitative and Asset Management

5.2.6. Other

5.3. Netherlands Fintech Market Size and Forecast, by End User (2024-2032)

5.3.1. Banking

5.3.2. Insurance

5.3.3. Securities

6. Company Profile: Key Players

6.1. Mollie

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.3. Financial Overview

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

6.2. Adyen

6.3. Bunq

6.4. BUX

6.5. Ohpen

7. Key Findings

8. Analyst Recommendations

8.1. Strategic Recommendations

8.2. Future Outlook