Middle East and Africa Industrial Automation Services Market Industry Overview, Size, Share, Growth Trends, Research Insights and Forecast (2025–2032)

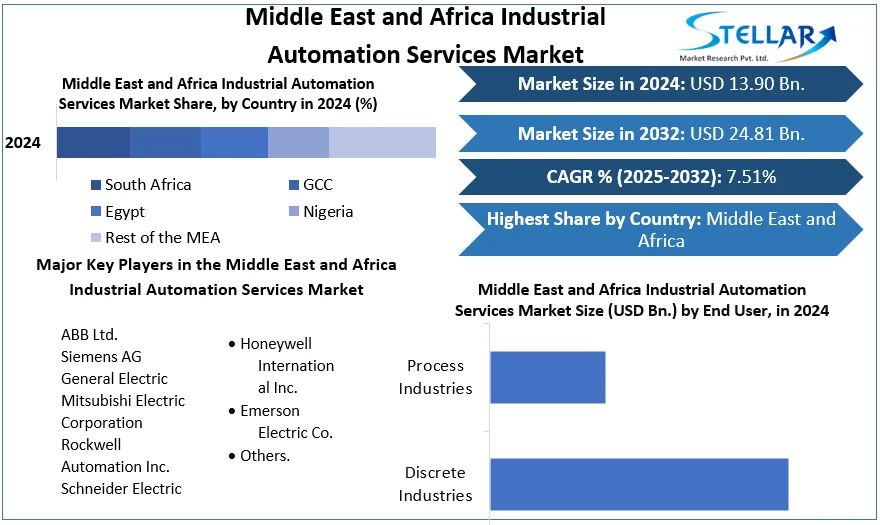

Middle East and Africa Industrial Automation Services Market size was valued at US$ 13.90 Bn. in 2024 and the market size is estimated to grow at a CAGR of 7.51% and is expected to reach at US$ 24.81 Bn. by 2032.

Format : PDF | Report ID : SMR_247

Middle East and Africa Industrial Automation Services Market Overview & Dynamics:

Looking forward, the MEA market is projected to reach a value of US$ 21.47 Bn. by 2030, expanding at a CAGR of around 7.51 % during 2024-2030. Governments across the Middle East and Africa are focused on the growth of process and discrete industries by adopting various efforts and strategies backed by investments to enhance efficiency in order to meet rising demand and changing consumer habits.

Manufacturers in MEA are striving to use automation and Industry 4.0 solutions to improve their efficiency as the demand for more throughput and lower prices continues. Manufacturers are aiming for a complete digital thread, from materials tracking to production and distribution. Automation is increasingly being used by manufacturers to improve precision and uniformity while also enhancing operational efficiency. Robotics, machine vision, IIoT, and other digital technologies are advancing the future of automation in MEA industrial industries.

To get more Insights: Request Free Sample Report

Following the worldwide economic slowdown triggered by COVID-19, the Middle Eastern and African factory automation and industrial control system markets had a positive demand impact and a mixed supply impact in the first half of 2020. Since most enterprises operating in the end-user industries (primarily manufacturing and automotive) had shuttered their production due to lockdown restrictions, smart factory initiatives have helped manufacturers overcome COVID-19 challenges and address issues such as workforce reductions, drops in sales for some specific products, social distancing, and extreme pressure to cut operational costs.

GCC Countries is expected to Hold Significant Share:

The GCC is looking to usher in a new era of manufacturing based on modern industrial society. One of the primary elements driving growth in the region's automation and manufacturing industries is the growing active cooperation between government, regulators, and organizations for economic development. During the forecast period, the GCC is expected to grow at the fastest rate of 8.12%.

From 2024 to 2030, Saudi Arabia is expected to have the highest nearly 53% share of the GCC countries' Industrial Automation Services Market. The expanded deployment of many IoT-related software and services, which are constantly driving the country to become a Middle East and Africaly known technology-driven economy, is causing considerable growth in the industrial sector in Saudi Arabia. In addition to the manufacturing sector, the country's food processing industry is well positioned to generate significant development in the future years.

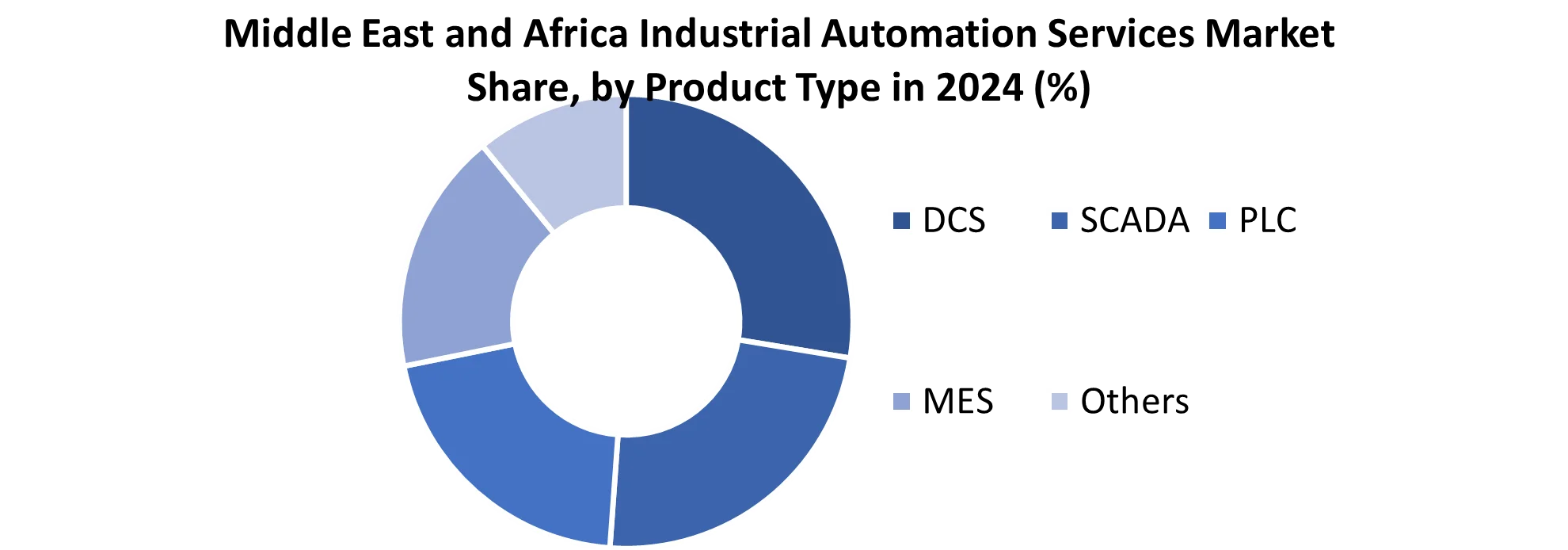

DCS Segment Is Expected to Grow at The Highest CAGR Of 8.52% Over 2024-2030.

By Product Type, DCS segment was valued US$ XX Bn. in 2024 and is expected to reach a value of US$ XX Bn. by 2032, with a CAGR of 41.23% during the forecast period. DCS type is expected to have a high demand owing to the rapid growth of industrialization among developing countries, derived from labour arbitrage. Likewise, the report will provide an accurate prediction of the contribution of the various segments to the growth of the MEA industrial automation services market size.

Industry Developments:

Key developments in the Middle East and Africa Industrial Automation Services market, as well as organic and inorganic growth strategies, are covered in the studies. Product launches, product approvals, and other organic growth tactics such as patents and events are being prioritised by a number of companies.

Rockwell Automation PlantPax created a modern DCS in April 2020 to optimise plant performance for the oil and gas industry in the Middle East and Africa.

October 2020 - ABB Limited has teamed with IBM to improve industrial cybersecurity by connecting its process control systems to the IBM security platform for digital threat visibility. This is supposed to assist industrial operators strengthen their security.

The objective of the report is to present a comprehensive analysis of the Middle East and Africa Industrial Automation Services Market to the stakeholders in the industry. The report provides trends that are most dominant in the Middle East and Africa Industrial Automation Services Market and how these trends will influence new business investments and market development throughout the forecast period. The report also aids in the comprehension of the Middle East and Africa Industrial Automation Services Market dynamics and competitive structure of the market by analyzing market leaders, market followers, and regional players.

The qualitative and quantitative data provided in the Middle East and Africa Industrial Automation Services Market report is to help understand which market segments, regions are expected to grow at higher rates, factors affecting the market, and key opportunity areas, which will drive the industry and market growth through the forecast period. The report also includes the competitive landscape of key players in the industry along with their recent developments in the Middle East and Africa Industrial Automation Services Market. The report studies factors such as company size, market share, market growth, revenue, production volume, and profits of the key players in the Middle East and Africa Industrial Automation Services Market.

The report provides Porter's Five Force Model, which helps in designing the business strategies in the market. The report helps in identifying how many rivals are existing, who they are, and how their product quality is in the Market. The report also analyses if the Middle East and Africa Industrial Automation Services Market is easy for a new player to gain a foothold in the market, do they enter or exit the market regularly if the market is dominated by a few players, etc.

The report also includes a PESTEL Analysis, which aids in the development of company strategies. Political variables help in figuring out how much a government can influence the Market. Economic variables aid in the analysis of economic performance drivers that have an impact on the Market. Understanding the impact of the surrounding environment and the influence of environmental concerns on the Middle East and Africa Industrial Automation Services Market is aided by legal factors.

East and Africa Industrial Automation Services Scope:

|

Middle East and Africa Industrial Automation Services Market |

|

|

Market Size in 2024 |

USD 13.90 Bn. |

|

Market Size in 2032 |

USD 24.81 Bn. |

|

CAGR (2025-2032) |

7.51% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

By Type of Service

|

|

By Product Type

|

|

|

|

By End User

|

|

|

By Country

|

Major players in Middle East and Africa Industrial Automation Services Market:

- ABB Ltd.

- Siemens AG

- General Electric

- Mitsubishi Electric Corporation

- Rockwell Automation Inc.

- Schneider Electric

- Honeywell International Inc.

- Emerson Electric Co.

- Others.

Frequently Asked Questions

Total CAGR expected to be recorded for the Industrial Automation Market in GCC is 8.12%

Major competitors of the market are General Electric, Rockwell, and Omron.

The market size of the Middle East and Africa Industrial Automation Market in 2024 is US$ 13.90 Bn.

The market size of the Middle East and Africa Industrial Automation Market by 2032 is US$ 24.81 Bn.

1. Research Methodology

1.1 Research Data

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. Middle East and Africa Industrial Automation Services Market Executive Summary

2.1. Market Overview

2.2. Market Size (2024) and Forecast (2025 – 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments and Country

3. Middle East and Africa Industrial Automation Services Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Business Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2024)

3.2.7. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

3.4.1. Strategic Initiatives

3.4.2. Mergers and Acquisitions

3.4.3. Collaborations and Partnerships

3.4.4. Developments and Innovations

4. Middle East and Africa Industrial Automation Services Market: Dynamics

4.1. Middle East and Africa Industrial Automation Services Market Trends

4.2. Middle East and Africa Industrial Automation Services Market Drivers

4.3. Middle East and Africa Industrial Automation Services Market Restraints

4.4. Middle East and Africa Industrial Automation Services Market Opportunities

4.5. Middle East and Africa Industrial Automation Services Market Challenges

4.6. PORTER’s Five Forces Analysis

4.6.1. Intensity of the Rivalry

4.6.2. Threat of New Entrants

4.6.3. Bargaining Power of Suppliers

4.6.4. Bargaining Power of Buyers

4.6.5. Threat of Substitutes

4.7. PESTLE Analysis

4.7.1. Political Factors

4.7.2. Economic Factors

4.7.3. Social Factors

4.7.4. Technological Factors

4.7.5. Legal Factors

4.7.6. Environmental Factors

4.8. Technological Roadmap

5. Middle East and Africa Industrial Automation Services Market: Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

5.1. Middle East and Africa Industrial Automation Services Market Size and Forecast, by Type of Service (2024-2032)

5.1.1. Project Engineering and Installation

5.1.2. Maintenance and Support Services

5.1.3. Consulting Services

5.1.4. Operational Services

5.2. Middle East and Africa Industrial Automation Services Market Size and Forecast, by Product Type (2024-2032)

5.2.1. DCS

5.2.2. SCADA

5.2.3. PLC

5.2.4. MES

5.2.5. Others

5.3. Middle East and Africa Industrial Automation Services Market Size and Forecast, by End User (2024-2032)

5.3.1. Discrete Industries

5.3.2. Process Industries

5.4. Middle East and Africa Industrial Automation Services Market Size and Forecast, by Country (2024-2032)

5.4.1. South Africa

5.4.2. GCC

5.4.3. Egypt

5.4.4. Nigeria

5.4.5. Rest of Middle East and Africa

6. Company Profile: Key Players

6.1. ABB Ltd.

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.3. Financial Overview

6.1.3.1. Total Revenue

6.1.3.2. Segment Revenue

6.1.3.3. Regional Revenue

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

6.2. Siemens AG

6.3. General Electric

6.4. Mitsubishi Electric Corporation

6.5. Rockwell Automation Inc.

6.6. Schneider Electric

6.7. Honeywell International Inc.

6.8. Emerson Electric Co.

7. Key Findings

8. Analyst Recommendations

8.1. Strategic Recommendations

8.2. Future Outlook