Mexico Bike Sharing Market Industry Overview, Size, Share, Growth Trends, Research Insights and Forecast (2025–2032)

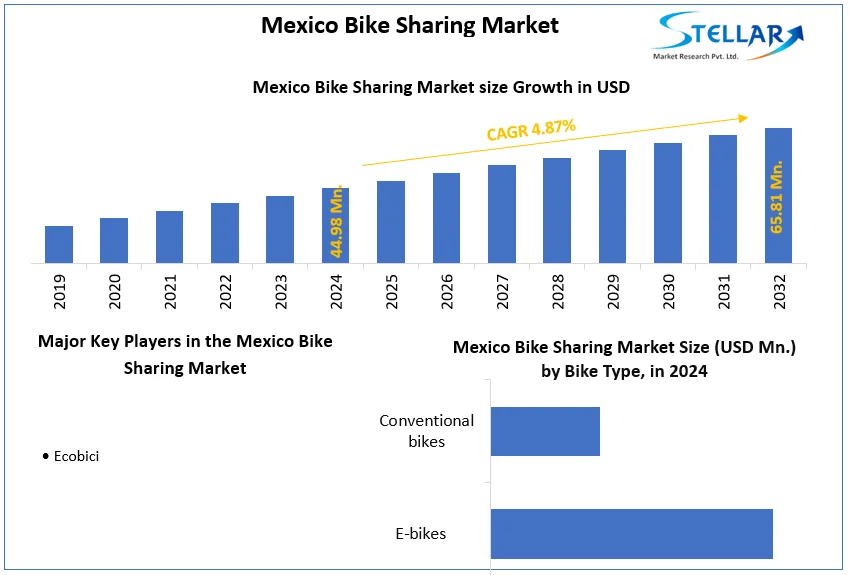

Mexico Bike Sharing Market size was valued at US$ 44.98 Million in 2024 and the total Mexico Bike Sharing Market revenue is expected to grow at 4.87% through 2025 to 2032, reaching nearly US$ 65.81 Million.

Format : PDF | Report ID : SMR_98

Mexico Bike Sharing Market Overview:

EcoBici, Mexico City's public bike sharing scheme, has been launched as a complementary mode of transportation to public transportation. Citizens and visitors can use bicycles for free if they register and pay a small, inexpensive cost for a specified period of time (one year, one week, three days or one day). Customer service centres, as well as many modules and stalls located across the city, are available for registration. Users who register obtain an EcoBici card, which allows them to borrow a bike from a designated bike station, ride it about, and return it to the next closest station within 45 minutes. If this period is surpassed, there will be an extra charge.

To get more Insights: Request Free Sample Report

Mexico Bike Sharing Market Dynamics:

EcoBici, Mexico City's bike-sharing programme, began in 2010 with the goal of increasing cycling while also lowering traffic congestion and transportation-related greenhouse gas emissions. When users register and pay a nominal price, bikes located at many stations can be utilized for transportation within the city. Since the program's inception in 2010, customer demand has risen significantly in line with the expansion of bike and bike station infrastructure, which now covers roughly 35 kilometers2. The initiative began with approximately 84 bike stations and 1,200 bicycles. By 2020, the number of bike stations had expanded to 484, with over 5200 bikes available for the over 100,000 users. . In addition, nearly 300 kilometres of new bike lanes have been built across the federal area of Mexico City. These new bike pathways serve not only EcoBici users, but other bikers in the city as well.

A standard one-day membership costs around 90 pesos (5.6 Euros), according to the EcoBici webpage in 2020, while an annual membership costs around 400 pesos (25 Euros). Bike stations are frequently positioned near public transportation stops, allowing for a seamless integration of modes of commuting.

The study, which was completed in 2019, also predicted that EcoBici's advantages will expand in the coming years. The total reduction in carbon dioxide emissions from 2020 to 2030 is anticipated to be 3,641 TonCO2eq, or the equivalent of planting 10,938 trees over the same time period. The EcoBici system is planned to grow over time, so emission reductions are predicted to increase on an annual basis. Local financing source of EcoBici - the capital investment for EcoBici was supported entirely by Mexico City's general budget, and each bike cost around 3,400 Euros. The average operational cost per trip is estimated to be around 12 Euros.

P2P bike sharing is the dominating segment in the bike sharing market as P2P is the only cost budgeted option for the poor demographics of the Mexico city. P2P bike sharing costs average of 25 Euros which is quite efficient comparing to station based bikes.

Mexico City's government has introduced EcoBici. SEDEMA, Mexico City's Ministry of the Environment, manages and implements the project. The system is managed by a commercial corporation called "Clear Channel," which was hired by SEDEMA to carry out the project.

Government of Mexico City Plans for Bike Sharing:

|

Annual |

$496.00 |

|

Temporary 7 days |

$372.00 |

|

Temporary 3 days |

$223.00 |

|

Temporary 1 days |

$112.00 |

Mexico Bike Sharing Market Scope:

|

Mexico Bike Sharing Market |

|

|

Market Size in 2024 |

USD 44.98 Mn. |

|

Market Size in 2032 |

USD 65.81 Mn. |

|

CAGR (2025-2032) |

4.87% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

by Bike Type

|

|

by Model

|

|

|

by Sharing System

|

|

Mexico Bike Sharing Market Players

Frequently Asked Questions

Mexico City region have the highest growth rate of 5.5% in the Mexico Bike Sharing market with total system installations of 400.

Ecobici is the only player in the Mexico Bike Sharing market as it is government led company runs on public capitals.

Mexico City and La Paz are the top regions in the Mexico bike sharing market in terms of system installations.

1. Mexico Bike Sharing Market: Research Methodology

1.1. Research Data

1.1.1. Secondary Data

1.1.2. Primary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Up Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. Mexico Bike Sharing Market Introduction

2.1. Study Assumption and Market Definition

2.2. Scope of the Study

2.3. Executive Summary

3. Mexico Bike Sharing Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Product Segment

3.2.3. End-user Segment

3.2.4. Revenue (2024)

3.2.5. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Mergers and Acquisitions Details

4. Mexico Bike Sharing Market: Dynamics

4.1. Mexico Bike Sharing Market Trends

4.2. Mexico Bike Sharing Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.2.4. Challenges

4.3. PORTER’s Five Forces Analysis

4.4. PESTLE Analysis

4.5. Technological Roadmap

4.6. Regulatory Landscape

5. Mexico Bike Sharing Market: Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

5.1. Mexico Bike Sharing Market Size and Forecast, by Bike Type (2024-2032)

5.1.1. E-bikes

5.1.2. Conventional bikes

5.2. Mexico Bike Sharing Market Size and Forecast, by Model (2024-2032)

5.2.1. Free-floating

5.2.2. P2P

5.2.3. Station Based

5.3. Mexico Bike Sharing Market Size and Forecast, by Sharing System (2024-2032)

5.3.1. Dockless

5.3.2. Docked

5.3.3. Hybrid

6. Company Profile: Key Players

6.1. Ecobici

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.3. Financial Overview

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

7. Key Findings

8. Industry Recommendations