Menthol Cigarette Market Global Industry Analysis and Forecast (2026-2032) Trends, Statistics, Dynamics, Segment Analysis

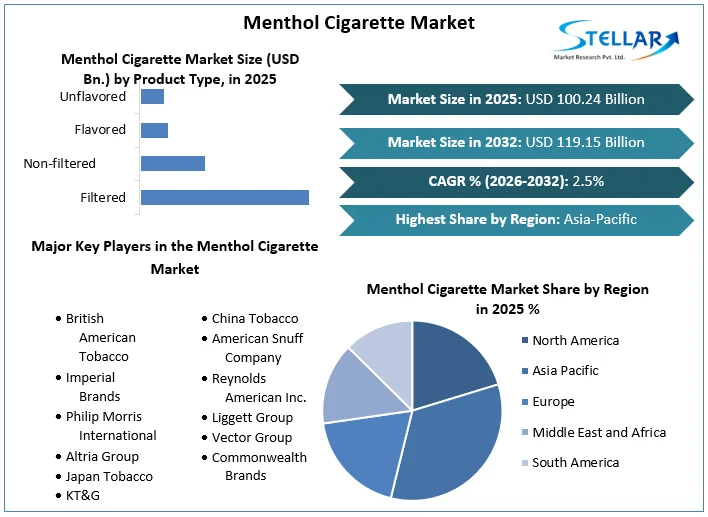

The Global Menthol Cigarette Market size was valued at USD 100.24 Billion in 2025 and is expected to reach USD 119.15 Billion by 2032, at a CAGR of 2.5% from 2026 to 2032.

Format : PDF | Report ID : SMR_1475

Menthol Cigarette Market Overview:

A menthol cigarette is a cylindrical roll made with shredded or ground tobacco and menthol flavouring. Mint plants, including spearmint and peppermint, produce the chemical component known as menthol. Typically, it is included in cigarettes to provide a cooling effect and lessen the harshness of the smoke for the customer. It also has anaesthetic effects and can help by relaxing dry throats to control the cough reflex. To release a burst of flavour while smoking, menthol may be found in some variations in trace amounts inside or close to the cigarette filter.

One of the main drivers boosting the market's expansion is the rising urbanisation of the world. Working professionals are smoking more often to reduce stress and calm their nerves as a result of their sedentary lifestyle patterns and busy schedules. Menthol cigarettes provide a refreshing flavour, a cooling feeling, and sensory stimulation that relieves discomfort and helps the user develop a taste aversion. Additionally, the advent of menthol cigarettes with an additional capsule and flavourless cigarettes with tiny menthol capsules is accelerating market expansion.

The user can adjust the flavour intensity of these capsules to their preferred level. In addition, further product developments, such as the creation of low-tar cigarettes and ultra-long and ultra-slim variations for female consumers, are fostering market expansion. The market is expected to be further fueled by additional reasons such the growing smoking population, which includes young people and women, and intensive marketing campaigns by manufacturers on social media platforms.

To get more Insights: Request Free Sample Report

Menthol Cigarette Market Dynamics:

Consumer Preferences, Regulation and Legislation, Health Concerns, etc.

The demand for menthol cigarettes is significantly influenced by consumer tastes. Due to the menthol's alleged ability to cool and relax the throat and lungs, some smokers like menthol-flavored cigarettes.

The menthol cigarette market may be significantly impacted by governmental rules and legislation. For instance, due to health concerns, certain nations and areas have instituted limitations or outright bans on menthol cigarettes.

Consumer decisions may be influenced by the cost of menthol cigarettes in comparison to other tobacco products. Tax laws can also affect pricing, which in turn affects customer demand.

Growing knowledge of the negative health effects of smoking, especially those from menthol cigarettes, may discourage some customers from buying these goods. Health-related advertisements and warnings may alter consumer behaviour.

The competitive landscape within the tobacco industry can drive innovation and product development in the menthol cigarette market. Companies may introduce new menthol cigarette varieties to capture market share.

Health Concerns, Tobacco Control Efforts, etc.

Menthol cigarettes are often perceived as less harsh and easier to smoke, which can lead to increased consumption. This has raised health concerns because menthol may mask the harshness of smoking, potentially encouraging people to smoke more and making it harder for them to quit. These concerns have led to increased calls for menthol cigarette bans.

Campaigns for public health and anti-smoking programmes have been successful in lowering tobacco use. Since flavoured cigarettes, notably menthol ones, are thought to be more enticing to young people, these initiatives frequently target them. The desire for menthol cigarettes may be directly impacted by this.

Although a certain subset of smokers who favour the minty flavour find menthol cigarettes appealing, not everyone does. As customer tastes shift towards substitutes like e-cigarettes or smokeless tobacco products, their restricted appeal may hinder industry expansion.

The tobacco industry is regularly subject to legal issues and lawsuits, including those involving product responsibility, marketing strategies, and health claims. These legal battles can have financial implications and damage the reputation of menthol cigarette brands.

Menthol Cigarette Market Opportunities:

Market Expansion, Product Innovation, etc.

Despite increased regulations and health concerns, the menthol cigarette market still has room for expansion in some regions. Emerging markets and countries with less stringent regulations may present growth opportunities.

The creation of new menthol cigarette products, like lower-risk substitutes like menthol-flavored e-cigarettes or heat-not-burn goods, may be of interest to customers seeking an alternative to traditional menthol cigarettes.

A wider consumer base can be attracted by providing different menthol flavours and intensities. While some consumers choose more subdued menthol flavours, others favour stronger menthol sensations.

Menthol Cigarette Market Challenges:

Flavor Ban Concerns, Economic and Social Factors, etc.

Beyond menthol, there is a broader debate about flavored tobacco products in general. Some regions have banned flavored tobacco products, including menthol, to deter young people from smoking and reduce the appeal of these products. This has a direct impact on the menthol cigarette market.

Economic factors, such as the rising cost of tobacco products due to taxation and economic instability, can influence the affordability and demand for menthol cigarettes. Additionally, changing social norms and attitudes towards smoking can affect the market as well.

The menthol cigarette market, like the broader tobacco market, faced issues related to counterfeit and illicit products. This not only impacted legitimate sales but also raised health and safety concerns.

Menthol Cigarette Market Regional Insights:

By 2025, more than half of all menthol cigarette sales globally will take place in the Asia-Pacific region. The market is developing as a result of the high smoking prevalence in the region and the increasing appeal of menthol cigarettes among teen smokers.

In Asia Pacific, China leads the pack in terms of menthol cigarette sales, followed by Indonesia, Japan, and South Korea. More than 70% of all cigarettes sold in China are menthol cigarettes.

North America is expected to be the second-largest menthol cigarette market in 2024, with around 30% of worldwide sales. The greatest market for menthol cigarettes in North America is found in the United States, followed by Canada.

After China and the United States, Europe is anticipated to be the third-largest menthol cigarette market in 2024, with over 15% of worldwide sales. The continent's biggest menthol cigarette market is in the United Kingdom, followed by France, Germany, and Italy.

With less than 10% of global sales in 2023, Latin America and the Middle East and Africa (MEA) are smaller menthol cigarette markets. Nevertheless, the market expansion in these areas is being fueled by factors including population growth and rising disposable incomes.

Menthol Cigarette Market Segment Analysis:

By Product Type: The market for menthol cigarettes is dominated by the most widely consumed variation, filtered cigarettes. This is done in order to allow the sale of filtered menthol cigarettes, which are thought to be less dangerous than unfiltered menthol cigarettes. Particularly among younger smokers, flavor-infused menthol cigarettes are very common. Flavoured menthol cigarettes are available in tastes besides mint, cherry, and peach.

In certain places, unflavored menthol cigarettes are still available despite their declining popularity. Smokers who desire a strong menthol flavour typically prefer unflavored menthol cigarettes.

By Distribution Channel: The greatest distribution channel for menthol cigarettes is supermarkets and hypermarkets, followed by convenience stores. Because internet shopping is becoming more and more popular, the distribution channel for supermarkets and hypermarkets is anticipated to expand more slowly than the distribution channel for convenience stores. Because of its ease and cheaper costs, the online menthol cigarette distribution channel is anticipated to grow at the quickest rate.

By End-User: Male smokers dominate the menthol cigarette market, followed by female smokers and adolescent smokers. The category of female smokers is expected to grow the fastest due to the increased number of female smokers. It is projected that the category of young smokers would experience slight expansion as a result of the rising prevalence of smoking among young people.

Menthol Cigarette Market Competitive Landscape:

In recent years, British American Tobacco (BAT) has launched a number of new products, including: Vuse, a line of e-cigarettes, Glo, a heated tobacco product, Logic, a line of disposable e-cigarettes

In 2022, BAT acquired Reynolds American Inc., the maker of Camel and Newport cigarettes, for $49 billion. This acquisition made BAT the largest tobacco company in the United States.

A joint venture between JT Group and Altria Group is announced in order to market heated tobacco sticks made by Ploom in the United States. A joint venture between JT Group and Altria Group to market Ploom heated tobacco sticks in the US was announced on October 31, 2022. It is anticipated that this joint venture will hasten Ploom's expansion into the US market.

E-cigarettes and other innovative tobacco products are also representing an increasing threat to China Tobacco. China's government has approved the sale of e-cigarettes as they are growing more and more popular there. Younger smokers have been drawn to e-cigarettes because they are thought to be a less dangerous alternative to conventional cigarettes.

|

Menthol Cigarette Market Scope |

|

|

Market Size in 2025 |

USD 100.24 Billion. |

|

Market Size in 2032 |

USD 119.15 Billion. |

|

CAGR (2026-2032) |

2.5% |

|

Historic Data |

2020-2025 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2032 |

|

Segment Scope |

By Product Type

|

|

By Distribution Channel

|

|

|

By End-User

|

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Menthol Cigarette Market Key Players:

- British American Tobacco

- Imperial Brands

- Philip Morris International

- Altria Group

- Japan Tobacco

- KT&G

- China Tobacco

- American Snuff Company

- Reynolds American Inc.

- Liggett Group

- Vector Group

- Commonwealth Brands

Frequently Asked Questions

The Menthol Cigarette Market size is expected to reach $ 119.15 billion by 2032.

The major players in the Menthol Cigarette Market include British American Tobacco Imperial Brands Philip Morris International Altria Group Japan Tobacco KT&G China Tobacco American Snuff Company Reynolds American Inc. Liggett Group Vector Group Commonwealth Brands.

The expected CAGR of the Menthol Cigarette Market is 2.5% from 2026 to 2032.

The Asia-Pacific market dominated the Menthol Cigarette Market by Region in 2025.

1. Global Menthol Cigarette Market : Research Methodology

2. Global Menthol Cigarette Market : Executive Summary

3. Global Menthol Cigarette Market : Competitive Landscape

3.1. Stellar Competition Matrix

3.2. Competitive Landscape

3.3. Key Players Benchmarking

3.4. Market Structure

3.4.1. Market Leaders

3.4.2. Market Followers

3.4.3. Emerging Players

3.5. Consolidation of the Market

4. Global Menthol Cigarette Market : Dynamics

4.1. Market Trends by Region

4.1.1. North America

4.1.2. Europe

4.1.3. Asia Pacific

4.1.4. Middle East and Africa

4.1.5. South America

4.2. Market Drivers by Region

4.2.1. North America

4.2.2. Europe

4.2.3. Asia Pacific

4.2.4. Middle East and Africa

4.2.5. South America

4.3. Market Restraints

4.4. Market Opportunities

4.5. Market Challenges

4.6. PORTER’s Five Forces Analysis

4.7. PESTLE Analysis

4.8. Value Chain Analysis

4.9. Regulatory Landscape by Region

4.9.1. North America

4.9.2. Europe

4.9.3. Asia Pacific

4.9.4. Middle East and Africa

4.9.5. South America

5. Global Menthol Cigarette Market Size and Forecast by Segments (by Value USD and Volume Units)

5.1. Global Menthol Cigarette Market Size and Forecast, by Product Type (2025-2032)

5.1.1. Filtered

5.1.2. Non-filtered

5.1.3. Flavored

5.1.4. Unflavored

5.2. Global Menthol Cigarette Market Size and Forecast, by Distribution Channel (2025-2032)

5.2.1. Retail Stores

5.2.2. Online Stores

5.2.3. Convenience Stores

5.2.4. Supermarkets

5.2.5. Other

5.3. Global Menthol Cigarette Market Size and Forecast, by End-User (2025-2032)

5.3.1. Male

5.3.2. Female

5.4. Global Menthol Cigarette Market Size and Forecast, by Region (2025-2032)

5.4.1. North America

5.4.2. Europe

5.4.3. Asia Pacific

5.4.4. Middle East and Africa

5.4.5. South America

6. North America Global Menthol Cigarette Market Size and Forecast (by Value USD and Volume Units)

6.1. North America Global Menthol Cigarette Market Size and Forecast, by Product Type (2025-2032)

6.1.1. Filtered

6.1.2. Non-filtered

6.1.3. Flavored

6.1.4. Unflavored

6.2. North America Global Menthol Cigarette Market Size and Forecast, by Distribution Channel (2025-2032)

6.2.1. Retail Stores

6.2.2. Online Stores

6.2.3. Convenience Stores

6.2.4. Supermarkets

6.2.5. Other

6.3. North America Global Menthol Cigarette Market Size and Forecast, by End-User (2025-2032)

6.3.1. Male

6.3.2. Female

6.4. North America Global Menthol Cigarette Market Size and Forecast, by Country (2025-2032)

6.4.1. United States

6.4.2. Canada

6.4.3. Mexico

7. Europe Global Menthol Cigarette Market Size and Forecast (by Value USD and Volume Units)

7.1. Europe Global Menthol Cigarette Market Size and Forecast, by Product Type (2025-2032)

7.1.1. Filtered

7.1.2. Non-filtered

7.1.3. Flavored

7.1.4. Unflavored

7.2. Europe Global Menthol Cigarette Market Size and Forecast, by Distribution Channel (2025-2032)

7.2.1. Retail Stores

7.2.2. Online Stores

7.2.3. Convenience Stores

7.2.4. Supermarkets

7.2.5. Other

7.3. Europe Global Menthol Cigarette Market Size and Forecast, by End-User (2025-2032)

7.3.1. Male

7.3.2. Female

7.4. Europe Global Menthol Cigarette Market Size and Forecast, by Country (2025-2032)

7.4.1. UK

7.4.2. France

7.4.3. Germany

7.4.4. Italy

7.4.5. Spain

7.4.6. Sweden

7.4.7. Austria

7.4.8. Rest of Europe

8. Asia Pacific Global Menthol Cigarette Market Size and Forecast (by Value USD and Volume Units)

8.1. Asia Pacific Global Menthol Cigarette Market Size and Forecast, by Product Type (2025-2032)

8.1.1. Filtered

8.1.2. Non-filtered

8.1.3. Flavored

8.1.4. Unflavored

8.2. Asia Pacific Global Menthol Cigarette Market Size and Forecast, by Distribution Channel (2025-2032)

8.2.1. Retail Stores

8.2.2. Online Stores

8.2.3. Convenience Stores

8.2.4. Supermarkets

8.2.5. Other

8.3. Asia Pacific Global Menthol Cigarette Market Size and Forecast, by End-User (2025-2032)

8.3.1. Male

8.3.2. Female

8.4. Asia Pacific Global Menthol Cigarette Market Size and Forecast, by Country (2025-2032)

8.4.1. China

8.4.2. S Korea

8.4.3. Japan

8.4.4. India

8.4.5. Australia

8.4.6. Indonesia

8.4.7. Malaysia

8.4.8. Vietnam

8.4.9. Taiwan

8.4.10. Bangladesh

8.4.11. Pakistan

8.4.12. Rest of Asia Pacific

9. Middle East and Africa Global Menthol Cigarette Market Size and Forecast (by Value USD and Volume Units)

9.1. Middle East and Africa Global Menthol Cigarette Market Size and Forecast, by Product Type (2025-2032)

9.1.1. Filtered

9.1.2. Non-filtered

9.1.3. Flavored

9.1.4. Unflavored

9.2. Middle East and Africa Global Menthol Cigarette Market Size and Forecast, by Distribution Channel (2025-2032)

9.2.1. Retail Stores

9.2.2. Online Stores

9.2.3. Convenience Stores

9.2.4. Supermarkets

9.2.5. Other

9.3. Middle East and Africa Global Menthol Cigarette Market Size and Forecast, by End-User (2025-2032)

9.3.1. Male

9.3.2. Female

9.4. Middle East and Africa Global Menthol Cigarette Market Size and Forecast, by Country (2025-2032)

9.4.1. South Africa

9.4.2. GCC

9.4.3. Egypt

9.4.4. Nigeria

9.4.5. Rest of ME&A

10. South America Global Menthol Cigarette Market Size and Forecast (by Value USD and Volume Units)

10.1. South America Global Menthol Cigarette Market Size and Forecast, by Product Type (2025-2032)

10.1.1. Filtered

10.1.2. Non-filtered

10.1.3. Flavored

10.1.4. Unflavored

10.2. South America Global Menthol Cigarette Market Size and Forecast, by Distribution Channel (2025-2032)

10.2.1. Retail Stores

10.2.2. Online Stores

10.2.3. Convenience Stores

10.2.4. Supermarkets

10.2.5. Other

10.3. South America Global Menthol Cigarette Market Size and Forecast, by End-User (2025-2032)

10.3.1. Male

10.3.2. Female

10.4. South America Global Menthol Cigarette Market Size and Forecast, by Country (2025-2032)

10.4.1. Brazil

10.4.2. Argentina

10.4.3. Rest of South America

11. Company Profile: Key players

11.1. British American Tobacco

11.1.2. Company Overview

11.1.3. Financial Overview

11.1.4. Business Portfolio

11.1.5. SWOT Analysis

11.1.6. Business Strategy

11.1.7. Recent Developments

11.2. Imperial Brands

11.3. Philip Morris International

11.4. Altria Group

11.5. Japan Tobacco

11.6. KT&G

11.7. China Tobacco

11.8. American Snuff Company

11.9. Reynolds American Inc.

11.10. Liggett Group

11.11. Vector Group

11.12. Commonwealth Brands

12. Key Findings

13. Industry Recommendation