Clean Beauty Market Industry Analysis and Forecast (2026-2032)

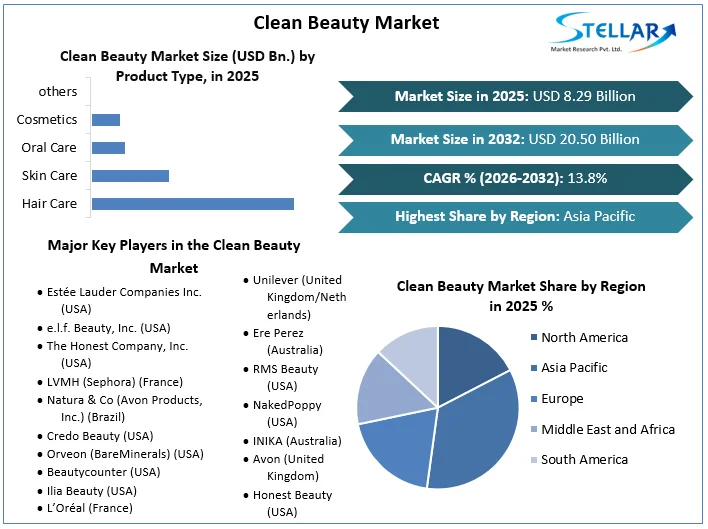

The Clean Beauty Market size was valued at USD 8.29 Bn. in 2025 and the total Global Clean Beauty revenue is expected to grow at a CAGR of 13.8 % from 2026 to 2032, reaching nearly USD 20.50 Bn. by 2032.

Format : PDF | Report ID : SMR_1839

Clean Beauty Market Overview

The global clean beauty market has been experiencing a surge in demand as consumers become increasingly conscious of the ingredients in their beauty products. Clean beauty products, which are free from harmful toxins and chemicals, are gaining popularity owing to their safer and more sustainable nature. These products are characterized by transparent labeling of ingredients and are considered safe to use on the skin, reducing the risk of skin damage caused by harsh chemicals.

One of the defining aspects of clean beauty is its emphasis on ingredient transparency and safety. Consumers are becoming more educated about the potential risks associated with certain chemicals found in traditional beauty products, leading them to seek out cleaner alternatives. This shift in consumer behavior has prompted many beauty brands to reformulate their products to meet the growing demand for clean and natural ingredients. As a result, the clean beauty market is witnessing a proliferation of new products and brands that cater to this emerging trend.

The market is segmented based on product type, form, end user, distribution channel, and region & country level, reflecting the diverse preferences and buying behaviours of consumers worldwide. In addition to ingredient safety, clean beauty products are also valued for their sustainability and eco-friendliness. Many clean beauty brands prioritize ethical sourcing practices, cruelty-free production, and sustainable packaging, appealing to environmentally conscious consumers. This emphasis on sustainability aligns with broader global trends towards eco-friendly lifestyles and consumption patterns. As the clean beauty market continues to grow, it is expected to drive innovation and encourage more beauty brands to adopt cleaner and more sustainable practices.

The report also includes an analysis of both quantitative and qualitative data, with a forecast period extending from 2025 to 2032. The report takes into consideration various factors such as product pricing and penetration at both country and regional levels, country GDP, market dynamics of parent market and child markets, end End User industries, major players, consumer buying behaviour, and economic, political, and social scenarios of countries.

To get more Insights: Request Free Sample Report

Clean Beauty Market Dynamics

Consumer shift towards natural and non-toxic skincare driving the market growth

The consumer shift towards natural and non-toxic skincare products is a significant driver of growth in the clean beauty industry. As consumers become more aware of the potential harm posed by chemicals in traditional skincare products, there is a growing demand for safer and more sustainable alternatives. This shift is not only driven by a desire for healthier skin but also by a broader trend towards eco-conscious consumption. One of the key factors driving this trend is the increasing availability of information about skincare ingredients and their potential effects on health and the environment.

Consumers are now more informed and are actively seeking out products that are free from harmful chemicals such as parabens, phthalates, and sulfates. This has led to a surge in demand for natural and non-toxic skincare products, driving up sales volume and profit margins for companies that offer these products. Brands that have embraced this trend and offer natural and non-toxic skincare products have seen significant growth in recent years.

Other brands, such as Tata Harper Skincare and Drunk Elephant, have also seen success by focusing on natural ingredients and non-toxic formulations. As consumers continue to prioritize natural and non-toxic skincare, this trend is expected to drive further growth in the clean beauty industry.

- For example, Beautycounter, a clean beauty brand that prioritizes ingredient transparency and safety, has experienced rapid growth and expanded its product line to meet the increasing demand for clean beauty products.

- According to MMR Analysis, 67% of shoppers have made changes in order to lessen their environmental impact, such as seeking recyclable or environmentally friendly packaging in products

- 43% of consumers in this age group (Millennials and Gen Z) indicated a preference toward natural skincare, compared to 31% of overall consumers in the U.S.

- When shopping for beauty and personal care products, consumers consider first the presence of natural ingredients (40.2%), the respect for the environment (17.6%), and finally the use of recyclable packaging (15.8%).

Table 1. The Clean and Green Revolution

|

|

CLAIM |

MARKET VALUE |

% GROWTH |

|

CLEAN BEAUTY 1.0 |

PARABEN FREE |

$27 Billion |

+4.7% |

|

PHTHALATE FREE |

$11 Billion |

+8.9% |

|

|

SULFATE FREE |

$20 Billion |

+5.0% |

|

|

CLEAN BEAUTY 2.0 |

VEGAN |

$11 Billion |

+6.5% |

|

SUSTAINABLE |

$14 Billion |

+3.4% |

|

|

HUMANE |

$6 Billion |

+8.0% |

|

|

CLEAN BEAUTY 3.0 |

FAIR TRADE |

$408 Million |

+4.2% |

Higher Cost of Products and Lack of Transparency

One of the key restraints for the clean beauty market is the higher cost of clean beauty products compared to traditional beauty products. Clean beauty products often use natural and organic ingredients, which is more expensive to source and produce, leading to higher retail prices. This price difference deters some consumers, especially those with lower disposable incomes, from purchasing clean beauty products. Additionally, the lack of regulation and standardized definitions for terms like "clean" and "natural" in the beauty industry leads to confusion among consumers, making it difficult for them to identify genuine clean beauty products. This lack of clarity and transparency hinders the growth of the clean beauty market, as consumers are skeptical about the efficacy and authenticity of these products.

Clean Beauty Market Trends

Clean beauty refers to products that are safe, non-toxic, and have transparent ingredient labels. It is not just about organic, natural, or green beauty; it encompasses all types of beauty that deviate from normal beauty. Clean beauty products are mindfully created without toxic ingredients, ethically sourced, and made with the health of the customer's bodies and the environment in mind. These products are vegan, cruelty-free, eco-friendly, and sustainably sourced. They contain beneficial ingredients like collagen, diminishing dark spots, moisturizers, wrinkle reduction, and acne prevention.

The global market for clean beauty products is growing owing to increasing demand for products with more skin-consciousness and awareness, as well as the emergence of sophisticated, clean beauty products for better skin care. These products offer numerous benefits, including boosting collagen, diminishing dark spots, reducing wrinkles, shrinking pores, and brightening and toning the skin.

- 80% of trending beauty brands over Black Friday and Cyber Monday in 2024 were clean skin-care brands

- Younger consumers are the most interested in sustainable products. Gen Z consumers are 1.3 times more likely to want to try environmentally friendly products.

Clean Beauty Market Segment Analysis

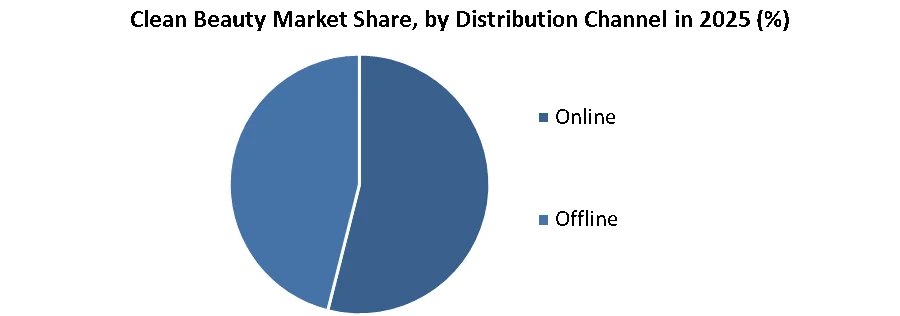

By Distribution Channel, According to SMR research, the Distribution Channel segment is divided into Online and Offline. The online segment was leading the clean beauty market, experienced significant growth owing to its convenience and accessibility. Online platforms offer a wide range of clean beauty products, allowing consumers to easily compare products, read reviews, and make informed decisions from the comfort of their homes.

This accessibility has contributed to the increasing popularity of clean beauty products, especially among younger consumers who are more tech-savvy and value convenience. Additionally, online retailers often offer promotions and discounts, further incentivizing consumers to purchase clean beauty products online. As a result, the online segment has become a key driver of market growth, with many beauty brands focusing on expanding their online presence to capitalize on this trend.

- In 2023 clean beauty had 5.7 million hashtag views on Instagram and 1.3 billion on TikTok. In 2024, it’s 6.3 million on Instagram

Clean Beauty Market Regional Analysis

The Asia Pacific region held the highest market share in 2025 and is expected to grow in forecast period (2026-2032). The major player in the global clean beauty market, with countries like Japan, South Korea, China, and India leading the way. In 2025, the market experienced significant growth owing to a growing population of conscious consumers demanding safer, more sustainable alternatives. This shift has put pressure on beauty brands to be more transparent about their ingredients and production practices, leading to a surge in demand for clean beauty products. Brand accountability is also driving the growth, as consumers demand clear, transparent labeling and assurance that their products are free from harmful chemicals. This trend is forcing brands to reevaluate their supply chains and adopt more sustainable practices.

In India, the concept of clean beauty is gaining popularity owing to the unique needs of the local market, which requires products tailored to specific skin types and hair. This presents an opportunity for local companies to innovate and develop products that cater to these specific needs. Thus, the Asia Pacific region is poised to continue its rapid growth in the clean beauty industry.

Clean Beauty Market Competitive Landscape

The clean beauty market is characterized by a competitive landscape with a mix of established players and new entrants. Key players such as The Honest Company, Beautycounter, and Tata Harper Skincare dominate the market with their range of clean and natural beauty products. These companies focus on ingredient transparency, safety, and sustainability to differentiate themselves in the market. However, the market is also witnessing the emergence of new brands and startups offering innovative clean beauty products, creating a dynamic and competitive environment. As consumer demand for clean beauty continues to grow, competition is expected to intensify, driving further innovation and market expansion.

- In January 2024, Glossier introduces the highly anticipated Full Orbit Eye Cream, featuring hydrating ingredients like polyglutamic and hyaluronic acid, niacinamide, arctic microalgae, white hawthorn, and jasmine flower extract. Available online, in stores, and at select Sephora locations, it addresses eye area concerns with 24-hour hydration, depuffing, and dark circle reduction. The launch aligns with industry trends emphasizing hydration, clean beauty, and targeted skincare.

- In January 2024, Amika launches "Stylist Collective," enlisting influencers like Eric Vaughn and Sal Salcedo to shape education initiatives for salons. Following Amika's acquisition, the expected 100% revenue growth signals a commitment to professional hair care, constituting 40% of overall revenue. The brand aims to foster loyalty and industry investment with this program.

- March 2023: Cavinkare, new brand from FMCG and personal care firm launched Truthsome. This company sells products for skin care and hair care that are "clean beauty," meaning they don't include any toxic chemicals and have the highest level of efficacy.

- In December 2023, Lumson, a leader in skincare and makeup packaging, expanded into hair care with three comprehensive collections: Slim, Verona, and Round. These turnkey solutions cater to various hair care products, aligning with the holistic trend and addressing the fusion of hair care and skincare.

- In December 2023, Northern California-based clean beauty brand Iris&Romeo expands its retail presence into Sephora with a Series A partnership backed by True Beauty Ventures. The brand emphasizes minimalist, multi-functional products, and plans to enhance retail readiness and expand its team with the new investment.

|

Clean Beauty Market Scope |

|

|

Market Size in 2025 |

USD 8.29 Bn. |

|

Market Size in 2032 |

USD 20.50 Bn. |

|

CAGR (2026-2032) |

13.8% |

|

Historic Data |

2020-2025 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2032 |

Segments |

by Product Type Hair Care Skin Care Oral Care Cosmetics others |

|

by Form Powder liquid gel |

|

|

by End User Men Women Children |

|

|

by Distribution Channel Online Offline |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key Player in the Clean Beauty

• Estée Lauder Companies Inc. (USA)

• e.l.f. Beauty, Inc. (USA)

• The Honest Company, Inc. (USA)

• LVMH (Sephora) (France)

• Natura & Co (Avon Products, Inc.) (Brazil)

• Credo Beauty (USA)

• Orveon (BareMinerals) (USA)

• Beautycounter (USA)

• Ilia Beauty (USA)

• L’Oréal (France)

• Unilever (United Kingdom/Netherlands)

• Ere Perez (Australia)

• RMS Beauty (USA)

• NakedPoppy (USA)

• INIKA (Australia)

• Avon (United Kingdom)

• Honest Beauty (USA)

• Allure (USA)

• Vapour (USA)

• BareMinerals (USA)

- XXX

Frequently Asked Questions

Consumer shift towards natural and non-toxic skincare driving the Clean Beauty market growth.

The Clean Beauty Market size was valued at USD 8.29 Billion in 2025 and the total Global Clean Beauty revenue is expected to grow at a CAGR of 13.8 % from 2026 to 2032, reaching nearly USD 20.50 Billion by 2032.

The Clean Beauty is Segmented by Product type, Form, End User, Distribution Channel and Geography.

1. Clean Beauty Market: Research Methodology

1.1. Research Data

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Assumptions

2. Clean Beauty Market: Executive Summary

2.1. Market Overview

2.2. Market Size (2025) and Forecast (2026 – 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments and Regions

3. Clean Beauty Market: Competitive Landscape

3.1. Stellar Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Business Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2025)

3.2.7. Profit Margin

3.2.8. Market Share

3.2.9. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

3.4.1. Strategic Initiatives and Developments

3.4.2. Mergers and Acquisitions

3.4.3. Collaborations and Partnerships

3.4.4. Product Launches and Innovation

4. Clean Beauty Market: Dynamics

4.1. Market Trends by Region

4.1.1. North America

4.1.2. Europe

4.1.3. Asia Pacific

4.1.4. Middle East and Africa

4.1.5. South America

4.2. Market Drivers

4.3. Market Restraints

4.4. Market Opportunities

4.5. Market Challenges

4.6. PORTER’s Five Forces Analysis

4.6.1. Intensity of the Rivalry

4.6.2. Threat of New Entrants

4.6.3. Bargaining Power of Suppliers

4.6.4. Bargaining Power of Buyers

4.6.5. Threat of Substitutes

4.7. PESTLE Analysis

4.7.1. Political Factors

4.7.2. Economic Factors

4.7.3. Social Factors

4.7.4. Technological Factors

4.7.5. Legal Factors

4.7.6. Environmental Factors

4.8. Technological Roadmap

4.9. Regulatory Landscape by Region

4.9.1. North America

4.9.2. Europe

4.9.3. Asia Pacific

4.9.4. Middle East and Africa

4.9.5. South America

5. Clean Beauty Market Size and Forecast by Segments (by Value USD Million)

5.1. Clean Beauty Market Size and Forecast, By Product Type (2025-2032)

5.1.1. Hair Care

5.1.2. Skin Care

5.1.3. Oral Care

5.1.4. Cosmetics

5.1.5. Other

5.2. Clean Beauty Market Size and Forecast, By Form (2025-2032)

5.2.1. Powder

5.2.2. Liquid

5.2.3. Gel

5.3. Clean Beauty Market Size and Forecast, By End-User (2025-2032)

5.3.1. Men

5.3.2. Women

5.3.3. Children

5.4. Clean Beauty Market Size and Forecast, By Distribution Channel (2025-2032)

5.4.1. Online

5.4.2. Offline

5.5. Clean Beauty Market Size and Forecast, by Region (2025-2032)

5.5.1. North America

5.5.2. Europe

5.5.3. Asia Pacific

5.5.4. Middle East and Africa

5.5.5. South America

6. North America Clean Beauty Market Size and Forecast (by Value USD Million)

6.1. North America Clean Beauty Market Size and Forecast, By Product Type (2025-2032)

6.1.1. Hair Care

6.1.2. Skin Care

6.1.3. Oral Care

6.1.4. Cosmetics

6.1.5. Other

6.2. North America Clean Beauty Market Size and Forecast, By Form (2025-2032)

6.2.1. Powder

6.2.2. Liquid

6.2.3. Gel

6.3. North America Clean Beauty Market Size and Forecast, By End-User (2025-2032)

6.3.1. Men

6.3.2. Women

6.3.3. Children

6.4. North America Clean Beauty Market Size and Forecast, By Distribution Channel (2025-2032)

6.4.1. Online

6.4.2. Offline

6.5. North America Clean Beauty Market Size and Forecast, by Country (2025-2032)

6.5.1. United States

6.5.2. Canada

6.5.3. Mexico

7. Europe Clean Beauty Market Size and Forecast (by Value USD Million)

7.1. Europe Clean Beauty Market Size and Forecast, By Product Type (2025-2032)

7.2. Europe Clean Beauty Market Size and Forecast, By Form (2025-2032)

7.3. Europe Clean Beauty Market Size and Forecast, By End-User (2025-2032)

7.4. Europe Clean Beauty Market Size and Forecast, By Distribution Channel (2025-2032)

7.5. Europe Clean Beauty Market Size and Forecast, by Country (2025-2032)

7.5.1. UK

7.5.2. France

7.5.3. Germany

7.5.4. Italy

7.5.5. Spain

7.5.6. Sweden

7.5.7. Austria

7.5.8. Rest of Europe

8. Asia Pacific Clean Beauty Market Size and Forecast (by Value USD Million)

8.1. Asia Pacific Clean Beauty Market Size and Forecast, By Product Type (2025-2032)

8.2. Asia Pacific Clean Beauty Market Size and Forecast, By Form (2025-2032)

8.3. Asia Pacific Clean Beauty Market Size and Forecast, By End-User (2025-2032)

8.4. Asia Pacific Clean Beauty Market Size and Forecast, By Distribution Channel (2025-2032)

8.5. Asia Pacific Clean Beauty Market Size and Forecast, by Country (2025-2032)

8.5.1. China

8.5.2. S Korea

8.5.3. Japan

8.5.4. India

8.5.5. Australia

8.5.6. Indonesia

8.5.7. Malaysia

8.5.8. Vietnam

8.5.9. Taiwan

8.5.10. Bangladesh

8.5.11. Pakistan

8.5.12. Rest of Asia Pacific

9. Middle East and Africa Clean Beauty Market Size and Forecast (by Value USD Million)

9.1. Middle East and Africa Clean Beauty Market Size and Forecast, By Product Type (2025-2032)

9.2. Middle East and Africa Clean Beauty Market Size and Forecast, By Form (2025-2032)

9.3. Middle East and Africa Clean Beauty Market Size and Forecast, By End-User (2025-2032)

9.4. Middle East and Africa Clean Beauty Market Size and Forecast, By Distribution Channel (2025-2032)

9.5. Middle East and Africa Clean Beauty Market Size and Forecast, by Country (2025-2032)

9.5.1. South Africa

9.5.2. GCC

9.5.3. Egypt

9.5.4. Nigeria

9.5.5. Rest of ME&A

10. South America Clean Beauty Market Size and Forecast (by Value USD Million)

10.1. South America Clean Beauty Market Size and Forecast, By Product Type (2025-2032)

10.2. South America Clean Beauty Market Size and Forecast, By Form (2025-2032)

10.3. South America Clean Beauty Market Size and Forecast, By End-User (2025-2032)

10.4. South America Clean Beauty Market Size and Forecast, By Distribution Channel (2025-2032)

10.5. South America Clean Beauty Market Size and Forecast, by Country (2025-2032)

10.5.1. Brazil

10.5.2. Argentina

10.5.3. Rest of South America

11. Company Profile: Key players

11.1. Estée Lauder Companies Inc. (USA)

11.1.1. Company Overview

11.1.2. Business Portfolio

11.1.3. Financial Overview

11.1.3.1. Total Revenue

11.1.3.2. Segment Revenue

11.1.3.3. Regional Revenue

11.1.4. SWOT Analysis

11.1.5. Strategic Analysis

11.1.6. Recent Developments

11.2. e.l.f. Beauty, Inc. (USA)

11.3. The Honest Company, Inc. (USA)

11.4. LVMH (Sephora) (France)

11.5. Natura & Co (Avon Products, Inc.) (Brazil)

11.6. Credo Beauty (USA)

11.7. Orveon (BareMinerals) (USA)

11.8. Beautycounter (USA)

11.9. Ilia Beauty (USA)

11.10. L’Oréal (France)

11.11. Unilever (United Kingdom/Netherlands)

11.12. Ere Perez (Australia)

11.13. RMS Beauty (USA)

11.14. NakedPoppy (USA)

11.15. INIKA (Australia)

11.16. Avon (United Kingdom)

11.17. Honest Beauty (USA)

11.18. Allure (USA)

11.19. Vapour (USA)

11.20. BareMinerals (USA)

11.21. XXX

12. Key Findings

13. Industry Recommendations

13.1. Strategic Recommendations

13.2. Future Outlook