Home Organisation Products Market - Global Industry Analysis and Forecast (2025-2032)

The Home Organisation Products Market size was valued at USD 13.69 Bn. in 2024 and the total Global Home Organisation Products revenue is expected to grow at a CAGR of 4.3% from 2025 to 2032, reaching nearly USD 19.17 Bn. by 2032.

Format : PDF | Report ID : SMR_1838

Home Organisation Products Market Overview

Home organization products encompass a diverse range of items designed to streamline and optimize the arrangement and storage of belongings within a household. These products include storage bins and baskets, modular or fixed shelving systems, closet organizers with shelves, drawers, and accessories, as well as drawer organizers.

- According to SMR analysis, the top five items that people misplace in their homes regularly are shoes, keys, TV remotes, phones, and glasses. This is mainly due to clutter and disorganization in the home.

The report provides an analysis of the Home Organisation Products market, both in the past and present, as well as future estimates. The research objective of the home organization products market is to analyze and assess market trends, consumer preferences, and purchasing behaviors across different regions within the market. Additionally, the study aims to identify key drivers, challenges, and opportunities for growth in the market.

The report is divided into various segments to provide a detailed analysis of the market from every possible aspect. The market report lists the major players involved in the Home Organization Products Market under the competitive landscape and company profile chapters. The major players in the market are evaluated based on their product and/or service offerings, financial statements, key developments, strategic approach to the market, position in the market, geographical penetration, and other key features.

The report also includes an analysis of both quantitative and qualitative data, with a forecast period extending from 2025 to 2032. The market estimates are based on a comprehensive research methodology that includes primary research, secondary research, and expert advice. The report takes into account current market dynamics, economic, social, and political factors, as well as regulations, government spending, and research and development growth. Positive and negative changes to the market are also considered.

To get more Insights: Request Free Sample Report

Home Organisation Products Market Dynamics

Urbanization and Technological Innovation Drive Growth

Urbanization has led to decrease in the available living spaces, leading to the rise in demand for an effective cost of production and profit margin growth in designing home organisation materials. The shifting consumer preferences to seek innovative solutions to enhance the limited spaces positively impacts the revenue of the home organisation industry driving the market growth. The shift towards smaller living spaces is creating the need for home organisation products that help organise and declutter homes and convincing consumers to adopt minimalist belongings. The growth of home organisation products is marked in the regions such as North America and parts of Asia, where urbanisation has been most prominent and has led to the increase in home organisation products revenue.

The sales performance in the home organisation products market has observed growth as consumer preferences are shifting towards multifunctional home organisation solutions that cater to various needs such as storage, space-saving, wall mounting, and modular systems which offer both functionality and aesthetics. Additionally, the innovation in technology trends plays an important role in developing products that flawlessly get incorporated with smart home systems, offering the consumers improved control and convenience driving the growth of the home organisation products market. For instance, home organization products with built-in charging stations and smart storage solutions cater to tech-savvy consumers who desire efficiency and connectivity in their living spaces.

The growth in online retail trends as customers shift towards e-commerce platforms for their shopping needs opens up new avenues for the key players to reach wider audiences and boost sales. Additionally, offerings that prioritize durability and adaptability are tailored to the needs of consumers seeking long-term investments in their homes further fueling the home organisation products market growth.

- According to SMR; approximately one-third of India's total population resides in urban areas. Over the past decade, there has been a notable rise in urbanization, with a nearly 4% increase indicating a significant shift of people from rural regions to cities in search of employment opportunities and a better livelihood.

Fluctuation in Raw Material Prices

The volatility in the availability of raw materials impacts the cost of manufacturing, and the ability to maintain stable pricing and profit margins. Fluctuations in the raw material costs such as wood, plastic, metal, etc. also influence the pricing strategy. The management of these fluctuations depends on market concentration with leading companies being better equipped to bear the cost changes. The new entrants face challenges as it is difficult to maintain competitive pricing and quality leading to market barriers to entry and hindering innovation.

The different trade policies across the regions and countries due to tariffs, import duties, and export restrictions influence raw material pricing and availability. Also, countries that rely heavily on imported raw materials face higher production costs, while those with abundant resources experience less impact leading to higher product prices for consumers and potential shifts in demand. Fluctuating raw material prices are a significant restraint for the global home organization products market. The challenges posed by market concentration, market consolidation, and variations in trade policy further compound the issue, contributing to an uncertain market environment.

Home Organisation Products Market Segment Analysis

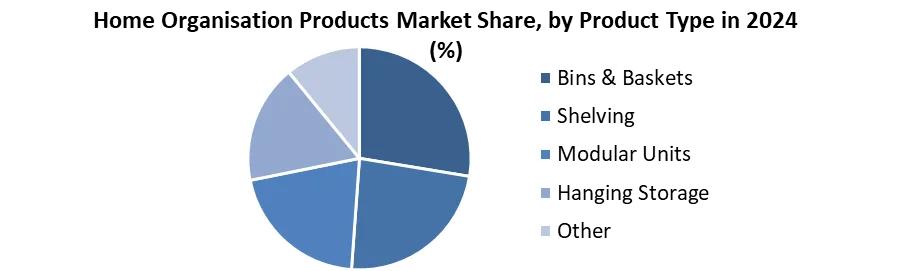

By Product Type, According to SMR research, the bins & basket segment held the largest market share in the global home organisation products market in 2024. Consumers are increasingly choosing the Bins & Baskets category to organize their homes efficiently, which aligns with present-day preferences for minimalism and a clutter-free lifestyle. Companies are expanding their product ranges to include different styles, materials, and sizes, catering to diverse needs and tastes, as market penetration strategies are focused on the segment further fuelling the home-organized products market growth.

Brands position bins and baskets as storage solutions that blend seamlessly with modern interior designs while still being practical. Additionally, brand loyalty is a crucial aspect of the segment as consumers stick to brands that offer high-quality, durable, and stylish products. As lifestyles become busier and homes become smaller, efficient storage solutions become increasingly vital. Aftermarket distribution channels such as online platforms and specialty stores play a vital role in making these products accessible to consumers across different regions.

Companies in the bins and basket segment are constantly innovating to stay competitive, by launching new products that align with emerging trends and consumer demands. For example, multi-functional bins and baskets that serve as both decorative items and collapsible storage options are gaining traction. The Bins & Baskets segment holds a dominant position in the global home-organized products market, thanks to its alignment with consumer insights and customer preferences for stylish and efficient storage solutions. As market dynamics continue to evolve, the segment remains poised for continued growth and innovation.

Home Organisation Products Market Regional Analysis

North America held the dominant position in the global home organisation products market in 2024. The strong purchasing power of consumers, particularly in the United States, drives market growth. The consumer base in the US favors innovative and high-quality products influenced by increasing trends toward home improvement and organisation. The trade policies in the region encourage continuous import/export of goods, which enables the steady flow of international products further driving the home organisation products market. Additionally, the consumer preference for sustainable and eco-friendly products aligns with the environment-conscious consumerism. Also, the rising manufacturing sector in Mexico offers opportunities for international trade in home organisation products.

The major cities in North America including New York, Los Angeles, and Toronto are the top-selling regions owing to the dense population and need for efficient living arrangements. Also, the trade relations of North America with Asian and European markets facilitate the import of a wide range of products further increasing the home organisation products market demand globally. The region’s dominance is further solidified by its well-established e-commerce infrastructure as the online platforms provide an extensive selection of products that cater to the diverse needs and preferences of consumers.

- According to SMR Analysis, the United States e-commerce market is expected to reach from USD 669.5 billion in 2023 to USD 1145.7 billion by 2029.

Home Organisation Products Market Competitive Landscape

The home organization products market's competitive landscape provides insights into each competitor's profile, including company overview, financials, global presence, production sites, product offerings, and more. This helps stakeholders evaluate the market's competitive dynamics and make informed decisions. The major key players include Rubbermaid (USA), GarageTek Inc (New York), Home Products International (Chicago), ClosetMaid (United States), Organized Living (Ohio), and Whitmor (New York) among others.

- In 2023, NWL Rubbermaid, a brand owned by Newell Brands Inc., introduced a new food storage container called EasyFindLids. These are BPA-free, microwave, and freezer-safe.

- In 2023, Houzz Inc. announced the release of Room Planner for Houzz Pro, an all-in-one business management and marketing software for interior designers and remodelers. The Room Planner provides designers with a highly visual, collaborative workspace where they can create, discuss, and share different design concepts both internally with their team and externally with clients.

- In 2023, Mensa announced the launch of its home decor label, Folkulture, in the Indian market. Following Mensa Brands' acquisition of Folkulture in 2021, aimed at bolstering its presence in the furniture segment, the brand is expanding its reach to the Indian market.

- In February 2023, Brabantia and Curve Distribution Services announced today that they have formed a valuable distribution agreement in which Curve will offer Brabantia's household product line to the Canadian market.

- In 2022, The Container Store, a specialist retailer of storage and organization products as well as bespoke closets, announced the acquisition of Closet Works, a Chicago-based home storage and closet organization firm, for USD 21.5 million.

- In 2022, Masterclass Kitchens, a kitchen designer, partnered with Now Kitchens. This collaboration sought to improve Masterclass Kitchens' sales by including Masterclass Kitchens' products in Now Kitchens' product portfolio.

|

Home Organisation Products Market Scope |

|

|

Market Size in 2024 |

USD 13.69 Bn. |

|

Market Size in 2032 |

USD 19.17 Bn. |

|

CAGR (2025-2032) |

4.3% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

Segments |

By Material TypeMetal & WirePlasticWoodOther |

|

By Product Type Bins & Baskets Shelving Modular Units Hanging Storage Other |

|

|

By Application Bedrooms Living & Family Rooms Kitchens Utility Rooms Others |

|

|

By End-User Do-it-yourself Professional Installation |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key Player in the Home Organisation Products Market

- Rubbermaid (USA)

- GarageTek Inc (New York)

- Home Products International (Chicago)

- ClosetMaid (United States)

- Organized Living (Ohio)

- Whitmor (New York)

- Iris USA, Inc. (USA)

- Sterilite Corporation (USA)

- Akro-Mils (USA)

- Myers Industries, Inc. (USA)

- Häfele (Germany)

- Whirlpool Corporation (USA)

- Masco Corporation (USA)

- ORG Home (The Stow Company) (Holland)

- Inter IKEA Systems B.V. (Netherlands)

- Houzz Inc. (California)

- Lowe's (North Carolina)

- Wayfair LLC (USA)

- Target Brands, Inc. (USA)

- Staples Inc. (USA)

- storeWALL (USA)

- XX

Frequently Asked Questions

Growing Urbanisation and smaller living spaces, changing lifestyles, and growing awareness of organisation benefits are the drivers of the Home Organisation Products market.

Investors capitalize on the home organization market by targeting companies developing space-saving, customizable solutions focused on the home improvement sector.

The Market size was valued at USD 13.69 billion in 2024 and the total Market revenue is expected to grow at a CAGR of 4.3% from 2025 to 2032, reaching nearly USD 19.17 billion.

The segments covered in the market report are material type, product type, application, end-user, and region.

1. Home Organisation Products Market: Research Methodology

1.1. Research Data

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Assumptions

2. Home Organisation Products Market: Executive Summary

2.1. Market Overview

2.2. Market Size (2024) and Forecast (2025– 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments and Regions

3. Home Organisation Products Market: Competitive Landscape

3.1. Stellar Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Product Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2024)

3.2.7. Profit Margin

3.2.8. Market Share

3.2.9. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

3.4.1. Strategic Initiatives and Developments

3.4.2. Mergers and Acquisitions

3.4.3. Collaborations and Partnerships

3.4.4. Product Launches and Innovation

4. Home Organisation Products Market: Dynamics

4.1. Market Trends by Region

4.1.1. North America

4.1.2. Europe

4.1.3. Asia Pacific

4.1.4. Middle East and Africa

4.1.5. South America

4.2. Market Drivers

4.3. Market Restraints

4.4. Market Opportunities

4.5. Market Challenges

4.6. PORTER’s Five Forces Analysis

4.6.1. Intensity of the Rivalry

4.6.2. Threat of New Entrants

4.6.3. Bargaining Power of Suppliers

4.6.4. Bargaining Power of Buyers

4.6.5. Threat of Substitutes

4.7. PESTLE Analysis

4.7.1. Political Factors

4.7.2. Economic Factors

4.7.3. Social Factors

4.7.4. Technological Factors

4.7.5. Legal Factors

4.7.6. Environmental Factors

4.8. Technological Roadmap

4.9. Value Chain Analysis

4.10. Regulatory Landscape by Region

4.10.1. North America

4.10.2. Europe

4.10.3. Asia Pacific

4.10.4. Middle East and Africa

4.10.5. South America

5. Home Organisation Products Market Size and Forecast by Segments (by Value USD Million)

5.1. Home Organisation Products Market Size and Forecast, By Material Type (2024-2032)

5.1.1. Metal & Wire

5.1.2. Plastic

5.1.3. Wood

5.1.4. Other

5.2. Home Organisation Products Market Size and Forecast, By Product Type (2024-2032)

5.2.1. Bins & Baskets

5.2.2. Shelving

5.2.3. Modular Units

5.2.4. Hanging Storage

5.2.5. Other

5.3. Home Organisation Products Market Size and Forecast, By Application (2024-2032)

5.3.1. Bedrooms

5.3.2. Living & Family Rooms

5.3.3. Kitchens

5.3.4. Utility Rooms

5.3.5. Others

5.4. Home Organisation Products Market Size and Forecast, By End-User (2024-2032)

5.4.1. Do-It-Yourself

5.4.2. Professional Installation

5.5. Home Organisation Products Market Size and Forecast, by Region (2024-2032)

5.5.1. North America

5.5.2. Europe

5.5.3. Asia Pacific

5.5.4. Middle East and Africa

5.5.5. South America

6. North America Home Organisation Products Market Size and Forecast (by Value USD Million)

6.1. North America Home Organisation Products Market Size and Forecast, By Material Type (2024-2032)

6.1.1. Metal & Wire

6.1.2. Plastic

6.1.3. Wood

6.1.4. Other

6.2. North America Home Organisation Products Market Size and Forecast, By Product Type (2024-2032)

6.2.1. Bins & Baskets

6.2.2. Shelving

6.2.3. Modular Units

6.2.4. Hanging Storage

6.2.5. Other

6.3. North America Home Organisation Products Market Size and Forecast, By Application (2024-2032)

6.3.1. Bedrooms

6.3.2. Living & Family Rooms

6.3.3. Kitchens

6.3.4. Utility Rooms

6.3.5. Others

6.4. North America Home Organisation Products Market Size and Forecast, By End-User (2024-2032)

6.4.1. Do-It-Yourself

6.4.2. Professional Installation

6.5. North America Home Organisation Products Market Size and Forecast, by Country (2024-2032)

6.5.1. United States

6.5.2. Canada

6.5.3. Mexico

7. Europe Home Organisation Products Market Size and Forecast (by Value USD Million)

7.1. Europe Home Organisation Products Market Size and Forecast, By Material Type (2024-2032)

7.2. Europe Home Organisation Products Market Size and Forecast, By Product Type (2024-2032)

7.3. Europe Home Organisation Products Market Size and Forecast, By Application (2024-2032)

7.4. Europe Home Organisation Products Market Size and Forecast, By End-User (2024-2032)

7.5. Europe Home Organisation Products Market Size and Forecast, by Country (2024-2032)

7.5.1. UK

7.5.2. France

7.5.3. Germany

7.5.4. Italy

7.5.5. Spain

7.5.6. Sweden

7.5.7. Austria

7.5.8. Rest of Europe

8. Asia Pacific Home Organisation Products Market Size and Forecast (by Value USD Million)

8.1. Asia Pacific Home Organisation Products Market Size and Forecast, By Material Type (2024-2032)

8.2. Asia Pacific Home Organisation Products Market Size and Forecast, By Product Type (2024-2032)

8.3. Asia Pacific Home Organisation Products Market Size and Forecast, By Application (2024-2032)

8.4. Asia Pacific Home Organisation Products Market Size and Forecast, By End-User (2024-2032)

8.5. Asia Pacific Home Organisation Products Market Size and Forecast, by Country (2024-2032)

8.5.1. China

8.5.2. S Korea

8.5.3. Japan

8.5.4. India

8.5.5. Australia

8.5.6. Indonesia

8.5.7. Malaysia

8.5.8. Vietnam

8.5.9. Taiwan

8.5.10. Bangladesh

8.5.11. Pakistan

8.5.12. Rest of Asia Pacific

9. Middle East and Africa Home Organisation Products Market Size and Forecast (by Value USD Million)

9.1. Middle East and Africa Home Organisation Products Market Size and Forecast, By Material Type (2024-2032)

9.2. Middle East and Africa Home Organisation Products Market Size and Forecast, By Product Type (2024-2032)

9.3. Middle East and Africa Home Organisation Products Market Size and Forecast, By Application (2024-2032)

9.4. Middle East and Africa Home Organisation Products Market Size and Forecast, By End-User (2024-2032)

9.5. Middle East and Africa Home Organisation Products Market Size and Forecast, by Country (2024-2032)

9.5.1. South Africa

9.5.2. GCC

9.5.3. Egypt

9.5.4. Nigeria

9.5.5. Rest of ME&A

10. South America Home Organisation Products Market Size and Forecast (by Value USD Million)

10.1. South America Home Organisation Products Market Size and Forecast, By Material Type (2024-2032)

10.2. South America Home Organisation Products Market Size and Forecast, By Product Type (2024-2032)

10.3. South America Home Organisation Products Market Size and Forecast, By Application (2024-2032)

10.4. South America Home Organisation Products Market Size and Forecast, By End-User (2024-2032)

10.5. South America Home Organisation Products Market Size and Forecast, by Country (2024-2032)

10.5.1. Brazil

10.5.2. Argentina

10.5.3. Rest of South America

11. Company Profile: Key players

11.1. Rubbermaid (USA)

11.1.1. Company Overview

11.1.2. Product Portfolio

11.1.2.1. Product Name

11.1.2.2. Product Details (Price, Features, etc.)

11.1.3. Financial Overview

11.1.3.1. Total Revenue

11.1.3.2. Segment Revenue

11.1.3.3. Regional Revenue

11.1.4. SWOT Analysis

11.1.5. Strategic Analysis

11.1.6. Recent Developments

11.2. GarageTek Inc (New York)

11.3. Home Products International (Chicago)

11.4. ClosetMaid (United States)

11.5. Organized Living (Ohio)

11.6. Whitmor (New York)

11.7. Iris USA, Inc. (USA)

11.8. Sterilite Corporation (USA)

11.9. Akro-Mils (USA)

11.10. Myers Industries, Inc. (USA)

11.11. Häfele (Germany)

11.12. Whirlpool Corporation (USA)

11.13. Masco Corporation (USA)

11.14. ORG Home (The Stow Company) (Holland)

11.15. Inter IKEA Systems B.V. (Netherlands)

11.16. Houzz Inc. (California)

11.17. Lowe's (North Carolina)

11.18. Wayfair LLC (USA)

11.19. Target Brands, Inc. (USA)

11.20. Staples Inc. (USA)

11.21. storeWALL (USA)

11.22. XX

12. Key Findings

13. Industry Recommendations

13.1. Strategic Recommendations

13.2. Future Outlook