Malaysia Automotive Engine Oil Market Industry Overview, Size, Share, Growth Trends, Research Insights and Forecast (2025–2032)

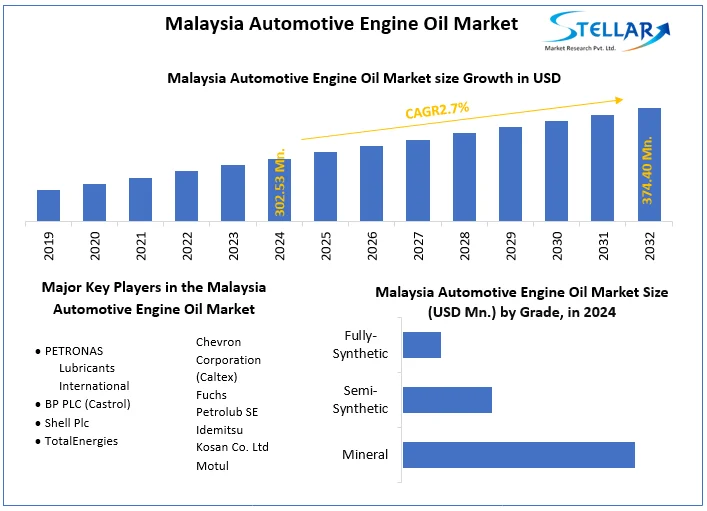

The Malaysia Automotive Engine Oil Market size was valued at 302.53 Mn. Liters in 2024 and the total Malaysia Automotive Engine Oil revenue is expected to grow at a CAGR of 2.7% from 2024 to 2032, reaching nearly 374.40 Mn. Liters in 2032.

Format : PDF | Report ID : SMR_1636

Malaysia Automotive Engine Oil Market Overview

In the complex fabric of Malaysia’s automotive industry, the report serves as a guiding beacon, offering a comprehensive overview of the Automotive Engine Oil Market. Embarking on a journey through the heart of the automotive engine oil sector, the first section provides a panoramic snapshot of the market's current state, navigating through key trends, market dynamics, and elucidating the critical role engine oils play in ensuring optimal performance and longevity of vehicles. Delving into the historical evolution of the Malaysia Automotive Engine Oil Market, the subsequent subsection scrutinizes the growth factors that have sculpted its trajectory. From technological advancements to shifts in consumer preferences, understanding the market's evolutionary path sets the stage for a nuanced exploration of its current landscape.

With clarity of purpose, the final segment outlines the report's mission, delineating specific objectives and the extent of its coverage. Whether unravelling market trends or deciphering the impact of regulatory landscapes, the report sets out to provide a comprehensive analysis that goes beyond the surface, offering stakeholders a strategic understanding of the Malaysia Automotive Engine Oil Industry. The report offers an all-encompassing view of the Malaysia automotive engine oil market, encapsulating its current landscape and future projections. The report offers a holistic view of the Malaysia Automotive Engine Oil market in 2024.

- Malaysia's GDP is expected to grow by 4-5% in 2024, indicating rising disposable income and potential for increased vehicle purchases

- Petronas Lubricants invested USD 120 million in R&D in 2022

- Shell and Hyundai signed a collaboration for co-branded lubricants in Southeast Asia

To get more Insights: Request Free Sample Report

Malaysia Automotive Engine Oil Market Dynamics:

Malaysia's Automotive Engine Oil Market Accelerates with Surging Vehicle Ownership

In the dynamic landscape of Malaysia's automotive industry, the surge in vehicle ownership emerges as a pivotal force driving the Automotive Engine Oil Market to new heights. As the Malaysian population experiences increasing wealth, more consumers are entering the automobile market, contributing significantly to the country's growing fleet of vehicles. The uptick in vehicle ownership is instrumental in shaping the demand for automotive engine oils, with consumers recognizing the critical role of quality lubricants in maintaining optimal engine performance. The market responds dynamically to the trend, with oil manufacturers and service providers adapting their strategies to cater to the diverse engine oil needs arising from an increasing vehicle ownership landscape. The paradigm shift underscores the integral relationship between the automotive and engine oil sectors, setting the stage for innovative products and tailored solutions to meet the evolving demands of Malaysian vehicle owners.

- As of December 2023, there were approximately 40.2 million registered vehicles in Malaysia, according to the Stellar analysis

- In 2023, Malaysia saw approximately 612,000 new vehicle sales, representing a 32% increase compared to 2022

Malaysia's Automotive Engine Oil Market Driven by Vehicle Technological Advancements

In the fast-paced world of Malaysia's automotive industry, the force of technological advancements in vehicles is reshaping the landscape of the Automotive Engine Oil Market. As vehicles become more sophisticated with cutting-edge engine technologies, a remarkable opportunity unfolds for engine oil manufacturers to innovate and cater to these evolving automotive demands. The surge in high-performance engines, turbocharging, and hybrid and electric vehicles necessitates specialized engine oils designed to meet the unique requirements of these advanced systems. The market responds dynamically to the trend, with a wave of innovative lubricants formulated to enhance engine efficiency, reduce friction, and ensure optimal performance in the face of emerging technologies. The intersection of automotive ingenuity and lubrication innovation not only drives the Malaysian automotive sector forward but positions the Automotive Engine Oil Market at the forefront of progress, ready to meet the challenges and seize the opportunities presented by the ever-evolving vehicle technological landscape.

- Market for low-friction oils expected to grow at 4.5% CAGR between 2023-2030

- Estimated 10% of heavy-duty vehicles to use DPFs by 2025, requiring specialized oils.

Malaysia Automotive Engine Oil Market Segment Analysis:

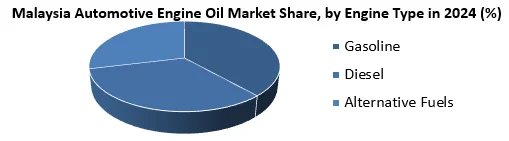

Based on Engine Type, the Gasoline segment held the largest market share of more than 75% and dominated the Malaysia Automotive Engine Oil industry in 2024. The segment is further expected to grow at a CAGR of 2.9% and maintain its dominance during the forecast period. The rising demand is driven by factors such as the increasing widespread prevalence of gasoline-powered vehicles in the country techniques have been expected to be the major factor driving the segment growth. Despite the decline, the high number of gasoline vehicles on the road ensures a stable demand for gasoline engine oil in the forecast period.

- The decline is expected due to the growing popularity of hybrids and electric vehicles.

Besides that, the Diesel segment is expected to grow at a rapid CAGR and offer lucrative growth opportunities for Malaysia Automotive Engine Oil manufacturers all across Malaysia during the forecast period. The rising demand is increasing thanks to continued use of diesel in commercial vehicles like trucks and buses for their power and torque advantages. The infrastructure development projects requiring heavy machinery reliant on diesel engines, growth in specific sectors like agriculture and construction, where diesel engines remain prevalent are expected to be the major factors driving the segment growth.

- Diesel engine oil tends to be slightly more expensive than gasoline oil due to its specific performance requirements for higher pressure and heat resistance.

- Annual Consumption is approximately 57 million liters in 2023.

The major key players in the Malaysia Automotive Engine Oil Market are TotalEnergies , Chevron Corporation (Caltex) , Fuchs Petrolub SE, and Idemitsu Kosan Co. Ltd. Thus, increasing demand for the Malaysia Automotive Engine Oil Market supports the segment growth.

Malaysia Automotive Engine Oil Market Scope:

|

Malaysia Automotive Engine Oil Market |

|

|

Market Size in 2024 |

302.53 Million Liters |

|

Market Size in 2032 |

374.40 Million Liters |

|

CAGR (2025-2032) |

2.7 % |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

By Grade

|

|

By Engine Type

|

|

|

By Vehicle Type

|

|

Malaysia Automotive Engine Oil Market Key Players:

- PETRONAS Lubricants International

- BP PLC (Castrol)

- Shell Plc

- TotalEnergies

- Chevron Corporation (Caltex)

- Fuchs Petrolub SE

- Idemitsu Kosan Co. Ltd

- Motul

Frequently Asked Questions

The segments covered in the Malaysia Automotive Engine Oil Market report are grade, engine, and vehicle type.

Factors such as the large and stable vehicle fleet, technological advancements, growing light commercial vehicle demand, and shifting preferences are driving the growth of the Automotive Engine Oil market in Malaysia.

1. Malaysia Automotive Engine Oil Market: Research Methodology

1.1. Research Data

1.1.1. Secondary Data

1.1.2. Primary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market breakdown and Data Triangulation

1.4. Assumptions

2. Malaysia Automotive Engine Oil Market: Executive Summary

2.1. Market Overview

2.2. Market Size (2024) and Forecast (2025 - 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments

3. Malaysia Automotive Engine Oil Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Competitive Landscape

3.3. Key Players Benchmarking

3.3.1. Company Name

3.3.2. Headquarter

3.3.3. Product Segment

3.3.4. Total Production (2024)

3.3.5. End-User Segment

3.3.6. Y-O-Y%

3.3.7. Revenue (2024)

3.3.8. Profit Margin

3.3.9. Market Share

3.3.10. Company Locations

3.4. Market Structure

3.4.1. Market Leaders

3.4.2. Market Followers

3.4.3. Emerging Players

3.5. Consolidation of the Market

3.5.1. Strategic Initiatives and Developments

3.5.2. Mergers and Acquisitions

3.5.3. Collaboration and Partnerships

3.5.4. Product Launches and Innovations

4. Malaysia Automotive Engine Oil Market: Dynamics

4.1. Market Trends

4.2. Market Drivers

4.3. Market Restraints

4.4. Market Opportunities

4.5. Market Challenges

4.6. PORTER’s Five Forces Analysis

4.6.1. Intensity of the Rivalry

4.6.2. Threat of New Entrants

4.6.3. Bargaining Power of Suppliers

4.6.4. Bargaining Power of Buyers

4.6.5. Threat of Substitutes

4.7. PESTLE Analysis

4.7.1. Political Factors

4.7.2. Economic Factors

4.7.3. Social Factors

4.7.4. Technological Factors

4.7.5. Legal Factors

4.7.6. Environmental Factors

4.8. Technological Roadmap

4.9. Value Chain Analysis

4.10. Regulatory Landscape

5. Malaysia Automotive Engine Oil Market Size and Forecast by Segments (by Value USD Million and Volume in Tonnes)

5.1. Malaysia Automotive Engine Oil Market Size and Forecast, By Grade (2024-2032)

5.1.1. Mineral

5.1.2. Semi-Synthetic

5.1.3. Fully-Synthetic

5.2. Malaysia Automotive Engine Oil Market Size and Forecast, By Engine Type (2024-2032)

5.2.1. Gasoline

5.2.2. Diesel

5.2.3. Alternative Fuels

5.3. Malaysia Automotive Engine Oil Market Size and Forecast, By Vehicle Type (2024-2032)

5.3.1. Passenger Cars

5.3.2. Motorcycle

5.3.3. Light Commercial Vehicles

5.3.4. Heavy-Duty Vehicles

6. Company Profile: Key players

6.1. PETRONAS Lubricants International

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.3. Financial Overview

6.1.3.1. Total Revenue

6.1.3.2. Segment Revenue

6.1.4. SWOT Analysis

6.1.5. Business Strategy

6.1.6. Recent Developments

6.2. BP PLC (Castrol)

6.3. Shell Plc

6.4. TotalEnergies

6.5. Chevron Corporation (Caltex)

6.6. Fuchs Petrolub SE

6.7. Idemitsu Kosan Co. Ltd

6.8. Motul

7. Key Findings

8. Industry Recommendations

8.1. Strategic Recommendations

8.2. Future Outlook