Middle East and Africa Dry Mix Mortar Market Industry Overview, Size, Share, Growth Trends, Research Insights and Forecast (2025–2032)

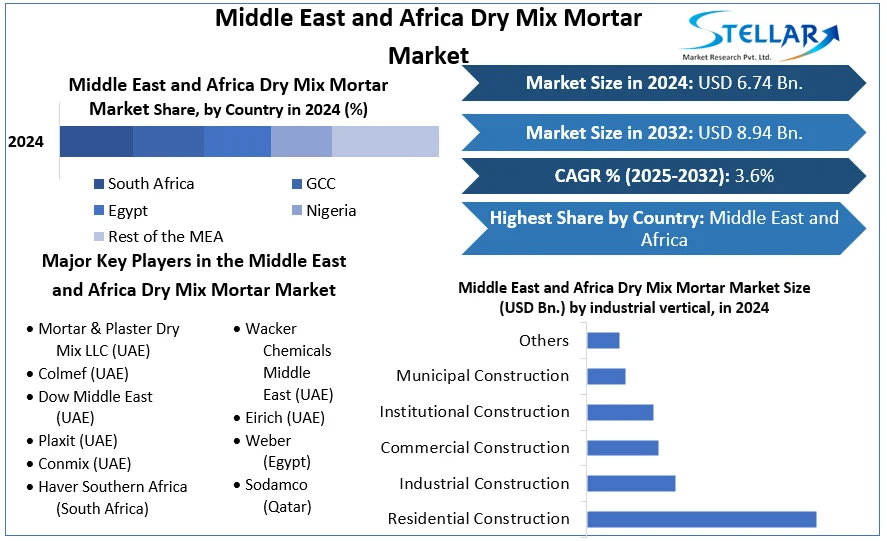

Middle East and Africa Dry Mix Mortar Market size was valued at US$ 6.74 Bn. in 2024 and the total revenue is expected to grow at 3.6 % through 2025 to 2032, reaching nearly US$ 8.94 Bn. by 2032.

Format : PDF | Report ID : SMR_1294

Middle East and Africa Dry Mix Mortar Market Definition:

Middle East and Africa Dry Mix Mortar Market is projected to grow during the forecast period at a significant rate owing to the focus of the constituent countries on building a strong industrial hub for the world and shifting focus from traditional commodity trade businesses the countries operate in. Most large economies across the world have set their sights on the African construction industry which is one of the major drivers of Dry Mix Mortar Market in the Middle East and Africa region. This is due to advantages such as the availability of vast natural resources, significant investment opportunities in energy and infrastructure, low labour costs, and a rapidly rising consumer market. There is also a positive business climate, with favourable economic development policies and growing commodity prices, as well as continuous success in the battle against corruption and the adoption of democratic regimes.

Middle East and Africa Dry Mix Mortar market is driven by the policies of gulf nations as well for instance, Saudi Arabia has chalked out an ambitious plan to rebrand itself as a popular tourist and real estate hub. It is the largest economy in the guld region and has begun to ramp up tendering on its Public Investment Fund (PIF) Giga projects programme, particularly on the Neom, Red Sea, Diriyah Gate, and Qiddiya developments. As per market projections, USD 500 billion development fund is expected to enter full-scale construction, more than a dozen large contract packages have already been released on Neom alone since June 2021.

To get more Insights: Request Free Sample Report

Middle East and Africa Dry Mix Mortar Market Dynamics:

The Dry Mix Mortar Market is projected to be driven by the increase in the construction activities in the commercial and industrial construction sectors of the constituent countries. Saudi Arabia leads with US$80.4 billion in projects, followed by Oman with US$50.9 billion in projects. Saudi Arabia, Oman, Iran, Nigeria, South Africa, the UAE, Guinea, Algeria, Egypt, and Tanzania are the top 10 countries in terms of project value. The Saudi’s CIC's (Centre for International Communication) highest-value project in the region is Saudi Arabia's US$25.0 billion Ras Al Khair Minerals Industrial City, followed by Guinea's US$20.0 billion Simandou Iron Ore Mine Development.

In addition, Roshn, a Saudi Arabian developer, has been awarded the first phase of the massive Al-Arous housing project in Jeddah, which is part of the Kingdom's Vision 2030 megaprojects programme. The whole project valuation is worth US$462.8 billion, with US$28.4 billion invested in 2019 and US$21.8 billion spent in 2021. The National Authority for Tunnels (NAT) is in the process of negotiating the final civil works package (CP 402) for the first phase of Cairo Metro Line 4, and the project's contract could be finalised in March. NAT is also prepared to put out tenders for work on its proposed 45.2-kilometer Alexandria metro network, as well as hold talks on additional packages for its 1,800-kilometer high-speed electrified rail network. Both tenders are expected to move forward in 2022.

In Dubai, post-pandemic real estate development is being driven by residential constructions. For its Peninsula One tower, Select Group has granted China State Construction Engineering Corporation Middle East an AED629 million (US$171.2 million) contract. Nakheel also recently picked ASGC as the local contractor for the Murooj al-Furjan project, which includes 418 units. Shapoorji Pallonji group which is based in India, was recently chosen by Saudi Entertainment Ventures (Seven) for their Exit 10 entertainment complex in Riyadh. In 2022, Seven's active tenders for projects in Jeddah, Obhur, Mecca, Medina, Tabuk, and Yanbu are expected to move forward. Riyadh is also scheduled to name a contractor for the Royal Art Complex at King Salman Park, which is expected to cost around SR7.5 billion (US$ 1.9 billion) and be completed by the end of this year. Projects which are in the implementation stage have a total value of US$201.7 billion, followed by projects in planning, which have a total value of US$116.5 billion. The value of projects in the pre-planning stage is $72.5 billion, while those in the pre-execution stage is $72.1 billion.

Middle East and Africa Dry Mix Mortar Market Segment Analysis:

On the basis of Industry Vertical, the Middle East and Africa Dry Mix Mortar Market is projected to be dominated by industrial construction during the forecast period. This is due to the increasing focus of the GCC (Gulf Cooperation Council) countries like United Arab Emirates, Saudi Arabia, Qatar, Kuwait, Bahrain, Oman to move from oil-based economies to become industrial hub of the world. Dry Mix Mortar Market is projected to benefit from the governmental policies of the respective governments to increase industrial infrastructure potential. As one of the advantages of Dry Mix Mortar product is the reduction in the time of external finishing of the civil structures, this helps in reduction of project lead times which is beneficial to the project stake holders that are looking to complete the construction activities in most optimum time duration in order to yield high output from the project investment.

The Middle East and Africa (MEA) region encompasses the Middle East's oil-rich GCC countries as well as Sub-Saharan Africa's growing commodity-rich countries. Saudi Arabia is looking to diversify and shift from an oil-based economy, this has been mentioned in reports from GCC council as well, Saudi Arabia is investing in industrial production facilities, as outlined in the National Transformation Program (NTP) and Saudi Vision 2030. All the aforementioned activities will heavily rely on quick construction pace and delivery of infrastructure projects which will be driven by the high growth rate of Dry Mix Mortar Market. Special economic zones are being created in new cities in order to attract foreign investment. The International Monetary Fund (IMF) had projected that sub-Saharan Africa's economic growth would accelerate from 2.9 percent in 2018 to 3.5 percent in 2019, and 3.6 percent in 2020. This trend of growth has been followed and is expected to continue during the forecast period. All the countries in the Sub-Sahara region are projected to witness significant growth

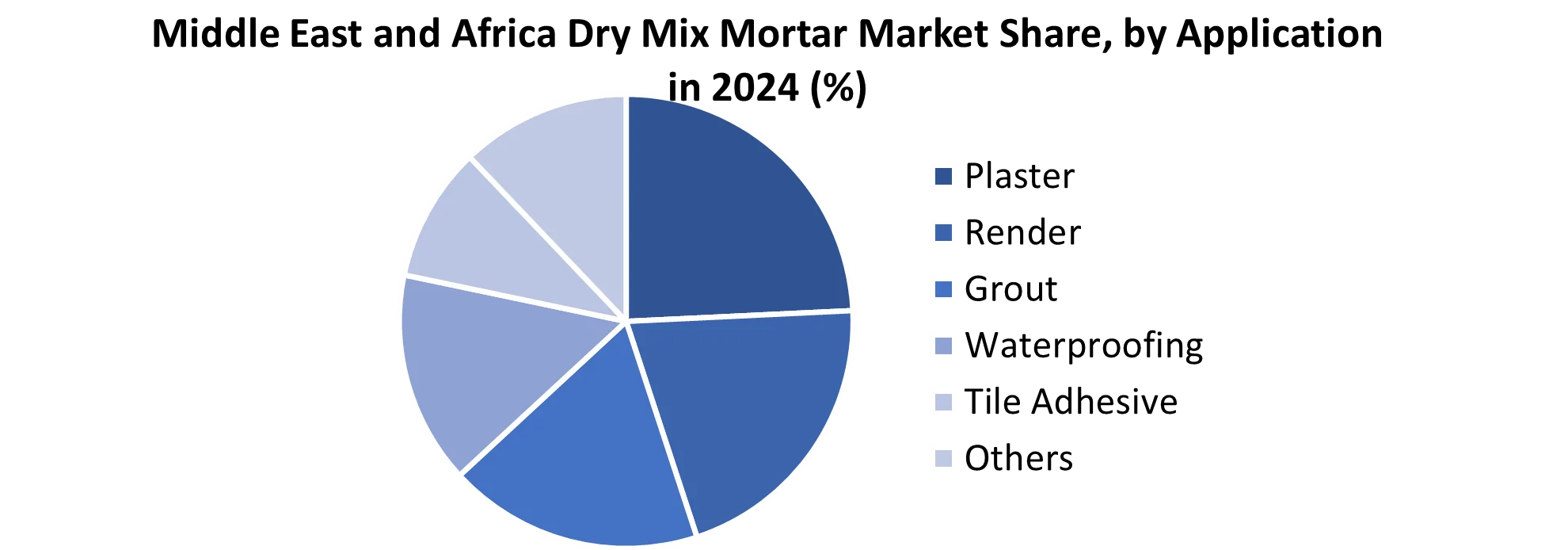

On the basis of application, plaster segment is projected to dominate the Middle East and Africa Dry Mix Mortar Market as it is used widely used in construction projects due to its ability to set very quickly when added to water as compared to other substitute products. The timelines of civil and infrastructure projects are very limited in the fast-growing Middle East and Africa region and hence reduction in lead time of projects can be achieved by using fast paced solutions like Dry Mix Mortar. These factors are driving the growth of Dry Mix Mortar Market in the Middle East and Africa region.

The objective of the report is to present a comprehensive analysis of the Middle East and Africa Dry Mix Mortar market to the stakeholders in the industry. The report provides trends that are most dominant in the Middle East and Africa Dry Mix Mortar market and how these trends will influence new business investments and market development throughout the forecast period. The report also aids in the comprehension of the Middle East and Africa Dry Mix Mortar Market dynamics and competitive structure of the market by analyzing market leaders, market followers, and regional players.

The qualitative and quantitative data provided in the Middle East and Africa Dry Mix Mortar market report is to help understand which market segments, regions are expected to grow at higher rates, factors affecting the market, and key opportunity areas, which will drive the industry and market growth through the forecast period. The report also includes the competitive landscape of key players in the industry along with their recent developments in the Middle East and Africa Dry Mix Mortar market. The report studies factors such as company size, market share, market growth, revenue, production volume, and profits of the key players in the Middle East and Africa Dry Mix Mortar market.

The report provides Porter's Five Force Model, which helps in designing the business strategies in the market. The report helps in identifying how many rivals are existing, who they are, and how their product quality is in the Middle East and Africa Dry Mix Mortar market. The report also analyses if the Middle East and Africa Dry Mix Mortar market is easy for a new player to gain a foothold in the market, do they enter or exit the market regularly if the market is dominated by a few players, etc.

The report also includes a PESTEL Analysis, which aids in the development of company strategies. Political variables help in figuring out how much a government can influence the Middle East and Africa Dry Mix Mortar market. Economic variables aid in the analysis of economic performance drivers that have an impact on the Middle East and Africa Dry Mix Mortar market. Understanding the impact of the surrounding environment and the influence of environmental concerns on the Middle East and Africa Dry Mix Mortar market is aided by legal factors.

Middle East and Africa Dry Mix Mortar Market Scope:

|

Dry Mix Mortar Market |

Market Segmentation |

||

|

Market Indicators: |

Details |

by industrial vertical |

|

|

by Application |

|

||

|

by Admixtures |

|

||

|

Forecast Period |

2025-2032 |

by Country |

|

|

Base Year: |

2024 |

||

|

CAGR: |

3.6 % |

||

|

Market Size in 2024: |

USD 6.74 Billion |

||

|

Market size in 2032: |

USD 8.94 Billion |

||

Middle East and Africa Dry Mix Mortar Key Players:

Frequently Asked Questions

Few of the key players in Middle East and Africa Dry Mix Mortar Market include Mortar & Plaster Dry Mix LLC (UAE), Colmef (UAE), Dow Middle East (UAE), Plaxit (UAE) and Conmix (UAE)

The factors driving the growth of Dry Mix Mortar market in Middle East and Africa are increasing focus on tourism infrastructure and rising level of industrialisation in gulf region.

The segments covered in Middle East and Africa Dry Mix Mortar Market report are based on industry vertical, application, admixture and region.

The forecast period for the Dry Mix Mortar Market is 2025-2032.

- Scope of the Report

- Research Methodology

- Research Process

- Dry Mix Mortar Market: Target Audience

- Dry Mix Mortar Market: Primary Research (As per Client Requirement)

- Dry Mix Mortar Market: Secondary Research

- Executive Summary

- Competitive Landscape

- Stellar Competition matrix

- Middle East and Africa Stellar Competition Matrix

- Key Players Benchmarking: by Product, Pricing, Investments, Expansion Plans, Physical Presence, and Presence in the Market.

- Mergers and Acquisitions in Industry: M&A by Region, Value, and Strategic Intent

- Market Dynamics

- Market Drivers

- Market Restraints

- Market Opportunities

- Market Challenges

- PESTLE Analysis

- PORTERS Five Force Analysis

- Value Chain Analysis

- Stellar Competition matrix

- Middle East and Africa Dry Mix Mortar Market Segmentation

- MEA Dry Mix Mortar Market, by Industry Verticals (2024-2032)

- Residential Construction

- Industrial Construction

- Commercial Construction

- Institutional Construction

- Municipal Construction

- Others

- MEA Dry Mix Mortar Market, by Application (2024-2032)

- Plaster

- Render

- Grout

- Waterproofing

- Tile Adhesive

- Others

- MEA Dry Mix Mortar Market, by Admixtures (2024-2032)

- Methyl Hydroxyethyl Cellulose (MHEC)

- Methyl hydroxypropyl Cellulose (MHPC)

- Methyl Cellulose

- Re-Dispersible Polymer Powder

- Others

- MEA Dry Mix Mortar Market, by country (2024-2032)

- South Africa

- Ethopia

- Saudi Arabia

- UAE

- Rest of Middle East & Africa

- MEA Dry Mix Mortar Market, by Industry Verticals (2024-2032)

- Company Profiles

- Key Players

- Mortar & Plaster Dry Mix LLC (UAE)

- Company Overview

- Product Portfolio

- Financial Overview

- Business Strategy

- Key Developments

- Colmef (UAE)

- Dow Middle East (UAE)

- Plaxit (UAE)

- Conmix (UAE)

- Haver Southern Africa (South Africa)

- Wacker Chemicals Middle East (UAE)

- Eirich (UAE)

- Weber (Egypt)

- Sodamco (Qatar)

- Mortar & Plaster Dry Mix LLC (UAE)

- Key Players

- Key Findings

- Recommendations