Luxury Goods Market Premium Consumption Expansion, Digital Luxury Adoption, and Asia-Pacific Demand Acceleration (2025–2032)

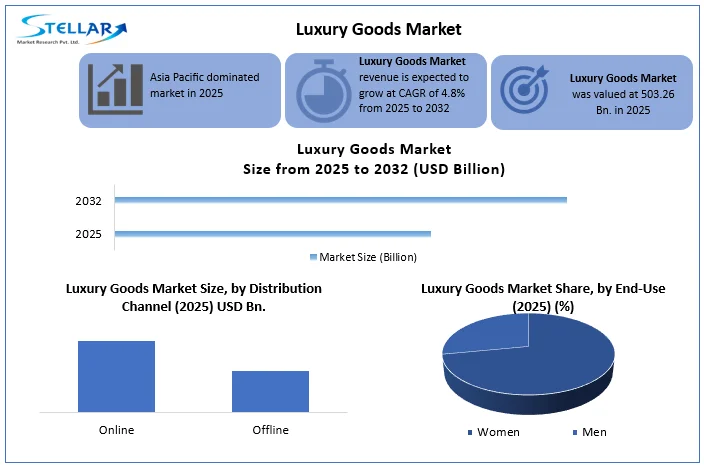

The Global Luxury Goods Market is expected to grow from USD 503.26 Bn. in 2025 to USD 698.75 Bn. by 2032, registering a CAGR of 4.8%, driven by rising high-net-worth populations, premium fashion and jewellery demand, digital luxury retail expansion, experiential consumption, and increasing spending across Asia Pacific, North America, and Europe.

Format : PDF | Report ID : SMR_1369

Global Luxury Goods Market Overview

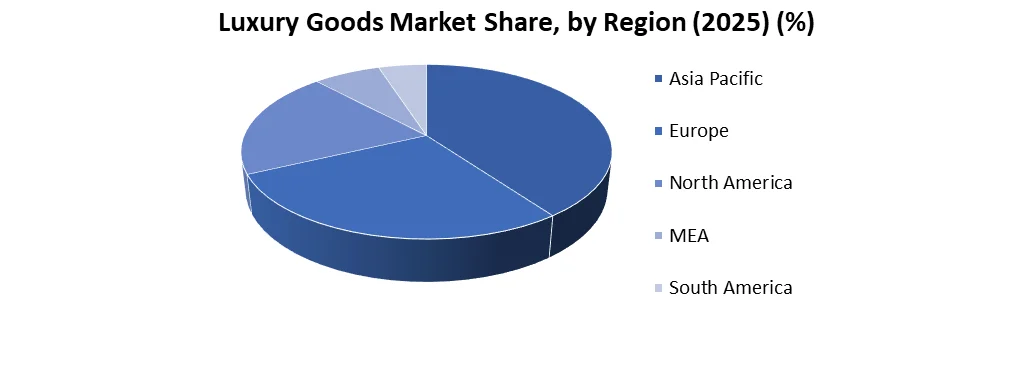

The Global Luxury Goods Market demonstrated strong structural resilience in 2025 and was valued at USD 503.26 Billion, supported by rising high-net-worth individual penetration, premium brand demand, and recovery in international travel and experiential spending. Luxury consumption remained concentrated in personal luxury categories, including fashion & leather goods, watches & jewellery, and premium beauty products, reflecting sustained demand from affluent and aspirational consumers. Leading luxury houses strengthened direct-to-consumer and omnichannel strategies, enhancing customer engagement, margin control, and brand exclusivity. Asia Pacific emerged as the dominant growth engine, driven by robust domestic consumption in China and India and accelerating digital luxury adoption. Sustainability initiatives, heritage branding, and personalised retail experiences increasingly influenced purchasing behaviour, reinforcing long-term market penetration and stable growth prospects across both developed and emerging economies.

To get more Insights: Request Free Sample Report

High-Net-Worth Consumers and Digital Luxury Channels Reshaping Market Dynamics

Rising global wealth and increasing high-net-worth individual penetration remain core growth drivers, with affluent consumers contributing over 40% market in 2025 total luxury goods demand. Asia Pacific held a dominated 38% market share in 2025 of global luxury consumption, supported by rapid income growth, urbanisation, and strong adoption of premium brands in China and India. At the same time, rising penetration of digital luxury channels and experiential retail models continues to support demand expansion, enhance brand engagement, and reinforce long-term growth prospects across mature and emerging markets.

Economic Volatility and Illicit Trade Weigh on Luxury Consumption

Economic volatility, inflationary pressures, and currency fluctuations heighten sensitivity around discretionary spending, moderating luxury goods growth during uncertain economic cycles, particularly among aspirational consumers. In parallel, counterfeiting and grey-market activity continue to dilute brand equity and pricing power, undermining consumer trust and brand exclusivity, and creating structural challenges to sustained market penetration and long-term value creation.

Next-Generation Consumers and Responsible Luxury Create Compelling Investment Potential

The global luxury goods market is expected to offer compelling investor opportunities as brands increasingly align with sustainable and ethical value propositions, with over 60% of luxury consumers showing a growing preference for transparency, responsible sourcing, and environmentally conscious products. This shift is likely to strengthen brand loyalty, pricing power, and long-term market penetration. In parallel, rising engagement from Gen Z and Millennial cohorts is anticipated to reshape demand dynamics, with younger consumers projected to account for more than 55% of total luxury consumption by 2030. Their emphasis on digital interaction, personalisation, and authentic brand storytelling is expected to accelerate the adoption of tech-enabled luxury experiences, expand omnichannel strategies, and support sustained revenue growth across both mature and emerging markets.

Luxury Goods Market Segmentation Analysis:

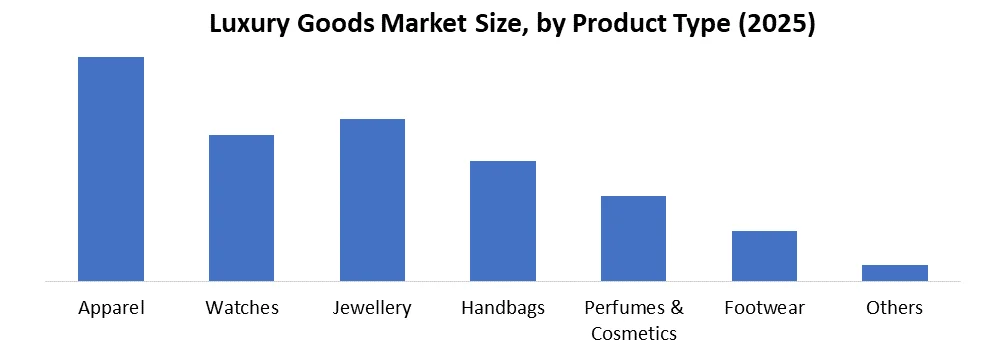

Luxury Goods Market Segmentation, by Product Type: Growth & Adoption Forecast (2025–2032)

• Apparel held the largest Luxury Goods Market share of over 28% in 2025, driven by high demand for designer clothing, brand penetration in emerging markets, and adoption among high-net-worth consumers.

• Watches accounted for 18% of the market share in 2025, supported by luxury craftsmanship, limited editions, and strong European and North American consumer bases.

• Jewellery contributed 20% to the market revenue in 2025, fueled by gold and precious stone consumption, gifting trends, and discretionary spend in affluent populations.

• Handbags made up 15% in 2025, driven by brand loyalty, exclusivity, and in-store experiential retail.

• Perfumes & Cosmetics held 10% in 2025, expanding due to digital marketing adoption and online purchasing trends.

• Footwear represented 6% in 2025, with growth supported by fashion trends and innovative designs.

• Others (eyewear, leather goods, accessories) captured 3%, contributing to diversified revenue streams.

Global Luxury Goods Market: Digital Luxury Adoption & E-Commerce Penetration in Asia Pacific

Asia Pacific emerged as the leading regional market in the global luxury industry, accounting for 40% of the total share in 2025, driven by strong domestic consumption and rapid growth in high-net-worth populations. Total luxury sales reached nearly USD XXX billion, with China, India, Japan, and Southeast Asia serving as the primary growth engines. The region has witnessed accelerated digital luxury penetration, supported by e-commerce platforms, virtual showrooms, and mobile-first consumer engagement strategies, enabling brands to expand reach and enhance customer acquisition. Millennials and Gen Z consumers continue to reshape demand, prioritizing personalized experiences, brand prestige, and sustainability. Collectively, these dynamics reinforce Asia Pacific’s strategic significance as the fastest-growing and most influential region shaping the future trajectory of the global luxury market.

Global Luxury Goods Market Competitive Landscape

LVMH commanded the largest share of the global luxury fashion market, estimated at 20% in 2025, driven by its unmatched multi-brand portfolio, strong exposure to high-growth Asian markets, and leadership across leather goods, fashion, and accessories. Kering, Hermès, Richemont, and Chanel collectively account for approximately 33% of the global luxury fashion market, reflecting a highly concentrated competitive structure where brand equity, pricing power, and controlled distribution models act as key barriers to entry.

|

The Luxury Goods Market Scope |

|

|

Market Size in 2025 |

USD 503.26 Bn. |

|

Market Size in 2032 |

USD 698.75 Bn. |

|

CAGR (2026-2032) |

4.8% |

|

Historic Data |

2020-2024 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2032 |

|

Segments |

By Product Type

|

|

By Distribution Channel

|

|

|

By End user

|

|

|

Regional Scope |

North America- US, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

The Luxury Goods Market Key Players

1. LVMH Moët Hennessy Louis Vuitton (France)

2. Kering S.A. (France)

3. Hermès International (France)

4. Richemont (Switzerland)

5. Chanel (France)

6. Prada S.p.A. (Italy)

7. Burberry Group plc (UK)

8. Rolex (Rolex SA) (Switzerland)

9. Cartier (Compagnie Financière Richemont) (Switzerland)

10. Dior (Christian Dior SE, LVMH) (France)

11. Gucci (Kering) (Italy)

12. Saint Laurent (Kering) (France)

13. Bottega Veneta (Kering) (Italy)

14. Balenciaga (Kering) (France)

15. Fendi (LVMH) (Italy)

16. Bulgari (LVMH) (Italy)

17. Tiffany & Co. (LVMH) (USA)

18. Givenchy (LVMH) (France)

19. Celine (LVMH) (France)

20. Loewe (LVMH) (Spain)

21. Montblanc (Richemont) (Germany)

22. Jaeger-LeCoultre (Richemont) (Switzerland)

23. IWC Schaffhausen (Richemont) (Switzerland)

24. Vacheron Constantin (Richemont) (Switzerland)

25. Hublot (LVMH) (Switzerland)

26. Piaget (Richemont) (Switzerland)

27. Alexander McQueen (Kering) (UK)

28. Valentino (Valentino S.p.A.) (Italy)

29. Versace (Capri Holdings) (Italy)

30. Michael Kors (Capri Holdings) (USA)

Frequently Asked Questions

The market size of the Luxury Goods Market in 2025 was valued at USD 503.26 Bn.

Asia Pacific is expected to hold the highest share of the Luxury Goods Market

The market size of the Global Luxury Goods Market by 2032 is expected to reach USD 698.75 Bn.

The forecast period for the Luxury Goods Market is 2026-2032.

1. Luxury Goods Market Introduction

1.1. Study Assumption and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global Luxury Goods Market: Competitive Landscape

2.1. Ecosystem Analysis

2.2. SMR Competition Matrix

2.3. Competitive Landscape

2.4. Key Players Benchmarking

2.4.1. Company Name

2.4.2. Business Segment

2.4.3. End-User Segment

2.4.4. Revenue (2024)

2.4.5. Company Locations

2.5. Market Structure

2.5.1. Market Leaders

2.5.2. Market Followers

2.5.3. Emerging Players

2.6. Mergers and Acquisitions Details

3. Luxury Goods Market: Dynamics

3.1. Luxury Goods Market Trends

3.2. Luxury Goods Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.2.4. Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Regulatory Landscape by Region

3.6. Key Opinion Leader Analysis For the Global Industry

3.7. Analysis of Government Schemes and Initiatives for Industry

4. Pricing and Profitability Analysis

4.1. Pricing Trend By Product Type (2019 to 2024)

4.2. Cost Structure Production, Operational, and Distribution Expenses

4.3. Consumer Price Sensitivity Regional Variations, Discounts, and Demand Response

4.4. Regional Price Comparisons North America, Europe, Asia-Pacific, and Emerging Markets

4.5. Impact of Inflation Raw Material Costs, Labor, and Currency Fluctuations

5. Brand Strategy and Positioning

5.1. Defining Brand Values, Vision, and Market Differentiation

5.2. Emotional Branding and Storytelling

5.3. Limited Editions and Exclusivity in Luxury goods

5.4. Celebrity and Influencer Endorsements

5.5. Co-Branding and Collaborations Partnerships with Designers, Artists, and Luxury Brands

5.6. Brand Heritage and Legacy Craftsmanship, Historical Milestones, and Brand Credibility

5.7. Market Entry Strategies Expansion into New Geographies and Emerging Luxury Segments

5.8. Competitive Positioning Matrix Mapping Competitors, Market Share, and Strategic Gaps

6. Distribution Channel Analysis

6.1. Offline Retail Stores Flagship Boutiques, Brand Stores, and Premium Outlets

6.2. E-commerce and Omnichannel Integration of Online Platforms and Physical Stores

6.3. Flagship and Concept Boutiques Iconic Stores Showcasing Brand Identity and Experience

6.4. Multi-Brand and Departmental Stores Partnerships

6.5. Duty-Free and Travel Retail Premium Airport and Travel Retail Channels

6.6. Future Channel Innovations Pop-Up Stores, Experiential Retail, and Emerging Platforms

7. Counterfeit and Grey Market Analysis

7.1. Counterfeiting Overview Scale, Product Types, and Key Global Hotspots

7.2. Supply Chain Vulnerabilities Weak Points and Risks in Distribution Channels

7.3. Impact on Brand Equity Effect on Consumer Trust, Sales, and Brand Value

7.4. Anti-Counterfeiting Technologies RFID, Blockchain, Holograms, and Smart Labels

7.5. Strategic Recommendations Measures to Protect Brand, Revenue, and Consumer Loyalty

8. Financing, Leasing and Investment Models

8.1. Luxury Leasing Programs Short-Term Access and Rental Solutions for High-Value Products

8.2. Subscription Programs Membership-Based Access

8.3. Investment Value of Assets Watches, Jewelry, Handbags, and Rare Collectibles

8.4. Financial Institutions and FinTech Platforms

8.5. Economic and Risk Analysis

9. After-Sales and Customer Service Strategies

9.1. Importance of After-Sales Enhancing Loyalty, Trust, and Long-Term Consumer Value

9.2. Service Structures Warranties, Repairs, Personalization, and Concierge Offerings

9.3. CRM Systems Digital Platforms for Tracking, Engagement, and Relationship Management

9.4. Staff Training Excellence Upskilling Employees for Premium Customer Service Delivery

9.5. Digital and On-Demand Services Seamless Online and Offline Service with Personalization

10. Supply Chain and Manufacturing

10.1. Luxury Production Overview End-to-End Design to Finished Product

10.2. Key Manufacturing Hubs Global Centers for Watches, Jewellery, Fashion

10.3. Raw Material Sourcing Ethical and Sustainable Procurement Practices

10.4. Supplier Network Analysis Reliability, Compliance, and Strategic Partnerships

10.5. Distribution and Logistics Efficient Storage, Transportation, and Inventory Management

10.6. Technology and Innovation AI, Blockchain, IoT, AR/VR, and Smart Manufacturing

11. Innovation, R&D, and Product Design Trends

11.1. Technological Innovations in Materials and Craftsmanship

11.2. Smart Luxury: Wearables, Connected Watches, and Digital Accessories

11.3. R&D in Perfumes, Textiles, and Jewellery Design

11.4. Collaborations Between Tech Firms and Luxury Houses

11.5. Patents and Design Registrations in the Luxury Segment

12. Sustainability and Ethical Luxury

12.1. Eco-Friendly Materials and Circular Economy in Luxury Production

12.2. Sustainable Sourcing: Leather Alternatives, Recycled Fabrics, and Low-Impact Packaging

12.3. Carbon Footprint Reduction and ESG Goals by Leading Brands

12.4. Ethical Labor Practices and Transparency Initiatives

12.5. Growth of Resale and Vintage Luxury Markets (Re-commerce Trends)

13. Marketing and Brand Communication Strategies

13.1. Influencer Collaborations and Digital Storytelling

13.2. Emotional Branding and Heritage Narratives

13.3. Global vs Localized Campaign Strategies

13.4. Experiential Marketing: Pop-up Boutiques and Immersive Retail

13.5. Brand Extensions into Lifestyle and Hospitality

14. Resale, Rental, and Circular Luxury Ecosystem

14.1. Growth of Resale Platforms (The RealReal, Vestiaire Collective)

14.2. Luxury Rental and Subscription Models

14.3. Consumer Acceptance of Second hand Luxury

14.4. Brand Partnerships with Re-commerce Platforms

14.5. Economic and Sustainability Impact of Circular Luxury

15. Consumer Behaviour and Demographic Insights

15.1. Evolving Consumer Preferences in Luxury Consumption

15.2. Demographic Breakdown: Millennials, Gen Z, and High-Net-Worth Individuals (HNWI)

15.3. Changing Notions of Status and Exclusivity

15.4. Role of Social Media and Influencers in Luxury Purchasing

15.5. Online vs Offline Luxury Purchase Behavior

15.6. Cultural Influences on Luxury Spending Patterns

16. Luxury Goods Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2025-2032)

16.1. Luxury Goods Market Size and Forecast, By Product Type (2025-2032)

16.1.1. Apparel

16.1.2. Watches

16.1.3. Jewellery

16.1.4. Handbags

16.1.5. Perfumes & Cosmetics

16.1.6. Footwear

16.1.7. Others

16.2. Luxury Goods Market Size and Forecast, By Distribution Channel (2025-2032)

16.2.1. Offline

16.2.2. Online

16.3. Luxury Goods Market Size and Forecast, By End-User (2025-2032)

16.3.1. Women

16.3.2. Men

16.4. Luxury Goods Market Size and Forecast, by Region (2025-2032)

16.4.1. North America

16.4.2. Europe

16.4.3. Asia Pacific

16.4.4. Middle East and Africa

16.4.5. South America

17. North America Luxury Goods Market Size and Forecast by Segmentation (by Value in USD Billion) (2025-2032)

17.1. North America Luxury Goods Market Size and Forecast, By Product Type (2025-2032)

17.1.1. Apparel

17.1.2. Watches

17.1.3. Jewellery

17.1.4. Handbags

17.1.5. Perfumes & Cosmetics

17.1.6. Footwear

17.1.7. Others

17.2. Luxury Goods Market Size and Forecast, By Distribution Channel (2025-2032)

17.2.1. Offline

17.2.2. Online

17.3. North America Luxury Goods Market Size and Forecast, By End-User (2024-2032

17.3.1. Women

17.3.2. Men

17.4. North America Luxury Goods Market Size and Forecast, by Country (2025-2032)

17.4.1. United States

17.4.1.1. United States Luxury Goods Market Size and Forecast, By Product Type (2025-2032)

17.4.1.1.1. Apparel

17.4.1.1.2. Watches

17.4.1.1.3. Jewellery

17.4.1.1.4. Handbags

17.4.1.1.5. Perfumes & Cosmetics

17.4.1.1.6. Footwear

17.4.1.1.7. Others

17.4.1.2. Luxury Goods Market Size and Forecast, By Distribution Channel (2025-2032)

17.4.1.2.1. Offline

17.4.1.2.2. Online

17.4.1.3. United States Luxury Goods Market Size and Forecast, By End-User (2025-2032)

17.4.1.3.1. Women

17.4.1.3.2. Men

17.4.2. Canada

17.4.3.1. Canada Luxury Goods Market Size and Forecast, By Product Type (2025-2032)

17.4.2.1.1. Apparel

17.4.2.1.2. Watches

17.4.2.1.3. Jewellery

17.4.2.1.4. Handbags

17.4.2.1.5. Perfumes & Cosmetics

17.4.2.1.6. Footwear

17.4.2.1.7. Others

17.4.3.2. Luxury Goods Market Size and Forecast, By Distribution Channel (2025-2032)

17.4.2.2.1. Offline

17.4.2.2.2. Online

17.4.3.3. Canada Luxury Goods Market Size and Forecast, By Product Type End-User (2025-2032)

17.4.3.3.1. Women

17.4.3.3.2. Men

17.4.3. Mexico Luxury Goods Market Size and Forecast, By Product Type (2025-2032)

17.4.3.1. Apparel

17.4.3.2. Watches

17.4.3.3. Jewellery

17.4.3.4. Handbags

17.4.3.5. Perfume & Cosmetics

17.4.3.6. Footwear

17.4.3.7. Others

17.4.3.8. Luxury Goods Market Size and Forecast, By Distribution Channel (2025-2032)

17.4.3.8.1. Offline

17.4.3.8.2. Online

17.4.3.9. Mexico Luxury Goods Market Size and Forecast, By End-User (2025-2032)

17.4.3.9.1. Women

17.4.3.9.2. Men

18. Europe Luxury Goods Market Size and Forecast by Segmentation (by Value in USD Billion) (2025-2032)

18.1. Europe Luxury Goods Market Size and Forecast, By Product Type (2025-2032)

18.2. Europe Luxury Goods Market Size and Forecast, By Distribution Channel (2025-2032)

18.3. Europe Luxury Goods Market Size and Forecast, By End-User (2025-2032)

18.4. Europe Luxury Goods Market Size and Forecast, by Country (2025-2032)

18.4.1. United Kingdom

18.4.1.1. United Kingdom Luxury Goods Market Size and Forecast, By Product Type (2025-2032)

18.4.1.2. United Kingdom Luxury Goods Market Size and Forecast, By Distribution Channel (2025-2032)

18.4.1.3. United Kingdom Luxury Goods Market Size and Forecast, By End-User (2025-2032)

18.4.2. France

18.4.2.1. France Luxury Goods Market Size and Forecast, By Product Type (2025-2032)

18.4.2.2. France Luxury Goods Market Size and Forecast, By Distribution Channel (2025-2032)

18.4.2.3. France Luxury Goods Market Size and Forecast, By End-User (2025-2032)

18.4.3. Germany

18.4.3.1. Germany Luxury Goods Market Size and Forecast, By Product Type (2025-2032)

18.4.3.2. Germany Luxury Goods Market Size and Forecast, By Distribution Channel (2025-2032)

18.4.3.3. Germany Luxury Goods Market Size and Forecast, By End-User (2025-2032)

18.4.4. Italy

18.4.4.1. Italy Luxury Goods Market Size and Forecast, By Product Type (2025-2032)

18.4.4.2. Italy Luxury Goods Market Size and Forecast, By Distribution Channel (2025-2032)

18.4.4.3. Italy Luxury Goods Market Size and Forecast, By End-User (2025-2032)

18.4.5. Spain

18.4.5.1. Spain Luxury Goods Market Size and Forecast, By Product Type (2025-2032)

18.4.5.2. Spain Luxury Goods Market Size and Forecast, By Distribution Channel (2025-2032)

18.4.5.3. Spain Luxury Goods Market Size and Forecast, By End-User (2025-2032)

18.4.6. Sweden

18.4.6.1. Sweden Luxury Goods Market Size and Forecast, By Product Type (2025-2032)

18.4.6.2. Sweden Luxury Goods Market Size and Forecast, By Distribution Channel (2025-2032)

18.4.6.3. Sweden Luxury Goods Market Size and Forecast, By End-User (2025-2032)

18.4.7. Austria

18.4.7.1. Austria Luxury Goods Market Size and Forecast, By Product Type (2025-2032)

18.4.7.2. Austria Luxury Goods Market Size and Forecast, By Distribution Channel (2025-2032)

18.4.7.3. Austria Luxury Goods Market Size and Forecast, By End-User (2025-2032)

18.4.8. Rest of Europe

18.4.8.1. Rest of Europe Luxury Goods Market Size and Forecast, By Product Type (2025-2032)

18.4.8.2. Rest of Europe Luxury Goods Market Size and Forecast, By Distribution Channel (2025-2032)

18.4.8.3. Rest of Europe Luxury Goods Market Size and Forecast, By End-User (2025-2032)

19. Asia Pacific Luxury Goods Market Size and Forecast by Segmentation (by Value in USD Billion) (2025-2032)

19.1. Asia Pacific Luxury Goods Market Size and Forecast, By Product Type (2025-2032)

19.2. Asia Pacific Luxury Goods Market Size and Forecast, By Distribution Channel (2025-2032)

19.3. Asia Pacific Luxury Goods Market Size and Forecast, By End-User (2025-2032)

19.4. Asia Pacific Luxury Goods Market Size and Forecast, by Country (2025-2032)

19.4.1. China

19.4.1.1. China Luxury Goods Market Size and Forecast, By Product Type (2025-2032)

19.4.1.2. China Luxury Goods Market Size and Forecast, By Distribution Channel (2025-2032)

19.4.1.3. China Luxury Goods Market Size and Forecast, By End-User (2025-2032)

19.4.2. S Korea

19.4.2.1. S Korea Luxury Goods Market Size and Forecast, By Product Type (2025-2032)

19.4.2.2. S Korea Luxury Goods Market Size and Forecast, By Distribution Channel (2025-2032)

19.4.2.3. S Korea Luxury Goods Market Size and Forecast, By End-User (2025-2032)

19.4.3. Japan

19.4.3.1. Japan Luxury Goods Market Size and Forecast, By Product Type (2025-2032)

19.4.3.2. Japan Luxury Goods Market Size and Forecast, By Distribution Channel (2025-2032)

19.4.3.3. Japan Luxury Goods Market Size and Forecast, By End-User (2025-2032)

19.4.4. India

19.4.4.1. India Luxury Goods Market Size and Forecast, By Product Type (2025-2032)

19.4.4.2. India Luxury Goods Market Size and Forecast, By Distribution Channel (2025-2032)

19.4.4.3. India Luxury Goods Market Size and Forecast, By End-User (2025-2032)

19.4.5. Australia

19.4.5.1. Australia Luxury Goods Market Size and Forecast, By Product Type (2025-2032)

19.4.5.2. Australia Luxury Goods Market Size and Forecast, By Distribution Channel (2025-2032)

19.4.5.3. Australia Luxury Goods Market Size and Forecast, By End-User (2025-2032)

19.4.6. Indonesia

19.4.6.1. Indonesia Luxury Goods Market Size and Forecast, By Product Type (2025-2032)

19.4.6.2. Indonesia Luxury Goods Market Size and Forecast, By Distribution Channel (2025-2032)

19.4.6.3. Indonesia Luxury Goods Market Size and Forecast, By End-User (2025-2032)

19.4.7. Malaysia

19.4.7.1. Malaysia Luxury Goods Market Size and Forecast, By Product Type (2025-2032)

19.4.7.2. Malaysia Luxury Goods Market Size and Forecast, By Distribution Channel (2025-2032)

19.4.7.3. Malaysia Luxury Goods Market Size and Forecast, By End-User (2025-2032)

19.4.8. Vietnam

19.4.8.1. Vietnam Luxury Goods Market Size and Forecast, By Product Type (2025-2032)

19.4.8.2. Vietnam Luxury Goods Market Size and Forecast, By Distribution Channel (2025-2032)

19.4.8.3. Vietnam Luxury Goods Market Size and Forecast, By End-User (2025-2032)

19.4.9. Philippines

19.4.9.1. Philippines Luxury Goods Market Size and Forecast, By Product Type (2025-2032)

19.4.9.2. Philippines Luxury Goods Market Size and Forecast, By Distribution Channel(2025-2032)

19.4.9.3. Philippines Luxury Goods Market Size and Forecast, By End-User (2025-2032)

19.4.10. ASEAN

19.4.10.1. ASEAN Luxury Goods Market Size and Forecast, By Product Type (2025-2032)

19.4.10.2. ASEAN Luxury Goods Market Size and Forecast, By Distribution Channel (2025-2032)

19.4.10.3. ASEAN Luxury Goods Market Size and Forecast, By End-User (2025-2032)

19.4.11. Rest of Asia Pacific

19.4.11.1. Rest of Asia Pacific Luxury Goods Market Size and Forecast, By Product Type (2025-2032)

19.4.11.2. Rest of Asia Pacific Luxury Goods Market Size and Forecast, By Distribution Channel (2025-2032)

19.4.11.3. Rest of Asia Pacific Luxury Goods Market Size and Forecast, By End-User (2025-2032)

20. Middle East and Africa Luxury Goods Market Size and Forecast by Segmentation (by Value in USD Billion) (2025-2032)

20.1. Middle East and Africa Luxury Goods Market Size and Forecast, By Product Type (2025-2032)

20.2. Middle East and Africa Luxury Goods Market Size and Forecast, By Distribution Channel (2025-2032)

20.3. Middle East and Africa Luxury Goods Market Size and Forecast, By End-User (2025-2032)

20.4. Middle East and Africa Luxury Goods Market Size and Forecast, by Country (2025-2032)

20.4.1. South Africa

20.4.1.1. South Africa Luxury Goods Market Size and Forecast, By Product Type (2025-2032)

20.4.1.2. South Africa Luxury Goods Market Size and Forecast, By Distribution Channel (2025-2032)

20.4.1.3. South Africa Luxury Goods Market Size and Forecast, By End-User (2025-2032)

20.4.2. GCC

20.4.2.1. GCC Luxury Goods Market Size and Forecast, By Product Type (2025-2032)

20.4.2.2. GCC Luxury Goods Market Size and Forecast, By Distribution Channel (2025-2032)

20.4.2.3. GCC Luxury Goods Market Size and Forecast, By End-User (2025-2032)

20.4.3. Nigeria

20.4.3.1. Nigeria Luxury Goods Market Size and Forecast, By Product Type (2025-2032)

20.4.3.2. Nigeria Luxury Goods Market Size and Forecast, By Distribution Channel (2025-2032)

20.4.3.3. Nigeria Luxury Goods Market Size and Forecast, By End-User (2025-2032)

20.4.4. Rest of ME&A

20.4.4.1. Rest of ME&A Luxury Goods Market Size and Forecast, By Product Type (2025-2032)

20.4.4.2. Rest of ME&A Luxury Goods Market Size and Forecast, By Distribution Channel (2025-2032)

20.4.4.3. Rest of ME&A Luxury Goods Market Size and Forecast, By End-User (2025-2032)

21. South America Luxury Goods Market Size and Forecast by Segmentation (by Value in USD Billion) (2025-2032)

21.1. South America Luxury Goods Market Size and Forecast, By Product Type (2025-2032)

21.2. South America Luxury Goods Market Size and Forecast, By Distribution Channel (2025-2032)

21.3. South America Luxury Goods Market Size and Forecast, By End-User (2025-2032)

21.4. South America Luxury Goods Market Size and Forecast, by Country (2025-2032)

214.1. Brazil

21.4.1.1. Brazil Luxury Goods Market Size and Forecast, By Product Type (2025-2032)

21.4.1.2. Brazil Luxury Goods Market Size and Forecast, By Distribution Channel (2025-2032)

21.4.1.3. Brazil Luxury Goods Market Size and Forecast, By End-User (2025-2032)

214.2. Argentina

21.4.2.1. Argentina Luxury Goods Market Size and Forecast, By Product Type (2025-2032)

21.4.2.2. Argentina Luxury Goods Market Size and Forecast, By Distribution Channel (2025-2032)

21.4.2.3. Argentina Luxury Goods Market Size and Forecast, By End-User (2025-2032)

214.3. Rest Of South America

21.4.3.1. Rest Of South America Luxury Goods Market Size and Forecast, By Product Type (2025-2032)

21.4.3.2. Rest Of South America Luxury Goods Market Size and Forecast, By Distribution Channel (2025-2032)

21.4.3.3. Rest Of South America Luxury Goods Market Size and Forecast, By End-User (2025-2032)

22. Company Profile: Key Players

22.1. LVMH Moët Hennessy Louis Vuitton (France)

22.1.1. Company Overview

22.1.2. Business Portfolio

22.1.3. Financial Overview

22.1.4. SWOT Analysis

22.1.5. Strategic Analysis

22.1.6. Recent Developments

22.2. Kering S.A. (France)

22.3. Hermès International (France)

22.4. Richemont (Switzerland)

22.5. Chanel (France)

22.6. Prada S.p.A. (Italy)

22.7. Burberry Group plc (UK)

22.8. Rolex (Rolex SA) (Switzerland)

22.9. Cartier (Compagnie Financière Richemont) (Switzerland)

22.10. Dior (Christian Dior SE, LVMH) (France)

22.11. Gucci (Kering) (Italy)

22.12. Saint Laurent (Kering) (France)

22.13. Bottega Veneta (Kering) (Italy)

22.14. Balenciaga (Kering) (France)

22.15. Fendi (LVMH) (Italy)

22.16. Bulgari (LVMH) (Italy)

22.17. Tiffany & Co. (LVMH) (USA)

22.18. Givenchy (LVMH) (France)

22.19. Celine (LVMH) (France)

22.20. Loewe (LVMH) (Spain)

22.21. Montblanc (Richemont) (Germany)

22.22. Jaeger-LeCoultre (Richemont) (Switzerland)

22.23. IWC Schaffhausen (Richemont) (Switzerland)

22.24. Vacheron Constantin (Richemont) (Switzerland)

22.25. Hublot (LVMH) (Switzerland)

22.26. Piaget (Richemont) (Switzerland)

22.27. Alexander McQueen (Kering) (UK)

22.28. Valentino (Valentino S.p.A.) (Italy)

22.29. Versace (Capri Holdings) (Italy)

22.30. Michael Kors (Capri Holdings) (USA)

22.31. Others

23. Key Findings

24. Analyst Recommendations

25. Luxury Goods Market: Research Methodology