Light Detection and Ranging Market: Industry Overview (2024-2030) by Technology, Type, Installation Type, End-User, and, Region

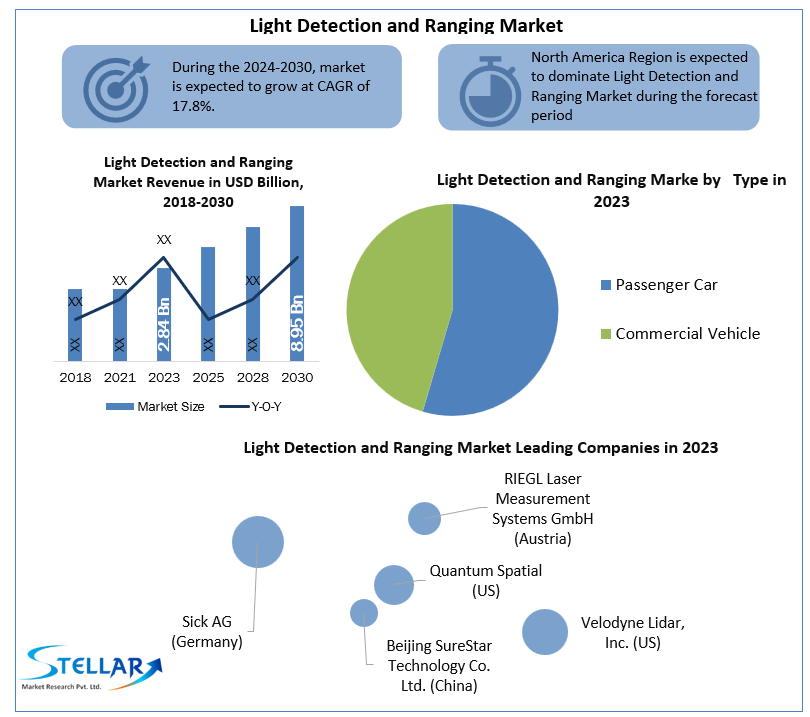

Light Detection and Ranging Market size was valued at US$ 2.84 Billion in 2023 and the total Light Detection and Ranging revenue is expected to grow at 17.8% through 2024 to 2030, reaching nearly US$ 8.95 Billion.

Format : PDF | Report ID : SMR_429

Light Detection and Ranging Market Overview:

Lidar is a technique for estimating ranges that involve using a beam to pinpoint an item and calculating the time taken for the light reflected to rebound to the receiver. By altering the wavelength, it can also be used to create computerized 3-D renderings of locations on the planet's surface and marine bottom. It has been used on the ground, in the air, and on portable devices.

LiDAR is a technology that allows automobiles of various sorts to detect whether barriers are close and how far away they are. LiDAR elements offer 3D mappings that not only locate and track things but also determine what they are. LiDAR data also assists a vehicle's computer network in anticipating how items will respond and adjusting the vehicle's movement effectively. Lidar has a variety of applications in prehistorical studies, including field planning and preparation, charting characteristics under the cover of a rainforest, and providing a view of wide, continuous attributes undetectable from the surface. The police utilize lidar speeding guns to measure the speed of cars in order to uphold speed limits. Lidars are used by a vast network of astronomers to find the distance between reflective surfaces on the moon.

The market's growth drivers, as well as the market's segments (Technology, Type, Installation Type, End-User, and, Region), are analyzed in this research. Market participants, regions, and special requirements have all provided data. This market study provides an in-depth look at all of the important advancements that are currently taking place across all industry sectors. Statistics, infographics, and presentations are used to provide key data analysis. The analysis looks at the market's Drivers, Restraints, Opportunities, and Challenges for the Light Detection and Ranging market. The study aids in the evaluation of market growth drivers and the determination of how to employ these drivers as a tool. The research also aids in the correction and resolution of difficulties with the global Light Detection and Ranging market.

To get more Insights: Request Free Sample Report

Light Detection and Ranging Market Dynamics:

The growing adoption of LiDAR systems in Unmanned Aerial Vehicles is one of the major drivers of the light detection and ranging market. The growing use of LiDAR-enabled unmanned aerial vehicles opens up a plethora of mapping projects that may be completed at a lower cost than traditional mapping methods. The growing usage of unmanned aerial vehicles has given a boost to aerial LiDAR-enabled surveying capabilities. Autonomous drones with LiDAR systems offer not just mobility and adaptability, but also the capacity to explore landscapes and circumstances where people cannot. Companies are rapidly using unmanned aerial vehicles for reduced height imaging, landscape modeling, and surveying. LiDAR has emerged as one of the most essential techniques in the consumer drone business for capturing higher quality and reliable assessment data in recent times.

Industrial and civil infrastructure operations have grown dramatically over the world to meet the needs of a forever-increasing populace, especially in emerging nations. From measurement and modeling to design plausibility tests, technology is becoming increasingly important in all aspects of development. LiDAR technologies can give a timely and efficient survey of big regions. Designers can also use imaging systems led by GPS devices and very precise cameras to perform precise risk assessments and develop solutions to satisfy project criteria. Many LiDAR service providers have sprung up as a result of this.

The COVID-19 outbreak has influenced the Light Detection and Ranging Market. It has influenced both LiDAR producers and consumers all around the world. COVID-19 outbreak was responsible for a catastrophic impact on the light detection and ranging market for expedition applications. LiDAR's qualitative research applications include the use of technology in the petroleum industry and mineral extraction. Globally, the enforced shutdowns have influenced the economics of countries. Fuel usage has been lowered internationally as a result of mass transit regulations. As a result, petroleum products prices have dropped. This has caused a standstill in the petroleum industry, which has had a significant influence on the LiDAR market for research purposes.

Light Detection and Ranging Market Segment Analysis:

By Installation Type, the Ground-based LiDAR segment is expected to witness a CAGR of 6.4% in the aforementioned forecast period.

Light Detection and Ranging systems on the surface are either fixed or mobile. Through the use of gear and stabilizing mechanisms, they are mounted on a small platform e.g. a sports station wagon or terrain vehicle. The price of surface systems is lower than that of aerial systems. They are not, though, capable of analyzing the entire area. Steep mountain walls, for instance, cannot be surveyed, and rapidly changing surface situations are tough to follow with systems of this sort.

Portable ground-based systems are often installed on a portable device, e.g. a vehicle. The benefit of having the LiDAR installed on a car is that it can scan huge regions that are easily reachable. The automobile industry is gaining traction as an application potential for movable ground-based systems, with the number of high-quality vehicles mounted with automated driving systems increasing every year. This is projected to drive demand for portable ground-based devices in the Light Detection and Ranging Market.

Light Detection and Ranging Market Regional Insights:

In 2023, North America had the greatest market share of the Light Detection and Ranging market. North America, which includes the United States, Canada, and Mexico, is one of the most key markets for LiDAR. This region is much ahead of the others in terms of LiDAR implementation. The advancement of the LiDAR market in North America is fueled by rising expenditures in driver assistance and autonomous cars, as well as increased recognition of the value of Lidar. Furthermore, the US is home to important companies in the Light Detection industry, including producers, designers, dealers, and vendors of Lidar and apparatus. Significant advances in the technology of Light Detection and Ranging have occurred over the years in the North American and European areas, allowing companies in these countries to sell high-quality applications to emerging economies e.g. China and India. These shipments are likely to be one of the main drivers of the market in the US and Europe.

The purpose of this research is to provide stakeholders in the industry with a thorough insight into the Light Detection and Ranging Market. The study includes an analysis of difficult data in simple language, as well as the industry's historical and current state, as well as anticipated market size and trends. The market report examines all segments of the industry, with a focus on significant players such as market leaders, followers, and new entrants. The report includes a PORTER, PESTEL analysis as well as the possible influence of microeconomic market determinants. External and internal elements that are expected to have a favorable or negative impact on the firm have been examined, providing decision-makers with a clear future vision of the industry. The research also aids in comprehending the Light Detection and Ranging Market dynamics and structure by studying market segments and forecasting market size. The research is an investor's guide since it depicts the competitive analysis of major competitors in the Light Detection and Ranging Market by product, price, financial situation, product portfolio, growth plans, and geographical presence.

Light Detection and Ranging Market Scope:

|

Light Detection and Ranging Market |

|

|

Market Size in 2023 |

USD2.84 Bn. |

|

Market Size in 2030 |

USD 8.85 Bn. |

|

CAGR (2024-2030) |

17.8%Percent |

|

Historic Data |

2018-2022 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

|

Segment Scope |

by Type

|

|

by Installation Type

|

|

|

|

by End-User

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Light Detection and Ranging Market Players:

- RIEGL Laser Measurement Systems GmbH (Austria)

- Sick AG (Germany)

- Quantum Spatial (US)

- Beijing SureStar Technology Co. Ltd. (China)

- Velodyne Lidar, Inc. (US)

- YellowScan (France)

- Geokno India Private Limited (India)

- Phoenix LiDAR Systems (US)

- Leddartech Inc. (Canada)

- Quanergy Systems, Inc. (US)

- Innoviz Technologies Ltd. (Israel)

- Leosphere (France)

- Waymo LLC (US)

- Valeo S.A. (France)

- Neptec Technologies Corp. (Canada)

- Ouster, Inc. (US)

- ZX Lidars (UK)

Frequently Asked Questions

The growing adoption of LiDAR systems in Unmanned Aerial Vehicles is one of the major drivers of the market.

The key players are Valeo, Ouster, etc.

the Ground-based LiDAR segment is expected to witness a CAGR of 6.4% in the aforementioned forecast period.

Chapter 1 Scope of the Report

Chapter 2 Research Methodology

2.1. Research Process

2.2. Global Light Detection and Ranging Market: Target Audience

2.3. Global Light Detection and Ranging Market: Primary Research (As per Client Requirement)

2.4. Global Light Detection and Ranging Market: Secondary Research

Chapter 3 Executive Summary

Chapter 4 Competitive Landscape

4.1. Market Share Analysis, By Value, 2023-2030

4.1.1. Market Share Analysis, By Region, By Value, 2023-2030 (In %)

4.1.1.1. North America Market Share Analysis, By Value, 2023-2030 (In %)

4.1.1.2. Europe Market Share Analysis, By Value, 2023-2030 (In %)

4.1.1.3. Asia Pacific Market Share Analysis, By Value, 2023-2030 (In %)

4.1.1.4. South America Market Share Analysis, By Value, 2023-2030 (In %)

4.1.1.5. Middle East and Africa Market Share Analysis, By Value, 2023-2030 (In %)

4.1.2. Market Share Analysis, By Technology, By Value, 2023-2030 (In %)

4.1.2.1. North America Market Share Analysis, By Technology, By Value, 2023-2030 (In %)

4.1.2.1.1. USA Market Share Analysis, By Technology, By Value, 2023-2030 (In %)

4.1.2.1.2. Canada Market Share Analysis, By Technology, By Value, 2023-2030 (In %)

4.1.2.1.3. Mexico Market Share Analysis, By Technology, By Value, 2023-2030 (In %)

4.1.2.2. Europe Market Share Analysis, By Technology, By Value, 2023-2030 (In %)

4.1.2.2.1. UK Market Share Analysis, By Technology, By Value, 2023-2030 (In %)

4.1.2.2.2. France Market Share Analysis, By Technology, By Value, 2023-2030 (In %)

4.1.2.2.3. Germany Market Share Analysis, By Technology, By Value, 2023-2030 (In %)

4.1.2.2.4. Italy Market Share Analysis, By Technology, By Value, 2023-2030 (In %)

4.1.2.2.5. Spain Market Share Analysis, By Technology, By Value, 2023-2030 (In %)

4.1.2.2.6. Sweden Market Share Analysis, By Technology, By Value, 2023-2030 (In %)

4.1.2.2.7. Austria Market Share Analysis, By Technology, By Value, 2023-2030 (In %)

4.1.2.2.8. Rest of Europe Market Share Analysis, By Technology, By Value, 2023-2030 (In %)

4.1.2.3. Asia Pacific Market Share Analysis, By Technology, By Value, 2023-2030 (In %)

4.1.2.3.1. China Market Share Analysis, By Technology, By Value, 2023-2030 (In %)

4.1.2.3.2. India Market Share Analysis, By Technology, By Value, 2023-2030 (In %)

4.1.2.3.3. Japan Market Share Analysis, By Technology, By Value, 2023-2030 (In %)

4.1.2.3.4. South Korea Market Share Analysis, By Technology, By Value, 2023-2030 (In %)

4.1.2.3.5. Australia Market Share Analysis, By Technology, By Value, 2023-2030 (In %)

4.1.2.3.6. ASEAN Market Share Analysis, By Technology, By Value, 2023-2030 (In %)

4.1.2.3.7. Rest of APAC Market Share Analysis, By Technology, By Value, 2023-2030 (In %)

4.1.2.4. South America Market Share Analysis, By Technology, By Value, 2023-2030 (In %)

4.1.2.4.1. Brazil Market Share Analysis, By Technology, By Value, 2023-2030 (In %)

4.1.2.4.2. Argentina Market Share Analysis, By Technology, By Value, 2023-2030 (In %)

4.1.2.4.3. Rest of South America Market Share Analysis, By Technology, By Value, 2023-2030 (In %)

4.1.2.5. Middle East and Africa Market Share Analysis, By Technology, By Value, 2023-2030 (In %)

4.1.2.5.1. South Africa Market Share Analysis, By Technology, By Value, 2023-2030 (In %)

4.1.2.5.2. GCC Market Share Analysis, By Technology, By Value, 2023-2030 (In %)

4.1.2.5.3. Egypt Market Share Analysis, By Technology, By Value, 2023-2030 (In %)

4.1.2.5.4. Nigeria Market Share Analysis, By Technology, By Value, 2023-2030 (In %)

4.1.2.5.5. Rest of Middle East and Africa Market Share Analysis, By Technology, By Value, 2023-2030 (In %)

4.1.3. Market Share Analysis, By Type, By Value, 2023-2030 (In %)

4.1.3.1. North America Market Share Analysis, By Type, By Value, 2023-2030 (In %)

4.1.3.1.1. USA Market Share Analysis, By Type, By Value, 2023-2030 (In %)

4.1.3.1.2. Canada Market Share Analysis, By Type, By Value, 2023-2030 (In %)

4.1.3.1.3. Mexico Market Share Analysis, By Type, By Value, 2023-2030 (In %)

4.1.3.2. Europe Market Share Analysis, By Type, By Value, 2023-2030 (In %)

4.1.3.2.1. UK Market Share Analysis, By Type, By Value, 2023-2030 (In %)

4.1.3.2.2. France Market Share Analysis, By Type, By Value, 2023-2030 (In %)

4.1.3.2.3. Germany Market Share Analysis, By Type, By Value, 2023-2030 (In %)

4.1.3.2.4. Italy Market Share Analysis, By Type, By Value, 2023-2030 (In %)

4.1.3.2.5. Spain Market Share Analysis, By Type, By Value, 2023-2030 (In %)

4.1.3.2.6. Sweden Market Share Analysis, By Type, By Value, 2023-2030 (In %)

4.1.3.2.7. Austria Market Share Analysis, By Type, By Value, 2023-2030 (In %)

4.1.3.2.8. Rest of Europe Market Share Analysis, By Type, By Value, 2023-2030 (In %)

4.1.3.3. Asia Pacific Market Share Analysis, By Type, By Value, 2023-2030 (In %)

4.1.3.3.1. China Market Share Analysis, By Type, By Value, 2023-2030 (In %)

4.1.3.3.2. India Market Share Analysis, By Type, By Value, 2023-2030 (In %)

4.1.3.3.3. Japan Market Share Analysis, By Type, By Value, 2023-2030 (In %)

4.1.3.3.4. South Korea Market Share Analysis, By Type, By Value, 2023-2030 (In %)

4.1.3.3.5. Australia Market Share Analysis, By Type, By Value, 2023-2030 (In %)

4.1.3.3.6. ASEAN Market Share Analysis, By Type, By Value, 2023-2030 (In %)

4.1.3.3.7. Rest of APAC Market Share Analysis, By Type, By Value, 2023-2030 (In %)

4.1.3.4.2. Argentina Market Share Analysis, By Type, By Value, 2023-2030 (In %)

4.1.3.4.3. Rest of South America Market Share Analysis, By Type, By Value, 2023-2030 (In %)

4.1.3.5. Middle East and Africa Market Share Analysis, By Type, By Value, 2023-2030 (In %)

4.1.3.5.1. South Africa Market Share Analysis, By Type, By Value, 2023-2030 (In %)

4.1.3.5.2. GCC Market Share Analysis, By Type, By Value, 2023-2030 (In %)

4.1.3.5.3. Egypt Market Share Analysis, By Type, By Value, 2023-2030 (In %)

4.1.3.5.4. Nigeria Market Share Analysis, By Type, By Value, 2023-2030 (In %)

4.1.3.5.5. Rest of Middle East and Africa Market Share Analysis, By Type, By Value, 2023-2030 (In %)

4.1.4. Market Share Analysis, By Installation Type, By Value, 2023-2030 (In %)

4.1.4.1. North America Market Share Analysis, By Installation Type, By Value, 2023-2030 (In %)

4.1.4.1.1. USA Market Share Analysis, By Installation Type, By Value, 2023-2030 (In %)

4.1.4.1.2. Canada Market Share Analysis, By Installation Type, By Value, 2023-2030 (In %)

4.1.4.1.3. Mexico Market Share Analysis, By Installation Type, By Value, 2023-2030 (In %)

4.1.4.2. Europe Market Share Analysis, By Installation Type, By Value, 2023-2030 (In %)

4.1.4.2.1. UK Market Share Analysis, By Installation Type, By Value, 2023-2030 (In %)

4.1.4.2.2. France Market Share Analysis, By Installation Type, By Value, 2023-2030 (In %)

4.1.4.2.3. Germany Market Share Analysis, By Installation Type, By Value, 2023-2030 (In %)

4.1.4.2.4. Italy Market Share Analysis, By Installation Type, By Value, 2023-2030 (In %)

4.1.4.2.5. Spain Market Share Analysis, By Installation Type, By Value, 2023-2030 (In %)

4.1.4.2.6. Sweden Market Share Analysis, By Installation Type, By Value, 2023-2030 (In %)

4.1.4.2.7. Austria Market Share Analysis, By Installation Type, By Value, 2023-2030 (In %)

4.1.4.2.8. Rest of Europe Market Share Analysis, By Installation Type, By Value, 2023-2030 (In %)

4.1.4.3. Asia Pacific Market Share Analysis, By Installation Type, By Value, 2023-2030 (In %)

4.1.4.3.1. China Market Share Analysis, By Installation Type, By Value, 2023-2030 (In %)

4.1.4.3.2. India Market Share Analysis, By Installation Type, By Value, 2023-2030 (In %)

4.1.4.3.3. Japan Market Share Analysis, By Installation Type, By Value, 2023-2030 (In %)

4.1.4.3.4. South Korea Market Share Analysis, By Installation Type, By Value, 2023-2030 (In %)

4.1.4.3.5. Australia Market Share Analysis, By Installation Type, By Value, 2023-2030 (In %)

4.1.4.3.6. ASEAN Market Share Analysis, By Installation Type, By Value, 2023-2030 (In %)

4.1.4.3.7. Rest of APAC Market Share Analysis, By Installation Type, By Value, 2023-2030 (In %)

4.1.4.4. South America Market Share Analysis, By Installation Type, By Value, 2023-2030 (In %)

4.1.4.4.1. Brazil Market Share Analysis, By Installation Type, By Value, 2023-2030 (In %)

4.1.4.4.2. Argentina Market Share Analysis, By Installation Type, By Value, 2023-2030 (In %)

4.1.4.4.3. Rest of South America Market Share Analysis, By Installation Type, By Value, 2023-2030 (In %)

4.1.4.5. Middle East and Africa Market Share Analysis, By Installation Type, By Value, 2023-2030 (In %)

4.1.4.5.1. South Africa Market Share Analysis, By Installation Type, By Value, 2023-2030 (In %)

4.1.4.5.2. GCC Market Share Analysis, By Installation Type, By Value, 2023-2030 (In %)

4.1.4.5.3. Egypt Market Share Analysis, By Installation Type, By Value, 2023-2030 (In %)

4.1.4.5.4. Nigeria Market Share Analysis, By Installation Type, By Value, 2023-2030 (In %)

4.1.4.5.5. Rest of Middle East and Africa Market Share Analysis, By Installation Type, By Value, 2023-2030 (In %)

4.1.5. Market Share Analysis, By End-User, By Value, 2023-2030 (In %)

4.1.5.1. North America Market Share Analysis, By End-User, By Value, 2023-2030 (In %)

4.1.5.1.1. USA Market Share Analysis, By End-User, By Value, 2023-2030 (In %)

4.1.5.1.2. Canada Market Share Analysis, By End-User, By Value, 2023-2030 (In %)

4.1.5.1.3. Mexico Market Share Analysis, By End-User, By Value, 2023-2030 (In %)

4.1.5.2. Europe Market Share Analysis, By End-User, By Value, 2023-2030 (In %)

4.1.5.2.1. UK Market Share Analysis, By End-User, By Value, 2023-2030 (In %)

4.1.5.2.2. France Market Share Analysis, By End-User, By Value, 2023-2030 (In %)

4.1.5.2.3. Germany Market Share Analysis, By End-User, By Value, 2023-2030 (In %)

4.1.5.2.4. Italy Market Share Analysis, By End-User, By Value, 2023-2030 (In %)

4.1.5.2.5. Spain Market Share Analysis, By End-User, By Value, 2023-2030 (In %)

4.1.5.2.6. Sweden Market Share Analysis, By End-User, By Value, 2023-2030 (In %)

4.1.5.2.7. Austria Market Share Analysis, By End-User, By Value, 2023-2030 (In %)

4.1.5.2.8. Rest of Europe Market Share Analysis, By End-User, By Value, 2023-2030 (In %)

4.1.5.3. Asia Pacific Market Share Analysis, By End-User, By Value, 2023-2030 (In %)

4.1.5.3.1. China Market Share Analysis, By End-User, By Value, 2023-2030 (In %)

4.1.5.3.2. India Market Share Analysis, By End-User, By Value, 2023-2030 (In %)

4.1.5.3.3. Japan Market Share Analysis, By End-User, By Value, 2023-2030 (In %)

4.1.5.3.4. South Korea Market Share Analysis, By End-User, By Value, 2023-2030 (In %)

4.1.5.3.5. Australia Market Share Analysis, By End-User, By Value, 2023-2030 (In %)

4.1.5.3.6. ASEAN Market Share Analysis, By End-User, By Value, 2023-2030 (In %)

4.1.5.3.7. Rest of APAC Market Share Analysis, By End-User, By Value, 2023-2030 (In %)

4.1.5.4. South America Market Share Analysis, By End-User, By Value, 2023-2030 (In %)

4.1.5.4.1. Brazil Market Share Analysis, By End-User, By Value, 2023-2030 (In %)

4.1.5.4.2. Argentina Market Share Analysis, By End-User, By Value, 2023-2030 (In %)

4.1.5.4.3. Rest of South America Market Share Analysis, By End-User, By Value, 2023-2030 (In %)

4.1.5.5. Middle East and Africa Market Share Analysis, By End-User, By Value, 2023-2030 (In %)

4.1.5.5.1. South Africa Market Share Analysis, By End-User, By Value, 2023-2030 (In %)

4.1.5.5.2. GCC Market Share Analysis, By End-User, By Value, 2023-2030 (In %)

4.1.5.5.3. Egypt Market Share Analysis, By End-User, By Value, 2023-2030 (In %)

4.1.5.5.4. Nigeria Market Share Analysis, By End-User, By Value, 2023-2030 (In %)

4.1.5.6. Rest of Middle East and Africa Market Share Analysis, By End-User, By Value, 2023-2030 (In %)

4.2. Stellar Competition matrix

4.2.1. Global Stellar Competition Matrix

4.2.2. North America Stellar Competition Matrix

4.2.3. Europe Stellar Competition Matrix

4.2.4. Asia Pacific Stellar Competition Matrix

4.2.5. South America Stellar Competition Matrix

4.2.6. Middle East and Africa Stellar Competition Matrix

4.3. Key Players Benchmarking

4.3.1. Key Players Benchmarking By Technology, Pricing, Market Share, Investments, Expansion Plans, Physical Presence and Presence in the Market.

4.4. Mergers and Acquisitions in Industry

4.4.1. M&A by Region, Value and Strategic Intent

4.5. Market Dynamics

4.5.1. Market Drivers

4.5.2. Market Restraints

4.5.3. Market Opportunities

4.5.4. Market Challenges

4.5.5. PESTLE Analysis

4.5.6. PORTERS Five Force Analysis

4.5.7. Value Chain Analysis

Chapter 5 Global Light Detection and Ranging Market Segmentation: By Technology

5.1. Global Light Detection and Ranging Market, By Technology, Overview/Analysis, 2023-2030

5.2. Global Light Detection and Ranging Market, By Technology, By Value, Market Share (%), 2023-2030 (USD Billion)

5.3. Global Light Detection and Ranging Market, By Technology, By Value, -

5.3.1. 2D

5.3.2. 3D

5.3.3. 4D

Chapter 6 Global Light Detection and Ranging Market Segmentation: By Type

6.1. Global Light Detection and Ranging Market, By Type, Overview/Analysis, 2023-2030

6.2. Global Light Detection and Ranging Market Size, By Type, By Value, Market Share (%), 2023-2030 (USD Billion)

6.3. Global Light Detection and Ranging Market, By Type, By Value, -

6.3.1. Solid-state

6.3.2. Mechanical

Chapter 7 Global Light Detection and Ranging Market Segmentation: By Installation Type

7.1. Global Light Detection and Ranging Market, By Installation Type, Overview/Analysis, 2023-2030

7.2. Global Light Detection and Ranging Market Size, By Installation Type, By Value, Market Share (%), 2023-2030 (USD Billion)

7.3. Global Light Detection and Ranging Market, By Installation Type, By Value, -

7.3.1. Airborne

7.3.2. Ground-based

Chapter 8 Global Light Detection and Ranging Market Segmentation: By End-User

8.1. Global Light Detection and Ranging Market, By End-User, Overview/Analysis, 2023-2030

8.2. Global Light Detection and Ranging Market Size, By End-User, By Value, Market Share (%), 2023-2030 (USD Billion)

8.3. Global Light Detection and Ranging Market, By End-User, By Value, -

8.3.1. Corridor mapping

8.3.2. Engineering

8.3.3. Environment

8.3.4. ADAS and Driverless Cars

8.3.5. Exploration

8.3.6. Urban Planning

8.3.7. Cartography

8.3.8. Meteorology

8.3.9. Other

Chapter 9 Global Light Detection and Ranging Market Segmentation: By Region

9.1. Global Light Detection and Ranging Market, By Region – North America

9.1.1. North America Light Detection and Ranging Market Size, By Technology, By Value, 2023-2030 (USD Billion)

9.1.2. North America Light Detection and Ranging Market Size, By Type, By Value, 2023-2030 (USD Billion)

9.1.3. North America Light Detection and Ranging Market Size, By Installation Type, By Value, 2023-2030 (USD Billion)

9.1.4. North America Light Detection and Ranging Market Size, By End-User, By Value, 2023-2030 (USD Billion)

9.1.5. By Country – U.S.

9.1.5.1. U.S. Light Detection and Ranging Market Size, By Technology, By Value, 2023-2030 (USD Billion)

9.1.5.2. U.S. Light Detection and Ranging Market Size, By Type, By Value, 2023-2030 (USD Billion)

9.1.5.3. U.S. Light Detection and Ranging Market Size, By Installation Type, By Value, 2023-2030 (USD Billion)

9.1.5.4. U.S. Light Detection and Ranging Market Size, By End-User, By Value, 2023-2030 (USD Billion)

9.1.5.5. Canada Light Detection and Ranging Market Size, By Value, 2023-2030 (USD Billion)

9.1.5.6. Mexico Light Detection and Ranging Market Size, By Value, 2023-2030 (USD Billion)

9.2. Europe Light Detection and Ranging Market Size, By Value, 2023-2030 (USD Billion)

9.2.1. UK

9.2.2. France

9.2.3. Germany

9.2.4. Italy

9.2.5. Spain

9.2.6. Sweden

9.2.7. Austria

9.2.8. Rest of Europe

9.3. Asia Pacific Light Detection and Ranging Market Size, By Value, 2023-2030 (USD Billion)

9.3.1. China

9.3.2. India

9.3.3. Japan

9.3.4. South Korea

9.3.5. Australia

9.3.6. ASEAN

9.3.7. Rest of APAC

9.4. Middle East and Africa Light Detection and Ranging Market Size, By Value, 2023-2030 (USD Billion)

9.4.1. South Africa

9.4.2. GCC

9.4.3. Egypt

9.4.4. Nigeria

9.4.5. Rest of Middle East and Africa

9.5. South America Light Detection and Ranging Market Size, By Value, 2023-2030 (USD Billion)

9.5.1. Brazil

9.5.2. Argentina

9.5.3. Rest of South America

Chapter 10 Company Profiles

10.1. Key Players

10.1.1. RIEGL Laser Measurement Systems GmbH (Austria)

10.1.1.1. Company Overview

10.1.1.2. Tube Portfolio

10.1.1.3. Financial Overview

10.1.1.4. Business Strategy

10.1.1.5. Key Developments

10.1.2. Sick AG (Germany)

10.1.3. Quantum Spatial (US)

10.1.4. Beijing SureStar Technology Co. Ltd. (China)

10.1.5. Velodyne Lidar, Inc. (US)

10.1.6. YellowScan (France)

10.1.7. Geokno India Private Limited (India)

10.1.8. Phoenix LiDAR Systems (US)

10.1.9. Leddartech Inc. (Canada)

10.1.10. Quanergy Systems, Inc. (US)

10.1.11. Innoviz Technologies Ltd. (Israel)

10.1.12. Leosphere (France)

10.1.13. Waymo LLC (US)

10.1.14. Valeo S.A. (France)

10.1.15. Neptec Technologies Corp. (Canada)

10.1.16. Ouster, Inc. (US)

10.1.17. ZX Lidars (UK)

10.2. Key Findings

10.3. Recommendations