Italy Coffee Market Industry Overview, Size, Share, Growth Trends, Research Insights and Forecast (2025–2032)

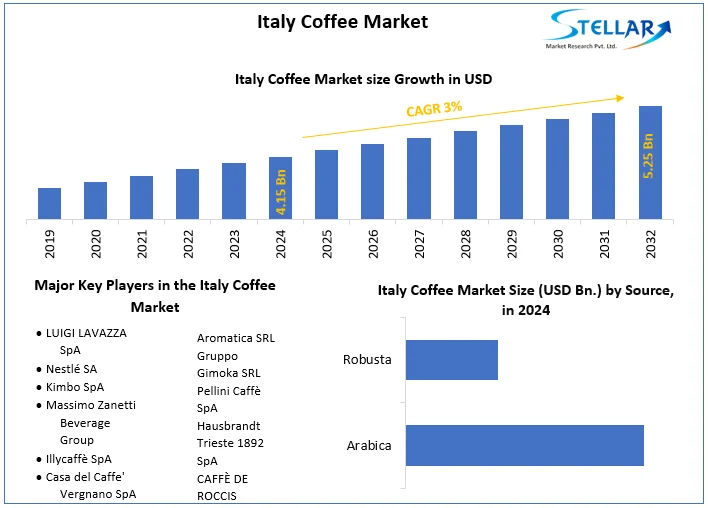

Italy Coffee Market size was valued at US$ 4.15 Bn. in 2024. Coffee will encourage a great deal of transformation in Beverage Sector in Italy.

Format : PDF | Report ID : SMR_500

Italy Coffee Market Definition:

Coffee is a brewed beverage made from roasted coffee beans, which are the fruit seeds of certain types of coffee. Grains are separated from the coffee berries to obtain a stable raw product, unroasted green coffee. The seeds are then roasted into a consumable product. Roasted coffee is crushed into small pieces, usually soaked in hot water, and then filtered to make a cup of coffee.

To get more Insights: Request Free Sample Report

Italy Coffee Market Dynamics:

Italy is Europe's second-largest importer of green coffee beans after Germany. Brazil, Vietnam, and India are Italy's major coffee suppliers, accounting for 65.2 % of Italy's coffee imports. The specialty coffee market is still a very small niche market in Italy, but it offers an interesting opportunity for exporters of high-quality coffee of special origin with a unique story. Italy's espresso blends are known around the world, so Italy is an important supplier of roasted coffee to other European countries. These factors are driving the demand for coffee in the market.

Coffee is an integral part of Italian culture. Italian consumers appreciate high-quality coffee and are loyal to certain flavors and Italian brands. Coffee is consumed at various times of the day, usually with sugar and without milk, except for cappuccino, macchiato, malocchino, and latte in this region.

75% of the coffee consumed by Italians is consumed at home. Coffee has become an integral part of Italian culture, with about 8 million bags imported annually. The availability of a wide range of coffees, flavors, and brewing styles, as well as the increasing number of grocery and retail stores, are some of the factors driving the growth of the coffee market in Italy.

Italians with a strong heritage of traditional coffee drinking culture prefer coffee from a local independent coffee shop. Italy is the top country in the number of coffees offered in Europe. Coffee quality is considered to be a major success factor for Italian coffee shops.

Increased personalization from coffee beans to standard ground coffee and coffee pods and the availability of different ranges of products offering high-quality coffee pods and capsules are expected to drive the growth of the coffee market in this region through the forecast period.

In Italy, leaders are recognizing the growing consumer trends for convenience, healthier eating, and particularly the expectation of internet availability at coffee shops. These are all hallmarks of branded coffee chain culture, which is being embraced by millennials and Generation Z driving the growth of the coffee market.

Italian coffee culture has a rich heritage as the country was an early coffee importer and the birthplace of espresso. Whether it's visiting an espresso bar in the morning or drinking coffee to put the finishing touches on a delicious rich meal, in Italy coffee consumption is a historic, time-honored ritual. This factor is driving the demand for coffee and is expected to drive through the forecast period.

Coffee is one that Italians are proud of and attached to despite the growth of third-wave coffee culture in most major coffee-consuming markets around Italy. Espresso is a symbol of Italian national identity, widely adopted in all its forms by the rest of the world: lungo, ristretto, macchiato, caffè latte, etc. The small, elegant espresso cup is widely perceived as the quintessential coffee vessel.

Traditional Italian chains are struggling to compete as consumer preferences change. Illy Caffe and Segafredo Zanetti Espresso have reduced their retail estate, while Lavazza Espression continues to trade from only one outlet.

New Trends:

Espresso was born in Italy and for many years a dark roasted coffee has been the norm. Now consumers are trending towards higher quality coffees that are roasted slightly lighter, keeping acidity to a controlled minimum and flavor to a maximum.

Market Developments:

In 2020, Caffè Musetti announced its acquistion of Caffè Bonomi Spa. Bonomi Spa is strong of a centenary territorial tradition, and acquisition main objective is to aggregate brands with a strong territorial identity in Italy but also recognized abroad as a symbol of Made in Italy.

In 2019, Illy Caffè SpA signed a framework agreement with Politecnico di Milano for the joint development of research projects to study the future of preparation systems and improve the experience of coffee consumption.

Italy Coffee Market Segment Analysis:

By Source, Robusta dominated the market with a 56 % share in 2024. Robusta coffee beans have a high caffeine content, which makes them less sour and much stronger. These beans are strong and tasty, with a pleasant chocolate aroma in the mouth. Italians prefer strong and bitter coffee. These factors are driving the growth of the segment in the market.

The objective of the report is to present a comprehensive analysis of the Italy Coffee market to the stakeholders in the industry. The report provides trends that are most dominant in the Italy Coffee market and how these trends will influence new business investments and market development throughout the forecast period. The report also aids in the comprehension of the Italy Coffee Market dynamics and competitive structure of the market by analyzing market leaders, market followers, and regional players.

The qualitative and quantitative data provided in the Italy Coffee market report is to help understand which market segments, regions are expected to grow at higher rates, factors affecting the market, and key opportunity areas, which will drive the industry and market growth through the forecast period. The report also includes the competitive landscape of key players in the industry along with their recent developments in the Italy Coffee market. The report studies factors such as company size, market share, market growth, revenue, production volume, and profits of the key players in the Italy Coffee market.

The report provides Porter's Five Force Model, which helps in designing the business strategies in the market. The report helps in identifying how many rivals are existing, who they are, and how their product quality is in the Italy Coffee market. The report also analyses if the Italy Coffee market is easy for a new player to gain a foothold in the market, do they enter or exit the market regularly if the market is dominated by a few players, etc.

The report also includes a PESTEL Analysis, which aids in the development of company strategies. Political variables help in figuring out how much a government can influence the Italy Coffee market. Economic variables aid in the analysis of economic performance drivers that have an impact on the Italy Coffee market. Understanding the impact of the surrounding environment and the influence of ecological concerns on the Italy Coffee market is aided by legal factors.

Italy Coffee Market Scope:

|

Italy Coffee Market |

|

|

Market Size in 2024 |

USD 4.15 Bn. |

|

Market Size in 2032 |

USD 5.25 Bn. |

|

CAGR (2025-2032) |

3% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

By Source

|

|

By Type

|

|

|

By Process

|

|

Italy Coffee Market KEY PLAYERS:

- LUIGI LAVAZZA SpA

- Nestlé SA

- Kimbo SpA

- Massimo Zanetti Beverage Group

- Illycaffè SpA

- Casa del Caffe' Vergnano SpA

- Aromatica SRL

- Gruppo Gimoka SRL

- Pellini Caffè SpA

- Hausbrandt Trieste 1892 SpA

- CAFFÈ DE ROCCIS

Frequently Asked Questions

Italy Coffee Market helps with the PESTEL, PORTER, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period.

Italy Coffee Market size was USD 4.15 Billion in 2024.

1. Italy Coffee Market: Research Methodology

2. Italy Coffee Market Introduction

2.1. Study Assumption and Market Definition

2.2. Scope of the Study

2.3. Executive Summary

3. Italy Coffee Market: Dynamics

3.1. Italy Coffee Market Trends

3.2. Italy Coffee Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.2.4. Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Technological Roadmap

3.6. Value Chain Analysis

3.7. Regulatory Landscape

4. Italy Coffee Market: Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Tonnes) (2024-2032)

4.1. Italy Coffee Market Size and Forecast, by Source (2024-2032)

4.1.1. Arabica

4.1.2. Robusta

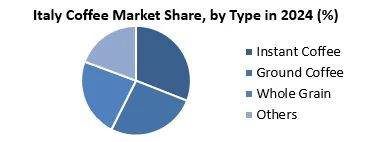

4.2. Italy Coffee Market Size and Forecast, by Type (2024-2032)

4.2.1. Instant Coffee

4.2.2. Ground Coffee

4.2.3. Whole Grain

4.2.4. Others

4.3. Italy Coffee Market Size and Forecast, by Process (2024-2032)

4.3.1. Caffeinated

4.3.2. Decaffeinated

5. Italy Coffee Market: Competitive Landscape

5.1. SMR Competition Matrix

5.2. Competitive Landscape

5.3. Key Players Benchmarking

5.3.1. Company Name

5.3.2. Product Segment

5.3.3. End-user Segment

5.3.4. Revenue (2024)

5.3.5. Company Locations

5.4. Market Structure

5.4.1. Market Leaders

5.4.2. Market Followers

5.4.3. Emerging Players

5.5. Mergers and Acquisitions Details

6. Company Profile: Key Players

6.1. LUIGI LAVAZZA SpA

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.3. Financial Overview

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

6.2. Nestlé SA

6.3. Kimbo SpA

6.4. Massimo Zanetti Beverage Group

6.5. Illycaffè SpA

6.6. Casa del Caffe' Vergnano SpA

6.7. Aromatica SRL

6.8. Gruppo Gimoka SRL

6.9. Pellini Caffè SpA

6.10. Hausbrandt Trieste 1892 SpA

6.11. CAFFÈ DE ROCCIS

7. Key Findings

8. Industry Recommendations