Iceland Fish Market: Industry Analysis and Forecast (2024-2030) Trends, Statistics, Dynamics, Segmentation by Distribution Channel, and Type, and Region

Iceland Fish Market was valued at USD 60.17 Million in 2023. Iceland’s Fish Market size is estimated to grow at a CAGR of 3.9% over the forecast period.

Format : PDF | Report ID : SMR_628

Iceland Fish Market Overview:

The report explores the Iceland Fish market's segments (Distribution Channel, and Type). Data has been provided by market participants, and regions (Hafnarfjordur, Akureyri, Egilsstadir, and Hofn). This market report provides a thorough analysis of the rapid advances that are currently taking place across all industry sectors. Facts and figures, illustrations, and presentations are used to provide key data analysis for the historical period from 2018 to 2022. The report investigates the Iceland Fish market's drivers, limitations, prospects, and barriers. This SMR report includes investor recommendations based on a thorough examination of the Iceland Fish market's contemporary competitive scenario.

Iceland Fish Market Dynamics:

The total production of fish in Iceland was 1.3 million tonnes in 2018 with a value of USD 1327.4 million. During 2008 and 2018 the quantity of fish produced decreased by 1% while its value increased by 15%. Iceland is surrounded by the juncture of the North Atlantic and Arctic Oceans. Iceland’s economy is heavily dependent on fishing which provides 405 of export earnings and employs 10% of the workforce. Iceland is a net exporter of fish and its products. Between 2002 and 2020 the total exports increased by 20% while the imports increased by 15%. The fastest-growing export markets for Fish Fillets in Iceland between 2019 and 2021 were Netherland (464.9Mn), the United States ($170Mn), Ukraine (4.58Mn), Spain ($63.5Mn), Belarus ($3.9Mn), United Kingdom ($219Mn) and France ($220Mn).

To get more Insights: Request Free Sample Report

The world’s appetite for fish has continued to increase, particularly in the urban populations and the growth in income in developing countries is leading to an increase in demand for seafood across countries. Aquaculture—fish farming—has arrived to meet this increased demand in Iceland. Production of fish from aquaculture has exploded in the past 20 years and continues to expand in Iceland. By end of 2029, it is expected that 90% of fish production will be consumed as food. At the global level, fish for human consumption is projected to increase by 16.3%, or an additional 25 Mt, to reach 180 Mt by 2029. As fish is the major source of omega-3 fatty acids, vitamin A, and B vitamins.Seafood is low in saturated fats and high in protein. All these nutrients are essential for maintaining health, particularly in the brain, eyes, and immune system.

The government of Iceland is also supporting its fisheries sectors through a wide range of policies that differ in the objectives but goals tend to center on goals such as maintaining employment and improving fishers’ welfare. The government has invested around USD 50.8 Mn for financing services to the fisheries sector and USD 112.9 Mn was recovered via cost-recovery charges. Also, other services are provided to operate their business more efficiently and sustainably such as education and training, marketing, promotion, research, and development by the government.

There is fighting illegal, unreported, and unregulated fishing that creates unfair competition between fishers. The employment opportunities also decrease by cutting the profitability of law-abiding fishers. It also further threatens the ecosystem by making use of damaging harvest methods. This also weakens the food security that depends on local seafood. These practices are creating challenges for the Iceland Fish Market during the forecast period.

The depletion of fish is also one of the major problems that have restrained the market growth in Iceland. Sustainable fishing techniques may increase the supply of seafood to meet the emerging demand over countries. Collaboration of fishermen and fish farmers with processors, distributors, retailers, restaurants, and foodservice providers is expected to provide a solution to resolve the environmental issues and further help in making the market environmentally, economically, and socially sustainable. These can prevent the Iceland Fish Market from retraining during the forecast period.

Iceland Fish Market Segment Analysis:

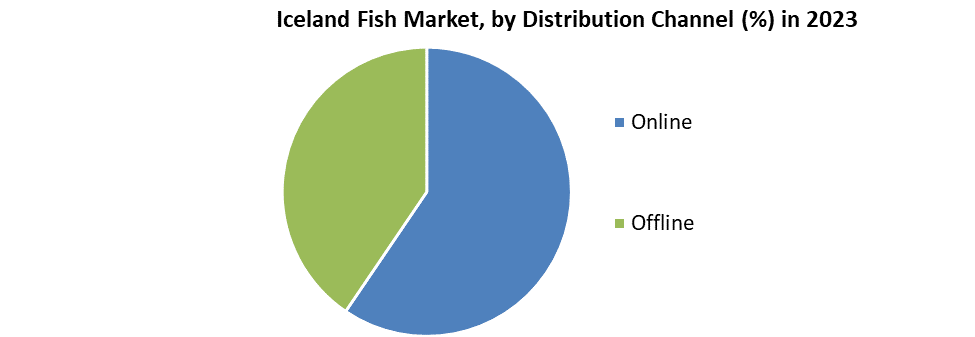

By distribution channel, the offline segment has dominated the market by holding the maximum market shares accounting for 83% in 2023. As the suppliers of the fish use traditional retail channels for increasing their sales, consumers prefer offline platforms for purchasing goods, groceries, and fish food products, where they can physically check the product’s quality. Easier access and searching for various fish products through stores are likely to drive the growth of the offline segment. Offline channels are expected to be dominant over the forecast period due to the improved distribution channel networks across countries.

By type, the marine water fish segment has dominated the market by holding the maximum market shares accounting for 63% in 2023. As Iceland is the only part of the Mid-Atlantic Ridge that rises above sea level and is covered by the North Atlantic Ocean. So marine water is the main source for the production of fish for fishers. In 2018, 1.3 million tonnes of fish were produced with a value of USD 1327.4 million were marine water fish, Hence, the marine water fish dement is dominating the Iceland Fish Market.

Iceland Fish Market Key Players Insights:

The market is characterized by the existence of several well-known firms. These companies control a large portion of the market, have a wide product portfolio, and have a global presence. In addition, the market comprises small to mid-sized competitors that sell a limited variety of items, some of which are self-publishing organizations.

The market's major companies have a significant impact because most of them have extensive global networks through which they can reach their massive client bases. To drive revenue growth and strengthen their positions in the global market, key players in the market, particularly in Iceland, are focusing on strategic initiatives such as acquisitions, new collection launches, and partnerships.

The objective of the report is to present a comprehensive analysis of the Iceland Fish market to the stakeholders in the industry. The report provides trends that are most dominant in theIceland Fish market and how these trends will influence new business investments and market development throughout the forecast period. The report also aids in the comprehension of the Iceland Fish Market dynamics and competitive structure of the market by analyzing market leaders, market followers, and regional players.

The qualitative and quantitative data provided in the Iceland Fish market report is to help understand which market segments, and regions are expected to grow at higher rates, factors affecting the market, and key opportunity areas, which will drive the industry and market growth through the forecast period. The report also includes the competitive landscape of key industry players and their recent developments in the Iceland Fish market. The report studies factors such as company size, market share, market growth, revenue, production volume, and profits of the key players in the Iceland Fish market.

The report provides Porter's Five Force Model, which helps in designing the business strategies in the market. The report helps in identifying how many rivals exist, who they are, and how their product quality is in the Iceland Fish market. The report also analyses if the Iceland Fish market is easy for a new player to gain a foothold in the market, do they enter or exit the market regularly, if the market is dominated by a few players, etc.

The report also includes a PESTEL Analysis, which aids in the development of company strategies. Political variables help in figuring out how much a government can influence the Iceland Fish market. Economic variables aid in the analysis of economic performance drivers that have an impact on the Iceland Fish market. Understanding the impact of the surrounding environment and the influence of environmental concerns on theIceland Fish market is aided by legal factors.

Iceland Fish Market Scope:

|

Iceland Fish Market |

|

|

Market Size in 2023 |

USD 60.17 Mn. |

|

Market Size in 2030 |

USD 78.65 Mn. |

|

CAGR (2024-2030) |

3.9% |

|

Historic Data |

2018-2022 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

|

Segment Scope |

By Distribution Channel

|

|

By Type

|

|

Iceland Fish MARKET KEY PLAYERS:

- Seafood King EU B.V. (London)

- Van der Lee Seafish (Urk)

- Northseafood Holland B.V (Urk)

- Kalloni S.A (Kimmeria)

- Seafood from Norway (Norway )

Frequently Asked Questions

The market size of the Iceland Fish Market by 2030 is expected to reach USD 78.65 Million.

The forecast period for the Iceland Fish Market is 2024-2030

The market size of the Iceland Fish Market in 2023 was valued at USD 60.17 Million.

1. Research Methodology

1.1 Research Data

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. Iceland Fish Market Executive Summary

2.1. Market Overview

2.2. Market Size (2023) and Forecast (2024 – 2030) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments

3. Iceland Fish Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Product Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2023)

3.2.7. Profit Margin

3.2.8. Market Share

3.2.9. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

3.4.1. Strategic Initiatives

3.4.2. Mergers and Acquisitions

3.4.3. Collaborations and Partnerships

3.4.4. Developments and Innovations

4. Iceland Fish Market: Dynamics

4.1. Iceland Fish Market Trends

4.2. Iceland Fish Market Drivers

4.3. Iceland Fish Market Restraints

4.4. Iceland Fish Market Opportunities

4.5. Iceland Fish Market Challenges

4.6. PORTER’s Five Forces Analysis

4.6.1. Intensity of the Rivalry

4.6.2. Threat of New Entrants

4.6.3. Bargaining Power of Suppliers

4.6.4. Bargaining Power of Buyers

4.6.5. Threat of Substitutes

4.7. PESTLE Analysis

4.7.1. Political Factors

4.7.2. Economic Factors

4.7.3. Social Factors

4.7.4. Technological Factors

4.7.5. Legal Factors

4.7.6. Environmental Factors

4.8. Value Chain Analysis and Supply Chain Analysis

4.9. Trade Analysis

4.9.1. Import Scenario

4.9.2. Export Scenario

4.10. Technological Roadmap

4.11. Regulatory Landscape

5. Iceland Fish Market: Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2030)

5.1. Iceland Fish Market Size and Forecast, by Type (2024-2030)

5.1.1. Freshwater Fish

5.1.2. Marine Water Fish

5.2. Iceland Fish Market Size and Forecast, by Distribution Channel (2024-2030)

5.2.1. Online

5.2.2. Offline

6. Company Profile: Key Players

6.1. Seafood King EU B.V. (London)

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.2.1. Product Name

6.1.2.2. Product Details

6.1.3. Financial Overview

6.1.3.1. Total Revenue

6.1.3.2. Segment Revenue

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

6.2. Van der Lee Seafish (Urk)

6.3. Northseafood Holland B.V (Urk)

6.4. Kalloni S.A (Kimmeria)

6.5. Seafood from Norway (Norway)

7. Key Findings

8. Analyst Recommendations

8.1. Strategic Recommendations

8.2. Future Outlook