Germany Esports Market Size, Share, Growth Trends, Industry Analysis, Key Players, Investment Opportunities and Forecast (2025-2032)

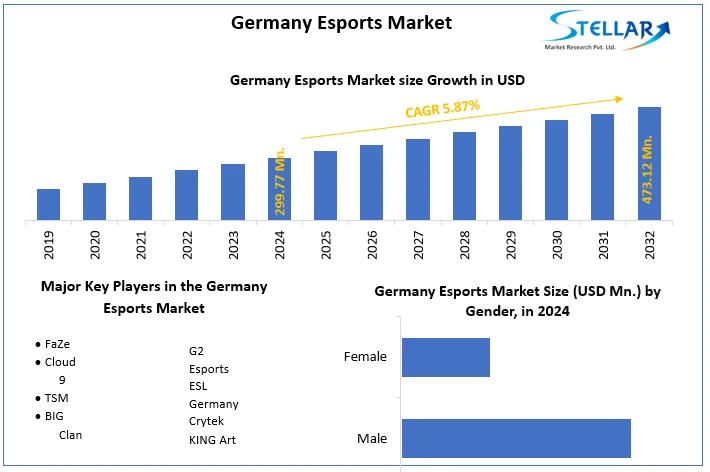

The Germany Esports Market size was valued at USD 299.77 Mn. in 2024. The total German Esports Market revenue is expected to grow at a CAGR of 5.87% from 2025 to 2032, reaching nearly USD 473.12 Mn. in 2032.

Format : PDF | Report ID : SMR_1581

Germany Esports Market Overview

The Comprehensive report of Stellar provides the research on German esports market, focusing on significant results and suggestions. The research examines the evolution and relevance of the German esports business, including through an examination of market size, growth trends, and significant participants. Germany's esports organization offers attractive investment potential, with over $XX million in venture capital expected by 2024. Esports organizations, game developers, streaming platforms, infrastructure suppliers, and data analytics corporations are among the most promising investment opportunities. Mobile esports, esports education, and virtual and augmented reality applications are all expected to rise significantly. The expected user penetration of 24.3% by 2030 shows a growing esports audience from various demographics.

Professionalization is visible in the form of increased sponsorships, improved production quality, and established leagues, all of which promote legitimacy and market growth. Government funding and prospective Olympic inclusion signify institutional recognition, which increases mainstream acceptability. Technological advancements, such as enhanced broadcasting, VR/AR integration, and mobile esports, offer increased accessibility. Embracing diversity by extending different types of games and supporting female esports hopes to attract new viewers and sponsors. Mobile esports is expected to account for 50% of the market by 2030, driving significant development. Increased media attention and collaboration with existing sports leagues might increase popularity and profitability. Germany has the potential to become a leading esports powerhouse, attracting international talent and tournaments.

To get more Insights: Request Free Sample Report

The growing number of esports enthusiasts and viewers

The Esports has gained immense popularity in Germany, with a growing number of esports enthusiasts and viewers. Major Esports tournaments and leagues attract a large audience, both online and in-person. Germany's gaming community, which includes 91% of 16-29-year-olds, has quickly adopted esports as a spectator sport. Major events increasingly take place online, removing barriers and encouraging widespread participation. Esports' increasing professionalism, as evidenced by sponsorships and high-value events, legitimizes the business and attracts larger audiences. The diversity of games across genres appeals to a wide range of demographics, increasing interest. The COVID-19 epidemic worked as a catalyst, driving up esports viewing as people sought amusement during lockdowns and limitations. Ultimately, the German esports scene represents a vibrant and inclusive gaming culture.

|

Esports is one of the world's fastest-growing industries, with around 500 million enthusiasts globally. |

|

Viewership hours on German esports streaming platforms like Twitch grew by 83% between 2018 and 2023. |

|

Attendance at major esports tournaments in Germany, such as ESL One Cologne, has consistently increased over the past five years. |

|

Venture capital investment in German esports organizations and entrepreneurs surpassed €50 million in 2023, indicating increased investor confidence.

|

Perception and Recognition

Despite the growing popularity of esports, there is still a perception gap in Germany regarding its legitimacy as a sport. Some traditionalists do not recognize esports as a valid sporting activity, which is expected to impact funding, sponsorships, and mainstream acceptance. Limited money restricts infrastructure and training in German esports since traditional sports financing remains unattainable. Sponsorship hesitancy exists owing to public perception and mainstream recognition issues. Esports experience media prejudice, with less coverage than traditional sports, restricting visibility. Strict visa requirements make it difficult to attract overseas talent, harming team makeup and competitiveness.

Germany Esports Market Segment Analysis

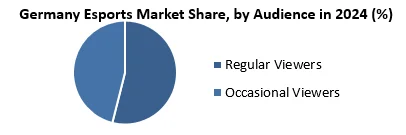

By Audience, Regular Viewers segments hold the largest share of the esports market, estimated at around 55%. Regular viewers generate cash through streaming subscriptions, in-game purchases, and goods, as well as increasing live event attendance. Its strong brand loyalty increases awareness, which leads to long-term relationships. Consistent involvement drives esports growth by attracting investors, developing infrastructure, and creating content inside the ecosystem.

|

Germany Esports Market Scope |

|

|

Market Size in 2024 |

USD 299.77 Mn. |

|

Market Size in 2032 |

USD 473.12 Mn. |

|

CAGR (2025-2032) |

5.87 % |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

By Gender

|

|

By Audience

|

|

|

By Revenue Model

|

|

Key Players in the German Esports Market

- FaZe

- Cloud9

- TSM

- BIG Clan

- G2 Esports

- ESL Germany

- Crytek

- KING Art

Frequently Asked Questions

There are opportunities for the establishment of esports education programs and training facilities. Collaboration with educational institutions to foster talent development is on the rise.

The Germany Esports Market size was valued at USD 299.77 Million in 2024. The total Germany Esports market revenue is expected to grow at a CAGR of 5.87 % from 2025 to 2032, reaching nearly USD 473.12 Million by 2032.

1. Germany Esports Market Introduction

1.1. Study Assumption and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

1.4. Milestones and Significant Events

2. Germany Esports Market: Dynamics

2.1. Germany Esports Market Trends

2.2. PORTER’s Five Forces Analysis

2.3. PESTLE Analysis

2.4. Key Opinion Leader Analysis for the Industry

2.5. Esports Arenas and Venues

2.6. Technological Advancements Supporting Esports

2.7. Profile of Esports Enthusiasts in Germany

2.8. Viewer and Player Demographics

2.9. Key Sponsors and Investors in the German Esports Scene

2.10. Integration of Esports in Education

2.11. Legal Framework for Esports in Germany

2.12. Esports Organizations and Communities

2.13. Key Opinion Leader Analysis for the German Esports Industry

3. Germany Esports Market: Market Size and Forecast by Segmentation for (by Value in USD Million) (2024-2032)

3.1. Germany Esports Market Size and Forecast, by Gender (2024-2032)

3.1.1. Male

3.1.2. Female

3.2. Germany Esports Market Size and Forecast, by Audience (2024-2032)

3.2.1. Regular Viewers

3.2.2. Occasional Viewers

3.3. Germany Esports Market Size and Forecast, by Revenue Model (2024-2032)

3.3.1. Sponsorship & advertising

3.3.2. Esports betting & fantasy site

3.3.3. Prize pool

3.3.4. Amateur & micro tournament

3.3.5. Merchandising

3.3.6. Ticket sale

4. Germany Esports Market: Competitive Landscape

4.1. Stellar Competition Matrix

4.2. Competitive Landscape

4.3. Key Players Benchmarking

4.3.1. Company Name

4.3.2. Product Segment

4.3.3. End-user Segment

4.3.4. Revenue (2024)

4.4. Market Analysis by Organized Players vs. Unorganized Players

4.4.1. Organized Players

4.4.2. Unorganized Players

4.5. Leading German Digital Payment Market Companies, by market capitalization

4.6. Market Trends and Challenges in Australia

4.6.1. Technological Advancements

4.6.2. Affordability and Accessibility

4.6.3. Shortage of Skilled Professionals

4.7. Market Structure

4.7.1. Market Leaders

4.7.2. Market Followers

4.7.3. Emerging Players in the Market

4.7.4. Challenges

4.7.5. Mergers and Acquisitions Details

5. Company Profile: Key Players

5.1. FaZe

5.1.1. Company Overview

5.1.2. Business Portfolio

5.1.3. Financial Overview

5.1.4. SWOT Analysis

5.1.5. Strategic Analysis

5.1.6. Details on Partnership

5.1.7. Potential Impact of Emerging Technologies

5.1.8. Regulatory Accreditations and Certifications Received by Them

5.1.9. Strategies Adopted by Key Players

5.1.10. Recent Developments

5.2. Cloud9

5.3. TSM

5.4. BIG Clan

5.5. G2 Esports

5.6. ESL Germany

5.7. Crytek

5.8. KING Art

6. Key Findings

7. Industry Recommendations

8. Germany Esports Market: Research Methodology