Germany Digital Payment Market Size, Share, Growth Trends, Industry Analysis, Key Players, Investment Opportunities and Forecast (2025-2032)

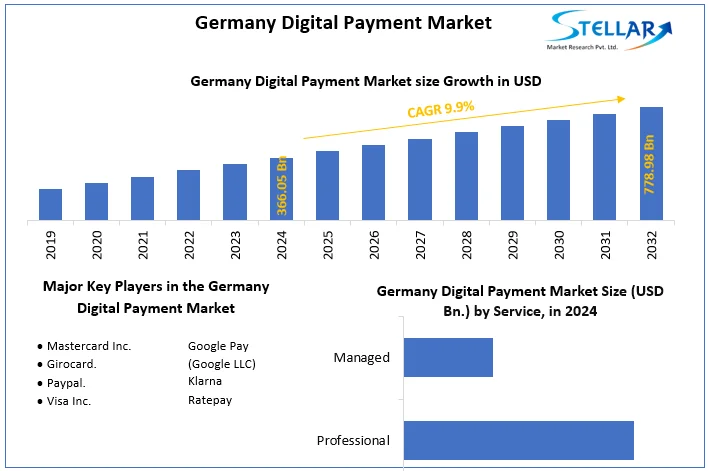

The German Digital Payment Market size was valued at USD 366.05 Billion in 2024. The total German Digital Payment Market revenue is expected to grow at a CAGR of 9.90 % from 2025 to 2032, reaching nearly USD 778.98 Billion in 2032.

Format : PDF | Report ID : SMR_1574

Germany Digital Payment Market Overview

The Stellar Report covers the current State of the Digital Payment Market in Germany, highlighting the growth trajectory and key players in the Industry. The report provides an analysis of the trends such as an increase in mobile payments, contactless transactions, and the impact of regulatory frameworks set the foundation for understanding the market dynamics. The increasing e-commerce sector, driven by digital payments, is explored in detail. The report underscores its role in job creation, revenue generation, and the overall economic impact on the market. The German digital payments market presents desirable investment opportunities for a variety of stakeholders, including fintech startups developing innovative payment solutions, established financial institutions growing digital services, technology firms providing platform solutions, and investors who want to be exposed to thriving e-commerce and digital economies.

The growth of e-commerce drives the German digital payments sector, encouraging customers to use digital payment methods. Growing mobile payment use, driven by greater smartphone usage and mobile wallet convenience, adds to market growth. Government programs, such as "Deutschland bargello," encourage cashless transactions, while technical advances, such as contactless payments and biometrics, improve security and user experience. Consumer tastes are shifting, particularly among younger generations, favoring digital payments.

To get more Insights: Request Free Sample Report

Growth of the E-commerce sector in Germany

The e-commerce sector in Germany has witnessed substantial growth, leading to a higher demand for digital payment solutions. The increasing e-commerce sector encourages job creation in shipping, customer service, information technology, and marketing, thus strengthening the economy and increasing tax income. Digital payments provide consumers with a quick, safe, and typically contactless online payment option, improving the shopping experience and encouraging more online purchases. The increase in e-commerce promotes increased competition, which is expected to lead to reduced costs and benefit both online and traditional merchants implementing omnichannel tactics. Digital payments also help to increase financial inclusion by reaching out to unbanked or underbanked people, allowing them to participate in the digital economy. It also drives advancements in cybersecurity, data analytics, and artificial intelligence.

Some Key highlights of the digital payment market are covered in the Stellar report.

|

|

|

|

Security Concerns Remain a significant Barrier in Germany

Security issues restrict the digital payments market in Germany, resulting in slow growth. Consumer unwillingness has an impact on fintech companies, retailers, and the entire e-commerce ecosystem. The hesitation to embrace digital payments reduces transaction volumes, reducing revenue opportunities for stakeholders. The opposition promotes market fragmentation as consumers adhere to familiar cash transactions or other payment methods, slowing the adoption of innovative technologies.

According to the Stellar Estimations, recorded cyberattacks against German organizations increased by 38% between 2018 and 2023. Annual losses due to payment fraud in Germany increased from $XX billion in 2018 to $XX billion in 2023, indicating the growing risk. Stellar Research discovered that 42% of German consumers value data security, while 37% are concerned about fraud in digital payments.

Germany Digital Payment Market Segment Analysis

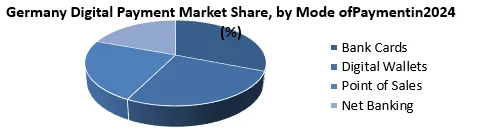

By Mode of Payment, the Bank Cards segment holds the dominant share of the German Digital Payment market, estimated at around 60%. Cards continue to dominate the Australian retail environment, both in physical stores and online, and are largely recognized and preferred by consumers because of their ubiquitous convenience. Such ubiquity encourages widespread adoption, particularly among small retailers and independent vendors. In the Australian market, debit cards (Eftpos) have a notable advantage over credit cards in terms of customer purchasing habits and transaction values.

Debit and credit cards play a substantial role in the transaction volume of the Australian digital payment market, particularly in larger purchases. Australians utilize cards not only for everyday expenses such as groceries and dining but also for significant transactions such as electronics, travel, and bill payments. The robust transaction activity positions cards as essential contributors to the ongoing growth and value of the Australian digital payment landscape.

|

Germany Digital Payment Market Scope |

|

|

Market Size in 2024 |

USD 366.05 Bn. |

|

Market Size in 2032 |

USD 778.98 Bn. |

|

CAGR (2025-2032) |

9.90% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

By Service

|

|

By Solution

|

|

|

By Mode of Payment

|

|

|

By Organization Size

|

|

|

By Deployment Mode

|

|

|

By Industry

|

|

Key Players in the German Digital Payment Market

Frequently Asked Questions

The German digital payment Market size was valued at USD 366.05 billion in 2024. The total German digital payment market revenue is expected to grow at a CAGR of 9.90% from 2025 to 2032, reaching nearly USD 778.98 billion by 2032.

1. Germany Digital Payment Market: Research Methodology

1.1. Research Data

1.1.1. Secondary Data

1.1.2. Primary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. Germany Digital Payment Market: Introduction

2.1. Study Assumption and Market Definition

2.2. Scope of the Study

2.3. Executive Summary

3. Germany Digital Payment Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Service Segment

3.2.3. End-user Segment

3.2.4. Revenue (2024)

3.2.5. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Mergers and Acquisitions Details

4. Germany Digital Payment Market: Dynamics

4.1. Germany Digital Payment Market Trends

4.2. Germany Digital Payment Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.2.4. Challenges

4.3. PORTER’s Five Forces Analysis

4.4. PESTLE Analysis

4.5. Technological Roadmap

4.6. Regulatory Landscape

5. Germany Digital Payment Market: Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

5.1. Germany Digital Payment Market Size and Forecast, by Service (2024-2032)

5.1.1. Professional

5.1.2. Managed

5.2. Germany Digital Payment Market Size and Forecast, by Solution (2024-2032)

5.2.1. Payment Gateway

5.2.2. Payment Processing

5.2.3. Payment Security & Fraud Management

5.3. Germany Digital Payment Market Size and Forecast, by Mode of Payment (2024-2032)

5.3.1. Bank Cards

5.3.2. Digital Wallets

5.3.3. Point of Sales

5.3.4. Net Banking

5.4. Germany Digital Payment Market Size and Forecast, by Organization Size (2024-2032)

5.4.1. SMEs

5.4.2. Large Enterprises

5.5. Germany Digital Payment Market Size and Forecast, by Deployment Mode (2024-2032)

5.5.1. Cloud

5.5.2. On-premises

5.6. Germany Digital Payment Market Size and Forecast, by Industry (2024-2032)

5.6.1. BFSI

5.6.2. Healthcare

5.6.3. IT & Telecom

5.6.4. Retail & E-commerce

5.6.5. Transportation

6. Company Profile: Key Players

6.1. Mastercard Inc.

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.3. Financial Overview

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

6.2. Girocard.

6.3. Paypal.

6.4. Visa Inc.

6.5. Google Pay (Google LLC)

6.6. Klarna

6.7. Ratepay

7. Key Findings

8. Analyst Recommendations

8.1. Strategic Recommendations

8.2. Future Outlook