Germany AI in FinTech Market Size, Share, Growth Trends, Industry Analysis, Key Players, Investment Opportunities and Forecast (2025-2032)

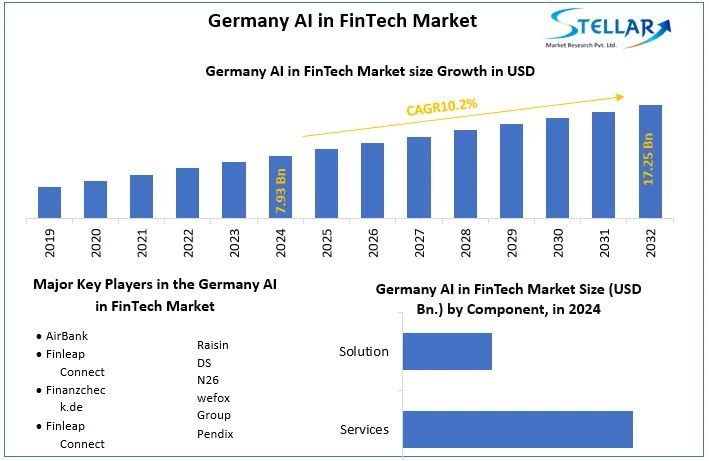

The German AI in FinTech Market size was valued at USD 7.93 Billion in 2024. The total German AI in FinTech Market revenue is expected to grow at a CAGR of 10.2 % from 2025 to 2032, reaching nearly USD 17.25 Billion in 2032.

Format : PDF | Report ID : SMR_1567

Germany AI in FinTech Market Overview

The Stellar comprehensive report analyzes the German AI in the FinTech industry indicating a dynamic landscape driven by technological developments, particularly in machine learning and natural language processing. The rapid usage of AI tools in automation, fraud detection, personalized finance, and risk management drives FinTech innovation. Open banking initiatives promote collaboration by allowing data sharing between FinTechs and traditional financial institutions. Continuous advances in AI technologies and data analytics capabilities drive the sector's growth. The German government actively supports AI development through initiatives such as the National Strategic AI Program and the Platform for Artificial Intelligence. Public funding in AI research has more than doubled from $400 million in 2018 to $1 billion in 2024. With its significant development potential, the AI in the FinTech market offers appealing investment opportunities for venture capitalists, private equity firms, and angel investors the landscape provides a varied range of options, from AI FinTech startups to established firms merging AI and technology suppliers to produce creative solutions. Personalized finance, robo-advisors, fraud detection, regulatory compliance, and AI-powered customer care are all key areas of attention. The AI FinTech sector is creating new jobs, and attracting skilled professionals in data science, software development, machine learning, and finance.

- 500+ AI startups currently operating in Germany

- According to Stellar estimations suggest that the expected 2 million AI-related job opportunities in Germany by 2030.

- AI-powered solutions for fraud detection and anomaly identification helps financial institutions avoid significant financial losses, leading to high profit margins.

To get more Insights: Request Free Sample Report

Smart Automation for Operational Efficiency

Implementing automation in corporate processes has numerous benefits. For example, it improves productivity by freeing human resources from repetitive duties, allowing them to focus on strategic and creative endeavors, thus increasing total efficiency. Also, the streamlining results in cost savings across a variety of operational areas, including labor charges, error correction, and resource usage. Customers benefit from faster and more accurate processing of requests and verifications, which encourages increased satisfaction and loyalty. In addition, the data-driven insights made possible by AI automation enable informed decision-making and effective risk management. Ultimately, organizations that embrace smart automation get an economic advantage through faster turnaround times, more accuracy, and lower costs.

Key Highlights of the Report

- A study by Stellar found that AI-powered automation is expected to increase German GDP by up to 7.2% by 2030.

- German businesses have been saving $XX billion annually by 2030 through automation

- AI could create XX million new jobs in Germany by 2030 while automating around XX million existing roles.

Dependency on Data Quality

Biased algorithms based on biased information increase the danger of discriminatory lending and unfair insurance pricing, creating reputational damage and a loss of faith in FinTech. Inaccurate risk assessments and fraud detection models can result in financial losses for customers and organizations. Incorrect AI-driven investment decisions based on bad data contribute to market volatility, potentially leading to financial crises. According to Stellar, low data quality costs businesses $ XX trillion per year globally. Calculating it to the German economy indicates a potentially massive impact. Also, 85% of AI projects fail owing to poor data quality, highlighting the critical need for strong data governance procedures in the German FinTech industry.

Germany AI in FinTech Market Segment Analysis

By Application, Customer Behavioral Analytics holds a significant share around 55% showcasing its dominance in Germany. AI has a major impact on FinTech, personalizing user experiences through targeted suggestions, marketing efforts, and customized product offerings. It improves risk management by forecasting customer behavior and identifying probable fraud. In addition, artificial intelligence improves customer service by understanding users' requirements and preferences, allowing for more efficient personalized support.

|

Germany AI in the FinTech Market Scope |

|

|

Market Size in 2024 |

USD 7.93 Bn. |

|

Market Size in 2032 |

USD 17.25 Bn. |

|

CAGR (2025-2032) |

10.2% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

By Component

|

|

By Application

|

|

|

By Deployment Type

|

|

Key Players in the German AI Fintech Market

- AirBank

- Finleap Connect

- Finanzcheck.de

- Finleap Connect

- Raisin DS

- N26

- wefox Group

- Pendix

Frequently Asked Questions

Key drivers include the need for enhanced cybersecurity, the demand for personalized financial services, regulatory compliance requirements, and the pursuit of operational efficiency through AI-driven solutions.

The German AI in Fintech Market size was valued at USD 7.93 billion in 2024. The total German AI in Fintech market revenue is expected to grow at a CAGR of 10.2% from 2025 to 2032, reaching nearly USD 17.25 billion by 2032.

1. Germany AI in FinTech Market: Research Methodology

1.1. Research Data

1.1.1. Secondary Data

1.1.2. Primary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. Germany AI in FinTech Market: Introduction

2.1. Study Assumption and Market Definition

2.2. Scope of the Study

2.3. Executive Summary

3. Germany AI in FinTech Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Service Segment

3.2.3. End-user Segment

3.2.4. Revenue (2024)

3.2.5. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Mergers and Acquisitions Details

4. Germany AI in FinTech Market: Dynamics

4.1. Germany AI in FinTech Market Trends

4.2. Germany AI in FinTech Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.2.4. Challenges

4.3. PORTER’s Five Forces Analysis

4.4. PESTLE Analysis

4.5. Technological Roadmap

4.6. Regulatory Landscape

5. Germany AI in FinTech Market: Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

5.1. Germany AI in FinTech Market Size and Forecast, by Component (2024-2032)

5.1.1. Services

5.1.2. Solution

5.2. Germany AI in FinTech Market Size and Forecast, by Application (2024-2032)

5.2.1. Customer Behavioral Analytics

5.2.2. Business Analytics and Reporting

5.2.3. Virtual Assistants (Chatbots)

5.3. Germany AI in FinTech Market Size and Forecast, by Deployment Mode (2024-2032)

5.3.1. Cloud

5.3.2. On-premises

6. Company Profile: Key Players

6.1. AirBank

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.3. Financial Overview

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

6.2. Finleap Connect

6.3. Finanzcheck.de

6.4. Finleap Connect

6.5. Raisin DS

6.6. N26

6.7. wefox Group

6.8. Pendix

7. Key Findings

8. Analyst Recommendations

8.1. Strategic Recommendations

8.2. Future Outlook