Europe Online Gambling Market- Industry Analysis and Forecast (2025-2032) Trends, Statistics, Dynamics, Segmentation by Type, Device and Region

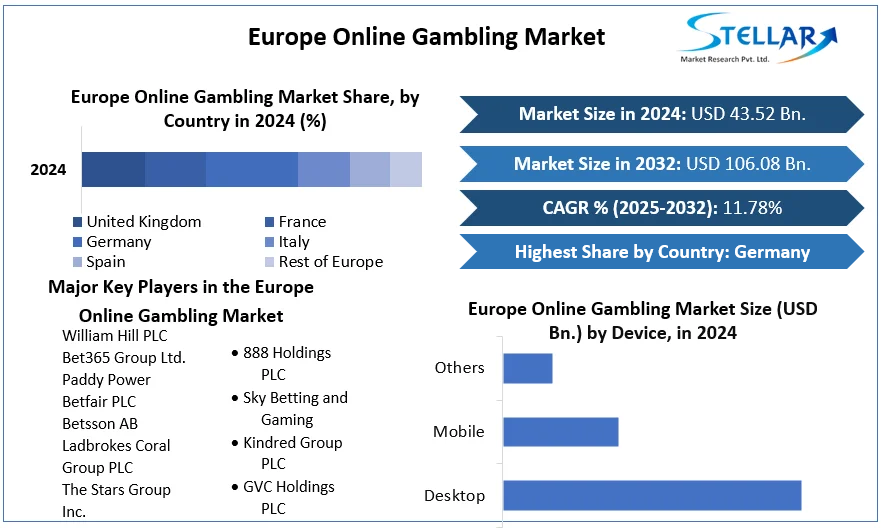

Europe Online Gambling Market was valued at US$ 43.52 Bn. in 2024 and Market size is estimated to grow at a CAGR of 11.78% & is expected to reach at US$ 106.08 Bn. by 2032.

Format : PDF | Report ID : SMR_256

Europe Online Gambling Market Overview:

Smartphone demand is expanding, internet technology is improving, & consumers' buying power is increasing, to name a few aspects contributing to the expansion of the digital gaming sector. Online gambling software suppliers are aggressively investing in innovative technologies & partnering with them to improve the customer experience, which will increase player interest. For example, William Hill Plc. partnered with CBS Sports in September 2024. The corporation announced the debut of a wide range of digital material as a result of their relationship. Free-to-play games, video programming, & editorial content from William Hill are just a few of their offers for sports bettors and fans across the CBS Sports Digital environment.

To get more Insights: Request Free Sample Report

Despite the fact that Europe is seen as a "one state" in terms of economic significance & is regulated to some extent by European Union legislation, individual countries are still ultimately responsible for establishing their own laws. This is especially true in the gambling industry, where there is no legislation or regulation governing betting and gaming across Europe. As a result, staying on top of the legality of gambling, especially online gambling, across the continent is a difficult task. Many of the top gaming sites serve the European market, but what is allowed & what is not might vary substantially from one region to the next.

Jurisdictions for Online Gambling Throughout Europe:

In Europe, there are a number of online gambling jurisdictions. Some are members of the European Union (EU) & hence subject to its many rules & regulations, while others are self-governing. Each of these jurisdictions has a body in charge of approving gambling sites for licenses that allow them to legally offer their services. Their licensees are likewise regulated by them.

France's Gambling Laws:

In France, many types of gambling are permitted, & there are three primary authorities in charge of regulating them. Horse racing is handled by the Pari Mutuel Urbain, betting games & lotteries are handled by the Francaise des Jeux, and online gambling is handled by ARJEL. Following requests from the European Union, the French government submitted a new legislative measure dealing to internet gambling in 2009, and three forms of online gambling were legally legalized in the year 2010. Sports betting (live betting, fixed odds betting, and pool betting), horse racing betting (pool betting only), and poker were the three options. ARJEL issues licenses to operators who want to deliver these services to French citizens. At present time, there are no licenses available for casino games, spread betting, or sports betting.

Spain's Gambling Laws

Spain's gambling regulations have been changed multiple times in recent years. The most recent modifications went into effect in 2012, when businesses were able to apply for licenses to operate in the zone if they met specific criteria. The Spanish National Gaming Commission granted several companies licenses, and they were permitted to operate as a result. Residents of Spain can currently gamble and play at any of the country's licensed gambling sites. Many of the most well-known and well-known brands, including as Bet365 & William Hill, offer dedicated Spanish betting, poker, & other sorts of gaming sites.

Online gambling and Artificial intelligence in Europe:

Artificial intelligence (AI) has altered the internet gambling industry, as well as other industries like as Spotify, Netflix, & Amazon, to name a few, in recent years, and will likely continue to do so in the years ahead as AI use grows exponentially. The use of AI in these industries aids in the learning of habits, patterns, behaviour (sometimes even emotions), and interactions, hence maximizing the potential reach of these organizations’ services and goods. However, AI can also introduce new forms of gambling or social betting in the online gambling arena, where AI can automate and create odds, set pay-outs, and target or segment individuals for this type of betting/gaming.

AI is also a powerful ally in improving customer service, preventing fraud, & automating some regulatory compliance, like AML & CFT checks. It can be used for onboarding, age restrictions, & geolocation, among other things. AI is also utilised to govern player behaviour so that problem gamblers can be identified and intervened with before they self-exclude. AI can also be used to automate the self-exclusion process. AI also aids in the more effective use of client data, resulting in better products and more personalized experiences for gamers. Its full potential has yet to be realised, and stellar market predict increased AI adoption in the gaming business in the coming years.

In 2024, the gambling & casino industries will be transformed by trends.

Land-Based Casinos on the Decline With the increasing success of internet gambling sites, land-based casinos are feeling the heat from their online counterparts and are on the decline. Over the last year, rates have decreased, owing to the fact that customers must make an effort to get to a real casino. These physical casinos are clustered in one location, such as Las Vegas or the Jersey Shore. To get to these brick-and-mortar casinos, people must spend a significant amount of money. Before a client even enters the casino, he or she has already spent a significant amount of money and time to be able to play a game. Because of this, consumers are opting to save their transport and other incidental costs, and they channel these figures to online gaming, where they can use their money for bets instead. Online casinos have the edge because they offer more privacy and more convenience to their players. On top of that, online casinos also offer a better and more vibrant gaming experience. Some online casinos have numerous games to offer that players are hard-pressed to choose. These games even go through routine upgrades, so clients will always enjoy their experience. This is something that land-based casinos cannot be at par with because of their limited games.

Slot Machine Upgrades

As casinos try to appeal to a younger demographic, the industry will continue to integrate slot machines with a skill component. After all, these types of gaming elements may be found in the many video games & gaming consoles that younger attendees grew up playing. This demonstrates that people desire to be entertained & engaged at all times. People will surely become bored if they are provided with material that is repetitious. And casino operator don't want this to happen to their customers since the instant they start to feel bored, they start thinking about leaving to find anything else to do. Upgrading those slot machines necessitates ongoing maintenance.

Interaction is altered via interactive gaming systems.

Many online casinos provide the best online material to meet & exceed the expectations of its countless customers. Users can now access interesting & engaging online games in a more luxury lounge setting thanks to technical advancements like touch-enabled kiosks, wall panels, & tables. The popularity of online & social gaming can be brought to the real casino floor using interactive gaming systems. Interactive gaming has always been the name of the game, which is why even when today's casino patrons were young, they were already having fun with their old Atari, Sega, or Nintendo interactive gaming systems.

Insights from COVID19

The market is expected to benefit from the COVID-19 epidemic. Countries all around the world have set restrictions and are advocating social separation in order to prevent the virus from spreading. People's movement restrictions are expected to have a severe impact on land-based casino operations. As a result of the ban on land-based gambling, many gamers are turning to internet gaming. However, the postponement of major sporting events around the world is having a negative influence on sports betting, limiting industry growth.

The objective of the report is to present a comprehensive analysis of the Europe Online Gambling Market to the stakeholders in the industry. The report provides trends that are most dominant in the Europe Online Gambling Market and how these trends will influence new business investments and market development throughout the forecast period. The report also aids in the comprehension of the Europe Online Gambling Market dynamics and competitive structure of the market by analyzing market leaders, market followers, and regional players.

The qualitative and quantitative data provided in the Europe Online Gambling Market report is to help understand which market segments, regions are expected to grow at higher rates, factors affecting the market, and key opportunity areas, which will drive the industry and market growth through the forecast period. The report also includes the competitive landscape of key players in the industry along with their recent developments in the Europe Online Gambling Market. The report studies factors such as company size, market share, market growth, revenue, production volume, and profits of the key players in the Europe Online Gambling Market.

The report provides Porter's Five Force Model, which helps in designing the business strategies in the market. The report helps in identifying how many rivals are existing, who they are, and how their product quality is in the Market. The report also analyses if the Europe Online Gambling Market is easy for a new player to gain a foothold in the market, do they enter or exit the market regularly if the market is dominated by a few players, etc.

The report also includes a PESTEL Analysis, which aids in the development of company strategies. Political variables help in figuring out how much a government can influence the Market. Economic variables aid in the analysis of economic performance drivers that have an impact on the Market. Understanding the impact of the surrounding environment and the influence of environmental concerns on the Europe Online Gambling Market is aided by legal factors.

Europe Online Gambling Market Scope:

|

Europe Online Gambling Market |

|

|

Market Size in 2024 |

USD 43.52 Bn. |

|

Market Size in 2032 |

USD 106.08 Bn. |

|

CAGR (2025-2032) |

11.78% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

By Type

|

|

By Device

|

|

|

Country Scope |

|

Europe Online Gambling Market Major Players:

- William Hill PLC

- Bet365 Group Ltd.

- Paddy Power Betfair PLC

- Betsson AB

- Ladbrokes Coral Group PLC

- The Stars Group Inc.

- 888 Holdings PLC

- Sky Betting and Gaming

- Kindred Group PLC

- GVC Holdings PLC

Frequently Asked Questions

Mobile segment is the dominating end use segment in the market.

William Hill PLC, Bet365 Group Ltd., Paddy Power Betfair PLC, Betsson AB Ladbrokes Coral Group PLC, The Stars Group Inc., 888 Holdings PLC, Sky Betting and Gaming, Kindred Group PLC, GVC Holdings PLC.

The major factors for the growth of the Europe Online Gambling market includes high internet penetration and increasing use of mobile phones among individuals for playing online games from their homes and public places.

1. Research Methodology

1.1 Research Data

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. Europe Online Gambling Market Executive Summary

2.1. Market Overview

2.2. Market Size (2024) and Forecast (2025 – 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments and Country

3. Europe Online Gambling Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Business Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2024)

3.2.7. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

3.4.1. Strategic Initiatives

3.4.2. Mergers and Acquisitions

3.4.3. Collaborations and Partnerships

3.4.4. Developments and Innovations

4. Europe Online Gambling Market: Dynamics

4.1. Europe Online Gambling Market Trends

4.2. Europe Online Gambling Market Drivers

4.3. Europe Online Gambling Market Restraints

4.4. Europe Online Gambling Market Opportunities

4.5. Europe Online Gambling Market Challenges

4.6. PORTER’s Five Forces Analysis

4.6.1. Intensity of the Rivalry

4.6.2. Threat of New Entrants

4.6.3. Bargaining Power of Suppliers

4.6.4. Bargaining Power of Buyers

4.6.5. Threat of Substitutes

4.7. PESTLE Analysis

4.7.1. Political Factors

4.7.2. Economic Factors

4.7.3. Social Factors

4.7.4. Technological Factors

4.7.5. Legal Factors

4.7.6. Environmental Factors

4.8. Technological Analysis

4.8.1. Blockchain

4.8.2. Real-time rendering

4.8.3. Technological Roadmap

4.9. Regulatory Landscape

5. Europe Online Gambling Market: Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

5.1. Europe Online Gambling Market Size and Forecast, by Type (2024-2032)

5.1.1. Sports Betting

5.1.2. Casinos

5.1.3. Poker

5.1.4. Bingo

5.1.5. Others

5.2. Europe Online Gambling Market Size and Forecast, by Device (2024-2032)

5.2.1. Desktop

5.2.2. Mobile

5.2.3. Others

5.3. Europe Online Gambling Market Size and Forecast, by Country (2024-2032)

5.3.1. UK

5.3.2. France

5.3.3. Germany

5.3.4. Italy

5.3.5. Spain

5.3.6. Sweden

5.3.7. Austria

5.3.8. Rest of Europe

6. Company Profile: Key Players

6.1. William Hill PLC

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.3. Financial Overview

6.1.3.1. Total Revenue

6.1.3.2. Segment Revenue

6.1.3.3. Regional Revenue

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

6.2. Bet365 Group Ltd.

6.3. Paddy Power Betfair PLC

6.4. Betsson AB

6.5. Ladbrokes Coral Group PLC

6.6. The Stars Group Inc.

6.7. 888 Holdings PLC

6.8. Sky Betting and Gaming

6.9. Kindred Group PLC

6.10. GVC Holdings PLC

7. Key Findings

8. Analyst Recommendations

8.1. Strategic Recommendations

8.2. Future Outlook