Europe Casino Gaming Equipment Market- Industry Analysis and Forecast (2025-2032) Trends, Statistics, Dynamics, Segmentation by Product Type, Installation and Region

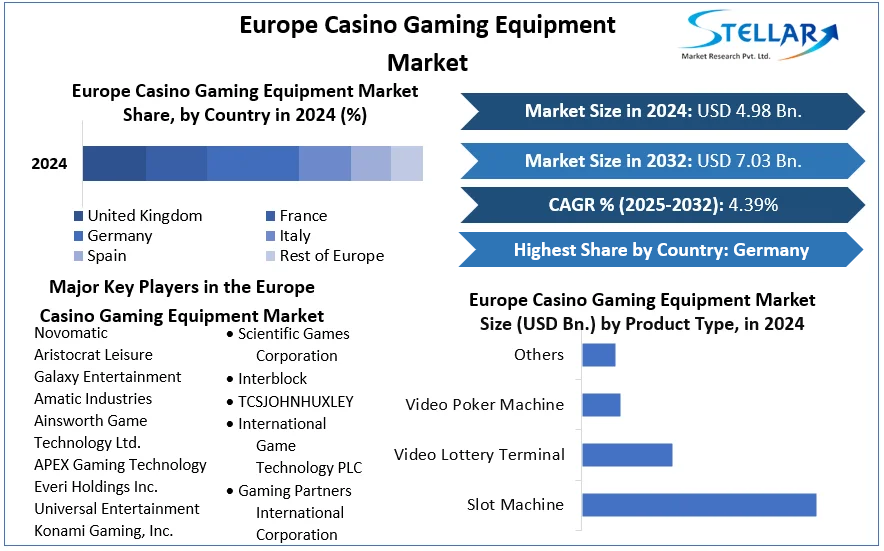

Europe Casino Gaming Equipment Market was valued nearly US$ 4.98 Bn. in 2024 and Market size is estimated to grow at a CAGR of 4.39% and is expected to reach at US$ 7.03 Bn. by 2032.

Format : PDF | Report ID : SMR_208

Europe Casino Gaming Equipment Market Overview:

Gaming machines & instruments used for gambling & guaranteeing visibility in casino operations are referred to as casino gaming equipment. Some of the most regularly used casino gaming based on all these items roulette wheels, gaming tables, shuffle machines, player tracking systems, slot machines, video poker machines, & online poker. Poker, big six-wheel, baccarat, blackjack, craps, & five-card draws are all played on these machines. Profitability, convenience, safety, and cost-effectiveness are all improved by the equipment. They're also used to analyse player activity and verify the authenticity of phony & genuine money notes. As a result, malls, casinos, & gaming arenas all have casino gaming equipment.

To get more Insights: Request Free Sample Report

Market Trends for Casino Gaming Equipment:

Total gambling revenue in Europe will rise 7.5 % this year to €87.2 billion in gross gaming revenue, while total gambling market revenue will fall 13% from 2019 levels, as Europe's land-based gambling business continues to be affected by COVID-19 restrictions.

Online betting continues to grow, with mobile betting taking control.

The epidemic is projected to accelerate & continue the expansion of Europe's online gambling sector, with online GGR projected to increase at a rate of around 9% each year, reaching 41% of Europe's total gambling income by 2026, up from 26% in 2019. Another trend that is projected to continue is the increased use of mobile devices (phones & tablets) for online gambling, with mobile bets expected to account for the majority (50.5 %) of all online bets in Europe for the first time this year, and 61.5 percent by 2026.

The online gambling market in Europe is continuing to grow, but there is still a lot of room for growth in markets like France, Germany, Italy, & Spain, where the online share of the total gambling market is still relatively low despite the fact that the online markets in these countries are relatively mature. With continuous online development comes the duty of ensuring that the market is well-regulated and that operators continue to use the most cutting-edge online technologies to build a stronger culture of safer gambling.

Revenue

- Online gaming GGR totaled €10.9 Bn, accounting for 36% of total online gambling income in Europe.

- Sports betting accounted for 45.9% of GGR, with casino accounting for 42%.

Customers:

- A total of 29 Mn people use the internet.

- 97.1 Bn Client bets/stakes (including bonuses) were processed, with a total value of €179 Bn.

- Customers received €168.1 Bn in prizes, with a 94.0 percent average return to player rate.

Betting on sports:

- In-play betting has lost ground, and pre-match betting currently accounts for 54% of total sports betting revenue

Licensing:

- There are now licenses in the Czech Republic and Portugal, for a total of 234 online gambling licenses across 19 European nations.

In Europe, the gambling market generates revenue.

The COVID-19 pandemic, like many other sectors, resulted in lower market revenues in Europe's gaming business in 2020 & 2021 compared to previous years, and exacerbated an already-existing online growth trend. The whole gambling market in Europe is predicted to be worth €87.2 Bn in gross gaming income in 2021, a fall of 13% from the pre-pandemic market in 2019, but a 7.5 percent increase from 2020 levels. Europe's online gambling revenue is predicted to reach €36.4 Bn in 2021, accounting for 41.7 percent of overall gambling revenue, up 19 percent from 2020 levels. Meanwhile, as the epidemic continues to restrict land-based gambling activities in many European nations, gross gaming revenue is predicted to climb moderately to €50.8 Bn (58.3 percent of total gambling) in 2021, up 0.4 percent from 2020 levels.

In Europe, there is a regulated internet gaming sector.

Online gambling is becoming more regulated. In 2021, Europe's online gambling market is expected to achieve 82.7 percent onshore market channeling, which means that over four-fifths of Europe's online gambling activity, by revenue, will take place on gambling websites or apps that are licensed and regulated in the country where the gambling activity took place, while 17.3 percent will take place in the offshore market. The establishment of the regulated online gaming market in The Netherlands, according to our report, will be the major driver of predicted gains in Europe's onshore market channeling in 2021.

Europe's most popular online gambling goods

Sports as well as other types of betting are Europe's most popular online gambling products, accounting for 40% of Europe's online gross gaming income in 2021 and expected to be worth €14.64 Bn. Horse racing betting is predicted to generate €4.88 billion (13 percent of total) online gross gaming revenue, while online betting on sports, such as football, as well as other sorts of online betting, such as event betting, are expected to generate €9.76 Bn (27 percent).

In Europe, there seem to be a lot of online gambling gadgets.

Gambling on the internet is becoming more mobile. For the first time in Europe, betting from mobile devices (phones and tablets) is predicted to overtake betting from personal computers in 2021, with 50.5 percent of all internet bets projected from mobile devices and 49.5 percent expected from desktop computers. A widespread movement towards mobile betting is foreseen, with mobile betting accounting for 61.5 percent of all online bets by 2026.

In Europe, online gambling has a large share in national gambling markets (2024)

The online gambling market shares of different national gaming markets differ significantly. In 2020, Sweden was the European country with the biggest proportion of online gambling (66.2%), followed by Denmark (59.4%), the United Kingdom (59.3%), Finland (58.5%), and Romania (58.5%). (56.7 percent). Interestingly, several of the nations with larger total gambling markets by revenues, including such Germany, France, Italy, and Spain, have lower online gambling market shares.

In Europe, online gaming products account for a significant portion of national gambling market (2023)

The online gambling product percentages of different national gambling marketplaces differ significantly. Online casino and poker are illegal in Cyprus, although they contribute for 24% of the country's annual gambling revenue (all offshore). Although online casinos are illegal in France, they account for 16 % of the country's gross gambling revenue.

The objective of the report is to present a comprehensive analysis of the Europe Casino Gaming Equipment Market to the stakeholders in the industry. The report provides trends that are most dominant in the Europe Casino Gaming Equipment Market and how these trends will influence new business investments and market development throughout the forecast period. The report also aids in the comprehension of the Europe Casino Gaming Equipment Market dynamics and competitive structure of the market by analyzing market leaders, market followers, and regional players.

The qualitative and quantitative data provided in the Europe Casino Gaming Equipment Market report is to help understand which market segments, regions are expected to grow at higher rates, factors affecting the market, and key opportunity areas, which will drive the industry and market growth through the forecast period. The report also includes the competitive landscape of key players in the industry along with their recent developments in the Europe Casino Gaming Equipment Market. The report studies factors such as company size, market share, market growth, revenue, production volume, and profits of the key players in the Europe Casino Gaming Equipment Market.

The report provides Porter's Five Force Model, which helps in designing the business strategies in the market. The report helps in identifying how many rivals are existing, who they are, and how their product quality is in the Market. The report also analyses if the Europe Casino Gaming Equipment Market is easy for a new player to gain a foothold in the market, do they enter or exit the market regularly if the market is dominated by a few players, etc.

The report also includes a PESTEL Analysis, which aids in the development of company strategies. Political variables help in figuring out how much a government can influence the Market. Economic variables aid in the analysis of economic performance drivers that have an impact on the Market. Understanding the impact of the surrounding environment and the influence of environmental concerns on the Europe Casino Gaming Equipment Market is aided by legal factors.

Europe Casino Gaming Equipment Market Scope:

|

Europe Casino Gaming Equipment Market |

|

|

Market Size in 2024 |

USD 4.98 Bn. |

|

Market Size in 2032 |

USD 7.03 Bn. |

|

CAGR (2025-2032) |

4.39% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

by Product Type

|

|

by Installation

|

|

|

Country Scope |

|

Major Players operating in the Europe Casino Gaming Equipment Market are:

- Novomatic

- Aristocrat Leisure

- Galaxy Entertainment

- Amatic Industries

- Ainsworth Game Technology Ltd.

- APEX Gaming Technology

- Everi Holdings Inc.

- Universal Entertainment

- Konami Gaming, Inc.

- Scientific Games Corporation

- Interblock

- TCSJOHNHUXLEY

- International Game Technology PLC

- Gaming Partners International Corporation

- Casino Technology

- ARUZE GAMING AMERICA, INC

Frequently Asked Questions

Chapter 1 Scope of the Report

Chapter 2 Research Methodology

2.1. Research Process

2.2. Europe Casino Gaming Equipment Market: Target Audience

2.3. Europe Casino Gaming Equipment Market: Primary Research (As per Client Requirement)

2.4. Europe Casino Gaming Equipment Market: Secondary Research

Chapter 3 Executive Summary

Chapter 4 Competitive Landscape

4.1. Market Share Analysis, By Region, 2024-2032(In %)

4.1.1.1. Europe Market Share Analysis, By Value, 2024-2032 (In %)

4.2. Market Dynamics

4.2.1. Market Drivers

4.2.2. Market Restraints

4.2.3. Market Opportunities

4.2.4. Market Challenges

4.2.5. PESTLE Analysis

4.2.6. PORTERS Five Force Analysis

4.2.7. Value Chain Analysis

4.3. Europe Casino Gaming Equipment Market Segmentation Analysis, 2024-2032 (Value US$ BN)

4.3.1.1. Europe Market Share Analysis, By Product Type, 2024-2032 (Value US$ BN)

4.3.1.1.1. Slot Machine

4.3.1.1.2. Video Lottery Terminal

4.3.1.1.3. Video Poker Machine

4.3.1.1.4. Others

4.3.1.2. Europe Market Share Analysis, By Installation, 2024-2032 (Value US$ BN)

4.3.1.2.1. Installed Inside Casino

4.3.1.2.2. Installed Outside Casino

4.3.1.3. Europe Market Share Analysis, By Country, 2024-2032 (Value US$ BN)

4.3.1.3.1. UK

4.3.1.3.2. France

4.3.1.3.3. Germany

4.3.1.3.4. Italy

4.3.1.3.5. Spain

4.3.1.3.6. Sweden

4.3.1.3.7. Austria

4.3.1.3.8. Rest Of Europe

Chapter 5 Stellar Competition Matrix

5.1. Europe Competition Matrix

5.2. Key Players Benchmarking

5.2.1. Key Players Benchmarking By Product Type, Pricing, Market Share, Investments, Expansion Plans, Physical Presence and Presence in the Market.

5.3. Mergers and Acquisitions in Navigation Technology

5.3.1. M&A by Region, Value and Strategic Intent

Chapter 6 Company Profiles

6.1. Key Players

6.1.1. Novomatic.

6.1.1.1. Company Overview

6.1.1.2. Source Portfolio

6.1.1.3. Financial Overview

6.1.1.4. Business Strategy

6.1.1.5. Key Developments

6.1.2. Aristocrat Leisure

6.1.3. Galaxy Entertainment

6.1.4. Amatic Industries

6.1.5. Ainsworth Game Technology Ltd.

6.1.6. APEX Gaming Technology

6.1.7. Everi Holdings Inc.

6.1.8. Universal Entertainment

6.1.9. Konami Gaming, Inc.

6.1.10. Scientific Games Corporation

6.1.11. Interblock

6.1.12. TCSJOHNHUXLEY

6.1.13. International Game Technology PLC

6.1.14. Gaming Partners International Corporation

6.1.15. Casino Technology

6.1.16. ARUZE GAMING AMERICA, INC

6.2. Key Findings

6.3. Recommendations.