Drone Defense System Market Global Industry Analysis and Forecast (2026-2032)

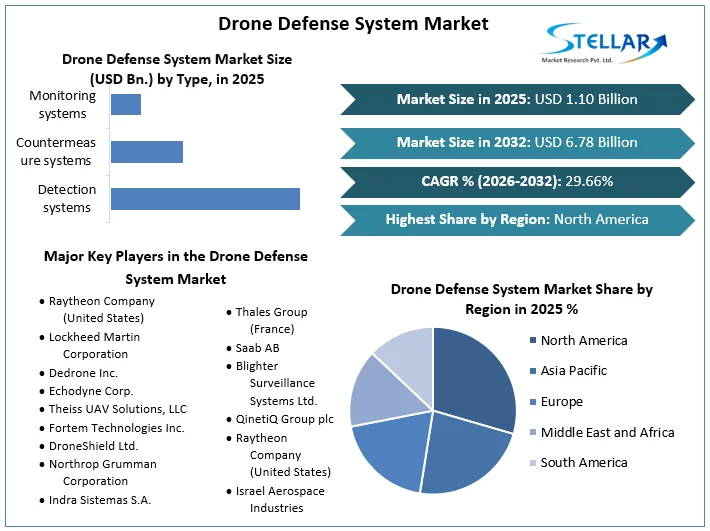

Drone Defense System Market size was valued at USD 1.10 Bn. in 2025 and the Drone Defense System revenue is expected to grow at a CAGR of 29.66 % from 2026 to 2032, reaching nearly USD 6.78 Bn. by 2032.

Format : PDF | Report ID : SMR_1962

Drone Defense System Market Overview:

The global drone defense system market is witnessing strong growth, with rising fears of drones being used improperly in criminal ways driving it. This phenomenon has made the North America to be the leading region due to big companies such as Lockheed Martin, Raytheon Technologies and Northrop Grumman that keep coming up with new counter-drone ideas which are more sophisticated. Europe is also closely followed by such companies as Airbus, MBDA, and Leonardo S.p.A., which are instrumental in shaping its market. It is in Asia Pacific that enormous opportunities for expansion exist courtesy of increased expenditure on defense infrastructure by countries such as China and India, as well as local enterprises for indigenous defense technologies.

The Drone Defense System market provides market size, share, scope, growth, and potential of the industry. It offers valuable in application to help businesses identify opportunities and potential risks within the market. Also the global Drone Defense System market research reports provide detailed analysis of market conditions, trends, challenges, and recommendations for stakeholders in the industry.

To get more Insights: Request Free Sample Report

Drone Defense System Market Dynamics:

Rising Threats and Technological Advances Drive Growth in Drone Defense Systems Market

The market for drone defense systems undergoes continuous change due to fast technological advancements and changing threats. Similarly, there is a threat of these devices being misused during unauthorized surveillance, smuggling and terrorism. There is a number of factors that elevate the growth of the market for drone defense systems. There are worries on the rapid increase of commercial drones which in turn create fears that they might be used in committing crimes hence there is need for counter-drone solutions that work effectively. Developments in drone technology, such as expanded range and carrying capacity as well as self-guided intelligence, make it vital that defense systems improve their ability to detect, track, and disable drones that operate illegally.

Challenges Facing the Drone Defense System Market

Concerns about the possible misuse of these abundant commercial drones surge concurrently with their growing numbers. This swift proliferation also poses a big challenge to all presently existing systems that defend against drone attacks due to increased capacity for heavier loads and extended operational range which made them more independent in their ability to operate outside any pre-set barriers as well as wider geographic areas during attack missions.

Constant innovation is required to detect, track, and neutralize rogue drones so as to efficiently protect against emerging threats. This increases the significance of modifying defense systems to keep up with changing security risks and advancements in drone technology.

Drone Defense System Market Segment Analysis:

By Type, The detection systems represent the most powerful sub-segment in type segment. They’re intended to detect and spot unfriendly or unauthorized drones in the air space using advanced technology tools including radar devices, radiofrequency sensors (RF) as well as electro-optical, infrared (EO/IR) sensors that capture any signals related with such aircrafts. Detection systems play a crucial role in providing early warning and situational awareness to security personnel, enabling them to respond effectively to potential threats.

Drone Defense System Market Regional Insight:

North America is one of the key strongholds for the Drone Defense global market with the region leading in market share because drones are increasingly being used for numerous reasons like surveillance, law enforcement or even in battle field among others. North America is a strong defense sector, with several key players in the drone defense market which contribute to its dominance. The demand for drone defense systems in the region is driven by well-established regulations and infrastructures set for addressing security concerns associated with drone activities.

Also, Asia Pacific is one of the fastest-growing regions in the global Drone Defense market. Drones are being increasingly used in diverse industries, which include defense, infrastructure and agriculture.

Drone Defense System Market Competitive Landscape:

- In January 2023, a company called Drone Shield Ltd that specialises in providing solutions for detecting drones as well as ways to protect against them showcased their latest innovation- a new prototype for an anti-drone system that uses the latest advanced artificial intelligence technologies. This system improves instant identification ability and prompt response time making it difficult for unauthorized drones to operate.

- In April 2023, a cutting-edge Drone Interception System was introduced by Aero Defend Inc., a leading company in the drone defense market. This advanced innovative resolution links high-speed drones, net-based capture mechanisms equipped with advanced radar technology to catch and render ineffective rogue drones in a secure controlled manner.

Drone Defense System Market Scope:

|

Drone Defense System Market |

|

|

Market Size in 2025 |

USD 1.10 Bn. |

|

Market Size in 2032 |

USD 6.78 Bn. |

|

CAGR (2026-2032) |

29.66 % |

|

Historic Data |

2020-2025 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2032 |

|

Segments |

By Type Detection systems Countermeasure systems Monitoring systems |

|

By Application Radar RF Detection Advanced AI Machine Learning |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Drone Defense System Market Key Players:

- Raytheon Company (United States)

- Lockheed Martin Corporation

- Dedrone Inc.

- Echodyne Corp.

- Theiss UAV Solutions, LLC

- Fortem Technologies Inc.

- DroneShield Ltd.

- Northrop Grumman Corporation

- Indra Sistemas S.A.

- SRC Inc. (United States)

- Thales Group (France)

- Saab AB

- Blighter Surveillance Systems Ltd.

- QinetiQ Group plc

- Raytheon Company (United States)

- Israel Aerospace Industries

- Hanwha Corporation

- Rakuten Mobile, Inc.

- Rheinmetall AG

- Hanwha Group.

- XX Ltd

Frequently Asked Questions

Concerns about the possible misuse of these abundant commercial drones challenge in the Drone Defense System Market.

The Market size was valued at USD 1.10 Billion in 2025 and the total Market revenue is expected to grow at a CAGR of 29.66 % from 2026 to 2032, reaching nearly USD 6.78 Billion.

The segments covered in the market report are by Product type and Application.

1. Research Methodology

1.1 Research Data

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. Drone Defense System Market: Executive Summary

2.1. Market Overview

2.2. Market Size (2025) and Forecast (2026– 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments and Regions

3. Global Drone Defense System Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Product Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2025)

3.2.7. Profit Margin

3.2.8. Market Share

3.2.9. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

3.4.1. Strategic Initiatives and Developments

3.4.2. Mergers and Acquisitions

3.4.3. Collaborations and Partnerships

3.4.4. Product Launches and Innovations

4. Drone Defense System Market: Dynamics

4.1. Drone Defense System Market Trends by Region

4.1.1. North America

4.1.2. Europe

4.1.3. Asia Pacific

4.1.4. Middle East and Africa

4.1.5. South America

4.2. Drone Defense System Market Drivers

4.3. Drone Defense System Market Restraints

4.4. Drone Defense System Market Opportunities

4.5. Drone Defense System Market Challenges

4.6. PORTER’s Five Forces Analysis

4.6.1. Intensity of the Rivalry

4.6.2. Threat of New Entrants

4.6.3. Bargaining Power of Suppliers

4.6.4. Bargaining Power of Buyers

4.6.5. Threat of Substitutes

4.7. PESTLE Analysis

4.7.1. Political Factors

4.7.2. Economic Factors

4.7.3. Social Factors

4.7.4. Technological Factor

4.7.5. Legal Factors

4.7.6. Environmental Factors

4.8. Technological Analysis

4.8.1. Innovations in Drone Defense System Design and Functionality

4.8.2. Trends in Safety Technologies

4.8.3. Impact of IoT and AI on Drone Defense System Operations

4.8.4. Technological Roadmap

4.9. Value Chain Analysis and Supply Chain Analysis

4.10. Regulatory Landscape

4.10.1. Market Regulation by Region

4.10.1.1. North America

4.10.1.2. Europe

4.10.1.3. Asia Pacific

4.10.1.4. Middle East and Africa

4.10.1.5. South America

4.10.2. Impact of Regulations on Market Dynamics

4.10.3. Government Schemes and Initiatives

5. Drone Defense System Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

5.1. Drone Defense System Market Size and Forecast, by Type (2025-2032)

5.1.1. Detection systems

5.1.2. Countermeasure systems

5.1.3. Monitoring systems

5.2. Drone Defense System Market Size and Forecast, by Application (2025-2032)

5.2.1. Radar

5.2.2. RF Detection

5.2.3. Advanced AI

5.2.4. Machine Learning

5.3. Drone Defense System Market Size and Forecast, by Region (2025-2032)

5.3.1. North America

5.3.2. Europe

5.3.3. Asia Pacific

5.3.4. Middle East and Africa

5.3.5. South America

6. North America Drone Defense System Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

6.1. North America Drone Defense System Market Size and Forecast, by Type (2025-2032)

6.1.1. Detection systems

6.1.2. Countermeasure systems

6.1.3. Monitoring systems

6.2. North America Drone Defense System Market Size and Forecast, by Application (2025-2032)

6.2.1. Radar

6.2.2. RF Detection

6.2.3. Advanced AI

6.2.4. Machine Learning

6.3. North America Drone Defense System Market Size and Forecast, by Country (2025-2032)

6.3.1. United States

6.3.2. Canada

6.3.3. Mexico

7. Europe Drone Defense System Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

7.1. Europe Drone Defense System Market Size and Forecast, by Type (2025-2032)

7.2. Europe Drone Defense System Market Size and Forecast, by Application (2025-2032)

7.3. Europe Drone Defense System Market Size and Forecast, by Country (2025-2032)

7.3.1. United Kingdom

7.3.2. France

7.3.3. Germany

7.3.4. Italy

7.3.5. Spain

7.3.6. Sweden

7.3.7. Austria

7.3.8. Rest of Europe

8. Asia Pacific Drone Defense System Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

8.1. Asia Pacific Drone Defense System Market Size and Forecast, by Type (2025-2032)

8.2. Asia Pacific Drone Defense System Market Size and Forecast, by Application (2025-2032)

8.3. Asia Pacific Drone Defense System Market Size and Forecast, by Country (2025-2032)

8.3.1. China

8.3.2. S Korea

8.3.3. Japan

8.3.4. India

8.3.5. Australia

8.3.6. Indonesia

8.3.7. Malaysia

8.3.8. Vietnam

8.3.9. Taiwan

8.3.10. Rest of Asia Pacific

9. Middle East and Africa Drone Defense System Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

9.1. Middle East and Africa Drone Defense System Market Size and Forecast, by Type (2025-2032)

9.2. Middle East and Africa Drone Defense System Market Size and Forecast, by Application (2025-2032)

9.3. Middle East and Africa Drone Defense System Market Size and Forecast, by Country (2025-2032)

9.3.1. South Africa

9.3.2. GCC

9.3.3. Nigeria

9.3.4. Rest of ME&A

10. South America Drone Defense System Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

10.1. South America Drone Defense System Market Size and Forecast, by Type (2025-2032)

10.2. South America Drone Defense System Market Size and Forecast, by Application (2025-2032)

10.3. South America Drone Defense System Market Size and Forecast, by Country (2025-2032)

10.3.1. Brazil

10.3.2. Argentina

10.3.3. Rest Of South America

11. Company Profile: Key Players

11.1. Raytheon Company (United States)

11.1.1. Company Overview

11.1.2. Product Portfolio

11.1.2.1. Product Name

11.1.2.2. Product Details (Price, Features, etc.)

11.1.3. Financial Overview

11.1.3.1. Total Revenue

11.1.3.2. Segment Revenue

11.1.3.3. Regional Revenue

11.1.4. SWOT Analysis

11.1.5. Strategic Analysis

11.1.6. Recent Developments

11.2. Lockheed Martin Corporation

11.3. Dedrone Inc.

11.4. Echodyne Corp.

11.5. Theiss UAV Solutions, LLC

11.6. Fortem Technologies Inc.

11.7. DroneShield Ltd.

11.8. Northrop Grumman Corporation

11.9. Indra Sistemas S.A.

11.10. SRC Inc. (United States)

11.11. Thales Group (France)

11.12. Saab AB

11.13. Blighter Surveillance Systems Ltd.

11.14. QinetiQ Group plc

11.15. Raytheon Company (United States)

11.16. Israel Aerospace Industries

11.17. Hanwha Corporation

11.18. Rakuten Mobile, Inc.

11.19. Rheinmetall AG

11.20. Hanwha Group.

11.21. XX Ltd

12. Key Findings

13. Analyst Recommendations

13.1. Strategic Recommendations

13.2. Future Outlook