Asia Pacific Limited Slip Differential Market Size, Share, Growth Trends, Industry Analysis, Key Players, Investment Opportunities and Forecast (2025-2032)

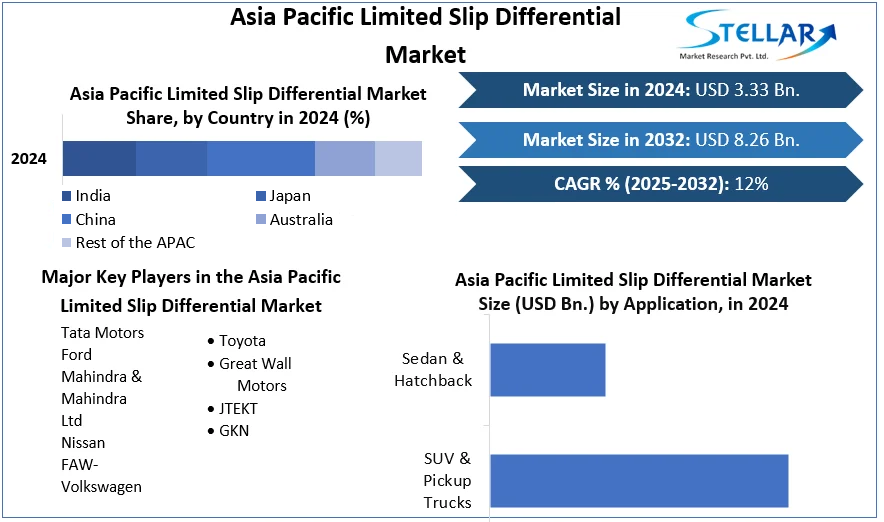

Asia Pacific Limited Slip Differential Market was valued at USD 3.33 billion in 2024. Asia Pacific Limited Slip Differential Market size is estimated to grow at a CAGR of 12 % over the forecast period.

Format : PDF | Report ID : SMR_859

Asia Pacific Limited Slip Differential Market Definition:

The Limited Slip Differential is a device that is used to limit the amount of wheelspin when the driven wheels lose grip when power is applied it helps in the situation where one wheel begins to slip, and the slipping or non-contacting wheel receives the majority of the power and maintain directional stability. It increases a car’s power and speed by utilizing engine power more efficiently and provides an improved driving experience.

Further, the Asia Pacific Limited Slip Differential market is segmented by Type, distribution channel, application, and geography. Based on type, the Asia Pacific Limited Slip Differential market is segmented under Mechanical LSD and Electronic LSD. Based on the distribution channel, the market is segmented under the channels of Aftermarket and Original equipment market. Based on application, the market is segmented under the channels of SUV & Pickup Trucks and Sedan and Hatchback. By geography, the market covers the major countries in the Asia Pacific i.e., India, China, Japan, Australia, and the Rest of Asia Pacific For each segment, the market sizing and forecasts have been done based on value (in USD Million/Billion).

To get more Insights: Request Free Sample Report

Asia Pacific Limited Slip Differential Market Dynamics:

The rise in demand for electric vehicles will boost the limited-slip differential market

Rapid Urbanization, government initiatives, technological innovations, and a rise in consumer disposable income are the major factor propelling the overall growth of the market. The region contributes about 55-60% of the vehicle production across the globe. The demand for limited-slip differential will increase with the increase in vehicle production. For example, India is aggressively promoting the adoption of Electric Vehicles. The country aims to switch 30% of private cars and 70% of commercial vehicles to EVs by the year 2030. These initiatives will attract investment in the automotive manufacturing value chain and will positively impact the limited-slip differential market because it is utilized in both electric vehicles and Internal Combustion Engines.

The automotive industry in the Asia Pacific has experienced healthy growth over the years due to high development prospects in all segments of the vehicle industry. To keep up with the growing demand, several automakers have started investing heavily in various segments of the industry. For example, Aisin Seiki has built the Toyota Prius which has recorded the highest sales in China. Apart from these several countries have also made significant investments in India through the PLI scheme this will encourage industries to make fresh investments for the global supply chain of the differential markets. As a result, the growing number of automotive industries along with the growing adoption of Limited Slip Differential in it are expected to boost the regional market growth throughout the forecast period.

Asia Pacific Limited Slip Differential Market Segment Analysis:

By type, the limited-slip differential market is divided into mechanical limited-slip differential and electronic limited-slip differential. The mechanical Limited Slip Differential segment held the largest market share and is expected to remain the same during the forecast period. Because of its wide range of applications, it is the most common type of differential it limits the slip of the wheel with the least traction. The use of electronic limited-slip differential is growing faster because mechanical differentials are expensive to develop and the growing demand for E-Vehicles will boost the market growth.

COVID-19 Impact on Asia Pacific Limited Slip Differential Market

The pandemic negatively impacted the industry all across the globe due to which the world economy has a slowdown in 2020 and continued till the first quarter of 2021 India’s auto component industry saw a cumulative revenue decline of 3% in the year 2021 and the global shortage of semiconductors also weighed on production. Imports from the Asia Pacific declined by 9% and the industry is hoping that the government PLI and other policies focused on export compositeness and increasing localization will further reduce the trade gap. The outbreak shifts consumer demand to large EVs with better performance will boost the market growth for electronic limited-slip differential. China is more likely to see a quick recovery and strong growth in the EV market. The governments in the region are investing in charging infrastructure as part of their economic stimulus program

Recent Development in Asia Pacific Region Limited Slip Differential Market

- In August 2021 Toyota launches a new land Cruiser 300 with new technologies enabling the driver to drive on any type of road in the world.

- Eaton’s Vehicle Group has launched an extensive lineup of specialized differentials for electrified vehicles including automatic limited-slip, automatic locking, and electronic selectable locking differential.

- In February 2022, the Indian government has received an investment proposal of 45,016 crores from 20 automotive companies under the PLI Auto scheme.

Asia Pacific Limited Slip Differential Market Key Players Insights:

The market is characterized by the existence of a number of well-known firms. These companies control a large portion of the market, have a wide product portfolio, and have a global presence. In addition, the market comprises small to mid-sized competitors that sell a limited variety of items, some of which are self-publishing organizations.

The market's major companies have a significant impact because most of them have extensive global networks through which they can reach their massive client bases. To drive revenue growth and strengthen their positions in the global market, key players in the market, particularly in North America and Europe, are focusing on strategic initiatives such as acquisitions, new collection launches, and partnerships.

The objective of the report is to present a comprehensive analysis of the Asia Pacific Limited Slip Differential Market to the stakeholders in the industry. The report provides trends that are most dominant in the Asia Pacific Limited Slip Differential Market and how these trends will influence new business investments and market development throughout the forecast period. The report also aids in the comprehension of the Asia Pacific Limited Slip Differential Market dynamics and competitive structure of the market by analyzing market leaders, market followers, and regional players.

The qualitative and quantitative data provided in the Asia Pacific Limited Slip Differential Market report is to help understand which market segments, regions are expected to grow at higher rates, factors affecting the market, and key opportunity areas, which will drive the industry and market growth through the forecast period. The report also includes the competitive landscape of key players in the industry along with their recent developments in the Asia Pacific Limited Slip Differential Market. The report studies factors such as company size, market share, market growth, revenue, production volume, and profits of the key players in the Asia Pacific Limited Slip Differential Market.

The report provides Porter's Five Force Model, which helps in designing the business strategies in the market. The report helps in identifying how many rivals exist, who they are, and how their product quality is in the Asia Pacific Limited Slip Differential Market. The report also analyses if the Asia Pacific Limited Slip Differential Market is easy for a new player to gain a foothold in the market, do they enter or exit the market regularly, if the market is dominated by a few players, etc.

The report also includes a PESTEL Analysis, which aids in the development of company strategies. Political variables help in figuring out how much a government can influence the Asia Pacific Limited Slip Differential Market. Economic variables aid in the analysis of economic performance drivers that have an impact on the Asia Pacific Limited Slip Differential Market. Understanding the impact of the surrounding environment and the influence of environmental concerns on the Asia Pacific Limited Slip Differential Market is aided by legal factors.

Asia Pacific Limited Slip Differential Market Scope:

|

Asia Pacific Limited Slip Differential Market |

|

|

Market Size in 2024 |

USD 3.33 Bn. |

|

Market Size in 2032 |

USD 8.26 Bn. |

|

CAGR (2025-2032) |

12% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

By Type

|

|

By Application

|

|

|

Country Scope |

China India Japan South Korea Australia ASEAN Rest of APAC |

Asia Pacific Limited Slip Differential Market Key Players:

Frequently Asked Questions

India is expected to hold the highest share in the Asia Pacific Limited Slip Differential Market.

The market size of the Asia Pacific Limited Slip Differential Market by 2032 is expected to reach USD 8.26 Billion.

The forecast period for the Asia Pacific Limited Slip Differential Market is 2025-2032.

The market size of the Asia Pacific Limited Slip Differential Market in 2024 was valued at USD 3.33 Billion.

1. Asia Pacific Limited Slip Differential Market: Research Methodology

2. Asia Pacific Limited Slip Differential Market Introduction

2.1. Study Assumption and Market Definition

2.2. Scope of the Study

2.3. Executive Summary

3. Asia Pacific Limited Slip Differential Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Product Segment

3.2.3. End-user Segment

3.2.4. Revenue (2024)

3.2.5. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Mergers and Acquisitions Details

4. Asia Pacific Limited Slip Differential Market: Dynamics

4.1. Asia Pacific Limited Slip Differential Market Trends

4.2. Asia Pacific Limited Slip Differential Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.2.4. Challenges

4.3. PORTER’s Five Forces Analysis

4.4. PESTLE Analysis

4.5. Technological Roadmap

4.6. Regulatory Landscape

5. Asia Pacific Limited Slip Differential Market: Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

5.1. Asia Pacific Limited Slip Differential Market Size and Forecast, by Type (2024-2032)

5.1.1. Mechanical LSD

5.1.2. Electronic LSD

5.2. Asia Pacific Limited Slip Differential Market Size and Forecast, by Application (2024-2032)

5.2.1. SUV and Pickup Trucks

5.2.2. Sedan and Hatchback

5.3. Asia Pacific Limited Slip Differential Market Size and Forecast, by Country (2024-2032)

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Australia

5.3.6. ASEAN

5.3.7. Rest of APAC

6. Company Profile: Key Players

6.1. Tata Motors

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.3. Financial Overview

6.1.3.1. Total Revenue

6.1.3.2. Segment Revenue

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

6.2. Ford

6.3. Mahindra & Mahindra

6.4. Nissan

6.5. Toyota

6.6. GKN

6.7. FAW – Volkswagen

7. Key Findings

8. Industry Recommendations

8.1.1. Strategic Recommendations for Stakeholders

8.1.2. Future Outlook