Asia Pacific In-Vehicle Payment Market Size, Share, Growth Trends, Industry Analysis, Key Players, Investment Opportunities and Forecast (2025-2032)

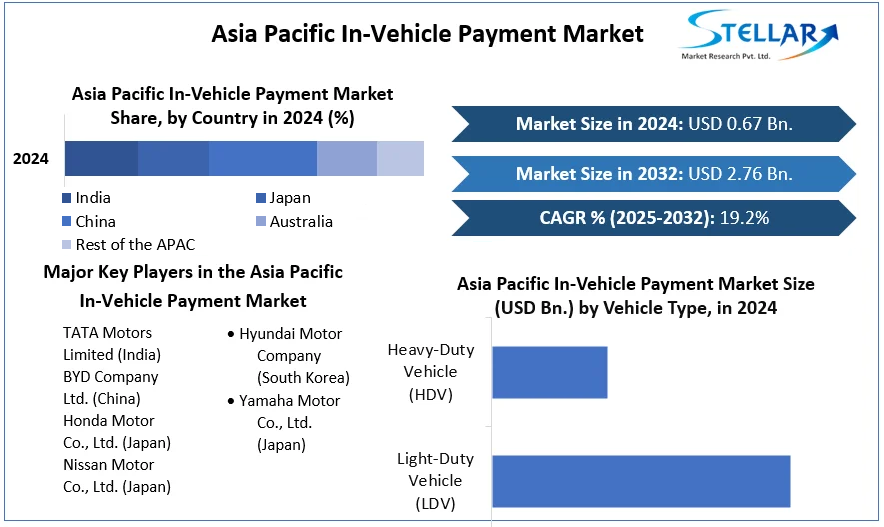

Asia Pacific In-Vehicle Payment Market was valued at USD 0.67 billion in 2024. The Asia Pacific In-Vehicle Payment Market size is estimated to grow at a CAGR of 19.2 % over the forecast period

Format : PDF | Report ID : SMR_942

Asia Pacific In-Vehicle Payment Market Definition:

The in-vehicle payment system is an automotive system that includes payment technology. This system enables the driver to make payments or transactions with a wide range of businesses or applications, such as toll gates, smart parking, gas stations, charging stations, and others.

Further, the Asia Pacific In-Vehicle Payment market is segmented by Mode of Payment, Vehicle Type, Application, and geography. On the basis of Payment Mode type, the Asia Pacific In-Vehicle Payment System market is segmented under Credit/Debit Card, App/E-Wallet, QR Code/RFID, NFC, and Others. Based on the Vehicle Type, the market is segmented under the Light-Duty Vehicle (LDV) and Heavy-Duty Vehicle (HDV). Based on the Application, the In-Vehicle Payment System market is segmented under Fuel/Charging Stations, Toll/Parking, Food/Groceries and Others. By geography, the market covers the major countries in Asia Pacific i.e., India, China, Japan, Australia and Rest of Asia Pacific For each segment, the market sizing and forecasts have been done on the basis of value (in USD Billion).

To get more Insights: Request Free Sample Report

Asia Pacific In-Vehicle Payment COVID 19 Insights:

Due to the outbreak of the COVID-19 pandemic, the Asia Pacific region market is falling rapidly in 2021. This is because most governments have implemented lockdowns and increased restrictions on international travel.

Furthermore, during the COVID-19 outbreak, an increase in the number of COVID-19 patients in the region, as well as increased travel restrictions have an impact on the growth of the in-vehicle payment services market. The rise in digitalization in the travel business, on the other hand, is expected to provide a lucrative opportunity to boost market growth following COVID-19.

Asia Pacific In-Vehicle Payment Market Dynamics:

Asia Pacific In-Vehicle Payment Market Drivers:

In the face of a pandemic and growing public safety concerns, government-enforced extensive social distancing guidelines are expected to fuel demand for contactless payment solutions, accelerating the adoption of in-vehicle payment services in Asia Pacific.

Furthermore, the focus of major key players such as Mercedes, General Motors, Honda, Hyundai, and others on developing contactless connected vehicle payment solutions is expected to drive market growth.

The Contactless Payment Services Market of Asia Pacific region was valued at US$ 52.90 in 2021. The Contactless Payment Services Market of Asia Pacific region size is expected to grow at a CSGR of 15 % through the forecast period.

In Asia Pacific, rising traffic congestion on roads, toll plazas, gas stations, parking lots, and other locations encourages people to use these payment services. The use of this payment technology in these applications will save time and make it easier for customers to order and pay.

As a result, the infrastructural development of these locations to accommodate in-car payment is expected to boost the market growth in the forecast period.

The increasing digitalization of automobiles, as well as the rising adoption of loT and maturing 5G connectivity, is expected to drive demand for in-car payment solutions in Asia Pacific.

Furthermore, rising awareness of various in-vehicle services in underdeveloped and developing economies, as well as expanding applications for these services is expected to drive market growth during the forecast period.

IoT market of Asia Pacific valued at 98.41 Bn in 2021 and it will reach 198.44Bn by 2027. The IoT market is expected to grow at a CAGR of 12.4%through the forecast period.

Vehicles with built-in technology that allows them to communicate with other technologies are known as connected cars. Connected cars use their connectivity to provide in-vehicle payment services to passengers. As a result, the increasing adoption and development of connected cars are expected to increase demand for these types of payment services.

Autonomous Vehicle Market of Asia Pacific was valued at US$ 0.76 Bn in 2021. The Autonomous Vehicle Market size of Asia Pacific is expected to grow at a CAGR of 24.5 % through the forecast period.

Asia Pacific In-Vehicle Payment Market Restraints:

The high cost of embedded systems in comparison to integrated systems is expected to stifle market growth over the forecast period. Furthermore, cyber security and vulnerability threats associated with using in-vehicle payment services, such as security issues involving personal data, card numbers, CVV, PIN, and others, are expected to limit in-vehicle payment system implementation during the forecast period.

Asia Pacific In-Vehicle Payment Market Segment Analysis:

By Mode of Payment, In Asia Pacific, The credit/debit card segment held the largest market share and is expected to continue to dominate the market through the forecast period. Consumer preference for using credit and debit cards for contactless payments is driving the segment's growth.

Furthermore, its rising popularity among people of all ages in developing economies for safe and convenient transactions is expected to fuel segment growth during the forecast period.

The app/e-wallet segment is expected to grow at the fastest CAGR during the forecast period. App and e-wallet payment methods have grown in popularity in recent years due to their high convenience and transaction speed.

The rising popularity of these digital payment apps and e-wallets, such as Google Pay, Apple Pay, and Amazon Pay, combined with the ability to pay via mobile devices and on-demand apps, is expected to drive segment growth during the forecast period.

Asia Pacific is dominating in Mobile Payment market with 35% share. Mobile Payment Market of Asia Pacific was valued at US$ 710.11 Bn in 2021. The Mobile Payment Market size is expected to grow at a CAGR of 26 % through the forecast period.

The QR code/RFID segment is also expected to grow at a high rate in the forecast period. QR codes, like e-wallets, allow for quick and flexible transactions. Furthermore, growing QR code and RFID adoption in a variety of applications such as gas/charging stations, parking lots, toll plazas, and others is expected to drive segment growth through the forecast period.

The NFC segment is also expected to grow significantly due to its ability to perform instant payments and transactions using mobile devices.

By Application, The gas/charging station segment held the largest market share in 2024 and is expected to continue to dominate the market through the forecast period. Rising road and gas/charging station traffic is expected to boost segment growth during the forecast period.

Additionally, the increasing adoption of next-generation electric vehicles as a result of changing government emission control standards is expected to have an impact on segment growth. Electric Vehicle market of Asia Pacific valued at 670.21 Bn in 2021 .The Electric Vehicle market is expected to grow at a CAGR of 25.9%through the forecast period.

Furthermore, automakers' efforts to roll out in-vehicle fuel payment services for customer convenience, as well as increased connected vehicle sales in the world, are expected to accelerate market growth during the forecast period.

The parking segment is expected to grow at the fastest rate. Parking infrastructure development, combined with rising demand for parking spaces in urban areas, is expected to drive segment growth. Additionally, increased passenger and commercial vehicle sales are expected to drive segment growth.

The commercial vehicle market of Asia Pacific was valued at US$ 697.9 Bn in 2021. The commercial vehicle market size of Asia Pacific is expected to grow at a CAGR of 6.5 % through the forecast period.

The food and coffee segment also experienced significant growth during the forecast period. Demand for on-the-go foods and beverages among drivers and passengers are expected to drive segment growth.

Furthermore, increased traffic congestion encourages people to use in-vehicle payment services to buy food and coffee. The toll collection segment is expected to grow at a rapid pace due to the development of toll plaza infrastructure to be compatible with various modes of payment and consumer preference for contactless delivery.

Asia Pacific In-Vehicle Payment Market Key Players Insights:

The market is characterized by the existence of a number of well-known firms. These companies control a large portion of the market, have a wide product portfolio, and have a global presence. In addition, the market comprises small to mid-sized competitors that sell a limited variety of items, some of which are self-publishing organizations.

The market's major companies have a significant impact because most of them have extensive global networks through which they can reach their massive client bases. To drive revenue growth and strengthen their positions in the europemarket, key players in the market, particularly in this region, are focusing on strategic initiatives such as acquisitions, new collection launches, and partnerships.

The objective of the report is to present a comprehensive analysis of the Asia Pacific In-Vehicle Payment market to the stakeholders in the industry. The report provides trends that are most dominant in the Asia Pacific In-Vehicle Payment market and how these trends will influence new business investments and market development throughout the forecast period. The report also aids in the comprehension of the Asia Pacific In-Vehicle Payment Market dynamics and competitive structure of the market by analyzing market leaders, market followers, and regional players.

The qualitative and quantitative data provided in the Asia Pacific In-Vehicle Payment market report is to help understand which market segments, regions are expected to grow at higher rates, factors affecting the market, and key opportunity areas, which will drive the industry and market growth through the forecast period. The report also includes the competitive landscape of key players in the industry along with their recent developments in the Asia Pacific In-Vehicle Payment market. The report studies factors such as company size, market share, market growth, revenue, production volume, and profits of the key players in the Asia Pacific In-Vehicle Payment market.

The report provides Porter's Five Force Model, which helps in designing the business strategies in the market. The report helps in identifying how many rivals exist, who they are, and how their product quality is in the Asia Pacific In-Vehicle Payment market. The report also analyses if the Asia Pacific In-Vehicle Payment market is easy for a new player to gain a foothold in the market, do they enter or exit the market regularly, if the market is dominated by a few players, etc.

The report also includes a PESTEL Analysis, which aids in the development of company strategies. Political variables help in figuring out how much a government can influence the Asia Pacific In-Vehicle Payment market. Economic variables aid in the analysis of economic performance drivers that have an impact on the Asia Pacific In-Vehicle Payment market. Understanding the impact of the surrounding environment and the influence of environmental concerns on the Asia Pacific In-Vehicle Payment market is aided by legal factors.

Asia Pacific In-Vehicle Payment Market Scope:

|

Asia Pacific In-Vehicle Payment Market |

|

|

Market Size in 2024 |

USD 0.67 Bn. |

|

Market Size in 2032 |

USD 2.76 Bn. |

|

CAGR (2025-2032) |

19.2% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

By Mode of Payment

|

|

By Vehicle Type

|

|

|

By Application

|

|

|

By Country

|

|

Asia Pacific In-Vehicle Payment MARKET KEY PLAYERS:

- TATA Motors Limited (India)

- BYD Company Ltd. (China)

- Honda Motor Co., Ltd. (Japan)

- Nissan Motor Co., Ltd. (Japan)

- Hyundai Motor Company (South Korea)

- Yamaha Motor Co., Ltd. (Japan)

Frequently Asked Questions

The market size of the Asia Pacific In-Vehicle Payment Market by 2032 is expected to reach USD 2.76 Billion.

The forecast period for the Asia Pacific In-Vehicle Payment Market is 2025-2032.

The market size of the Asia Pacific In-Vehicle Payment Market in 2024 was valued at USD 0.67 Billion.

Asia Pacific region held the highest share in 2024.

1. Asia Pacific In-Vehicle Payment Market: Research Methodology

1.1 Research Data

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Up Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. Asia Pacific In-Vehicle Payment Executive Summary

2.1. Market Overview

2.2. Market Size (2024) and Forecast (2025 – 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments

3. Asia Pacific In-Vehicle Payment Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Service Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2024)

3.2.7. Profit Margin

3.2.8. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

4. Asia Pacific In-Vehicle Payment Market: Dynamics

4.1. Asia Pacific In-Vehicle Payment Market Trends

4.2. Asia Pacific In-Vehicle Payment Market Drivers

4.3. Asia Pacific In-Vehicle Payment Market Restraints

4.4. Asia Pacific In-Vehicle Payment Market Opportunities

4.5. Asia Pacific In-Vehicle Payment Market Challenges

4.6. PORTER’s Five Forces Analysis

4.7. PESTLE Analysis

4.8. Technological Roadmap

4.9. Regulatory Landscape

5. Asia Pacific In-Vehicle Payment Market: Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

5.1. Asia Pacific In-Vehicle Payment Market Size and Forecast, by Mode of Payment (2024-2032)

5.1.1. Credit/Debit Card

5.1.2. App/E-Wallet

5.1.3. QR Code/RFID

5.1.4. NFC

5.1.5. Others

5.2. Asia Pacific In-Vehicle Payment Market Size and Forecast, by Vehicle Type (2024-2032)

5.2.1. Light-Duty Vehicle (LDV)

5.2.2. Heavy-Duty Vehicle (HDV)

5.3. Asia Pacific In-Vehicle Payment Market Size and Forecast, by Application (2024-2032)

5.3.1. Fuel/Charging Stations

5.3.2. Toll/Parking

5.3.3. Food/Groceries

5.3.4. Others

5.4. Asia Pacific In-Vehicle Payment Market Size and Forecast, by Country (2024-2032)

5.4.1. China

5.4.2. India

5.4.3. Japan

5.4.4. South Korea

5.4.5. Australia

5.4.6. Rest of APAC

6. Company Profile: Key Players

6.1. TATA Motors Limited (India)

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.3. Financial Overview

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

6.2. BYD Company Ltd. (China)

6.3. Honda Motor Co., Ltd. (Japan)

6.4. Nissan Motor Co., Ltd. (Japan)

6.5. Hyundai Motor Company (South Korea)

6.6. Yamaha Motor Co., Ltd. (Japan)

7. Key Findings

8. Analyst Recommendations

8.1. Strategic Recommendations

8.2. Future Outlook