Asia Pacific Coffee Market Size, Share, Growth Trends, Industry Analysis, Key Players, Investment Opportunities, and Forecast (2025-2032)

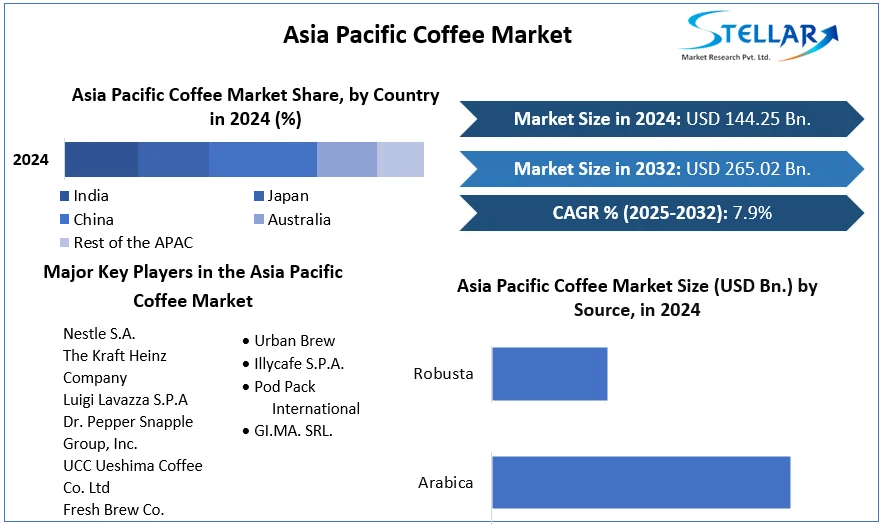

Asia Pacific Coffee Market size was valued at US$ 144.25 Bn. in 2024. Coffee will encourage a great deal of transformation in Beverage Sector in the Asia Pacific.

Format : PDF | Report ID : SMR_84

Asia Pacific Coffee Market Definition:

Coffee is a brewed beverage made from roasted coffee beans, which are the fruit seeds of certain types of coffee. Grains are separated from the coffee berries to obtain a stable raw product, unroasted green coffee. The seeds are then roasted into a consumable product

To get more Insights: Request Free Sample Report

Asia Pacific Coffee Market Dynamics:

Coffee has a wide range of nutrients that help boost the body's immune system and maintain body health, this factor is driving the growth of the coffee market. Due to the high risk of cardiovascular disease associated with coffee consumption, a variety of consumers are switching to alternatives, a factor driving the growth of the coffee market. New advanced with different flavor pinches as different manufacturers invest in new products and acquire or merge different coffee brands to survive in growing markets and meet customer needs.

The growing popularity of various coffee products among consumers in the region. Countries such as India, Thailand, the Philippines, and Indonesia, which contribute to the coffee market, are seeing an increasing number of coffee cafes and shops. The climate and geographical location of Southeast Asia make it ideal for growing coffee. It is the region's coffee culture and coffee production expertise that helped create the region's booming coffee industry.

Some Southeast Asian countries, such as Indonesia, Vietnam, and Laos, have become coffee export giants. Demand for coffee is also rising in Thailand, attracting companies and investment. The Philippines is determined to revitalize the coffee industry in order to capture the growing domestic demand for niche markets and specialty coffees. Vietnam is also the second-largest coffee exporter in the world after Brazil.

The opening and expansion of local and new coffee shops is another factor driving demand for coffee, which contributes to the growth of the bean market. Increased milk consumption also favors market growth, as consumers mix coffee and milk for a better taste. The ability to live in a coffee shop for a long time has also attracted the attention of consumers, and the demand for coffee is increasing. In addition, the coffee shop acts as an alternative to the library.

In the Asia-Pacific region, drinking coffee is seen as a fashion and relaxing lifestyle for young people, leading to increased demand for coffee. Coffee beans are treated differently for sale in different blends of coffee and are available in retail stores, grocery stores, and online.

Japan remains a major coffee market, like coffee in sachets and freshly brewed coffee are widely used by busy lifestyle consumers. Still, in emerging markets such as Indonesia and the Philippines, instant coffee continues to grow strongly due to its affordability, versatility, and ease of cooking.

Nestlé dominates the coffee market in the Asia Pacific region, but local players such as the Kapalua Pi Group in Indonesia are facing competition due to increased marketing activity and an extensive distribution network. Local businesses and specialty cafes offer freshly brewed coffee such as drip coffee and freshly ground coffee pods to appeal to consumer sophistication, especially in developed markets, including South Korea. Launched retail products.

COVID 19 Analysis:

In Thailand, for instance, a café, “Art of Coffee” has installed a rope and pulley system to serve drinks at a one-meter distance to limit contact between staff and customers- an innovative step towards curbing the spread of the virus.

In Malaysia, however, coffee shops will not be allowing customers to dine in but will remain partially open for takeaway. A similar trend is seen in Singapore, where people will no longer dine in at food and beverage outlets including hawker centers and coffee shops but are allowed to buy takeaways.

Tata Starbucks India launched drive-through outlets and home deliveries as well as increased its focus on digital solutions like digital payments and transacting through mobile app., to mitigate the economic impact of the Coronavirus pandemic.

SWOT Analysis of the potential market for Pacific Coffee:

Strengths

Brand Image: The company is recognized as serving the best coffee in Hong Kong, having won numerous consumer awards organized by major magazines and websites. Fine Products and Services: The company selects only the best coffees from Central and South Africa, Indonesia, and Kona. The coffee is 100% Arabica, sustainable varieties, chemical, and pesticide-free. Social Responsibility: The company has committed to raising funds for disabled children in local communities and actively combating climate change.

Weaknesses

Low brand awareness & low market share in overseas markets: Pacific Coffee's goal was the Asia Pacific region but the company only has a few branches outside of Hong Kong Over dependent on coffee and coffee-related products: With the coffee industry growing and offering a variety of different drinks and foods, Pacific coffee doesn't have much variety compared to its competitors. High price products: The product price is also higher than some competitors such as McCafé, which can result in loss of customers and profit. Poor advertisement: There's limited advertising while other companies in the market have better marketing, which results in more customers

Opportunities

Expansion of Global Operations: Due to the growing popularity of coffee, Pacific Coffee has the ability to enter different markets. Social Trend of Environmental Protection: Pacific Coffee can encourage the use of reusable cups and in return provide discounts.

Threats

Limited Variety: There are always new drinks being introduced to the market and this can be harmful to the company since it only relies on coffee products. Multiple Competitors: Starbucks, McCafé, and local Rock’n’Joe Cafe are all direct competition for Pacific Coffee. Economic Impact: Downturns in the economy and shifting consumer priorities can affect consumer

The objective of the report is to present a comprehensive analysis of the Asia Pacific Coffee market to the stakeholders in the industry. The report provides trends that are most dominant in the Asia Pacific Coffee market and how these trends will influence new business investments and market development throughout the forecast period. The report also aids in the comprehension of the Asia Pacific Coffee Market dynamics and competitive structure of the market by analyzing market leaders, market followers, and regional players.

The qualitative and quantitative data provided in the Asia Pacific Coffee market report is to help understand which market segments, regions are expected to grow at higher rates, factors affecting the market, and key opportunity areas, which will drive the industry and market growth through the forecast period. The report also includes the competitive landscape of key players in the industry along with their recent developments in the Asia Pacific Coffee market. The report studies factors such as company size, market share, market growth, revenue, production volume, and profits of the key players in the Asia Pacific Coffee market.

The report provides Porter's Five Force Model, which helps in designing the business strategies in the market. The report helps in identifying how many rivals are existing, who they are, and how their product quality is in the Asia Pacific Coffee market. The report also analyses if the Asia Pacific Coffee market is easy for a new player to gain a foothold in the market, do they enter or exit the market regularly if the market is dominated by a few players, etc.

The report also includes a PESTEL Analysis, which aids in the development of company strategies. Political variables help in figuring out how much a government can influence the Asia Pacific Coffee market. Economic variables aid in the analysis of economic performance drivers that have an impact on the Asia Pacific Coffee market. Understanding the impact of the surrounding environment and the influence of ecological concerns on the Asia Pacific Coffee market is aided by legal factors.

Asia Pacific Coffee Market Scope:

|

Asia Pacific Coffee Market |

|

|

Market Size in 2024 |

USD 144.25 Bn. |

|

Market Size in 2032 |

USD 265.02 Bn. |

|

CAGR (2025-2032) |

7.9% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

By Source

|

|

By Type

|

|

|

By Process

|

|

|

Country Scope |

China India Japan South Korea Australia ASEAN Rest of APAC |

Asia Pacific Coffee KEY PLAYERS:

-

The Kraft Heinz Company

-

Luigi Lavazza S.P.A

-

Dr. Pepper Snapple Group, Inc.

-

UCC Ueshima Coffee Co. Ltd

-

Urban Brew

-

Illycafe S.P.A.

-

Pod Pack International

-

GI.MA. SRL.

Frequently Asked Questions

The Asia Pacific Coffee Market size was USD 5 Billion in 2024.

Asia Pacific Coffee Market is studied from 2024 to 2032.

Asia Pacific Coffee Market report helps with the PESTEL, PORTER, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period.

The Asia Pacific Coffee Market is growing at a CAGR of 7.9% during forecasting period 2025-2032.

Table of Contents: Chapter 1 Scope of the Report

Chapter 2 Research Methodology

2.1. Research Process

2.2. Asia Pacific Coffee Market: Target Audience

2.3. Asia Pacific Coffee Market: Primary Research (As per Client Requirement)

2.4. Asia Pacific Coffee Market: Secondary Research

Chapter 3 Executive Summary

Chapter 4 Competitive Landscape

4.1. Market Share Analysis, By Value, 2024-2032

4.1.1. Asia Pacific Market Share Analysis, By Source, By Value, 2024-2032 (In %)

4.1.1.1.China Market Share Analysis, By Source, By Value, 2024-2032 (In %)

4.1.1.2.India Market Share Analysis, By Source, By Value, 2024-2032 (In %)

4.1.1.3.Japan Market Share Analysis, By Source, By Value, 2024-2032 (In %)

4.1.1.4.South Korea Market Share Analysis, By Source, By Value, 2024-2032 (In %)

4.1.1.5.Australia Market Share Analysis, By Source, By Value, 2024-2032 (In %)

4.1.1.6.ASEAN Market Share Analysis, By Source, By Value, 2024-2032 (In %)

4.1.1.7.Rest of APAC Market Share Analysis, By Source, By Value, 2024-2032 (In %)

4.1.2. Asia Pacific Market Share Analysis, By Type, By Value, 2024-2032 (In %)

4.1.2.1.China Market Share Analysis, By Type, By Value, 2024-2032 (In %)

4.1.2.2.India Market Share Analysis, By Type, By Value, 2024-2032 (In %)

4.1.2.3.Japan Market Share Analysis, By Type, By Value, 2024-2032 (In %)

4.1.2.4.South Korea Market Share Analysis, By Type, By Value, 2024-2032 (In %)

4.1.2.5.Australia Market Share Analysis, By Type, By Value, 2024-2032 (In %)

4.1.2.6.ASEAN Market Share Analysis, By Type, By Value, 2024-2032 (In %)

4.1.2.7.Rest of APAC Market Share Analysis, By Type, By Value, 2024-2032 (In %)

4.1.3. Asia Pacific Market Share Analysis, By Process, By Value, 2024-2032 (In %)

4.1.3.1.China Market Share Analysis, By Process, By Value, 2024-2032 (In %)

4.1.3.2.India Market Share Analysis, By Process, By Value, 2024-2032 (In %)

4.1.3.3.Japan Market Share Analysis, By Process, By Value, 2024-2032 (In %)

4.1.3.4.South Korea Market Share Analysis, By Process, By Value, 2024-2032 (In %)

4.1.3.5.Australia Market Share Analysis, By Process, By Value, 2024-2032 (In %)

4.1.3.6.ASEAN Market Share Analysis, By Process, By Value, 2024-2032 (In %)

4.1.3.7.Rest of APAC Market Share Analysis, By Process, By Value, 2024-2032 (In %)

4.2. Stellar Competition matrix

4.2.1.Asia Pacific Stellar Competition Matrix

4.3. Key Players Benchmarking

4.3.1.Key Players Benchmarking by Source, Pricing, Market Share, Investments, Expansion Plans, Physical Presence and Presence in the Market.

4.4. Mergers and Acquisitions in Industry

4.4.1.M&A by Region, Value and Strategic Intent

4.5. Market Dynamics

4.5.1.Market Drivers

4.5.2.Market Restraints

4.5.3.Market Opportunities

4.5.4.Market Challenges

4.5.5.PESTLE Analysis

4.5.6.PORTERS Five Force Analysis

4.5.7.Value Chain Analysis

Chapter 5 Asia Pacific Coffee Market Segmentation: By Source

5.1. Asia Pacific Coffee Market, By Source, Overview/Analysis, 2024-2032

5.2. Asia Pacific Coffee Market, By Source, By Value, Market Share (%), 2024-2032 (USD Million)

5.3. Asia Pacific Coffee Market, By Source, By Value, -

5.3.1.Arabica

5.3.2.Robusta

Chapter 6 Asia Pacific Coffee Market Segmentation: By Type

6.1. Asia Pacific Coffee Market, By Type, Overview/Analysis, 2024-2032

6.2. Asia Pacific Coffee Market Size, By Type, By Value, Market Share (%), 2024-2032 (USD Million)

6.3. Asia Pacific Coffee Market, By Type, By Value,

6.3.1.Instant Coffee

6.3.2.Ground Coffee

6.3.3.Whole Grain

6.3.4.Others

Chapter 7 Asia Pacific Coffee Market Segmentation: By Process

7.1. Asia Pacific Coffee Market, By Process, Overview/Analysis, 2024-2032

7.2. Asia Pacific Coffee Market Size, By Process, By Value, Market Share (%), 2024-2032 (USD Million)

7.3. Asia Pacific Coffee Market, By Process, By Value, -

7.3.1.Caffeinated

7.3.2.Decaffeinated

Chapter 8 Asia Pacific Coffee Market Size, By Value, 2024-2032 (USD Million)

8.1.1.China

8.1.2.India

8.1.3.Japan

8.1.4.South Korea

8.1.5.Australia

8.1.6.ASEAN

8.1.7.Rest of APAC

Chapter 9 Company Profiles

9.1. Key Players

9.1.1. Nestle

9.1.1.1.Company Overview

9.1.1.2.Source Portfolio

9.1.1.3.Financial Overview

9.1.1.4.Business Strategy

9.1.1.5.Key Developments

9.1.2.The Kraft Heinz Company

9.1.3.Luigi Lavazza S.P.A

9.1.4.Dr. Pepper Snapple Group, Inc.

9.1.5.UCC Ueshima Coffee Co. Ltd

9.1.6.Fresh Brew Co.

9.1.7.Urban Brew

9.1.8.Illycafe S.P.A.

9.1.9.Pod Pack International

9.1.10. GI.MA. SRL.

9.2. Key Findings

9.3. Recommendations