Malaysia Pea Protein Market Size, Share, Growth Trends, Industry Analysis, Key Players, Investment Opportunities and Forecast (2025-2032)

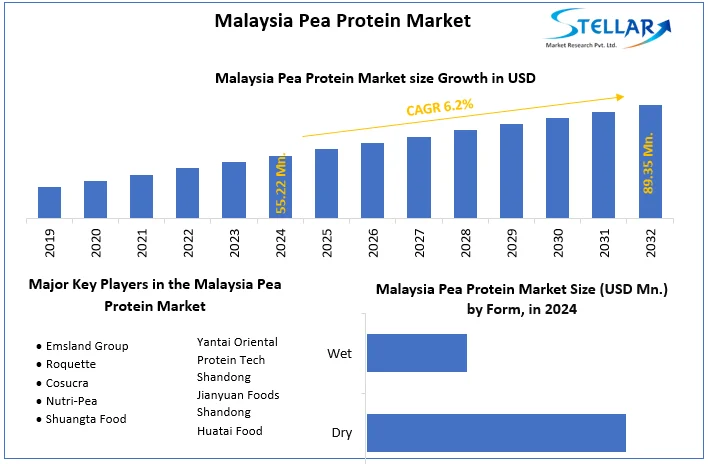

The Malaysia Pea Protein Market size was valued at USD 55.22 Mn. in 2024 and the total Malaysia Pea Protein revenue is expected to grow at a CAGR of 6.2% from 2025 to 2032, reaching nearly USD 89.35 Mn. in 2032.

Format : PDF | Report ID : SMR_1668

Malaysia Pea Protein Market Overview-

Pea protein extraction involves a two-step process such as mechanically removing outer shells in a dry phase and isolating water-soluble proteins through wet filtration and centrifugation. Driven by health consciousness, sustainability, and technological advancements, pea protein gains traction in the food industry. Innovative extraction methods, like chemical-free dry fractionation, offer cost-effectiveness and minimal environmental impact. This study researches pea protein intricacies, covering extraction techniques, chemical composition, functional attributes, modification methods, and diverse applications, showcasing its versatility and promising role in the food industry, from emulsifiers to dairy and meat products.

The Malaysia pea protein market experiences robust growth thanks to factors such as increasing demand for plant-based proteins, driven by health-conscious consumers. Pea protein's health benefits, sustainability, and appeal to the growing vegan and vegetarian population contribute to its popularity. Technological advancements and evolving consumer preferences improve the market's growth.

The Malaysia Pea Protein market report explores trends, technological advancements, and potential disruptions, evaluating the market size, growth, economic factors, regulations, and commercial drivers. The competitive landscape is scrutinized, emphasizing differentiation among key operators, and drawing on historical data. The report forecasts sector resilience challenges, spotlighting the Malaysia Pea Protein industry's response to economic downturns.

To get more Insights: Request Free Sample Report

Increased Demand for Plant-Based Protein Drives the Malaysia Pea Protein Market

The increasing demand for plant-based alternatives drives significant growth in the Malaysia pea protein market. With increasing interest in plant-based diets, pea protein, boasting a complete profile and versatility, stands out as a preferred ingredient for food manufacturers, reflecting the market's growth driven by evolving consumer preferences.

The growing preference for plant-based options stimulates innovation in Malaysia pea protein market. Manufacturers engage in product development, introducing novel items such as plant-based meat substitutes, protein powders, and health-focused food products to meet the increasing demand for diverse and sustainable dietary choices.

Additionally, leveraging pea protein confers a competitive advantage in the Malaysia pea protein market, enabling companies to position themselves as providers of healthy and sustainable options. Effectively incorporating pea protein into products enhances appeal, attracting a broader customer base and reinforcing a strategic edge in the competitive landscape. The growing demand for plant-based alternatives drives significant growth in the Malaysia pea protein market. This trend fuels innovation, with manufacturers developing new products like plant-based meat substitutes and protein powders, gaining a competitive advantage by positioning themselves as providers of healthy and sustainable options, attracting a wider customer base.

Malaysia Pea Protein Market Segment Analysis:

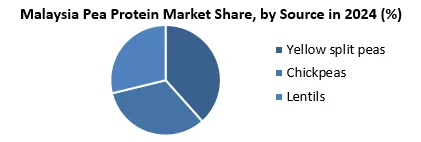

Based on Source, the yellow split peas segment held the largest market share of about 80% in the Malaysia Pea Protein Market in 2024. According to the STELLAR analysis, the segment is further expected to grow at a CAGR of 6.3% during the forecast period. It stands out as the dominant segment within the Pea Protein Market thanks to its rapid technological advancement and growing adoption of smart devices with data connectivity and integration.

Malaysia acknowledges yellow split peas as an excellent protein source, ideal for pea protein extraction. Considering domestic cultivation, cultivating yellow peas locally diminishes import dependence, fostering a sustainable pea protein supply chain and enhancing self-sufficiency in Malaysia pea protein market.

Additionally, Yellow split peas face potential processing cost challenges in the Malaysia pea protein market, delaying widespread adoption by manufacturers. Limited data availability on pea protein sources complicates assessing yellow split peas' market share, emphasizing the need for comprehensive information to make informed decisions in the evolving protein industry landscape. Yellow split peas emerge as a place player in Malaysia pea protein market, given optimal domestic cultivation for cost-effectiveness. With the increasing pea protein market and increasing demand for sustainable sources, yellow split peas hold future potential if processing costs are mitigated, making them an appealing choice for consumers.

In Malaysia's pea protein market, blending from various legumes is common for desired functionalities or cost efficiency, complicating the identification of yellow split peas' specific contribution. The focus on imports suggests a reliance on established pea protein producers, potentially utilizing yellow peas from other countries, obscuring market dynamics.

Malaysia Pea Protein Market Scope:

|

Malaysia Pea Protein Market |

|

|

Market Size in 2024 |

USD 55.22 Mn. |

|

Market Size in 2032 |

USD 89.35 Mn. |

|

CAGR (2025-2032) |

6.2% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

By Product

|

|

By Form

|

|

|

By Source

|

|

|

By Application

|

|

Leading Key Players in the Malaysia Pea Protein Market

- Emsland Group

- Roquette

- Cosucra

- Nutri-Pea

- Shuangta Food

- Yantai Oriental Protein Tech

- Shandong Jianyuan Foods

- Shandong Huatai Food

Frequently Asked Questions

Price sensitivity is expected to be the major restraining factor for the Malaysia Pea Protein market growth.

The Malaysia Pea Protein Market size was valued at USD 55.22 Million in 2024. The total Malaysia Pea Protein revenue is expected to grow at a CAGR of 6.2 % from 2025 to 2032, reaching nearly USD 89.35 Million By 2032.

1. Malaysia Pea Protein Market: Research Methodology

1.1. Research Data

1.1.1. Secondary Data

1.1.2. Primary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. Malaysia Pea Protein Market: Executive Summary

2.1. Market Overview

2.2. Market Size (2024) and Forecast (2025 – 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments

3. Malaysia Pea Protein Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Product Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2024)

3.2.7. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

4. Malaysia Pea Protein Market: Dynamics

4.1. Malaysia Pea Protein Market Trends

4.2. Malaysia Pea Protein Market Drivers

4.3. Malaysia Pea Protein Market Restraints

4.4. Malaysia Pea Protein Market Opportunities

4.5. Malaysia Pea Protein Market Challenges

4.6. PORTER’s Five Forces Analysis

4.7. PESTLE Analysis

4.8. Technological Roadmap

4.9. Value Chain Analysis

4.10. Regulatory Landscape

5. Malaysia Pea Protein Market: Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

5.1. Malaysia Pea Protein Market Size and Forecast, by Product (2024-2032)

5.1.1. Includes Isolates

5.1.2. Concentrates

5.1.3. Textured

5.1.4. Hydrolysates

5.2. Malaysia Pea Protein Market Size and Forecast, by Form (2024-2032)

5.2.1. Dry

5.2.2. Wet

5.3. Malaysia Pea Protein Market Size and Forecast, by Source (2024-2032)

5.3.1. Yellow split peas

5.3.2. Chickpeas

5.3.3. Lentils

5.4. Malaysia Pea Protein Market Size and Forecast, by Application (2024-2032)

5.4.1. Food

5.4.2. Meat Substitutes

5.4.3. Performance Nutrition

5.4.4. Functional Foods

5.4.5. Snacks

5.4.6. Bakery Products

5.4.7. Confections

5.4.8. Food Applications Beverages

5.4.9. Others

6. Company Profile: Key Players

6.1. Emsland Group

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.3. Financial Overview

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

6.2. Roquette

6.3. Cosucra

6.4. Nutri-Pea

6.5. Shuangta Food

6.6. Yantai Oriental Protein Tech

6.7. Shandong Jianyuan Foods

6.8. Shandong Huatai Food

7. Key Findings

8. Analyst Recommendations

8.1. Strategic Recommendations

8.2. Future Outlook