Asia Pacific Pea Protein Market Size, Share, Growth Trends, Industry Analysis, Key Players, Investment Opportunities, and Forecast (2025-2032)

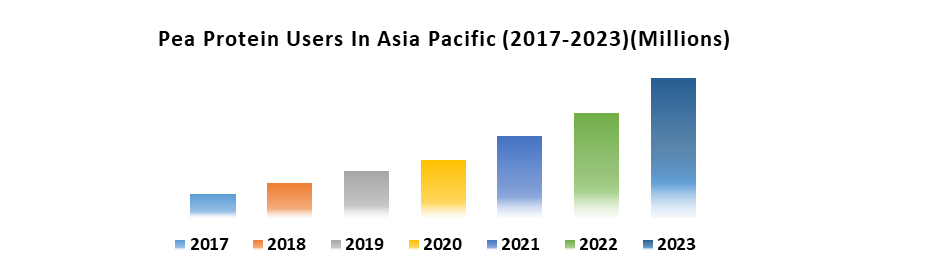

The Asia Pacific Pea Protein Market size was valued at USD 324.04 Mn. in 2024 and the total Asia Pacific Pea Protein Market revenue is expected to grow at a CAGR of 7.3% from 2025 to 2032, reaching nearly USD 569.38 Mn.

Format : PDF | Report ID : SMR_1662

Asia Pacific Pea Protein Market Overview

Pea stands out as a vital nutritional source, boasting high protein, starch, and fiber content. Its protein, recognized for quality, has become a significant player globally, valued for low allergenicity, sustainability, and cost-effectiveness. Revealing exceptional functional properties such as solubility, mix ability, and viscosity, pea protein is gaining traction in the food industry. Extraction methods, including chemical-free dry fractionation, have emerged, offering cost-effectiveness and minimal environmental impact. The explores the intricacies of pea protein, covering extraction techniques, chemical composition, functional attributes, modification methods, and diverse applications, from food emulsifiers to dairy and meat products, showcasing its versatility and promising role in the food industry.

The analysis offers crucial insights into the current Asia Pacific Pea Protein market and unravels emerging trends and possibilities. Catering to industry professionals, policymakers, and investors, the report provides actionable intelligence by strategically examining market dynamics, technological advancements, and key stakeholders. Focused on Pea Proteins, it empowers decision-makers with a comprehensive understanding of the market landscape, addressing challenges and forecasting potential evolution. The market's innovative healthcare solutions for children are highlighted, encompassing diagnostic, therapeutic, and monitoring aspects. This detailed overview navigates through market nuances, emphasizing specialties and offering a holistic perspective on the Asia Pacific Pea Proteins industry.

To get more Insights: Request Free Sample Report

Asia Pacific Pea Protein Market Dynamics

Rising health and wellness awareness to drive Asia Pacific Pea Protein Market

The Asia Pacific Pea Protein Market witnesses a surge in demand thanks to rising health consciousness. Consumers, concerned about chronic diseases, opt for healthier food, with plant-based proteins like pea protein viewed as lower in saturated fat and cholesterol. Increasing interest in preventive healthcare amplifies the demand for pea protein, reflecting a shift toward healthier lifestyles. In the Asia Pacific Pea Protein Market, changing dietary preferences, driven by the surge in vegetarianism and veganism, particularly in India and China, amplify the demand for plant-based proteins.

Consumers prioritize ethical considerations, environmental sustainability, and perceived health benefits, shaping their choices toward plant-based diets. The Asia Pacific Pea Protein Market sees a surge in demand for functional foods driven by increasing health awareness. Pea protein, abundant in essential amino acids and nutrients, gains prominence in fortified beverages, nutritional supplements, sports nutrition, and bakery and snack products, meeting the growing consumer preference for health-enhancing food choices.

The growing vegan and vegetarian population provide significant growth for the Asia Pacific Pea Protein market.

The Asia Pacific Pea Protein Market booms as the vegan and vegetarian population abstains from animal products. Pea protein, among plant-based alternatives, arises as a healthy substitute, meeting dietary needs. As the vegan and vegetarian community increases, the demand for pea protein rises correspondingly, presenting a robust market opportunity. The Asia Pacific Pea Protein Market is run by a surging vegan and vegetarian populace, particularly in India and China. Driven by ethical considerations, environmental sustainability, and perceived health benefits, this trend directly amplifies the demand for plant-based products, including those featuring pea protein, in the region.

In the Asia Pacific Pea Protein Market, the rising vegan and vegetarian demographic inspires innovative plant-based product development. Pea protein's adaptability and functional qualities make it a key ingredient in diverse alternatives, from textured substitutes for meat products to inspiring dairy alternatives like milk, yogurt, and cheese. Additionally, it enhances protein bars, bakery items, and nutritional supplements. The Pea Protein Market benefits from the growing vegan and vegetarian demographic seeking healthy, sustainable, and ethically sourced food. Pea protein, rich in essential amino acids, demands less land and water than animal proteins, aligning with cruelty-free principles. As this population grows, the Asia Pacific pea protein market flourishes, presenting opportunities for innovative solutions.

Asia Pacific Pea Protein Market Segment Analysis:

By Product, the Concentrates segment held the largest market share of about 55% in the Asia Pacific Pea Protein Market in 2024. According to the STELLAR analysis, the segment is further expected to grow at a CAGR of 7.4% during the forecast period. It stands out as the dominant segment within the Asia Pacific Pea Protein Market thanks to its rapid technological advancement and growing adoption of smart devices with data connectivity and integration.

In the Asia Pacific Pea Protein Market, cost-effectiveness is key. Concentrates, more affordable than isolates and textured pea protein, meet the region's high price sensitivity, especially in developing economies. This economical option enhances accessibility and adoption in a market where affordability plays a pivotal role.

In the Asia Pacific Pea Protein Market, concentrates are versatile. With excellent functional properties, they serve as effective thickeners, texturizers, and emulsifiers in diverse applications like soups, sauces, bakery items, beverages, and dressings. Additionally, concentrates function as nutritional enhancers, elevating protein content across various food products. In the Asia Pacific Pea Protein Market, the surge in demand for clean-label products propels the adoption of concentrates. Recognized for their minimal processing compared to isolates, concentrates align with consumer preferences for natural ingredients. This trend reflects the region's growing emphasis on clean-label criteria and natural product choices.

In the Asia Pacific Pea Protein Market, concentrates align with regional preferences, finding Favor in traditional dishes across Asian countries. Though current market dynamics favor concentrates, isolates are anticipated to rise due to higher protein content and hypoallergenic properties. Regional variations persist, influencing the roles and preferences for concentrates based on culinary traditions and country-specific dynamics. Concentrates continue to serve as the backbone of the Asia Pacific pea protein market, providing a cost-effective, versatile, and consumer-friendly solution for various food and beverage applications. Also, the evolving market landscape suggests that other pea protein segments are poised to gain ground in the future, signaling potential shifts in preferences and industry dynamics.

Asia Pacific Pea Protein Market Regional Insights:

China, the leading pea producer in the Asia Pacific maintains its status as the region's leading pea protein market, displaying a consistent and growing Compound Annual Growth Rate (CAGR). India, an emerging pea protein market, holds vast potential driven by its expansive and increasing population, rising disposable income, and a growing emphasis on health and wellness. Increasing health awareness drives the shift to plant-based proteins, with pea protein gaining traction in functional foods for added health benefits. The region's rising vegan and vegetarian population fuels demand for the Asia Pacific Pea Protein industry.

South Korea's mature plant-based protein market favors pea protein for its hypoallergenic nature and clean-label appeal. In Japan, a well-established functional foods market sees the integration of pea protein in diverse food and beverage products. Australia, driven by health consciousness, experiences a rising demand for plant-based proteins, including pea protein. Southeast Asia, encompassing Malaysia, Indonesia, and Vietnam, emerges as a promising market for the Asia Pacific pea protein industry and is driven by rising disposable income and heightened health awareness. In Bangladesh, a developing market with a substantial population, the Asia Pacific pea protein market is in its early stages, holding growth potential.

Competitive Landscape for the Asia Pacific Pea Protein Market

The Asia Pacific Pea Protein Market is expected to be highly competitive, with the active presence of numerous market players. Major companies are striving to introduce cost-efficient and advanced implant-focused products to meet the increasing demand, consequently fostering market growth. Key players are adopting various business strategies, including technical partnerships and mergers and acquisitions (M&A) to remain competitive in the Pea Protein market. For instance,

- At VITFOOD Asia 2023, Ingredion Incorporated featured its plant-based protein portfolio, spotlighting Vita™ Pea Pro, a pea protein isolate. The showcase emphasized its applications in plant-based meat and dairy alternatives.

- In 2022, Archer Daniels Midland Company (ADM) launched Heartland® Textured Pea Protein, a pea protein isolate, into the Asia Pacific market, addressing the increasing demand for textured pea protein in plant-based meat alternatives.

- In 2021, Ingredion Incorporated increased pea protein production capacity in China, showcasing its commitment to the Asia Pacific market. This expansion aligns with the company's anticipation of the region's growing demand for pea protein, emphasizing its belief in the future potential of this plant-based protein source.

These strategic endeavors underscore the Asia Pacific Pea Protein industry's commitment to diversifying product lines, innovating within segments, and adopting strategic partnerships to compete effectively in the market landscape. As consumer preferences evolve, these proactive strategies position the Asia Pacific Pea Protein manufacturers for sustained growth and competitiveness in the dairy market.

|

Asia Pacific Pea Protein Market Scope |

|

|

Market Size in 2024 |

USD 324.04 Mn. |

|

Market Size in 2032 |

USD 569.38 Mn. |

|

CAGR (2025-2032) |

7.3% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope

|

By Product

|

|

By Form

|

|

|

By Source

|

|

|

By Application

|

|

|

Country Scope |

|

Asia Pacific Pea Protein Market Key Players

- Archer Daniels Midland Company

- Cargill, Incorporated

- Ingredion Incorporated

- International Flavors & Fragrances Inc.

- Kerry Group PLC

- Roquette Frères

- Cosucra Groupe Warcoing SA

- Ingredion Incorporated

- AGT Food and Ingredients

- Shandong Jianyuan Group

- The Scoular Company

- Axiom Foods Inc.

- Farbest Brands

- Glanbia plc

- Yantai Shuangta Food Co., Ltd.

Country Breakdown:

Japan Pea Protein Market: Industry Analysis and Forecast (2024-2030)

Malaysia Pea Protein Market: Industry Analysis and Forecast (2024-2030)

Indonesia Pea Protein Market: Industry Analysis and Forecast (2024-2030)

Australia Pea Protein Market: Industry Analysis and Forecast (2024-2030)

Frequently Asked Questions

Supply Chain disruptions and Reimbursement uncertainties are expected to be the major restraining factors for the market growth.

China is expected to lead the Asia Pacific Pea Protein market during the forecast period.

The Market size was valued at USD 324.04 Million in 2024 and the total Market revenue is expected to grow at a CAGR of 7.3% from 2025 to 2032, reaching nearly USD 569.38 Million.

The segments covered in the market report are By Product, Form, Source, and Application.

1. Asia Pacific Pea Protein Market: Research Methodology

1.1 Research Data

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Up Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. Asia Pacific Pea Protein Market Executive Summary

2.1. Market Overview

2.2. Market Size (2024) and Forecast (2025 – 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments

3. Asia Pacific Pea Protein Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Product Segment

3.2.4. Total Production (2024)

3.2.5. End-user Segment

3.2.6. Y-O-Y%

3.2.7. Revenue (2024)

3.2.8. Profit Margin

3.2.9. Market Share

3.2.10. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

3.4.1. Strategic Initiatives and Developments

3.4.2. Mergers and Acquisitions

3.4.3. Collaborations and Partnerships

3.4.4. Product Launches and Innovations

4. Asia Pacific Pea Protein Market: Dynamics

4.1. Asia Pacific Pea Protein Market Trends

4.2. Asia Pacific Pea Protein Market Drivers

4.3. Asia Pacific Pea Protein Market Restraints

4.4. Asia Pacific Pea Protein Market Opportunities

4.5. Asia Pacific Pea Protein Market Challenges

4.6. PORTER’s Five Forces Analysis

4.6.1. Intensity of the Rivalry

4.6.2. Threat of New Entrants

4.6.3. Bargaining Power of Suppliers

4.6.4. Bargaining Power of Buyers

4.6.5. Threat of Substitutes

4.7. PESTLE Analysis

4.7.1. Political Factors

4.7.2. Economic Factors

4.7.3. Social Factors

4.7.4. Technological Factors

4.7.5. Legal Factors

4.7.6. Environmental Factors

4.8. Technological Roadmap

4.9. Value Chain Analysis

4.10. Regulatory Landscape

5. Asia Pacific Pea Protein Market: Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

5.1. Asia Pacific Pea Protein Market Size and Forecast, by Product (2024-2032)

5.1.1. Includes isolates

5.1.2. Concentrates

5.1.3. Textured

5.1.4. hydrolysates

5.2. Asia Pacific Pea Protein Market Size and Forecast, by Form (2024-2032)

5.2.1. Dry

5.2.2. Wet

5.3. Asia Pacific Pea Protein Market Size and Forecast, by Source (2024-2032)

5.3.1. Yellow split peas

5.3.2. Chickpeas

5.3.3. Lentils

5.4. Asia Pacific Pea Protein Market Size and Forecast, by Application (2024-2032)

5.4.1. Food

5.4.2. Meat substitutes

5.4.3. Performance Nutrition

5.4.4. Functional foods

5.4.5. Snacks

5.4.6. Bakery products

5.4.7. Confections

5.4.8. Other food applications

5.4.9. beverages

5.5. Asia Pacific Pea Protein Market Size and Forecast, by Country (2024-2032)

5.5.1. China

5.5.2. India

5.5.3. South Korea

5.5.4. Japan

5.5.5. Australia

5.5.6. Malaysia

5.5.7. Indonesia

5.5.8. Vietnam

5.5.9. Bangladesh

6. Company Profile: Key Players

6.1. Archer Daniels Midland Company

6.1.1. Company Overview

6.1.2. Product Portfolio

6.1.2.1. Product Name

6.1.2.2. Product Details (Price, Features, etc)

6.1.3. Financial Overview

6.1.3.1. Total Revenue

6.1.3.2. Segment Revenue

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

6.2. Cargill, Incorporated

6.3. Ingredion Incorporated

6.4. International Flavors & Fragrances Inc.

6.5. Kerry Group PLC

6.6. Roquette Frères

6.7. Cosucra Groupe Warcoing SA

6.8. Ingredion Incorporated

6.9. AGT Food and Ingredients

6.10. Shandong Jianyuan Group

6.11. The Scoular Company

6.12. Axiom Foods Inc.

6.13. Farbest Brands

6.14. Glanbia plc

6.15. Yantai Shuangta Food Co., Ltd.

7. Key Findings

8. Industry Recommendations

8.1. Strategic Recommendations

8.2. Future Outlook