Asia-Pacific Casino Gaming Equipment Market- Industry Analysis and Forecast (2025-2032) Trends, Statistics, Dynamics, Segmentation by Product Type, Installation and Region.

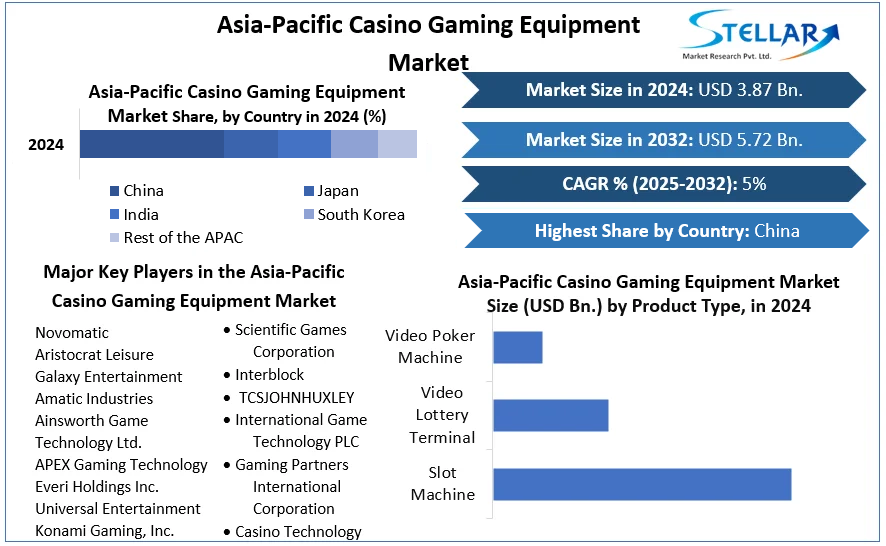

Asia-Pacific Casino Gaming Equipment Market was valued nearly US$ 3.87 Bn. in 2024. Asia-Pacific Casino Gaming Equipment Market size is estimated to grow at a CAGR of 5% & is expected to reach at US$ 5.72 Bn. by 2032.

Format : PDF | Report ID : SMR_222

Asia-Pacific Casino Gaming Equipment Market Overview:

Gaming machines & instruments used for gambling & guaranteeing visibility in casino operations are referred to as casino gaming equipment. Some of the most regularly used casino gaming based on all these items roulette wheels, gaming tables, shuffle machines, player tracking systems, slot machines, video poker machines, & online poker. Poker, big six-wheel, baccarat, blackjack, craps, & five-card draws are all played on these machines. Profitability, convenience, safety, and cost-effectiveness are all improved by the equipment. They're also used to analyse player activity and verify the authenticity of phony & genuine money notes. As a result, malls, casinos, & gaming arenas all have casino gaming equipment.

To get more Insights: Request Free Sample Report

The APAC region's online gaming market is growing.

The internet's rapid expansion has brought the entire world together. It has given people immediate access to entertainment, information, money-making opportunities, and more. It has undoubtedly altered the way we experience life, whether people recognize this or not. It has also resulted in numerous of industry-wide reforms. It has also offered small business owners the freedom to articulate themselves effectively.

People are more conscious than ever before of businesses people were previously unaware of. The internet gaming industry is however one revolutionary industry. People had little faith in online gaming a decade ago. The explosive expansion of internet usage has turned online gambling into a worth billions of dollars industry.

It's very difficult to pinpoint the specific year when online gambling first began. Many feel that the Free Trade and Processing Act passed by Antigua & Barbuda in 1994 was the catalyst. Online gambling is very popular in Asia-Pacific, particularly in India, where there are no explicit rules governing online gambling. Indians do not have the financial means to bet in brick-and-mortar casinos. This is why people prefer to play their best games in online casinos. Now let first take a look at the Asian markets before delving into the current condition of online gaming in Apac region. This is due to the fact that conventional gambling is legal in the majority of Asian countries. With each passing year, they have experienced amazing growth.

Asia Pacific casinos are outshining Las Vegas in terms of allure.

In Asia Pacific, there seem to be a plethora of gambling options. These bring in more gaming income than the entire Las Vegas strip. Following the popularity of casino gambling in its neighboring countries, a number of countries in the area have made it legal. In 2006, Macau eclipsed Las Vegas in terms of revenue. It was 14 years ago, & there was quite a stir in Asia Pacific countries. The internet gaming business was also affected by this decision. Macau's rise to fame was only the beginning. In terms of gambling revenue, many other countries have now exceeded Las Vegas. In 2012, Singapore has only two land-based casinos. By the end of 2013, it had overtaken income from the Las Vegas Strip. China's gaming sector was estimated at $0.5 Bn in 2006. The gambling market reached $40 Bn in 2018. This is 6 times the revenues of Las Vegas.

The massive growth that occurred in Asia Pacific's gaming business sparked the possibility of legalizing. Gambling activities in the region has increased as a result of massive expansion activities in the Philippines and the construction of integrated resorts in Japan. Gambling is now allowed in Taiwan. India has yet to take a firm stance on gambling legislation. This is due to a deep-seated cultural aversion to gambling. Nonetheless, the region makes a major contribution to the earnings of online casinos based outside of the country. Legalizing online gambling will increase the country's revenue. Goa, Sikkim, and Daman are three Indian states and a union territory which have reaped substantial revenues from regulating gaming. There are no strict rules governing gambling or internet casinos, though.

Asia Pacific Online Gambling:

Asia is without a doubt the world's greatest gambling market at the moment. In comparison to European countries, it might be attributed to lower rates and a larger population. For the time being, this remark solely applies to land-based casinos. The potential for the internet gaming sector to grow is enormous. To be successful, online gambling makes use of technology breakthroughs. Clear rules and regulations are also required. The future is absolutely good for such online gaming business, which is growing at an unprecedented rate.

From 2018 to 2022, the worldwide online gaming market is expected to increase at an annual rate of 11%. This can result in incremental growth of nearly $35 Bn. The APAC region will contribute for around 44% of the growth. The extraordinary expansion of the online gambling market is mostly due to the growing use of mobile internet. In some ways, the increasing popularity of bitcoins has aided the industry's growth.

China:

Despite the fact that several types of betting are widespread in China, the most of them are still banned. Poker, mah-jongg, & sports betting are examples of this. The online gambling industry has been deemed illegal. Players from the country wager on their favorite games at contains important and licensed online casinos. A number of players travel to Macau to engage in gaming activities.

Singapore:

In the country, offshore gambling websites are prohibited. It has made it plain that gambling on unapproved websites is a criminal violation. It recently passed the Remote Gambling Act. Remote gambling services, promotions, and ads are forbidden in the country under this law. In Singapore, certain online gaming services can only be provided by the local non-profit organizations.

Japan:

In Japan, no form of gambling is permitted. In the country, all gaming operations are regulated and prohibited. Scratch cards, lotteries, soccer betting, powerboat racing, cycling and motorbike racing, & horse racing are the only allowed activities. Japanese citizens do gamble on their favorite games on foreign gambling sites. The government is struggling to keep tabs on online gaming. Official channels, on the other hand, provide online betting services for public events including such football and the lottery.

Indonesia:

All games are absolutely outlawed in the country since it is overseen by Islamic rules. In Indonesia, the only legal form of gambling is a free licensed lottery. On licensed overseas websites, however, many citizens engage in online gambling, table games, and sports betting. There is still a lot of work to be done in terms of properly defining the laws that govern access to both domestic & overseas gaming websites.

India:

Despite having one of the world's fastest-growing economies, India still lacks clear regulations on online gambling. Gambling is not restricted in the country, which is why the internet market segment is blowing up. Online lottery & horse racing have been made legal by the government. However, there are no clear guidelines governing the legality of online gambling in the country. The two states in the country with special regulations governing internet gambling are Sikkim and Maharashtra. Operating licenses are being issued in Sikkim. However, Maharashtra has banned all forms of online gambling.

The objective of the report is to present a comprehensive analysis of the Asia-Pacific Casino Gaming Equipment Market to the stakeholders in the industry. The report provides trends that are most dominant in the Asia-Pacific Casino Gaming Equipment Market and how these trends will influence new business investments and market development throughout the forecast period. The report also aids in the comprehension of the Asia-Pacific market dynamics and competitive structure of the market by analyzing market leaders, market followers, and regional players.

The qualitative and quantitative data provided in the Asia-Pacific Casino Gaming Equipment Market report is to help understand which market segments, regions are expected to grow at higher rates, factors affecting the market, and key opportunity areas, which will drive the industry and market growth through the forecast period. The report also includes the competitive landscape of key players in the industry along with their recent developments in the Asia-Pacific Casino Gaming Equipment Market. The report studies factors such as company size, market share, market growth, revenue, production volume, and profits of the key players in the Asia-Pacific market.

The report provides Porter's Five Force Model, which helps in designing the business strategies in the market. The report helps in identifying how many rivals are existing, who they are, and how their product quality is in the Market. The report also analyses if the Asia-Pacific Casino Gaming Equipment Market is easy for a new player to gain a foothold in the market, do they enter or exit the market regularly if the market is dominated by a few players, etc.

The report also includes a PESTEL Analysis, which aids in the development of company strategies. Political variables help in figuring out how much a government can influence the Market. Economic variables aid in the analysis of economic performance drivers that have an impact on the Market. Understanding the impact of the surrounding environment and the influence of environmental concerns on the Asia-Pacific Casino Gaming Equipment Market is aided by legal factors.

Asia-Pacific Casino Gaming Equipment Market Scope:

|

Asia-Pacific Casino Gaming Equipment Market Scope |

|

|

Market Size in 2024 |

USD 3.87 Bn. |

|

Market Size in 2032 |

USD 5.72 Bn. |

|

CAGR (2025-2032) |

5 % |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

By Product Type

|

|

By Installation

|

|

|

Country Scope |

China |

Major Players operating in the Asia-Pacific Casino Gaming Equipment Market are:

- Novomatic

- Aristocrat Leisure

- Galaxy Entertainment

- Amatic Industries

- Ainsworth Game Technology Ltd.

- APEX Gaming Technology

- Everi Holdings Inc.

- Universal Entertainment

- Konami Gaming, Inc.

- Scientific Games Corporation

- Interblock

- TCSJOHNHUXLEY

- International Game Technology PLC

- Gaming Partners International Corporation

- Casino Technology

- ARUZE GAMING AMERICA, INC

Frequently Asked Questions

Chapter 1 Scope of the Report

Chapter 2 Research Methodology

2.1. Research Process

2.2. Asia-Pacific Casino Gaming Equipment Market: Target Audience

2.3. Asia-Pacific Casino Gaming Equipment Market: Primary Research (As per Client Requirement)

2.4. Asia-Pacific Casino Gaming Equipment Market: Secondary Research

Chapter 3 Executive Summary

Chapter 4 Competitive Landscape

4.1. Market Share Analysis, By Region, 2024-2032(In %)

4.1.1.1. Asia Pacific Market Share Analysis, By Value, 2024-2032 (In %)

4.2. Market Dynamics

4.2.1. Market Drivers

4.2.2. Market Restraints

4.2.3. Market Opportunities

4.2.4. Market Challenges

4.2.5. PESTLE Analysis

4.2.6. PORTERS Five Force Analysis

4.2.7. Value Chain Analysis

4.3. Asia-Pacific Casino Gaming Equipment Market Segmentation Analysis, 2024-2032 (Value US$ BN)

4.3.1.1. Asia-Pacific Market Share Analysis, By Product Type, 2024-2032 (Value US$ BN)

4.3.1.1.1. Slot Machine

4.3.1.1.2. Video Lottery Terminal

4.3.1.1.3. Video Poker Machine

4.3.1.1.4. Others

4.3.1.2. Asia-Pacific Market Share Analysis, By Installation, 2024-2032 (Value US$ BN)

4.3.1.2.1. Installed Inside Casino

4.3.1.2.2. Installed Outside Casino

4.3.1.3. Asia Pacific Market Share Analysis, By Country, 2024-2032 (Value US$ BN)

4.3.1.3.1. China

4.3.1.3.2. India

4.3.1.3.3. Japan

4.3.1.3.4. South Korea

4.3.1.3.5. Australia

4.3.1.3.6. ASEAN

4.3.1.3.7. Rest Of APAC

Chapter 5 Stellar Competition Matrix

5.1. Asia-Pacific Competition Matrix

5.2. Key Players Benchmarking

5.2.1. Key Players Benchmarking By Product Type, Pricing, Market Share, Investments, Expansion Plans, Physical Presence and Presence in the Market.

5.3. Mergers and Acquisitions in Navigation Technology

5.3.1. M&A by Region, Value and Strategic Intent

Chapter 6 Company Profiles

6.1. Key Players

6.1.1. Novomatic.

6.1.1.1. Company Overview

6.1.1.2. Source Portfolio

6.1.1.3. Financial Overview

6.1.1.4. Business Strategy

6.1.1.5. Key Developments

6.1.2. Aristocrat Leisure

6.1.3. Galaxy Entertainment

6.1.4. Amatic Industries

6.1.5. Ainsworth Game Technology Ltd.

6.1.6. APEX Gaming Technology

6.1.7. Everi Holdings Inc.

6.1.8. Universal Entertainment

6.1.9. Konami Gaming, Inc.

6.1.10. Scientific Games Corporation

6.1.11. Interblock

6.1.12. TCSJOHNHUXLEY

6.1.13. International Game Technology PLC

6.1.14. Gaming Partners International Corporation

6.1.15. Casino Technology

6.1.16. ARUZE GAMING AMERICA, INC

6.2. Key Findings

6.3. Recommendations.