Asia Pacific Welding Equipment Market Size, Share & Growth

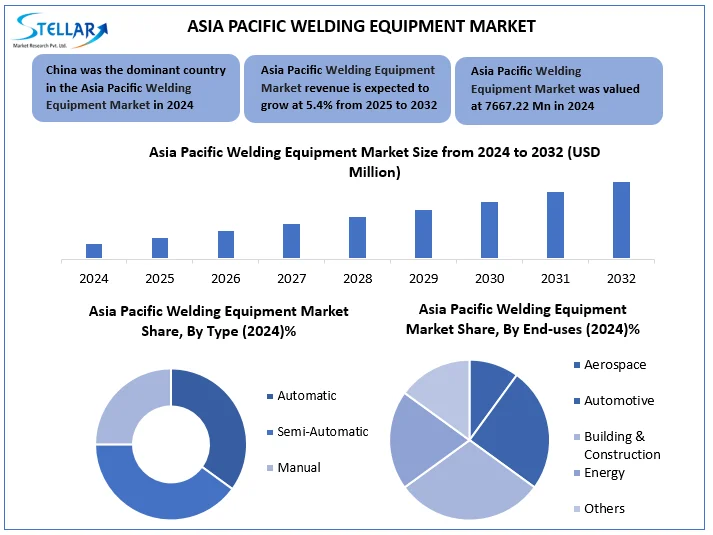

Asia Pacific Welding Equipment Market size was valued at USD 7667.22 Mn in 2024 and is expected to grow at a CAGR of 5.4% from 2025 to 2032, reaching nearly USD 11677.85 Mn by 2032

Format : PDF | Report ID : SMR_2866

Asia Pacific Welding Equipment Market Overview

Welding is fabrication process to join materials, usually metals or thermoplastics, mainly by using high temperature to melt material and allow them to cool, causing fusion. Most commonly welded material are metals like aluminium, mild steel and stainless steel.

Asia Pacific welding equipment market encompasses both industrial grade machines and consumables widely available across manufacturing, construction, automotive, aerospace, and energy sectors. Demand is due to industrial expansion and infrastructure development, while supply includes both domestic producers and global manufacturers with local operations.

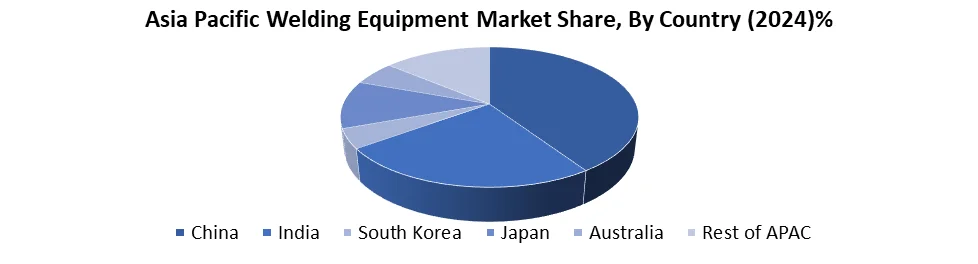

Infrastructure development in nations like China, India, and Southeast Asia and expansion of renewable energy projects like wind and solar farms are driving the Asia Pacific welding equipment market. China continues to most rapidly rising and dominant country in Asia Pacific welding equipment market. SME in price sensitive areas are particularly constrained by high capital investment and maintenance costs associated with modern technology like robotics and laser welding.

U.S implemented series of steep protective tariffs on imported goods, including 50% tariff on steel and aluminum, and 145% tariff on Chinese imports. These measures disrupted global supply chains, leading to increased costs for manufacturers in Asia Pacific region. For instance, companies like Lincoln Electric accelerated nearshoring strategies in Mexico and Southeast Asia to mitigate impact of these tariffs.

To get more Insights: Request Free Sample Report

Asia Pacific Welding Equipment Market Dynamics

Infrastructure Growth, and Energy Expansion to Boost Asia Pacific Welding Equipment Market Growth

Asia Pacific Welding equipment market is experiencing dynamic changes due to increasing demand from major areas such as market construction, motor vehicles and energy. One of the most prominent trends is a shift to automatic and robot welding system, which offers high precision, speed and cost-effective. With rise of industry 4.0, manufacturers AI and IOT capabilities are integrated into welding machines to enable future maintenance and distance monitoring.

Infrastructure development projects in the countries like India, China and the South East Asia are rising demand for welding equipment. Expansion of renewable energy projects like wind turbines and solar farms is creating new opportunities for welding applications.

- China and India are leading infrastructure growth, with China investing $1.4 trillion in infrastructure under its 14th Five-Year Plan.

High Capital Investment to Restrain Asia Pacific Welding Equipment Market Growth

High initial cost and maintenance associated with advanced welding technologies is major issue in Asia Pacific welding equipment market. Equipment like robotic welding systems, laser welding, and automated machines requires investment, barrier for SME.

- Only 15% of SMEs in Asia Pacific affords automated welding systems due to high capital expenditure.

Complexity of these systems often demands skilled labour and continuous maintenance, further increasing operational costs. These factors limit adoption across price sensitive areas and hinders market expansion, especially in developing economies where cost-efficiency remains a primary concern.

- Shortage of skilled welders in countries like India and Indonesia increases labor costs by 20–30% for operating advanced welding systems.

Asia Pacific Welding Equipment Market Segment Analysis

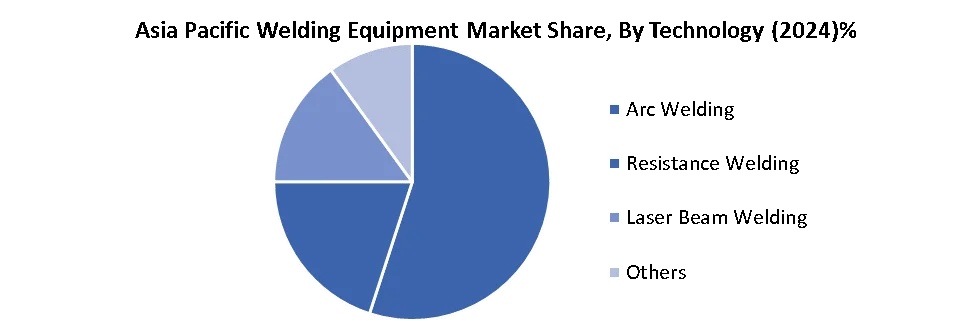

Based on Technology, Asia Pacific Welding Equipment Market is segmented into arc welding, resistance welding, laser beam welding, others, with arc welding was the dominant technology in 2024 and is expected to hold largest market share during forecast period. Dominance is due to its versatility, cost efficiency and comprehensive industrial applications. ARC welding is suitable for both the ferrous and nonferrous metals and is used in industries for mass construction, shipbuilding, motor vehicles and heavy machinery. ARC welding are relatively low costs, ease of use, and ability to produce strong and durable welds make it preferred option, especially in developing areas where strength and simplicity are important. Asia Pacific and other emerging markets continue to demand fuel for growing infrastructure and industrialization activities, strengthening its leading position for arch welding technology.

Based on Type, Asia Pacific Welding Equipment Market is segmented into automatic, semi-automatic, and manual, with semi-automatic dominating type in 2024 and is expected to hold largest market share during forecast period. Dominance is due to balance between operational efficiency and cost, making it suitable for wide range of applications across industries. Semi-automatic systems combine manual control with automation, allowing higher precision and speed compared to manual welding, while still being more affordable and flexible than fully automatic systems. Industries such as automotive, construction, and manufacturing prefer semi-automatic welding for its productivity gains without complexity and high investment required for full automation. This makes it especially popular in developing economies and small-to-medium enterprises looking to improve output with moderate automation.

Asia Pacific Welding Equipment Market Country Insight

China dominated Asia Pacific Welding Equipment Market as it has strong manufacturing infrastructure, rapid urbanization and significant investment in infrastructure development. As world’s largest manufacturing center, China's demand for China welding equipment is fuel by industries such as motor vehicle, shipbuilding, electronics and heavy machinery. Government initiatives like Belt and Road Initiative and Made in China 2025 promoted industrial development. Combined with the presence of major domestic manufacturers, cost -effective production and technological progress, Asia Pacific Welding Equipment strengthens China leadership in the market.

Asia Pacific Welding Equipment Market Competitive Landscape

|

Company Name |

Headquarters |

Key Strengths |

Major Application Areas |

|

Panasonic Welding Systems |

Japan |

Advanced robotic and arc welding systems; strong in automation and electronics |

Automotive, Manufacturing |

|

Kobe Steel (Kobelco Welding) |

Japan |

High-quality welding consumables and equipment; global reputation |

Shipbuilding, Construction, Energy |

|

Daihen Corporation |

Japan |

Specializes in arc welding robots, inverters, and automation systems |

Industrial Plants, Fabrication, Robotics |

|

Asia Pacific Welding Equipment Market |

|

|

Market Size in 2024 |

USD 7667.22 Mn. |

|

Market Size in 2032 |

USD 11677.85 Mn. |

|

CAGR (2024-2032) |

5.4% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments

|

By Technology Arc Welding Resistance Welding Laser Beam Welding Others |

|

By Type Automatic Semi-Automatic Manual |

|

|

By End-use Aerospace Automotive Building & Construction Energy Others |

|

|

Regional Scope

|

Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN (Indonesia, Vietnam, Laos, Brunei, Thailand, Myanmar, Philippines, Cambodia, Singapore, Malaysia) Rest of APAC |

Asia Pacific Welding Equipment Market Key Players

India

- Ador Welding Ltd.

- ESAB India (Subsidiary of ESAB Corp.)

China

- Jasic Technology Company Ltd.

- TIME Group Inc.

- Rilon Welding Equipment Co., Ltd.

- Aotai Electric Co., Ltd.

- Shanghai Hugong Electric Group

- Megmeet Welding Technology Co., Ltd.

Japan

- Panasonic Welding Systems

- Kobe Steel (Kobelco Welding)

- Daihen Corporation

- Denyo Co., Ltd.

- Iwatani Corporation

South Korea

- Hyundai Welding

- Hiweld (Hitronic Group)

Frequently Asked Questions

High capital and maintenance costs of advanced technologies like robotics and laser welding limit adoption, especially for SMEs in price-sensitive regions.

Arc welding is cost-effective, versatile, and widely used in construction, shipbuilding, and machinery, especially in emerging economies with growing infrastructure needs.

Semi-automatic welding offers a balance of precision, speed, and affordability, ideal for small and mid-size industries upgrading from manual systems.

1. Asia Pacific Welding Equipment Market: Research Methodology

2. Asia Pacific Welding Equipment Market Introduction

2.1. Study Assumption and Market Definition

2.2. Scope of the Study

2.3. Executive Summary

3. Asia Pacific Welding Equipment Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Competitive Landscape

3.3. Key Players Benchmarking

3.3.1. Company Name

3.3.2. Product Segment

3.3.3. End-user Segment

3.3.4. Revenue (2024)

3.3.5. Company Headquarter

3.4. Market Structure

3.4.1. Market Leaders

3.4.2. Market Followers

3.4.3. Emerging Players

3.5. Welding Equipment Import Export Analysis

3.6. Mergers and Acquisitions Details

4. Asia Pacific Welding Equipment Market: Dynamics

4.1. Asia Pacific Welding Equipment Market Trends

4.2. Asia Pacific Welding Equipment Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.2.4. Challenges

4.3. PORTER’s Five Forces Analysis

4.4. PESTLE Analysis

4.5. Technology Roadmap

4.6. Regulatory Landscape

5. Asia Pacific Welding Equipment Market Size and Forecast by Segmentation (Value in USD Million) (2024-2032)

5.1. Asia Pacific Welding Equipment Market Size and Forecast, By Technology (2024-2032)

5.1.1. Fruit Arc Welding

5.1.2. Resistance Welding

5.1.3. Laser Beam Welding

5.1.4. Others

5.2. Asia Pacific Welding Equipment Market Size and Forecast, By Type (2024-2032)

5.2.1. Automatic

5.2.2. Semi-Automatic

5.2.3. Manual

5.3. Asia Pacific Welding Equipment Market Size and Forecast, End-use (2024-2032)

5.3.1. Aerospace

5.3.2. Automotive Building & Construction Energy

5.3.3. Others

5.4. Asia Pacific Asia Pacific Welding Equipment Market Size and Forecast, by Country (2024-2032)

5.4.1. China

5.4.2. S Korea

5.4.3. Japan

5.4.4. India

5.4.5. Australia

5.4.6. Indonesia

5.4.7. Vietnam

5.4.8. Thailand

5.4.9. Philippines

5.4.10. Malaysia

5.4.11. Rest of Asia Pacific

6. Company Profile: Key Players

6.1. Panasonic Welding Systems – Japan

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.3. Financial Overview

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

6.2. Kobe Steel (Kobelco Welding) – Japan

6.3. Daihen Corporation – Japan

6.4. Hyundai Welding – South Korea

6.5. Hiweld (Hitronic Group) – South Korea

6.6. Jasic Technology Company Ltd. – China

6.7. TIME Group Inc. – China

6.8. Rilon Welding Equipment Co., Ltd. – China

6.9. Aotai Electric Co., Ltd. – China

6.10. Ador Welding Ltd. – India

6.11. ESAB India (Subsidiary of ESAB Corp.) – India

6.12. Denyo Co., Ltd. – Japan

6.13. Shanghai Hugong Electric Group – China

6.14. Megmeet Welding Technology Co., Ltd. – China

6.15. Iwatani Corporation – Japan

7. Key Findings

8. Industry Recommendations