Alpaca apparel and accessories Market Global Industry Analysis and Forecast (2026-2032) by Product, Form, Source and Application

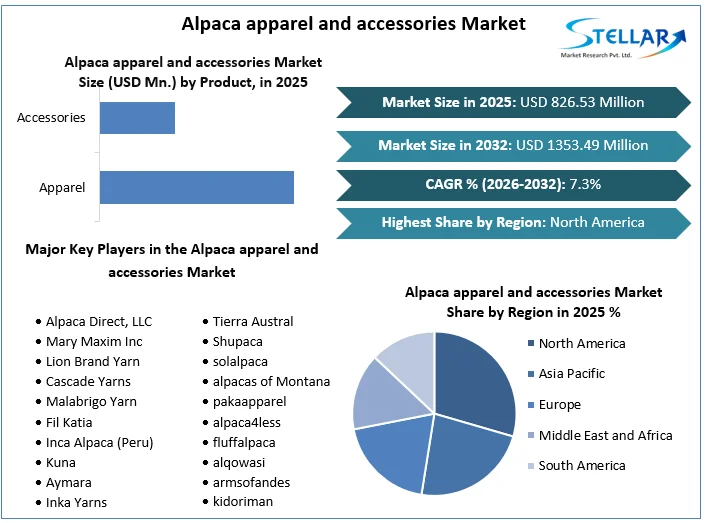

The Alpaca apparel and accessories Market size was valued at US$ 826.53 Mn. in 2025 and the total Global Alpaca apparel and accessories revenue is expected to grow at a CAGR of 7.3% from 2026 to 2032, reaching nearly USD 1353.49 Mn by 2032.

Format : PDF | Report ID : SMR_1661

Alpaca apparel and accessories Market Overview

The report offers a comprehensive analysis of the alpaca apparel and accessories market, providing insights into its market size, growth trends, key players, challenges, and opportunities. By examining various facets of the market, this report aims to provide stakeholders with valuable information to make informed decisions and capitalize on emerging trends. The alpaca apparel and accessories market is experiencing robust growth attributed to several key factors. Rising consumer awareness regarding the unique qualities of alpaca fiber, coupled with an increasing demand for sustainable and ethically sourced products, is driving the progression.

Additionally, the market is witnessing the introduction of innovative offerings beyond traditional knitwear, further driving its growth. A detailed analysis of key players in the alpaca apparel and accessories market is provided, including insights into their product portfolios, financial performance, recent developments, and strategic initiatives. Understanding the competitive landscape is crucial for stakeholders to identify market trends and stay ahead in the evolving market. The report highlights the sustainability practices adopted by brands in the alpaca industry, focusing on the impact of eco-friendly dyed products and recycled materials on market growth. The section sheds light on the increasing importance of sustainability in shaping consumer preferences and market trends.

To get more Insights: Request Free Sample Report

Alpaca apparel and accessories Market Dynamics

Sustainability and Ethical Sourcing

Alpacas provide long-term benefits while leaving a smaller environmental footprint than other animals. They graze sparingly, which lessens the degradation of the ground, and their dung makes excellent fertilizer. Despite synthetic fibers, alpaca fiber is inherently renewable, biodegradable, and requires little water or chemicals during manufacturing. Humane treatment of animals is ethically prioritized by many alpaca farms, which resonates with ethically conscious consumers who value ethical production processes. Growing customer demand for clothing made with sustainable and ethical materials is the driving force behind the development.

To appeal to environmentally sensitive consumers, brands in the market are highlighting sustainability and ethical practices as important selling features and incorporating these principles into their marketing strategies. Additionally, there has been a noticeable trend in favor of openness, with businesses collaborating with accredited farms and groups that support morality and sustainability. By giving consumers visibility into the sourcing and production processes, this transparency promotes consumer trust.

Rising Popularity of Luxury Fibers

Alpaca fiber is similar to cashmere or vicuna in that it is incredibly soft, warm, durable, and hypoallergenic. This adds to the clothes' opulent appeal. These features go above and beyond basic functionality to increase perceived value and provide a premium experience for discriminating customers. Additionally, alpaca clothing has a unique style that makes it stand out in the fashion industry. People who want to use their wardrobe selections to convey their individuality and elegance might relate to that distinctive personality. Alpaca clothing, in its essence, combines luxury and exclusivity, which is why those who are looking for unmatched comfort, style, and distinction adore it.

Companies are adopting premiumization tactics, providing sophisticated alpaca clothing at premium price ranges to appeal to affluent customers who demand luxury. The change is consistent with a larger trend toward product diversification, as the market grows to encompass a greater range of products made from alpaca than just traditional knitwear. Luxury firms are expanding their market reach by launching high-end clothing items like dresses, coats, jackets, and accessories. Additionally, as the retail landscape changes, upscale department shops and luxury merchants are carrying these high-end products in alpaca because they understand the appeal of the material and want to increase brand awareness and market penetration.

High Production Costs in the Alpaca Apparel and Accessories

Alpacas require different types of care and nutrition than other animals. Programs for improving fiber quality through breeding are expensive. Shearing requires specialist equipment and skilled workers, and processing the fiber which is more complex than processing sheep's wool requires specialized apparatus and knowledge, which drives up expenses. Because alpaca farms are smaller in size, it is more difficult to achieve economies of scale, which drives up the cost of production per unit of fiber.

Elevated retail pricing for alpaca clothing and accessories stems from high production costs, which may restrict market accessibility and drive away cost-conscious customers. Because they are less expensive to produce, synthetic alternatives pose a serious threat to alpacas, attracting customers on a tight budget and reducing their market share. In addition, alpaca product availability and selection are restricted due to production costs, which prevent firms from growing their product lines.

Alpaca apparel and accessories Market Segment Analysis

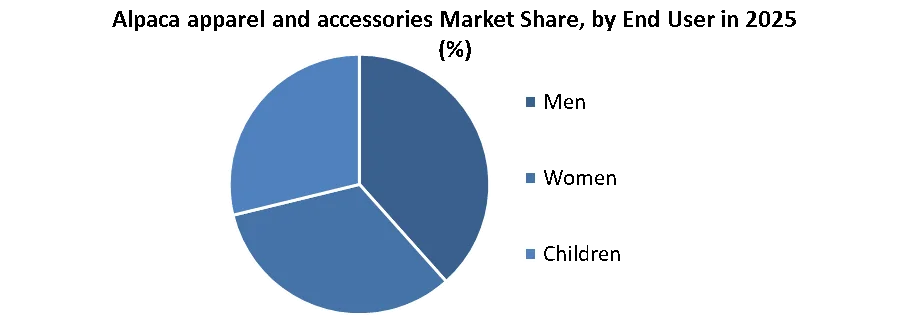

By End User, Women dominate the alpaca apparel and accessories industry, accounting for around 60% in 2025. The market's dominance is the result of several factors, including a larger selection of products geared toward women, such as ponchos, scarves, hats, and sweaters alignment with contemporary fashion trends that focus on comfort, luxury, and natural materials; and women's propensity to value ethical and sustainable sourcing, which is consistent with the alpaca industry's values. Brands continue focusing on product diversification, aligning with fashion trends, and highlighting the ethical and sustainable aspects of their offerings to maintain their dominance.

Alpaca apparel and accessories Market Regional Analysis

In 2025, North America accounted for a significant percentage of the alpaca market, and growth of the region is expected because of growing consumer awareness of the sustainable nature of alpaca fiber and its ethical sourcing. Market growth is supported by elements like the existence of well-established luxury merchants and the increased disposable income of North American consumers. In addition, there is a greater need for high-end alpaca goods in the area because of the growing interest in ethical fashion. To keep up with the growing demand, established businesses are growing their product lines and delivery systems. At the same time, new competitors diversify the market by launching eco-friendly and creative products made from alpaca.

Sales of alpaca clothing and accessories soar on e-commerce platforms because they provide easy access and wider brand exposure. Although the government does not actively target the alpaca market in North America, it does indirectly support ethical and sustainable practices through several measures that support the industry's growth. The governments of North America support sustainability in all areas, which is in line with alpaca production's natural sustainability. Fair labor and sourcing procedures are highlighted by ethical trade agreements, which obliquely support the alpaca industry's dedication to animal care.

Alpaca apparel and accessories Market Competitive Landscape

Brands are focusing on sustainability by implementing eco-friendly practices throughout their supply chains to attract consumers who care about the environment. In addition, as businesses manage manufacturing from alpaca farming to finished goods, guaranteeing that ethical sourcing and quality requirements are fulfilled all along the way, vertical integration is becoming more and more popular. Increasing their market reach, brands venture beyond the realm of traditional knitwear by introducing inventive products like coats, jackets, dresses, and accessories.

Blended fabrics, which combine alpaca with wool or recycled materials, are a clear indication of a shift towards performance and technological characteristics. These fabrics promise improved usefulness and durability. Sustainability is prioritized as firms demonstrate their commitment to environmentally responsible practices by introducing eco-friendly dyed alpaca products and incorporating recycled materials into packaging and production processes.

- Y. & SONS & THE INOUE BROTHERS and the design company "The INOUE BROTHERS" worked together in November 2022 to create kimono and haori clothing made of royal alpaca wool.

- In January 2023, the sustainable fashion brand Bee & Alpaca showcased their most recent upcycled designs at the "Just Around the Corner" event. These products provide a more accessible range of eco-friendly and reasonably priced clothing to a larger customer base. Their clothes are renowned for being lively, imaginative, and fascinating, which increases the marketability of sustainable fashion.

|

Alpaca apparel and accessories Market Scope |

|

|

Market Size in 2025 |

USD 826.53 Mn. |

|

Market Size in 2032 |

USD 1353.49 Mn. |

|

CAGR (2026-2032) |

7.3% |

|

Historic Data |

2020-2025 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2032 |

|

Segment Scope |

By Product Apparel Accessories |

|

By End User Men Women Children |

|

|

By Distribution Channel Online Offline |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key Players in the Alpaca apparel and accessories Market

- Alpaca Direct, LLC

- Mary Maxim Inc

- Lion Brand Yarn

- Cascade Yarns

- Malabrigo Yarn

- Fil Katia

- Inca Alpaca (Peru)

- Kuna

- Aymara

- Inka Yarns

- Allpa

- Tierra Austral

- Shupaca

- solalpaca

- alpacas of Montana

- pakaapparel

- alpaca4less

- fluffalpaca

- alqowasi

- armsofandes

- kidoriman

Frequently Asked Questions

Alpaca apparel and accessories are available both online and in select retail stores. Many brands have their online stores, while others may be available through specialty retailers or alpaca farms.

Brands can explore vertical integration strategies, controlling aspects of production from alpaca farming to finished products, to ensure a consistent supply of high-quality alpaca apparel and accessories. Additionally, expanding distribution channels and exploring emerging markets can help increase product availability.

The Market size was valued at USD 826.53 Million in 2025 and the total Market revenue is expected to grow at a CAGR of 7.3% from 2026 to 2032, reaching nearly USD 1353.49 Million.

The segments covered in the market report are By Product, End User, and Distribution Channel.

1. Alpaca apparel and accessories Market: Research Methodology

1.1. Research Data

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market breakdown and Data Triangulation

1.4. Assumptions

2. Alpaca apparel and accessories Market: Executive Summary

2.1. Market Overview

2.2. Market Size (2025) and Forecast (2026– 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments and Regions

3. Alpaca apparel and accessories Market: Competitive Landscape

3.1. Stellar Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Product Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2025)

3.2.7. Profit Margin

3.2.8. Market Share

3.2.9. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

3.4.1. Strategic Initiatives and Developments

3.4.2. Mergers and Acquisitions

3.4.3. Collaborations and Partnerships

3.4.4. Product Launches and Innovation

4. Alpaca apparel and accessories Market: Dynamics

4.1. Market Trends by Region

4.1.1. North America

4.1.2. Europe

4.1.3. Asia Pacific

4.1.4. Middle East and Africa

4.1.5. South America

4.2. Market Drivers

4.3. Market Restraints

4.4. Market Opportunities

4.5. Market Challenges

4.6. PORTER’s Five Forces Analysis

4.6.1. Intensity of the Rivalry

4.6.2. Threat of New Entrants

4.6.3. Bargaining Power of Suppliers

4.6.4. Bargaining Power of Buyers

4.6.5. Threat of Substitutes

4.7. PESTLE Analysis

4.7.1. Political Factors

4.7.2. Economic Factors

4.7.3. Social Factors

4.7.4. Technological Factors

4.7.5. Legal Factors

4.7.6. Environmental Factors

4.8. Technological Roadmap

4.9. Value Chain Analysis

4.10. Trade Analysis

4.10.1. Import Scenario

4.10.2. Export Scenario

4.11. Regulatory Landscape

4.11.1. Market Regulation by Region

4.11.1.1. North America

4.11.1.2. Europe

4.11.1.3. Asia Pacific

4.11.1.4. Middle East and Africa

4.11.1.5. South America

4.11.2. Impact of Regulations on Market Dynamics

5. Alpaca apparel and accessories Market Size and Forecast by Segments (by Value USD Million)

5.1. Alpaca apparel and accessories Market Size and Forecast, By Product (2025-2032)

5.1.1. Apparel

5.1.2. Accessories

5.2. Alpaca apparel and accessories Market Size and Forecast, By End User (2025-2032)

5.2.1. Men

5.2.2. Women

5.2.3. Children

5.3. Alpaca apparel and accessories Market Size and Forecast, By Distribution Channel (2025-2032)

5.3.1. Online

5.3.2. Offline

5.4. Alpaca apparel and accessories Market Size and Forecast, by Region (2025-2032)

5.4.1. North America

5.4.2. Europe

5.4.3. Asia Pacific

5.4.4. Middle East and Africa

5.4.5. South America

6. North America Alpaca apparel and accessories Market Size and Forecast (by Value USD Million)

6.1. North America Alpaca apparel and accessories Market Size and Forecast, By Product (2025-2032)

6.1.1. Apparel

6.1.2. Accessories

6.2. North America Alpaca apparel and accessories Market Size and Forecast, By End User (2025-2032)

6.2.1. Men

6.2.2. Women

6.2.3. Children

6.3. North America Alpaca apparel and accessories Market Size and Forecast, By Distribution Channel (2025-2032)

6.3.1. Online

6.3.2. Offline

6.4. North America Alpaca apparel and accessories Market Size and Forecast, by Country (2025-2032)

6.4.1. United States

6.4.2. Canada

6.4.3. Mexico

7. Europe Alpaca apparel and accessories Market Size and Forecast (by Value USD Million)

7.1. Europe Alpaca apparel and accessories Market Size and Forecast, By Product (2025-2032)

7.2. Europe Alpaca apparel and accessories Market Size and Forecast, By End User (2025-2032)

7.3. Europe Alpaca apparel and accessories Market Size and Forecast, By Distribution Channel (2025-2032)

7.4. Europe Alpaca apparel and accessories Market Size and Forecast, by Country (2025-2032)

7.4.1. UK

7.4.2. France

7.4.3. Germany

7.4.4. Italy

7.4.5. Spain

7.4.6. Sweden

7.4.7. Austria

7.4.8. Rest of Europe

8. Asia Pacific Alpaca apparel and accessories Market Size and Forecast (by Value USD Million)

8.1. Asia Pacific Alpaca apparel and accessories Market Size and Forecast, By Product (2025-2032)

8.2. Asia Pacific Alpaca apparel and accessories Market Size and Forecast, By End User (2025-2032)

8.3. Asia Pacific Alpaca apparel and accessories Market Size and Forecast, By Distribution Channel (2025-2032)

8.4. Asia Pacific Alpaca apparel and accessories Market Size and Forecast, by Country (2025-2032)

8.4.1. China

8.4.2. S Korea

8.4.3. Japan

8.4.4. India

8.4.5. Australia

8.4.6. Indonesia

8.4.7. Malaysia

8.4.8. Vietnam

8.4.9. Taiwan

8.4.10. Bangladesh

8.4.11. Pakistan

8.4.12. Rest of Asia Pacific

9. Middle East and Africa Alpaca apparel and accessories Market Size and Forecast (by Value USD Million)

9.1. Middle East and Africa Alpaca apparel and accessories Market Size and Forecast, By Product (2025-2032)

9.2. Middle East and Africa Alpaca apparel and accessories Market Size and Forecast, By End User (2025-2032)

9.3. Middle East and Africa Alpaca apparel and accessories Market Size and Forecast, By Distribution Channel (2025-2032)

9.4. Middle East and Africa Alpaca apparel and accessories Market Size and Forecast, by Country (2025-2032)

9.4.1. South Africa

9.4.2. GCC

9.4.3. Egypt

9.4.4. Nigeria

9.4.5. Rest of ME&A

10. South America Alpaca apparel and accessories Market Size and Forecast (by Value USD Million)

10.1. South America Alpaca apparel and accessories Market Size and Forecast, By Product (2025-2032)

10.2. South America Alpaca apparel and accessories Market Size and Forecast, By End User (2025-2032)

10.3. South America Alpaca apparel and accessories Market Size and Forecast, By Distribution Channel (2025-2032)

10.4. South America Alpaca apparel and accessories Market Size and Forecast, by Country (2025-2032)

10.4.1. Brazil

10.4.2. Argentina

10.4.3. Rest of South America

11. Company Profile: Key players

11.1. Alpaca Direct, LLC

11.1.1. Company Overview

11.1.2. Product Portfolio

11.1.2.1. Product Name

11.1.2.2. Product Details (Price, Features, etc.)

11.1.3. Financial Overview

11.1.3.1. Total Revenue

11.1.3.2. Segment Revenue

11.1.3.3. Regional Revenue

11.1.4. SWOT Analysis

11.1.5. Strategic Analysis

11.1.6. Recent Developments

11.2. Mary Maxim Inc

11.3. Lion Brand Yarn

11.4. Cascade Yarns

11.5. Malabrigo Yarn

11.6. Fil Katia

11.7. Inca Alpaca (Peru)

11.8. Kuna

11.9. Aymara

11.10. Inka Yarns

11.11. Allpa

11.12. Tierra Austral

11.13. Shupaca

11.14. solalpaca

11.15. alpacas of Montana

11.16. pakaapparel

11.17. alpaca4less

11.18. fluffalpaca

11.19. alqowasi

11.20. armsofandes

11.21. kidoriman

12. Key Findings

13. Industry Recommendations

13.1. Strategic Recommendations

13.2. Future Outlook