Airport Information Systems Market - Global Industry Analysis and Forecast (2025-2032)

Airport Information Systems Market size was valued at USD 4.23 Bn. in 2024 and the total Global Airport Information Systems Market revenue is expected to grow at a CAGR of 4.78% from 2025 to 2032, reaching nearly USD 6.15 Bn. by 2032.

Format : PDF | Report ID : SMR_2234

Airport Information Systems Market Overview

Airport information systems encompass a range of specialized digital platforms that streamline and automate key operations within airports. These systems typically include Airport Management Systems, Airside Management Systems, Passenger Information Systems, and Security Systems. Airport Information Systems encompass a wide range of software solutions designed to handle various airport functions, including flight information display, Baggage Handling Solutions, resource management, and security operations. Several companies and vendors offer these systems, providing products and services tailored to meet the unique needs of different airports.

The growth of the Airport Information Systems (AIS) market is driven by increasing air traffic, the need for efficient airport operations, and advancements in technology. Demand is fueled by the necessity for real-time data management, improved passenger experiences, and enhanced security measures. On the supply side, market expansion is supported by innovations in software solutions and strategic collaborations among key players.

The airport information systems is broken down into significant markets in North America, Europe, and Asia-Pacific. Key providers of airport information systems include companies such as Amadeus IT Group SA, SITA, and Rockwell Collins, Inc. These companies are prominent players in the global market, contributing to its growth and innovation.

The Airport Information Systems (AIS) market is segmented based on systems, applications, and regions. The airport operation control center manages real-time operations and ensures efficient airport management. For instance, companies such as Amadeus IT Group provide comprehensive solutions for airport operation control, integrating various subsystems to streamline processes. Another segment is the departure control system, which handles check-in, boarding, and load control operations, crucial for maintaining smooth passenger flow and operational efficiency.

To get more Insights: Request Free Sample Report

Airport Information Systems Market Dynamics

Increasing Passenger Traffic and Technological Advancements

The Airport Information Systems (AIS) market is driven by several key dynamics that are shaping its growth and evolution. The increasing volume of air passenger traffic necessitates the efficient management of airport operations and passenger information systems. This surge in traffic has led airports to invest in advanced AIS to streamline operations, reduce delays, and enhance passenger experience. With the growing need for enhanced security systems at airports with the rise in global security threats, airports are adopting sophisticated AIS to ensure safety and compliance with international regulations. Technological advancements, such as the integration of artificial intelligence (AI) and the Internet of Things (IT), are also propelling the market forward by enabling real-time Airport Data Analytics and improved decision-making capabilities.

Government initiatives and investments in airport infrastructure development, particularly in emerging economies, are further accelerating the adoption of AIS. These drivers collectively contribute to the steady growth of the AIS market, making it a critical component of modern airport operations.

Impact on Airport Information Systems Growth

The high value is related to implementing and maintaining advanced AIS technologies. The Airports specifically smaller and local ones, frequently struggle with the substantial financial investments required for upgrading their systems. Moreover, cybersecurity threats pose a critical venture as airports more and more rely upon virtual information systems, making them vulnerable to cyberattacks which can disrupt operations and compromise sensitive facts. Integration problems also persist, as airports have to make sure that new AIS technology seamlessly integrates with present structures and infrastructure, which may be complex and resource-intensive.

Leveraging technological advancements, and participating in infrastructure expansion

Innovations such as AI-driven analytics, IT integration for real-time data monitoring, and cloud-based solutions present opportunities for airports to enhance operational efficiency and passenger experience. The expansion of airport capacity and infrastructure development projects worldwide. As air travel demand continues to grow, particularly in emerging markets, there is a significant need for modernizing existing airports and building new ones. This opens avenues for AIS providers to collaborate on large-scale infrastructure projects, offering tailored solutions that meet specific operational requirements.

Airport Information Systems Market Segment Analysis

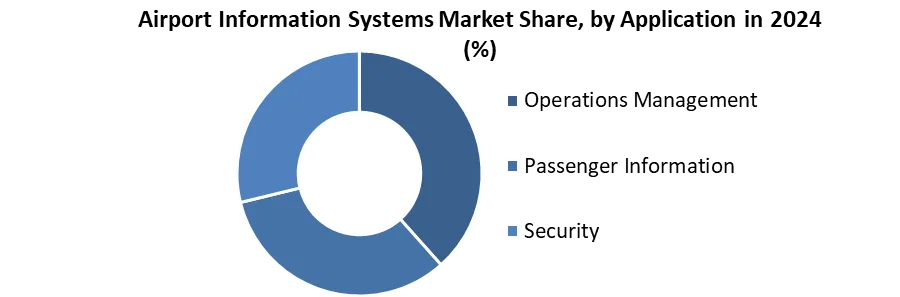

By application, Airport Information Systems (AIS) play a pivotal role in enhancing operational efficiency, passenger experience, and overall security in airports worldwide. These systems encompass various applications that cater to different aspects of airport management and passenger services. Airport Operations Management systems are critical for ensuring smooth day-to-day operations. They include functionalities such as resource allocation, scheduling, and maintenance tracking. Key components such as Airport Operations Control Centers (AOCC) integrate data from various subsystems to manage airport resources effectively. This segment focuses on optimizing ground handling, gate management, and runway operations to minimize delays and improve efficiency.

Passenger Information Systems focus on providing real-time flight information, wayfinding assistance, and personalized services to passengers. These systems include Flight Information Display Systems (FIDS), mobile apps, and interactive kiosks. They enhance the passenger experience by delivering accurate updates on flight status, gate changes, baggage claim details, and airport amenities, thereby reducing stress and improving satisfaction levels.

Airport Security Management systems are designed to enhance the safety and security of passengers, staff, and infrastructure. These include access control, video surveillance, biometric identification systems, and threat detection technologies. Integrated with AI and analytics, these systems provide real-time monitoring and proactive threat prevention measures, ensuring compliance with stringent aviation security regulations.

Airport Information Systems Market Regional Analysis

North America held the largest share of the global AIS market in 2024, driven by advanced infrastructure, high air traffic volume, and stringent regulatory frameworks promoting the adoption of advanced technologies. As of 2024, the North American market accounted for a substantial portion of the global AIS market, reflecting its mature aviation sector and technological advancements in airport operations. For instance, in the United States, airports such as Hartsfield-Jackson Atlanta International Airport and Los Angeles International Airport are among the busiest globally, necessitating robust AIS to manage passenger flow, security protocols, and operational efficiency. These airports leverage AIS solutions for real-time information dissemination, Baggage Handling Solutions, flight management, and passenger facilitation, contributing significantly to the market growth.

North America is projected to maintain a steady growth rate in the AIS market, with an anticipated increase from USD xx billion in 2024 to USD xx billion by 2032, at a compound annual growth rate (CAGR) of xx % during the forecast period. This growth trajectory is supported by ongoing investments in airport infrastructure upgrades, increasing demand for efficient passenger handling systems, and the adoption of cloud-based AIS solutions to enhance operational agility and customer experience.

Europe held a substantial share of the global AIS market in 2024, attributed to its extensive network of airports and robust aviation infrastructure. Countries such as Germany, France, the UK, and Spain are prominent contributors, leveraging advanced technologies to enhance operational efficiency and passenger experience. The European AIS market is characterized by a diverse range of systems including passenger processing, Baggage Handling Solutions, security management, and flight operations. For instance, major airports such as Heathrow in the UK and Charles de Gaulle in France have implemented sophisticated AIS to manage complex operations seamlessly.

The integration of AI and IoT technologies in AIS systems across European airports is enhancing operational efficiency further. These advancements not only streamline processes but also improve passenger flow management and enhance overall safety and security measures.

Airport Information Systems Market Competitive Landscape

The Airport Information Systems (AIS) market is highly competitive, with several key players shaping its landscape through innovative solutions and extensive global reach. Two prominent companies in this market are SITA and Thales Group, each bringing distinct strengths to the industry.

SITA, a global leader in IT and telecommunication services for the air transport industry, has established itself as a cornerstone provider of airport information systems. With a focus on enhancing operational efficiency and passenger experience, SITA offers a comprehensive range of solutions that include baggage management, airport management systems, and Passenger Processing Systems.

The company's extensive network and longstanding partnerships with airports worldwide underscore its robust market position Thales Group, renowned for its expertise in aerospace, defence, and transportation systems, is another significant player in the AIS market. Thales provides advanced solutions tailored to airport security, air traffic management, and operational efficiency. Its offerings span from integrated airport operations management systems to cutting-edge security solutions, addressing the critical needs of modern airports globally.

SITA boasts a broad global presence, serving over 1,000 airports worldwide and handling millions of passengers annually. This extensive footprint positions SITA as a pivotal player in facilitating seamless airport operations and enhancing passenger satisfaction. Thales Group, leveraging its strong presence in aerospace and defence sectors, brings specialized expertise to airport information systems. With a focus on security and operational efficiency, Thales serves numerous airports globally, catering to both civil and defence aviation needs.

SITA is known for its continuous investment in cutting-edge technologies, such as biometrics and AI-driven solutions, aimed at streamlining airport processes and improving security measures. Thales Group emphasizes technological innovation through its advanced air traffic management and cybersecurity solutions, integrating sophisticated technologies to meet the evolving demands of modern airports.

Airport Information Systems Market Scope:

|

Airport Information Market |

|

|

Market Size in 2024 |

USD 4.23 Bn. |

|

Market Size in 2032 |

USD 6.15 Bn. |

|

CAGR (2025-2032) |

4.78 % |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Airport Class A Airports Class B Airports Class C Airports Class D Airports |

|

By Application Operations Management Passenger Information Security |

|

|

|

By End-User Commercial Airports Private Airports Military Airports |

Airport Information Systems Market by Region

North America (United States, Canada, and Mexico)

Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe)

Asia Pacific (China, South Korea, Japan, India, Australia, ASEAN, and the Rest of APAC)

Middle East and Africa (South Africa, GCC, 8.3.3. Nigeria, Rest of ME & A)

South America (Brazil, Argentina Rest of South America)

Airport Information Systems Market Key Players:

- SITA

- Amadeus IT Group

- Thales Group

- Collins Aerospace (Raytheon Technologies Corporation)

- Honeywell International Inc.

- IBM Corporation

- Siemens AG

- Indra Sistemas SA

- NEC Corporation

- Rockwell Collins

- Cisco Systems Inc.

- Inform GmbH

- RESA Airport Data Systems

- Ikusi

- Leidos

- TAV Technologies

- Ultra Electronics Holdings

- Damarel Systems International Ltd.

- NEC Display Solutions

- Airport Information Systems Ltd.

Frequently Asked Questions

Airport Information Systems Market size is expected to reach USD 6.15 Billion by 2032.

The segments covered in the market report are airport, application, and end-user.

North America has the largest share of the market in 2024.

1. Research Methodology

1.1 Research Data

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. Airport Information Systems Market Executive Summary

2.1. Market Overview

2.2. Market Size (2024) and Forecast (2025– 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments and Regions

3. Global Airport Information Systems Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Business Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2024)

3.2.7. Profit Margin

3.2.8. Market Share

3.2.9. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

3.4.1. Strategic Initiatives and Developments

3.4.2. Mergers and Acquisitions

3.4.3. Collaborations and Partnerships

3.4.4. Service Launches and Innovations

4. Airport Information Systems Market: Dynamics

4.1. Airport Information Systems Market Trends by Region

4.1.1. North America

4.1.2. Europe

4.1.3. Asia Pacific

4.1.4. Middle East and Africa

4.1.5. South America

4.2. Airport Information Systems Market Drivers

4.3. Airport Information Systems Market Restraints

4.4. Airport Information Systems Market Opportunities

4.5. Airport Information Systems Market Challenges

4.6. PORTER’s Five Forces Analysis

4.6.1. Intensity of the Rivalry

4.6.2. Threat of New Entrants

4.6.3. Bargaining Power of Suppliers

4.6.4. Bargaining Power of Buyers

4.6.5. Threat of Substitutes

4.7. PESTLE Analysis

4.7.1. Political Factors

4.7.2. Economic Factors

4.7.3. Social Factors

4.7.4. Technological Factor

4.7.5. Legal Factors

4.7.6. Environmental Factors

4.8. Technological Roadmap

4.9. Regulatory Landscape

4.9.1. Market Regulation by Region

4.9.1.1. North America

4.9.1.2. Europe

4.9.1.3. Asia Pacific

4.9.1.4. Middle East and Africa

4.9.1.5. South America

4.9.2. Impact of Regulations on Market Dynamics

4.9.3. Government Schemes and Initiatives

5. Airport Information Systems Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

5.1. Airport Information Systems Market Size and Forecast, by Airport (2024-2032)

5.1.1. Class A Airports

5.1.2. Class B Airports

5.1.3. Class C Airports

5.1.4. Class D Airports

5.2. Airport Information Systems Market Size and Forecast, by Application (2024-2032)

5.2.1. Operations Management

5.2.2. Passenger Information

5.2.3. Security

5.3. Airport Information Systems Market Size and Forecast, by End-User (2024-2032)

5.3.1. Commercial Airports

5.3.2. Private Airports

5.3.3. Military Airports

5.4. Airport Information Systems Market Size and Forecast, by Region (2024-2032)

5.4.1. North America

5.4.2. Europe

5.4.3. Asia Pacific

5.4.4. Middle East and Africa

5.4.5. South America

6. North America Airport Information Systems Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

6.1. North America Airport Information Systems Market Size and Forecast, by Airport (2024-2032)

6.1.1. Class A Airports

6.1.2. Class B Airports

6.1.3. Class C Airports

6.1.4. Class D Airports

6.2. North America Airport Information Systems Market Size and Forecast, by Application (2024-2032)

6.2.1. Operations Management

6.2.2. Passenger Information

6.2.3. Security

6.3. North America Airport Information Systems Market Size and Forecast, by End-User (2024-2032)

6.3.1. Commercial Airports

6.3.2. Private Airports

6.3.3. Military Airports

6.4. North America Airport Information Systems Market Size and Forecast, by Country (2024-2032)

6.4.1. United States

6.4.2. Canada

6.4.3. Mexico

7. Europe Airport Information Systems Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

7.1. Europe Airport Information Systems Market Size and Forecast, by Airport (2024-2032)

7.2. Europe Airport Information Systems Market Size and Forecast, by Application (2024-2032)

7.3. Europe Airport Information Systems Market Size and Forecast, by End-User (2024-2032)

7.4. Europe Airport Information Systems Market Size and Forecast, by Country (2024-2032)

7.4.1. United Kingdom

7.4.2. France

7.4.3. Germany

7.4.4. Italy

7.4.5. Spain

7.4.6. Sweden

7.4.7. Austria

7.4.8. Rest of Europe

8. Asia Pacific Airport Information Systems Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

8.1. Asia Pacific Airport Information Systems Market Size and Forecast, by Airport (2024-2032)

8.2. Asia Pacific Airport Information Systems Market Size and Forecast, by Application (2024-2032)

8.3. Asia Pacific Airport Information Systems Market Size and Forecast, by End-User (2024-2032)

8.4. Asia Pacific Airport Information Systems Market Size and Forecast, by Country (2024-2032)

8.4.1. China

8.4.2. S Korea

8.4.3. Japan

8.4.4. India

8.4.5. Australia

8.4.6. Indonesia

8.4.7. Malaysia

8.4.8. Vietnam

8.4.9. Taiwan

8.4.10. Rest of Asia Pacific

9. Middle East and Africa Airport Information Systems Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

9.1. Middle East and Africa Airport Information Systems Market Size and Forecast, by Airport (2024-2032)

9.2. Middle East and Africa Airport Information Systems Market Size and Forecast, by Application (2024-2032)

9.3. Middle East and Africa Airport Information Systems Market Size and Forecast, by End-User (2024-2032)

9.4. Middle East and Africa Airport Information Systems Market Size and Forecast, by Country (2024-2032)

9.4.1. South Africa

9.4.2. GCC

9.4.3. Nigeria

9.4.4. Rest of ME&A

10. South America Airport Information Systems Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

10.1. South America Airport Information Systems Market Size and Forecast, by Airport (2024-2032)

10.2. South America Airport Information Systems Market Size and Forecast, by Application (2024-2032)

10.3. South America Airport Information Systems Market Size and Forecast, by End-User (2024-2032)

10.4. South America Airport Information Systems Market Size and Forecast, by Country (2024-2032)

10.4.1. Brazil

10.4.2. Argentina

10.4.3. Rest Of South America

11. Company Profile: Key Players

11.1. SITA

11.1.1. Company Overview

11.1.2. Business Portfolio

11.1.3. Financial Overview

11.1.3.1. Total Revenue

11.1.3.2. Segment Revenue

11.1.3.3. Regional Revenue

11.1.4. SWOT Analysis

11.1.5. Strategic Analysis

11.1.6. Recent Developments

11.2. Amadeus IT Group

11.3. Thales Group

11.4. Collins Aerospace (Raytheon Technologies Corporation)

11.5. Honeywell International Inc.

11.6. IBM Corporation

11.7. Siemens AG

11.8. Indra Sistemas SA

11.9. NEC Corporation

11.10. Rockwell Collins

11.11. Cisco Systems Inc.

11.12. Inform GmbH

11.13. RESA Airport Data Systems

11.14. Ikusi

11.15. Leidos

11.16. TAV Technologies

11.17. Ultra Electronics Holdings

11.18. Damarel Systems International Ltd.

11.19. NEC Display Solutions

11.20. Airport Information Systems Ltd.

12. Key Findings

13. Analyst Recommendations

13.1. Strategic Recommendations

13.2. Future Outlook