APAC External Blinds Market Industry Overview, Size, Share, Growth Trends, Research Insights and Forecast (2025–2032)

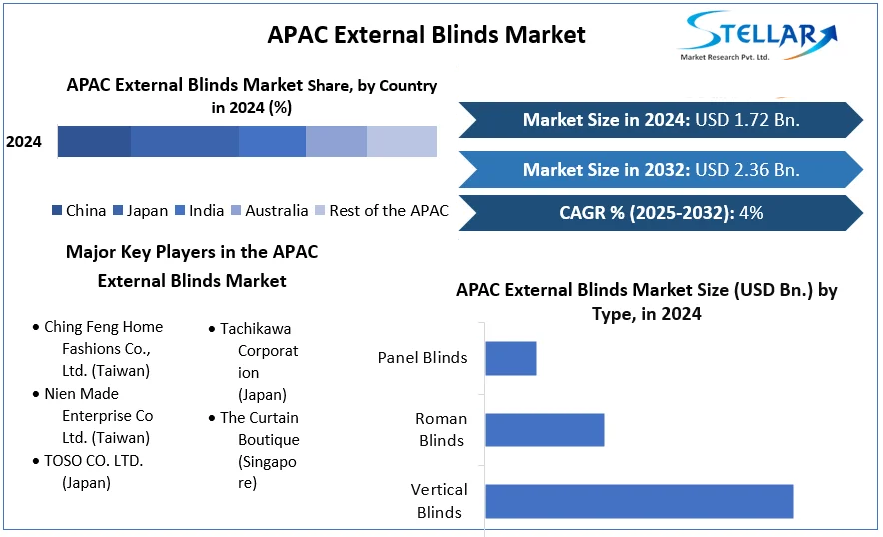

APAC External Blinds Market is expected to grow at a CAGR of 4% during the forecast period. APAC External Blinds Market is expected to reach US$ 2.36 Bn. in 2032 from US$ 1.72 Bn. in 2024.

Format : PDF | Report ID : SMR_789

APAC External Blinds Market Overview:

The APAC External Blinds Market was valued at USD 1.72 billion in 2024, and is predicted to grow at a CAGR of 4.1 percent to USD 2.36 billion by 2032. The APAC External Blinds Market is studied by segments like Type (Roller Blinds, Vertical Blinds, Roman Blinds, Panel Blinds, Corded Blinds, Venetian Blinds, Honeycomb, Pleated Shades, Zip Screens/Blinds, Roller Gates/Shutters, Others); Operation (Manual, Automatic); Material (Natural, Synthetic); End-User (Residential, Commercial); and Region (North America, APAC, Asia-Pacific, and Rest of the World). The report consists of the Trend, Forecast, Competitive Analysis, and Growth Opportunities of the market.

For the forecast period of 2025 to 2032, the report provides a complete analysis that reflects today's APAC External Blinds Market realities and future market prospects. To provide a comprehensive perspective of the market, the research segments and analyses it in great detail. The key data and observations offered in the study can help market participants and investors identify low-hanging fruit in the market and build growth strategies.

To get more Insights: Request Free Sample Report

COVID-19 Impact on APAC External Blinds Market:

The APAC External Blinds Market dropped significantly during the COVID-19 pandemic, owing to lockdowns and slow progress in the construction industry, particularly in the real-estate sector. During the peak of the pandemic, metropolitan areas became the epicenter of cases, causing authorities to impose strict lockdowns that hampered home development projects. The sluggish performance eventually diminished, notably since Q2 2021, encouraging estimates to improve. However, the pandemic's long-term effects are expected to remain as businesses continue to enforce remote working policies, resulting in the execution of a small number of construction projects.

During the pandemic, home renovations became more popular, although market sellers reported a drop in customized external blinds sales. This was also because of the ban on house visits. In addition, a sizable DIY industry arose as a means of facilitating "cheap home décor renovations." Trade shows were also cancelled or postponed.

APAC External Blinds Market Dynamics:

Infrastructure development is booming in the Asia Pacific region, with large projects being approved in Vietnam, the Philippines, Thailand, Malaysia, and Indonesia. In many cases, these were backed by loans or other help from Japan and China. The difference in one-year investments in Asia between China and Japan is very small. China's infrastructure investments in ASEAN have increased dramatically in recent years. Thus the latest development in the infrastructure and housing industry is expected to drive the demand for external blinds in the APAC region.

Government Support

Residential development growth in the APAC region remained low in 2020, but it is likely to pick up in 2021. There is indeed a strong government effort on affordable housing across the region's emerging markets. For example, the Indian government recently established the Cheap Rental Housing Scheme (AHRC) to provide migrant workers with affordable rental housing. This, combined with Maharashtra Chief Minister's introduction of the Maha Awas Yojana, a new rural housing project, is projected to grow India's residential construction sector forward.

Similarly, in Malaysia's budget 2021, the government proposed a number of incentives aimed at increasing homeownership. For example, the Malaysian government declared that first-time property buyers in the country will be exempt from paying stamp duty until 2025. Several Malaysians who want to buy a home in the nation will profit from the stamp duty exemption. Furthermore, the government has extended stamp duty exemption to buyers of the abandoned housing projects throughout the country. The stamp duty reduction will encourage new developers to take on half-finished projects, potentially speeding up the completion of the abandoned housing projects. As a result, the residential construction industry in the country is growing.

Due to such rapid and substantial growth in the housing industry along with governments backing them up, the APAC is estimated to be a huge market for external blinds in the near future.

Many countries in the APAC region fall in the tropical zone and they require protection from heat and external environment which makes this region an important one for the External blinds market.

APAC External Blinds Market Segment Analysis:

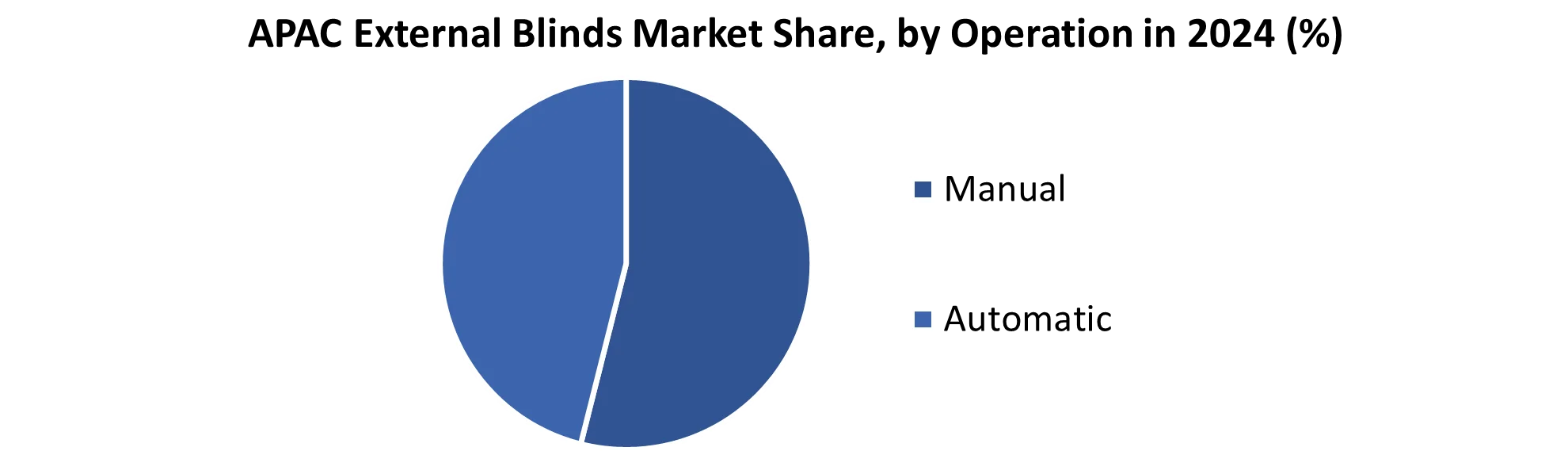

Based on Operation, the APAC External Blinds Market is classified into Manual, Automatic. The manual segment dominated the market in 2024, as the adjustment and position can be controlled by hand and thus the blind height can be simply lowered or raised without going through a complicated process. Meanwhile automated system is gaining its momentum as the income levels of the population increases with a better understanding of technology too.

Based on Material, the APAC External Blinds Market is classified into Natural, Synthetic. The natural segment which can include wood, cotton fabric etc. dominates this segment due to their and heat protectant properties. Furthermore, due to increased consumer demand for healthier products and growing worries about hazardous chemicals, synthetic fabrics and their sensitivities, the APAC market is seeing an increase in demand for organic & eco-friendly fabrics.

Based on End-User, the APAC External Blinds Market is classified into Residential, Commercial. The residential segment has a major share in this market segment in 2024, owing to an annual growth in residential buildings and remodeling, which necessitated safety, privacy, and ambiance. As the offline workplaces open up, the commercial segment is also estimated to grow at a decent rate in the APAC External Blinds Market.

Based on type, the APAC External Blinds Market is classified into Roller Blinds, Vertical Blinds, Roman Blinds, Panel Blinds, Corded Blinds, Venetian Blinds, Honeycomb, Pleated Shades, Zip Screens/Blinds, Roller Gates/Shutters, Others. Roman blinds dominated the global market in 2024 due to their decorative appeal along with protection from external heat and dust. Other types of blinds like are also preferred according to the customers' convenience and budget. Due to the increased popularity of energy-efficient products, the external blinds industry is expected to influence by cellular blinds and honeycomb blinds made from several natural materials to form a honeycomb-like shape in the coming years.

Venetian blinds are also becoming increasingly popular among customers, and are likely to account for a significant share in the APAC External Blinds Market over the forecast period. Venetian blinds are also less expensive than other blinds, which is why they are preferred by a large group of low-income families around the world. By 2031, demand for roller blinds is expected to grow at a CAGR of 4.1 percent, with over 30 million units sold.

APAC External Blinds Market Regional Insights:

Due to increased disposable income and an improving standard of living in the APAC region, particularly in India and China, Asia Pacific is estimated to grow at a considerable rate in the future years. To stay relevant in the market, industry actors are employing a variety of techniques.

The market will grow as long as construction activities in this region continue to improve the aesthetic appeal of the residential and commercial sectors. Furthermore, the quickly expanding infrastructure has resulted in a high need for infrastructural development, resulting in an increase in the demand for external blinds in both the commercial and residential sectors.

Japan, Singapore and Australia have comparatively modern homes with more demand of external blinds than some other regions.

To understand the External Blinds industry and study the market trends. Focusing on the Food External Blinds, knowing the drivers and challenges of the same. Understanding the market segment geographically to gauge the growth potential.

The report includes analytical models like the Porter’s Five Forces, which helps in understanding the operating environment of the competition in the APAC External Blinds Market and thereby study the stakeholders to derive an efficient strategy; and PESTLE Analysis to gain a macro perspective of the External Blinds Industry in terms of political aspects like Government stability, policies, trade regulation and economic aspects like market trends, taxes and inflation. It also provides the effect of environmental factors and influence of social and legal aspects on the APAC External Blinds Market.

APAC External Blinds Market Scope:

|

APAC External Blinds Market |

|

|

Market Size in 2024 |

USD 1.72 Bn. |

|

Market Size in 2032 |

US 2.36 Bn. |

|

CAGR (2025-2032) |

4% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

By Type

|

|

By Operation

|

|

|

Country Scope |

|

APAC External Blinds Market Key Players:

- Ching Feng Home Fashions Co., Ltd. (Taiwan)

- Nien Made Enterprise Co Ltd. (Taiwan)

- TOSO CO. LTD. (Japan)

- Tachikawa Corporation (Japan)

- The Curtain Boutique (Singapore)

Frequently Asked Questions

Japan is expected to hold the highest share in the APAC External Blinds Market.

The market size of the APAC External Blinds Market is expected to reach 2.36 Bn by 2032.

The forecast period for the APAC External Blinds Market is 2025-2032.

The market size of the APAC External Blinds Market in 2024 was 1.72 Bn.

1. APAC External Blinds Market: Research Methodology

1.1 Research Data

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. APAC External Blinds Market Executive Summary

2.1. Market Overview

2.2. Market Size (2024) and Forecast (2025 – 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments

3. APAC External Blinds Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Business Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2024)

3.2.7. Profit Margin

3.2.8. Market Share

3.2.9. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

3.4.1. Strategic Initiatives and Developments

3.4.2. Mergers and Acquisitions

3.4.3. Collaborations and Partnerships

3.4.4. Product Launches and Innovations

4. APAC External Blinds Market: Dynamics

4.1. APAC External Blinds Market Trends

4.2. APAC External Blinds Market Drivers

4.3. APAC External Blinds Market Restraints

4.4. APAC External Blinds Market Opportunities

4.5. APAC External Blinds Market Challenges

4.6. PORTER’s Five Forces Analysis

4.6.1. Intensity of the Rivalry

4.6.2. Threat of New Entrants

4.6.3. Bargaining Power of Suppliers

4.6.4. Bargaining Power of Buyers

4.6.5. Threat of Substitutes

4.7. PESTLE Analysis

4.7.1. Political Factors

4.7.2. Economic Factors

4.7.3. Social Factors

4.7.4. Technological Factors

4.7.5. Legal Factors

4.7.6. Environmental Factors

4.8. Technological Roadmap

4.9. Value Chain Analysis

4.10. Regulatory Landscape

5. APAC External Blinds Market: Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

5.1. APAC External Blinds Market Size and Forecast, by Type (2024-2032)

5.1.1. Vertical Blinds

5.1.2. Roman Blinds

5.1.3. Panel Blinds

5.2. APAC External Blinds Market Size and Forecast, by Operation (2024-2032)

5.2.1. Manual

5.2.2. Automatic

5.3. APAC External Blinds Market Size and Forecast, by Country (2024-2032)

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Australia

5.3.6. ASEAN

5.3.7. Rest of APAC

6. Company Profile: Key Players

6.1. Ching Feng Home Fashions Co. Ltd. (Taiwan)

6.1.1. Company Overview

6.1.2. Product Segment

6.1.2.1. Product Name

6.1.2.2. Product Details (Price, Features, etc)

6.1.3. Financial Overview

6.1.3.1. Total Revenue

6.1.3.2. Segment Revenue

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

6.2. Nien Made Enterprise Co Ltd. (Taiwan)

6.3. TOSO CO. LTD. (Japan)

6.4. Tachikawa Corporation (Japan)

6.5. The Curtain Boutique (Singapore)

7. Key Findings

8. Industry Recommendations

8.1. Strategic Recommendations

8.2. Future Outlook