AI Fintech Market in Europe Industry Overview, Size, Share, Growth Trends, Research Insights and Forecast (2025–2032)

The AI Fintech Market size in Europe was valued at USD 5.35 Billion in 2024 and the total AI Fintech Market size in Europe is expected to grow at a CAGR of 16.40% from 2025 to 2032, reaching nearly USD 18.04 Billion.

Format : PDF | Report ID : SMR_1692

AI Fintech Market in Europe Overview

Artificial intelligence is playing a crucial role, it is helping fintech companies automate routine procedures and improve outcomes on a scale beyond human intelligence. The early application of artificial intelligence enables fintech companies to identify threats, prevent fraud, automate everyday tasks, and enhance the quality of service. All these lead to improved efficiency and higher profits.

The report has covered various aspects that highlights the AI Fintech Market in Europe such as growth drivers, challenges, Restraints, and Opportunities. The Report consists of systematic qualitative and quantitative research focusing on interpreting data, identifying the patterns of data, and extracting meaningful insights. The market size is expected to grow from xx to xx during the forecast year with an increase in sales of the product. AI has boosted economic growth by xx% and financial services revenue by xx%. By leveraging AI in fintech in organizations, key Companies in Europe have gained significant profit and are estimated to grow faster by reaching targeted audiences. The report consists of broad research on various Leading players strategies like collaboration, partnership, mergers, and acquisition which are adopted by the companies.

The report analyzed the overall company’s market position with a SWOT analysis to identify strengths, weaknesses, opportunities, and threats. Analytical tools such as Porter's five forces analysis, feasibility study, and investment return analysis have been used to analyze European AI Fintech market. AI Fintech in Europe has revolutionized market segmentation by enabling more precise and personalized categorization of customer based on their financial behaviour. Depth Analysis, the profit margins of the key players by regions and different segments are analysed to gain insights into the current market trends in AI Fintech.

European Countries showcased a vibrant fintech ecosystem, driven by a combination of progressive regulations, technological advancements, and a strong appetite for digital transformation.

- European AI FinTech deal activity increased by 6% to 38 deals in Q2 2023 from the previous quarter.

- UK remains the most active European for FinTech seed deals despite a 50% drop in Q2.

To get more Insights: Request Free Sample Report

AI Fintech Market in Europe Dynamics

The Rising Influence of AI Fintech in Europe Market

The AI in fintech is expected to increasingly drive competitive advantages for financial firms, by improving efficiency through cost reduction and productivity enhancement, as well as by enhancing the quality of services and products offered to consumers. Increased Cognitive process automation is advancing, allowing AI systems to perform progressively more complicated automation procedures. Advanced and some emerging market economies are highly exposed to potential disruptions from AI—amid a substantial share of employment in the highly exposed Fintech Market. Surged in AI Fintech in Europe thanks to its convenience and efficiency, digital payments attracted a vast user base, enabling seamless transactions and reducing reliance on traditional banking methods. AI in Fintech helps to process all the data and creates reports faster than a human being, resulting in reduced time and cost. In banking apps, AI helps users track their spending goals and financial objectives. Artificial intelligence has the ability to respond faster to the data supplied to them through users’ behaviour patterns, by being monitored with the recognition of patterns and correlations.

The Evolution of AI in Fintech Amidst Regulatory Complexity and Workforce Readiness in Europe

AI in the Fintech industry faces challenges such as lack of availability in the employees to use Artificial Intelligence in the financial models. Wealthier economies, including advanced and some emerging market economies, are generally better prepared than low-income countries to adopt AI, although there is considerable variation across countries in Europe. Complex Regulation has created incompatibilities with existing financial supervision and internal governance frameworks, possibly challenging the technology-neutral approach to policymaking. The availability of a skilled workforce and a favorable regulatory environment have impacted the market growth. Failure to adapt to changes in the market and new regulations has been creating a negative impact on a company's profitability.

AI Fintech Market in Europe Segment Analysis

Based on the Application, Business Analytics and Reporting segment holds the majority share in Europe AI in the Fintech Market with a growing CAGR of 16.3% during the forecast period. Evolution is primarily driven by the increasing adoption of mobile devices and the growing demand for digital financial services. The high adoption rates show that European consumers are increasingly weaving FinTech as more customers interact with FinTech products and services, it generates vast amounts of data that is analysed to gain valuable insights. By analysing customer behavior patterns and preferences, FinTech companies tailor their products and services to meet specific needs, providing a more personalized and engaging experience. By analysing operational data, FinTech companies streamline processes, reduce costs, and optimize resource allocation, enhancing overall efficiency and productivity. Europe makes up 27% of the global cumulative valuation of the Fintech industry. For Instance, By receiving 20% of all venture capital investments, Fintech is also the largest Venture Capital (VC) investment category in Europe, a higher percentage than in Asia and the United States.

AI Fintech Market in Europe Regional Analysis

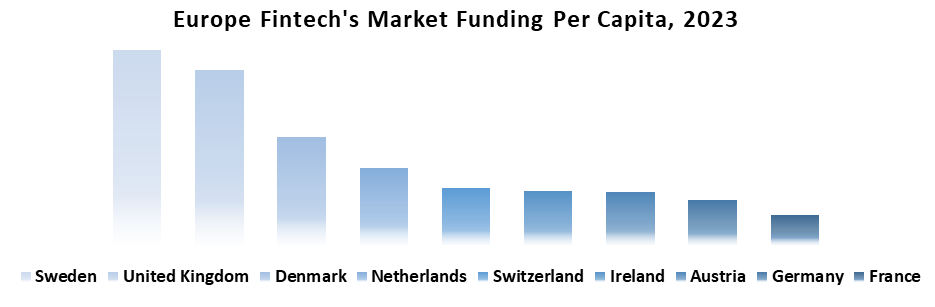

The United Kingdom has been a market leader in the financial services industry. Thanks to the quick rise in FinTech's industry and geographical reach that has been fuelled by a combination of increasing technological demand, regulation, and user participation in financial services, as well as the sector's response to the financial crisis. UK government is continuing to set the global standard for the application of technology, and much more widely, innovation in financial services, with a growing percentage of FinTech firms distributing abroad from the nation. Implementing Trade Finance in the UK's FinTech market supports digital infrastructure for the entire supply chain, from producers to retailers, as it makes it easier for businesses to connect and trade with each other. In Europe, Investors are heavily investing and funding the Fintech market resulting in economic growth in the region. For instance, in 2024, The UK was the leading country in which it closed 13 deals taking a 43% share of total deals. Followed by Spain with 7 deals and Switzerland with 6 deals. In terms of user distribution across countries, the United Kingdom, Germany, and France stood out with the highest number of fintech adopters.

The Netherlands is one of the fastest-growing centres for leading-edge fintech innovation and a European hotspot for fintech entrepreneurs. With our robust financial services sector, fast adoption rate for new technology, business-friendly climate, and flourishing start-up scene, the Netherlands offers a wealth of opportunities for financial services providers and fintech companies. In 2024, The Netherlands host 850+ fintech companies, financial institutions, and tech businesses.

AI Fintech Market in Europe Competitive Landscape

- KPMG UK, a major player in the consulting and accounting industry, has entered into a strategic partnership with Databricks, renowned for its excellence in data and artificial intelligence (AI) solutions. The primary goal of this alliance is to tap into the vast potential of generative AI, which is projected to contribute an additional £31bn annually to the UK economy.

- Abound, a consumer lending financial firm had the largest UK FinTech deal in 2023 after raising £500m ($601m) in their latest venture funding round from K3 Ventures, Hambro Perks Ltd., and SR Ventures.

| AI Fintech Market in Europe Scope | |

|

Market Size in 2024 |

USD 5.35 Bn. |

|

Market Size in 2032 |

USD 18.04 Bn. |

|

CAGR (2025-2032) |

16.40% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope

|

By Deployment Mode

|

|

By Application

|

|

|

By End User

|

|

|

Country Scope |

|

AI Fintech Market in Europe Key Players

- Revolut - UK

- Adyen - Netherlands

- Funding Circle - UK

- TransferWise (Wise) UK

- Monzo - UK

- N26 -Germany

- Klarna - Sweden

- Checkout.com - UK

- OakNorth - UK

- Lemonade - Netherlands

- iZettle (now PayPal) - Sweden

- Raisin -Germany

- Nutmeg - UK

- Onfido - UK

- ComplyAdvantage - UK

- Curve - UK

- Starling Bank - UK

- Zopa - UK

- Atom Bank - UK

- TransferGo – UK

- AirBank

- Finleap Connect

- Finanzcheck.de

- Raisin DS

- N26

- wefox Group

- Pendix

Country Breakdown:

AI Fintech Market in United Kingdom: Industry Analysis and Forecast (2024-2030)

Germany AI in FinTech Market: Industry Analysis and Forecast (2024-2030)

Frequently Asked Questions

High Cost are expected to be the major restraining factors for the market growth.

United Kingdom is expected to lead the AI Fintech Market in Europe during the forecast period.

The Market size was valued at USD 5.35 Billion in 2024 and the total Market revenue is expected to grow at a CAGR of 16.40% from 2025 to 2032, reaching nearly USD 18.04 Billion.

The segments covered in the market report are By Deployment Type, Application, and End User.

1. AI Fintech Market in Europe: Research Methodology

1.1. Research Data

1.1.1. Secondary Data

1.1.2. Primary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. AI Fintech Market in Europe: Executive Summary

2.1. Market Overview

2.2. Market Size (2024) and Forecast (2025 – 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments

3. AI Fintech Market in Europe: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Business Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2024)

3.2.7. Profit Margin

3.2.8. Market Share

3.2.9. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

4. AI Fintech Market in Europe: Dynamics

4.1. AI Fintech Market in Europe Trends

4.2. AI Fintech Market in Europe Drivers

4.3. AI Fintech Market in Europe Restraints

4.4. AI Fintech Market in Europe Opportunities

4.5. AI Fintech Market in Europe Challenges

4.6. PORTER’s Five Forces Analysis

4.7. PESTLE Analysis

4.8. Technological Roadmap

4.9. Regulatory Landscape

5. AI Fintech Market in Europe: Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

5.1. AI Fintech Market in Europe Size and Forecast, by Deployment Mode (2024-2032)

5.1.1. On-premises

5.1.2. Cloud-based

5.2. AI Fintech Market in Europe Size and Forecast, by Application (2024-2032)

5.2.1. Virtual Assistants

5.2.2. Business Analytics and Reporting

5.2.3. Customer Behavioral Analytics

5.2.4. Fraud Detection

5.2.5. Quantitative and Asset Management

5.2.6. Other

5.3. AI Fintech Market in Europe Size and Forecast, by End User (2024-2032)

5.3.1. Banking

5.3.2. Insurance

5.3.3. Securities

5.4. AI Fintech Market in Europe Size and Forecast, by Country (2024-2032)

5.4.1. Germany

5.4.2. United Kingdom

5.4.3. Spain

5.4.4. France

5.4.5. Italy

5.4.6. Belgium

5.4.7. Sweden

5.4.8. Poland

5.4.9. Russia

6. Company Profile: Key Players

6.1. Revolut - UK

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.3. Financial Overview

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

6.2. Adyen - Netherlands

6.3. Funding Circle - UK

6.4. TransferWise (Wise) UK

6.5. Monzo - UK

6.6. N26 -Germany

6.7. Klarna - Sweden

6.8. Checkout.com - UK

6.9. OakNorth - UK

6.10. Lemonade - Netherlands

6.11. iZettle (now PayPal) - Sweden

6.12. Raisin -Germany

6.13. Nutmeg - UK

6.14. Onfido - UK

6.15. ComplyAdvantage - UK

6.16. Curve - UK

6.17. Starling Bank - UK

6.18. Zopa - UK

6.19. Atom Bank - UK

6.20. TransferGo – UK

6.21. AirBank

6.22. Finleap Connect

6.23. Finanzcheck.de

6.24. Raisin DS

6.25. N26

6.26. wefox Group

6.27. Pendix

7. Key Findings

8. Analyst Recommendations

8.1. Strategic Recommendations

8.2. Future Outlook