Asia Pacific Wireless Charging Market Industry Overview, Size, Share, Growth Trends, Research Insights and Forecast (2025–2032)

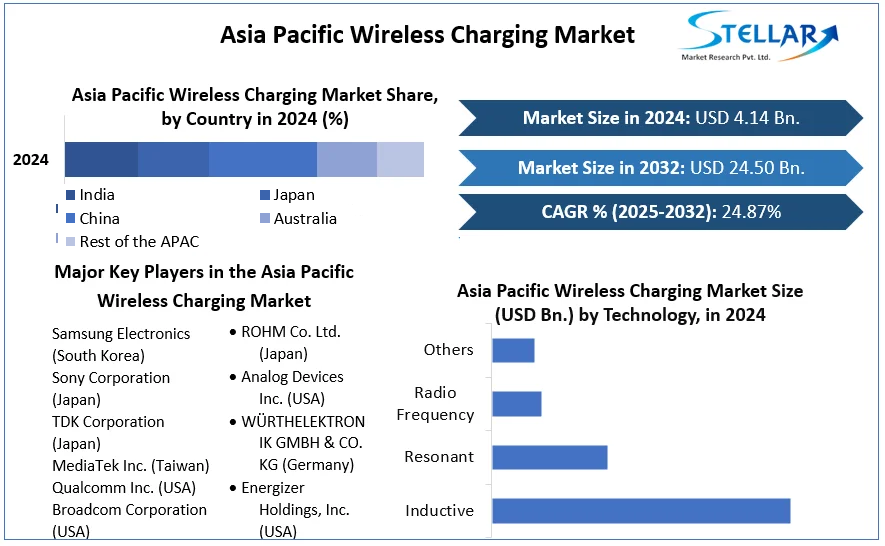

Asia Pacific Wireless Charging Market size was valued at USD 4.14 Bn. in 2024 and is expected to reach USD 24.50 Bn. by 2032, at a CAGR of 24.87%.

Format : PDF | Report ID : SMR_2325

Asia Pacific Wireless Charging Market Overview

Wireless charging is a technology that allows devices to be charged without physical cables, using electromagnetic fields to transfer energy between a charging pad and the device. The Asia Pacific Wireless Charging Market, valued at USD 4.14 billion in 2024, is projected to grow at a compound annual growth rate (CAGR) of 24.87% from 2025 to 2032. The increasing demand for high-speed wireless and multi-device charging stations is a key driver of this market growth. Wireless technology offers significant benefits, such as reducing wear and tear on device ports and connectors, which extends device lifespan and lowers maintenance and replacement costs, further boosting Wireless Charging demand. The rising adoption of electric vehicles (EVs) is significantly contributing to market growth.

Wireless charging technology eliminates the need for physical cables and connectors, providing a seamless and user-friendly charging experience for EV owners. This convenience factor is crucial in driving the widespread acceptance of wireless charging technology. The growing focus on improving user experience and enhancing the efficiency of charging solutions is expected to continue robust growth of the APAC wireless charging market over the forecast period.

To get more Insights: Request Free Sample Report

Asia Pacific Wireless Charging Market Dynamics

Rise in Adoption of Electric Vehicles (EVs) to boost Asia Pacific Wireless Charging Market Growth

The surge in EV popularity, driven by environmental concerns and government incentives, is propelling the demand for wireless charging infrastructure. This technology offers convenience and efficiency, aligning with the needs of modern EV users and accelerating market growth. As regulations change and consumers' preferences shift, the electric vehicle (EV) and energy storage system (ESS) industries are set to experience substantial growth, with the Asia Pacific region playing a vital role. Plug-in electric vehicle sales are set to soar, reaching an estimated 39 million units by 2030, partially fuelled by recent US regulations.

While global sales will continue to rise through 2050, the Asia Pacific region emerges as the primary growth driver of the Asia Pacific wireless charging market, accounting for a substantial portion of the market. Also, regulations demanding a higher share of EVs in car manufacturer’s portfolios have an impact on the industry. Car manufacturers are adapting to stricter regulations and evolving consumer preferences by focusing on the C/SUV-C and D/SUV-D model segments and providing high-performance and energy-efficient battery packs for electric vehicles. This collective effort is shaping the future of the automotive sector towards sustainable mobility and boost the Asia Pacific Wireless Charging Industry growth.

Chinese government began to invest heavily in subsidies for EV technology and batteries, in order to help its domestic automakers carve a niche and compete in global markets. That policy is now paying off resoundingly. Based on full-year 2022 data, China accounted for 58% of global sales of electric vehicles (EVs) and a mammoth 70% of total EV production. In recent months, the US and EU have been imposing new tariffs and local content requirements as try to build up their own EV supply chains, while China has retaliated with its export controls, most recently for graphite.

The rise of electric vehicles (EVs) in the Indo-Pacific is reshaping regional economies, with China at the forefront, producing 36% of new cars as EVs in 2023 and driving 57% of global EV sales. Emerging Asian economies are leveraging their late-developer status with strategic investments and subsidies, particularly in Southeast Asia. Thailand leads with a 10% EV market share, supported by Chinese automakers. Indonesia and Vietnam are also ramping up production, while India boosts EVs through subsidies and incentives. Established economies like Japan and South Korea are transitioning more cautiously. This competition intensifies the contest over critical minerals, essential for EV production and that production supports to increase the wireless charging market size.

New Innovations in Wireless Charging Technology to Boost the Market Growth

With the boom of the digital age and the fast pace of life, innovation has been the key to successful charging solutions. For people with a growing number of devices they own, the necessity for a fast and convenient charging technique rises. For instance, the Unigen 3-in-1 Wireless Charger exemplifies the evolution of charging technology, offering a solution to charge multiple devices simultaneously, such as smartphones, smartwatches, and earbuds. This device eliminates the hassle of tangled cables, enhancing convenience and efficiency. Its multiple coils and superior compatibility with Qi-enabled devices, including iPhones and Androids, make it a versatile and reliable option.

As technology advances, the Unigen Wireless Charger symbolizes the shift toward more efficient, wireless charging solutions for a seamless and faster charging experience. Such continuous innovations in wireless charging technology, such as increased efficiency and faster charging speeds, enhance user experience and drive adoption. These advancements are making wireless charging more accessible and appealing across various devices, from smartphones to wearable tech and driving the Asia Pacific Wireless Charging Market growth.

Fast wireless charging technology offers a significant leap in charging speed and efficiency, delivering a more seamless and responsive user experience. Unlike conventional wireless charging methods that take longer to refill a device battery, fast wireless charging employs advanced charging protocols and higher power levels. This results in a noticeable reduction in charging times, allowing users to quickly get their devices back to full power. Fast wireless charging provides a solution for users who are constantly on the move and need to recharge their machines rapidly. The implementation of fast wireless charging is common in modern smartphones, tablets, and even some wearables. Wireless Charging manufacturers in Asia pacific region are designing devices compatible with this high-speed charging method, recognizing the growing demand for faster and more efficient power delivery than before.

In February 2023, Xiaomi unveiled its flagship smartphone series, the Xiaomi 13, featuring groundbreaking wireless charging capabilities. The Xiaomi 13 supports 50W Wireless Turbo Charge, delivering exceptional charging speeds that rival many wired chargers. This breakthrough technology allows users to power up their devices without the hassle of cables quickly. The Xiaomi 13 boasts a 10W Reverse Wireless Charge, enabling it to function as a wireless power bank for compatible devices such as earbuds or smartwatches. This versatile feature enhances the overall user experience, allowing users to share power with their other devices conveniently.

Increasing Demand for Smartphones and Consumer Electronics in Asian Countries to Create Lucrative Opportunity in the Market

The increasing market for smartphones and other portable devices presents significant opportunities for wireless charging solutions and boosts the Asia Pacific Wireless Charging Market growth. As consumers seek hassle-free charging methods, manufacturers are integrating wireless charging capabilities into their products, expanding the market. Smart Phones, Portable Media Players, Digital Cameras, Tablets and Wearables: Consumers are asking for easy-to-use solutions, increased freedom of positioning, and shorter charging times. These applications typically require 2 W to 15 W of power. Multi-standard interoperability is preferred. Wireless charging coexist with NFC (Near Field Communication) and Bluetooth, allowing for very creative solutions.

The consumer adoption rate of smartphones in China has experienced exponential growth over the past decade, driven by rapid technological advancements, decreasing device costs, and a strong digital infrastructure. As of 2023, smartphone penetration in China had reached over 97%, with more than 1.4 billion active users, reflecting nearly ubiquitous adoption across the country. This widespread usage is underpinned by the country's robust 4G and expanding 5G networks, which provide fast and reliable internet access, enabling a seamless mobile experience for users. The adoption rate has been particularly influenced by the aggressive market strategies of local smartphone manufacturers like Huawei, Xiaomi, Oppo, and Vivo, which have captured significant Asia Pacific Wireless Charging market share through competitive pricing, innovative features, and effective marketing campaigns tailored to local preferences.

As of 2023, China has over 1.4 billion smartphone users, with a penetration rate exceeding 97%. This widespread adoption is driven by technological advancements, competitive local manufacturers, and robust digital infrastructure, appealing to both urban and rural demographics across various age groups. Rapid technological advancements, competitive pricing by local manufacturers, and robust digital infrastructure have driven widespread adoption, particularly among younger demographics and increasingly in rural areas. Such factors are expected to influence the Wireless Charging Market growth.

Asia Pacific Wireless Charging Market Segmentation

Based on components, the transmitter segment held the largest Asia Pacific Wireless Charging Market share in 2024, thanks to significant advancements in transmitter technology. These improvements in power delivery, charging speed, and transmission range have greatly enhanced the efficiency and practicality of the technology, driving the segment's growth prospects. The receiver component segment is anticipated to achieve a notable CAGR of over XX% during the forecast period. This growth is driven by the increasing incorporation of wireless charging receiver components in various devices, such as smartphones, smartwatches, and wireless earbuds. This integration streamlines the charging process, encouraging consumers to adopt wireless charging options and further propelling the segment's growth.

Asia Pacific Wireless Charging Market Country Analysis

China dominated the largest Asia Pacific Wireless Charging Market share in 2024. The rapid growth of electric vehicles and pro-EV policies in the country are expected to propel the growth of the market. China's electric vehicle (EV) charging station market is thriving, supported significantly by its robust battery electric vehicle sector and substantial government backing. In December 2022, the "Action Implementation Plan of Zhejiang on Accelerating the Construction of Charging Infrastructure along Highways" was introduced through a collaboration between the Zhejiang Provincial Communication Department, the Zhejiang Provincial Energy Bureau, and State Grid Zhejiang Electric Power Co., Ltd. By the end of 2022, the plan aimed to establish 1,000 charging stations in provincial expressway service areas, with this number expected to rise to 1,800 by the end of 2024.

Additionally, 600 charging spaces along ordinary highways were projected, to increase to 880 by the end of 2024. Also, 13 agencies, including the Sichuan Provincial Development and Reform Commission, launched the "Work Plan of Sichuan Province for Promoting the Construction of Charging Infrastructure for Electric Vehicles." This plan targets the construction of 200,000 charging facilities across Sichuan by 2025, aiming for comprehensive coverage of EV charging stations in counties and towns. In recent years, coastal regions bordering Hong Kong have developed hundreds of thousands of public charging points, akin to the EV equivalent of gas pumps.

According to the China Electric Vehicle Charging Infrastructure Promotion Alliance, Guangdong boasts the largest EV charging network in China, with 345,126 public chargers and 19,116 charging stations as of September 2022. This network is approximately three times the size of the entire public charging infrastructure in the United States, underscoring China's leading position in the Asia-Pacific EV market.

Asia Pacific Wireless Charging Market Scope

|

Asia Pacific Wireless Charging Market |

|

|

Market Size in 2024 |

USD 4.14 Bn. |

|

Market Size in 2032 |

USD 24.50 Bn. |

|

CAGR (2025-2032) |

24.87 % |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Asia Pacific Wireless Charging Market Segments |

By Component

|

|

By Technology

|

|

|

By Industry Vertical

|

|

|

Country Scope |

China, India, Japan, South Korea, Australia, ASEAN(Indonesia, Vietnam , Laos, Brunei, Thailand, Myanmar , Philippines, Cambodia, Singapore , Malaysia)Rest of APAC |

Asia Pacific Wireless Charging Market Key players

- Samsung Electronics (South Korea)

- Sony Corporation (Japan)

- TDK Corporation (Japan)

- MediaTek Inc. (Taiwan)

- Qualcomm Inc. (USA)

- Broadcom Corporation (USA)

- Toshiba Corporation (Japan)

- ROHM Co. Ltd. (Japan)

- Analog Devices Inc. (USA)

- WÜRTHELEKTRONIK GMBH & CO. KG (Germany)

- Energizer Holdings, Inc. (USA)

- WiTricity Corporation (USA)

- Others

For Global Scenario:

Wireless Charging Market - Global Industry Analysis and Forecast (2024-2030)

Frequently Asked Questions

During the forecast period, China is expected to dominate the Asia Pacific Wireless Charging Market.

The Asia Pacific Wireless Charging Market size is expected to reach USD 24.50 billion by 2032.

The top players in the Asia Pacific Wireless Charging Market are Samsung Electronics (South Korea), Sony Corporation (Japan) and TDK Corporation (Japan)

The segments covered in the Asia Pacific Wireless Charging Market report are based on Component, Technology, Industry Vertical and country.

1. Asia Pacific Wireless Charging Market: Research Methodology

2. Asia Pacific Wireless Charging Market Introduction

2.1. Study Assumption and Market Definition

2.2. Scope of the Study

2.3. Executive Summary

3. Asia Pacific Wireless Charging Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Competitive Landscape

3.3. Key Players Benchmarking

3.3.1. Company Name

3.3.2. Product Segment

3.3.3. End-user Segment

3.3.4. Revenue (2024)

3.3.5. Company Headquarter

3.4. Market Structure

3.4.1. Market Leaders

3.4.2. Market Followers

3.4.3. Emerging Players

3.5. Mergers and Acquisitions Details

4. Asia Pacific Wireless Charging Market: Dynamics

4.1. Wireless Charging Market Trends

4.2. Wireless Charging Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.2.4. Challenges

4.3. PORTER’s Five Forces Analysis

4.4. PESTLE Analysis

4.5. Application Roadmap

4.6. Regulatory Landscape

5. Asia Pacific Wireless Charging Market Size and Forecast by Segmentation (Value in USD Million) (2024-2032)

5.1. Asia Pacific Wireless Charging Market Size and Forecast, By Component (2024-2032)

5.1.1. Transmitters

5.1.2. Receivers

5.1.3. Others

5.2. Asia Pacific Wireless Charging Market Size and Forecast, By Technology (2024-2032)

5.2.1. Inductive

5.2.2. Resonant

5.2.3. Radio Frequency

5.2.4. Others

5.3. Asia Pacific Wireless Charging Market Size and Forecast, By Industry Vertical (2024-2032)

5.3.1. Automotive

5.3.2. Consumer Electronics

5.3.3. Industrial

5.3.4. Healthcare

5.3.5. Aerospace and Defence

5.3.6. Others

5.4. Asia Pacific Asia Pacific Managed Security Service Market Size and Forecast, by Country (2024-2032)

5.4.1. China

5.4.2. S Korea

5.4.3. Japan

5.4.4. India

5.4.5. Australia

5.4.6. ASEAN

5.4.6.1. Indonesia

5.4.6.2. Vietnam

5.4.6.3. Laos

5.4.6.4. Brunei

5.4.6.5. Thailand

5.4.6.6. Myanmar

5.4.6.7. Philippines

5.4.6.8. Cambodia

5.4.6.9. Singapore

5.4.6.10. Malaysia.

5.4.7. New Zealand

5.4.8. Taiwan

5.4.9. Rest of Asia Pacific

6. Company Profile: Key Players

6.1. Samsung Electronics (South Korea)

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.3. Financial Overview

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

6.2. Sony Corporation (Japan)

6.3. TDK Corporation (Japan)

6.4. MediaTek Inc. (Taiwan)

6.5. Qualcomm Inc. (USA)

6.6. Broadcom Corporation (USA)

6.7. Toshiba Corporation (Japan)

6.8. ROHM Co. Ltd. (Japan)

6.9. Analog Devices Inc. (USA)

6.10. WÜRTHELEKTRONIK GMBH & CO. KG (Germany)

6.11. Energizer Holdings, Inc. (USA)

6.12. WiTricity Corporation (USA)

7. Key Findings

8. Industry Recommendations