Asia Pacific Red Brick Market Driven by Urban Expansion and Sustainable Construction

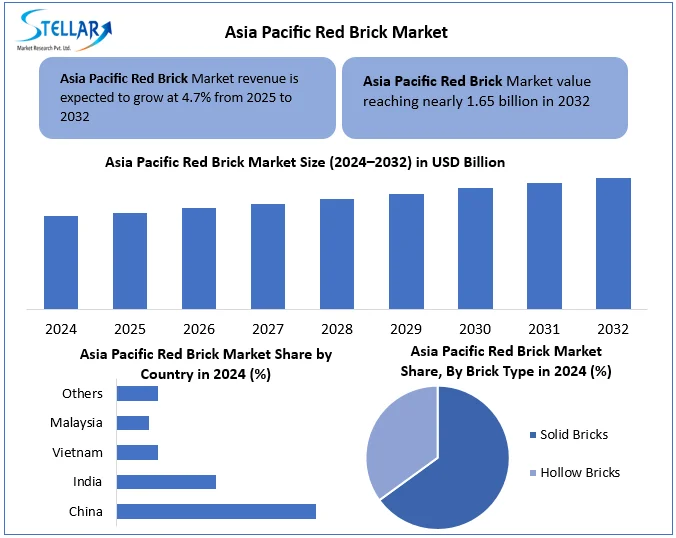

Asia Pacific Red Brick Market size was valued at USD 1.14 billion in 2024 and the total Asia Pacific Red Brick Market size is expected to grow at a CAGR of 4.7% from 2025 to 2032, reaching nearly USD 1.65 billion by 2032

Format : PDF | Report ID : SMR_2874

Asia Pacific Red Brick Market Overview:

Red bricks are rectangular blocks made of natural soil or shell that are removed (cooked) at high temperatures to create a hard, durable construction material.

In 2024, the Asia Pacific Red Brick Market is rapidly inspired by urbanization and development of infrastructure, with about 60 billion people added to the annual urban population. Countries like China and India rely a lot on red bricks due to their cost, durability and thermal insulation-80% of the thermal insulation used in the residential walls in India.

Stability is a major opportunity, as China's new urban buildings more than 60% of China's new urban buildings aim to meet the green standards by 2025. Innovations such as energy-efficient KILN technology have a 20% cut in energy use. Prominent players such as Wienerberger India focus on environmentally friendly products such as Porotherm Smart Bricks, while Brickworks Limited expands its market access through strategic acquisitions.

To get more Insights: Request Free Sample Report

Asia Pacific Red Brick Market Dynamics

Urbanization & Infrastructure Expansion to Drive Asia Pacific Red Brick Market

In 2024, the primary driver of the Red Brick Market in the Asia Pacific region has a rapid pace of joint urbanization with aggressive infrastructure development. Asia Pacific Countries like India, China and Vietnam are watching important rural-urban migrations, about 60 billion people are growing annually in the urban population of Asia. This increases the demand for housing and public infrastructure, where red bricks are used extensively due to their durability, cost-efficiency and thermal insulation properties. In India, about 70–80% of the residential construction of red bricks is walling materials, depending on deep roots on traditional building methods.

Stringent Environmental Regulations to Restrain the Asia Pacific Red Brick Market

A major restraint in the Asia Pacific Red Brick Market is the enforcement of strict environmental rules on traditional brick kilns. In India, kiln contributes 8–14% of air pollution in areas such as the Indo-Gangetic grounds, while in Bangladesh, they emit 1.8 million tonnes of carbon dioxide annually. These forces pressure manufacturers to invest in cleaner technologies, increase costs, and create compliance challenges, especially for small producers - equally slowing the market growth.

Sustainable Construction Demand to Boost the Asia Pacific Red Brick Market

The Asia Pacific Red Brick Market is looking at a major opportunity operating towards sustainable construction practices by the shift of the region. Asia Pacific Countries like India and China are promoting green building standards-as China's three-star Green Building Rating and also India's Integrated Housing Evaluation (GRIHA) improve environmental performance in the green rating-building sector. In China, more than 60% of new urban buildings are targeted to be green-prohibited by 2025, which is a significant demand for materials such as red bricks, offering natural thermal insulation, fire resistance and long lifetime. Additionally, innovations such as recycled materials and energy-efficient KILN technology have reduced energy consumption in brick manufacturing by 20%, aligning with national stability goals. This regulator and technical alignment reflect red bricks as an eco-compatible and reliable alternative to modern, climate-conscious infrastructure projects in the Asia Pacific region.

Asia Pacific Red Brick Market Segment Analysis:

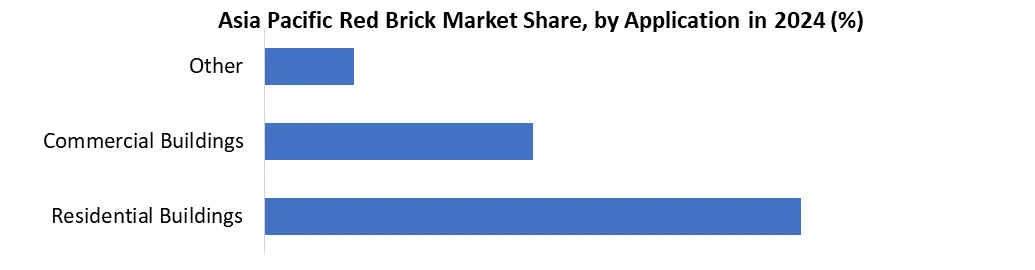

Based on the Red Brick Application Segment, the market is segmented into Residential Buildings, Commercial Buildings, Other. Residential Buildings Dominates the Asia Pacific Red Brick market in 2024 and is expected to hold the largest market share over the forecast period.

In the Asia Pacific Red Brick Market, residential buildings segment is dominating in Asia Pacific. This dominance is inspired by rapid urbanization and population growth of the region, which has increased the demand for inexpensive and sustainable housing solutions. Residential construction projects, especially inexpensive and government-supported housing, their cost-efficiency, thermal insulation properties and availability of raw materials are used largely red bricks. Also, traditional building practices in China favor red bricks for residential structures, further strengthening the leading position of this section in the market. This trend is supported by reports from market research firms, highlighting residential construction, which is the primary application that runs red brick consumption in the region.

Asia Pacific Red Brick Market Regional Insight:

China Dominates the Red Brick Market in 2024 and is Expected to hold the Largest Share due to Rapid Urbanization

China leads the Asia Pacific Red Brick Market in 2024, operating by large -scale affordable housing programs, rapid urbanization, adding more than 12 billion new urban inhabitants annually, and more than 500 smart city projects develop. Red bricks are integral to manufacture, with traditional masonry more than 60% of low-middle-world buildings are used. China's dominance is supported by the availability of abundant soil -rich soil and more than 700 billion units, the highest at the globally. Advanced manufacturing techniques, including energy-efficient kilns, have reduced emissions by 15–20%by increasing both production and stability. Whereas countries like India and Vietnam also contribute due to infrastructure investment and increasing population, the scale of China, the benefits of raw materials and the growth, which holds it strongly as a regional leader.

Asia Pacific Red Brick Market Competitive Landscape:

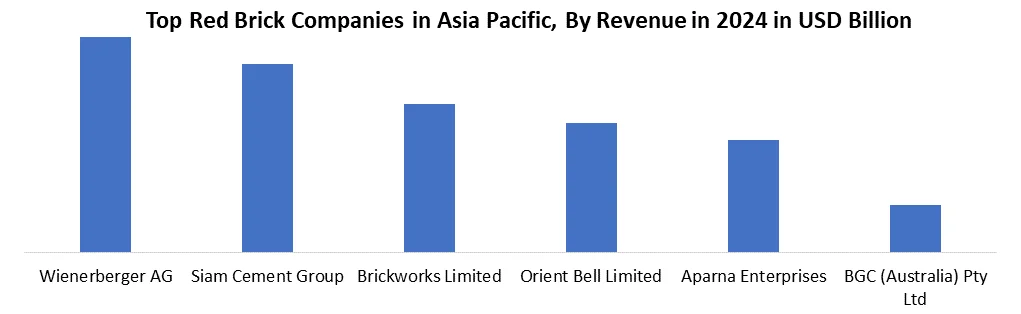

In the Asia Pacific Red Brick Market, Wienerberger India and Brickworks Limited are the two major contestants that use different strategies to strengthen their market status. Wienerberger India focuses on environmentally friendly innovation with its Porotherm smart bricks, which contains 55% zero ratio for better thermal insulation, 90% recycled materials such as stone solution and rice husk, and provide a lifetime of up to 150 years. These bricks have very low carbon footprint -97.103 kg per ton - for traditional clay bricks and concrete blocks, aligning with an increase in stability standards in construction.

In contrast, Brickwork Limited has focused on strategic expansion to increase its footprint. In 2022, it acquired the facility of National Masonry in MacKay, Queensland, enabling better distribution in major northern markets such as Rockhampton and Towns 8. The move has increased customer access and entry into the market. While the Wienerberger proceeds through permanent product development, brickworks strengthen its competitive edge by improving supply chain efficiency and regional access.

Asia Pacific Red Brick Market Key Development

1. In January 2025 - Wienerberger India achieved a large stability milestone with its porotherm smart bricks. A third-party life cycle analysis confirmed much lower carbon footprint compared to traditional walling materials. Bricks use 90% of recycled materials such as stone solution and rice husk and have a lifetime of over 150 years, which keeps them in the form of a major environmentally friendly solution in India's construction industry.

2. In May 2023 - Wienerberger India invested and invested 30 crores to modernize its Kunigal plant in Karnataka, increased machinery and increased its production capacity by 25%. Plant, operating since 2009, the largest high-tech automatic clay brick manufacturing facility in Asia and supports the increasing demand for sustainable construction solutions in the region.

3. In Aug 2023 - Wienerberger India completed its infection from coal to natural gas to operate kiln in its nail facility. This strategic change reduced the CO Emissions by 40% and eliminated the particulate matter during the brick-firing process, strengthening the company's commitment to sustainable construction practices in the Asia-Pacific region.

4. In September 2024 - Brickworks Limited, Australia's leading brick manufacturer, reported $ 118.9 million net loss due to a decline in housing construction and increase in foreign competition. In response, the company focused on long -term industrial property investments and called for government action to address housing power, continuing to develop its domestic brick operations.

5. In January 2025 - Viglacera Corporation in Vietnam expanded its red brick production capacity to meet the country's urban infrastructure and increasing demand in housing areas. This development strengthens the role of Vietnam in the Asia-Pacific construction supply chain, especially in changes towards durable and high-quality brick materials.

Asia Pacific Red Brick Market Scope:

|

Asia Pacific Red Brick Market |

|

|

Market Size in 2024 |

1.14 billion. |

|

Market Size in 2032 |

1.65 billion. |

|

CAGR (2025-2032) |

4.7% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Brick Type Hollow Bricks Solid Bricks |

|

By Colour Type Single Colour Bricks Blend Bricks |

|

|

|

By Application Residential Buildings Commercial Buildings Other |

Asia Pacific Red Brick Market Key Players:

- Wienerberger India (India)

- Brickworks Limited (Australia)

- Austral Bricks (Australia)

- Boral Limited (Australia)

- Sanghi Industries Ltd (India)

- The India Cements Ltd (India)

- Hanil Cement Co., Ltd (South Korea)

- LOPO China (China)

- Zibo Yonganda Industry and Trade Co., Ltd (China)

- Linyi Yitong Brick Machinery Co., Ltd. (China)

- SIG (PT Semen Indonesia Tbk) (Indonesia)

- MAA COTTOS INC. (Bangladesh)

- Sahyadri Industries Ltd (India)

- Anjo Materials Co., Ltd. (Japan)Xuan Hoa JSC (Vietnam)

Frequently Asked Questions

China, India, and Thailand are among the top producers of red bricks are leading in the Asia Pacific region.

Rapid urbanization drives demand for red bricks in Asia pacific as it fuels the construction of new housing and infrastructure projects.

Yes, companies are increasingly adopting eco-friendly manufacturing processes to reduce carbon emissions and energy consumption in Asia Pacific.

1. Asia Pacific Red Brick Market: Research Methodology

2. Asia Pacific Red Brick Market Introduction

2.1. Study Assumption and Market Definition

2.2. Scope of the Study

2.3. Executive Summary

3. Asia Pacific Red Brick Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Competitive Landscape

3.3. Key Players Benchmarking

3.3.1. Company Name

3.3.2. Product Segment

3.3.3. End-user Segment

3.3.4. Revenue (2023)

3.3.5. Company Headquarter

3.4. Market Structure

3.4.1. Market Leaders

3.4.2. Market Followers

3.4.3. Emerging Players

3.5. Red Brick Import Export Analysis

3.6. Mergers and Acquisitions Details

4. Asia Pacific Red Brick Market: Dynamics

4.1. Wire and Cables Market Trends

4.2. Wire and Cables Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.2.4. Challenges

4.3. PORTER’s Five Forces Analysis

4.4. PESTLE Analysis

4.5. Technology Roadmap

4.6. Regulatory Landscape

5. Asia Pacific Red Brick Market Size and Forecast by Segmentation (Value in USD Billion) (2024-2032)

5.1. Asia Pacific Red Brick Market Size and Forecast, By Brick Type (2024-2032)

5.1.1. Hollow Bricks

5.1.2. Solid Bricks

5.2. Asia Pacific Red Brick Market Size and Forecast, By Colour Type (2024-2032)

5.2.1. Single Colour Bricks

5.2.2. Blend Bricks

5.3. Asia Pacific Red Brick Market Size and Forecast, By Application (2024-2032)

5.3.1. Residential Buildings

5.3.2. Commercial Buildings

5.3.3. Other

5.4. Asia Pacific Asia Pacific Red Brick Market Size and Forecast, by Country (2024-2032)

5.4.1. China

5.4.2. S Korea

5.4.3. Japan

5.4.4. India

5.4.5. Australia

5.4.6. ASEAN

5.4.6.1. Indonesia

5.4.6.2. Vietnam

5.4.6.3. Laos

5.4.6.4. Brunei

5.4.6.5. Thailand

5.4.6.6. Myanmar

5.4.6.7. Philippines

5.4.6.8. Cambodia

5.4.6.9. Singapore

5.4.6.10. Malaysia.

5.4.7. New Zealand

5.4.8. Taiwan

5.4.9. Rest of Asia Pacific

6. Company Profile: Key Players

6.1. Wienerberger India

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.3. Financial Overview

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

6.2. Brickworks Limited (Australia)

6.3. Austral Bricks (Australia)

6.4. Boral Limited (Australia)

6.5. Sanghi Industries Ltd (India)

6.6. The India Cements Ltd (India)

6.7. Hanil Cement Co., Ltd (South Korea)

6.8. LOPO China (China)

6.9. Zibo Yonganda Industry and Trade Co., Ltd (China)

6.10. Linyi Yitong Brick Machinery Co., Ltd. (China)

6.11. SIG (PT Semen Indonesia Tbk) (Indonesia)

6.12. MAA COTTOS INC. (Bangladesh)

6.13. Sahyadri Industries Ltd (India)

6.14. Anjo Materials Co., Ltd. (Japan)

6.15. Xuan Hoa JSC (Vietnam)

7. Key Findings

8. Analyst Recommendations