Asia Pacific LiDAR Market Size, Share, Growth Trends, Industry Analysis, Key Players, Investment Opportunities, and Forecast (2025-2032)

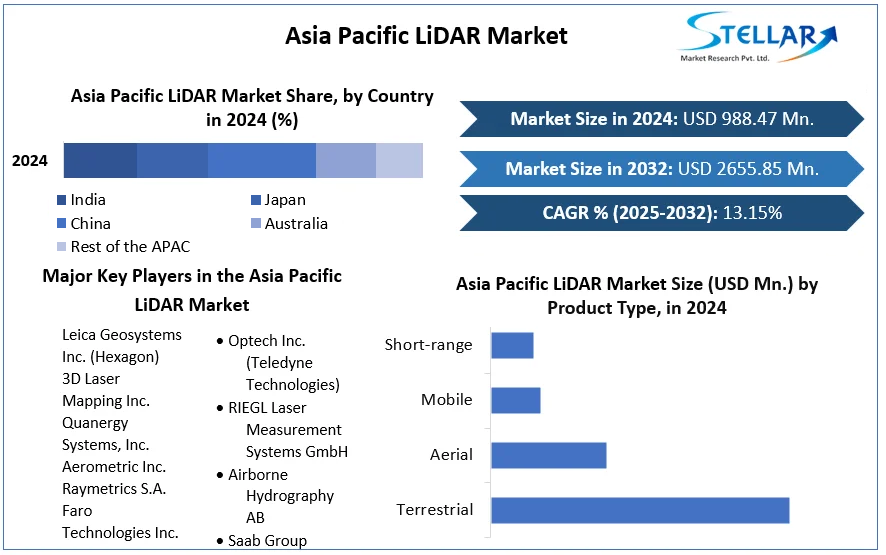

The Asia Pacific LiDAR Market size was valued at USD 988.47 Mn. in 2024 and the total Asia Pacific LiDAR revenue is expected to grow at a CAGR of 13.15% from 2025 to 2032, reaching nearly USD 2655.85 Mn. by 2032.

Format : PDF | Report ID : SMR_2306

Asia Pacific LiDAR Market Overview

LiDAR, or optical radar, is the abbreviation of Light Detection and Ranging system. The system emits laser beams to detect characteristics such as the position and speed of the target. In 2024, the Asia Pacific LiDAR market in Asia experienced impressive growth, driven by heightened demand across various sectors such as automotive, infrastructure, and environmental monitoring. This surge was fuelled by substantial investments in smart city initiatives, autonomous vehicle technology advancements, and increased LiDAR adoption for mapping and surveying.

Key markets like China, Japan, South Korea, and India played pivotal roles, with China leading due to its extensive infrastructure development and rapid technological innovations. Overall, the LiDAR market in Asia demonstrated a dynamic and growing landscape, marked by significant technological progress and developing applications.

Japan's Mitsubishi Electric Corporation has launched a compact LiDAR solution for autonomous vehicles, utilizing MEMS technology to enhance horizontal vision and pedestrian detection capabilities, with a volume of around 900cc. The company is also planning to develop a smaller variant, targeting a volume of 350cc or less. This innovation positions Mitsubishi Electric as a competitive player in the Asia Pacific LiDAR market, offering advanced detection capabilities in a compact form, and signaling their commitment to continuous improvement and technological advancement.

To get more Insights: Request Free Sample Report

Asia Pacific LiDAR Market Dynamics

Rising Adoption of UAV LiDAR Systems to Capture Accurate Evaluation Data

The rising adoption of UAV (Unmanned Aerial Vehicle) LiDAR systems in the Asia-Pacific region is driven by the need for accurate and high-resolution evaluation data across various industries, such as agriculture, forestry, mining, and urban planning. In precision agriculture, UAV LiDAR enables farmers to optimize irrigation and fertilization, potentially improving crop yields by up to 20% through detailed analysis of soil conditions, crop health, and field topography. In forestry management, these systems facilitate forest inventory, biomass estimation, and canopy structure analysis, reducing manual survey costs and time by up to 50%.

The mining sector benefits from UAV LiDAR's ability to provide detailed maps for resource estimation and operational planning, increasing survey efficiency by approximately 30% compared to traditional methods. Urban planners and civil engineers use UAV LiDAR for accurate mapping and monitoring of infrastructure projects, with data accuracy within a few centimeters aiding in better design and maintenance of roads, bridges, and buildings. This advanced usage of LiDAR technology boosts crop production and Asia Pacific LiDAR market share in the global market.

This growth is fueled by government initiatives investing in smart city projects and infrastructure development, such as China’s projected USD 30 billion investment in smart city initiatives by 2025. Additionally, technological advancements, including increased range and resolution of LiDAR systems and the decreasing cost of UAVs, have made these systems more accessible, with prices dropping by about 40% over the past five years. Consequently, UAV LiDAR technology is poised to become an integral tool for precise evaluation and mapping across the region, supported by substantial Asia Pacific LiDAR market growth projections and increasing governmental support.

Recent Investments in the Asia Pacific LiDAR Market

In 2022, Hesai Technology, a leading LiDAR technology based manufacturer in Shanghai, secured significant funding of approximately USD 190 million in a Series C funding round. This investment aimed to enhance their R&D capabilities and expand production capacity to meet the growing demand for automotive LiDAR systems.

Another major player, Robosense, raised USD 100 million in a Series C round in early 2023. The investment was directed towards developing advanced LiDAR sensors for autonomous vehicles and growing their market presence.

In 2022, Topcon Corporation invested around USD 50 million in developing next-generation LiDAR systems, focusing on smart infrastructure and agriculture applications. This move aligns with their strategy to integrate advanced LiDAR technology into various sectors.

Panasonic announced a USD 40 million investment in LiDAR technology in 2023, aimed at improving their sensor systems for automotive and industrial applications. The investment is part of Panasonic's broader strategy to enhance its technological portfolio in smart mobility.

In 2022, Hanwha Aerospace invested approximately USD 60 million in LiDAR technology to support its growing focus on autonomous systems and advanced manufacturing. The investment is expected to advance their capabilities in high-resolution LiDAR sensors.

LG Electronics made a strategic investment of USD 30 million in a South Korean LiDAR startup in 2023. This investment is geared towards integrating LiDAR technology into their automotive and robotics products usage in Asia Pacific LiDAR market.

In 2022, MapmyIndia, an Indian digital mapping company, partnered with international investors to boost its LiDAR mapping capabilities. While the exact investment amount was not disclosed, the partnership aimed to enhance its geographic information system (GIS) services using advanced LiDAR technology.

Import-Export Analysis for the Asia Pacific LiDAR Market

LiDAR equipment exports from the world to India involved 41 shipments facilitated by 14 global exporters and received by 17 Indian buyers. The leading exporters of LiDAR equipment to India were China, with 43 shipments; Vietnam, with 6 shipments; and Hong Kong, with 1 shipment.

India imported 31 LiDAR equipment shipments from 13 Indian importers, sourced from 14 suppliers. The top importing countries were India itself, with 31 shipments, followed by Russia, which imported 15 shipments, and Vietnam, which was the third largest importer with 10 shipments. This analysis indicates a significant flow of LiDAR equipment from global suppliers to India, with China being the predominant exporter. Conversely, India remains a major importer, demonstrating a strong demand for LiDAR technology within the country.

Asia Pacific LiDAR Market Regional Analysis

The Asia-Pacific LiDAR market growth is analyzed across key regions including Australia & New Zealand, China, Japan, Indonesia, India, Vietnam, Thailand, South Korea, and other parts of the Asia-Pacific. China, driven by decades of substantial economic development, has adopted advanced mapping technologies such as LiDAR sensors from leading system providers. The country boasts the world's largest automotive sector, producing over 20 million vehicles annually more than double that of the United States, the second-largest producer. Automotive Light

Detection and Ranging (LiDAR) plays an important role in precisely identifying and detecting road conditions and is crucial for the adoption of Advanced Driver Assistance Systems (ADAS). Their designs and scanning techniques impact the vehicle's performance and navigation. China's Ministry of Industry and Information Technology has also promoted the growth of intelligent connected vehicles through standards issued in 2018, further stimulating the Asia Pacific LiDAR market.

In contrast, Japan's prominent automotive industry features globally recognized brands like Lexus, Mazda, Toyota, and Honda. The Japanese government's focus on economic revitalization through infrastructure development is expected to significantly boost the construction sector, thereby fostering Asia Pacific LiDAR market growth in the region. Topcon Corporation, headquartered in Tokyo, is a key player in this space, specializing in a range of optical and surveillance instruments. The company's operations span smart infrastructure, positioning, eye care, and emerging fields such as IT agriculture and IT construction, contributing to the regional LiDAR market dynamics.

Asia Pacific LiDAR Market Segment Analysis

Based on Type, The Asia Pacific LiDAR market is segmented by type into terrestrial, aerial, mobile, and short-range systems, each with distinct applications and technological features. The Asia-Pacific terrestrial LiDAR market and is expected to maintain its dominant position throughout the forecast period. Terrestrial LiDAR is also known as ground-based LiDAR systems, these units are equipped with laser scanners and highly accurate GPS systems. Terrestrial LiDAR excels in generating detailed 3D images of land, making it particularly effective for mapping coastal regions and analyzing natural hazards. Traditional satellite imagery often struggles with vertical cliffs and rapid coastal changes due to its limited perspective.

Terrestrial LiDAR addresses these challenges by providing precise measurements from a safe and optimal distance. This capability is crucial for assessing land movements, such as landslides, and monitoring coastal erosion in the Asia-Pacific region, which is prone to such natural phenomena. Aerial LiDAR involves deploying LiDAR sensors from aircraft or drones to capture high-resolution data over large areas. Aerial LiDAR is widely used for topographic surveys, forestry management, and infrastructure development. Its ability to cover extensive regions quickly and efficiently makes it valuable for projects requiring large-scale data collection.

Mobile LiDAR systems are mounted on vehicles or other moving platforms to capture data while in motion. This type is particularly useful for mapping roadways, urban environments, and transportation infrastructure. The mobility of these systems allows for the rapid collection of spatial data along transportation routes and urban corridors in the Asia Pacific LiDAR market. Short-range LiDAR systems are designed for applications that require detailed and precise measurements over relatively small distances. These systems are commonly used in industrial automation, robotics, and interior mapping where high-resolution data is essential in confined spaces.

In the Asia-Pacific region, China stands out as the largest revenue-generating country in the terrestrial LiDAR segment. China's dominance in this Asia Pacific LiDAR market is attributed to its extensive infrastructure projects, rapid urbanization, and the need for detailed land assessments in various environmental contexts. The country is expected to maintain its leading position throughout the forecast period due to continued investments in advanced LiDAR technologies and growing demand for precise land and coastal monitoring solutions.

In Conclusion: To drive growth and innovation in the Asia Pacific LiDAR market, companies should invest in technological advancements and cost-effective solutions, expand applications beyond traditional uses, and enhance integration with AI and IoT. Strengthening regional collaborations, addressing regulatory standards, and leveraging government initiatives will further promote adoption. Additionally, increasing customer education and focusing on affordability will ensure wider market penetration and sustained development.

|

Asia Pacific LiDAR Market Scope |

|

|

Market Size in 2024 |

USD 988.47 million. |

|

Market Size in 2032 |

USD 2655.85 million. |

|

CAGR (2025-2032) |

13.15% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Product Type Terrestrial Aerial Mobile Short-range |

|

By Component Lasers Inertial navigation system Camera GPS/GNSS receiver Microelectromechanical system (MEMS) |

|

|

By Application Corridor mapping Seismology Exploration and detection Others |

|

|

|

By End-User Archaeology Mining Transportation Defense & Aerospace Forestry & Agriculture |

|

Regional Scope |

Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN (Indonesia , Vietnam, Laos, Brunei, Thailand, Myanmar, Philippines, Cambodia, Singapore, Malaysia), Rest of APAC |

Key Players in the Asia Pacific LiDAR Market

- Leica Geosystems Inc. (Hexagon)

- 3D Laser Mapping Inc.

- Quanergy Systems, Inc.

- Aerometric Inc.

- Raymetrics S.A.

- Faro Technologies Inc.

- Optech Inc. (Teledyne Technologies)

- RIEGL Laser Measurement Systems GmbH

- Airborne Hydrography AB

- Saab Group

For Global Scenario:

LiDAR Market - Global Industry Analysis and Forecast (2024-2030)

Frequently Asked Questions

The Asia-Pacific Light Detection and Ranging (LiDAR) Market growth rate will be 13.15% by 2032.

The upsurge in the adoption rate of LiDAR systems among UAVs and growing demand for 3D imaging technology are the growth drivers of the Asia-Pacific LiDAR Market.

The major companies in the Asia-Pacific Light Detection and Ranging (LiDAR) Market are HOKUYO AUTOMATIC CO., LTD, SICK AG, Trimble Inc., Quantum Spatial, Beijing Beike Digital Medical Technology Co.,Ltd., Geokno India Pvt. Ltd, Velodyne Lidar Inc., NV5 Global, Inc., Quanergy Systems Inc., Phoenix LiDAR Systems, Airborne Imagining, FARO, GeoDigital, and Leica Geosystems AG.

1. Asia Pacific Semiconductor Memory Market: Research Methodology

2. Asia Pacific Semiconductor Memory Market Introduction

2.1. Study Assumption and Market Definition

2.2. Scope of the Study

2.3. Executive Summary

3. Asia Pacific Semiconductor Memory Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Competitive Landscape

3.3. Key Players Benchmarking

3.3.1. Company Name

3.3.2. Product Segment

3.3.3. End-user Segment

3.3.4. Revenue (2024)

3.3.5. Company Headquarter

3.4. Market Structure

3.4.1. Market Leaders

3.4.2. Market Followers

3.4.3. Emerging Players

3.5. Mergers and Acquisitions Details

4. Asia Pacific Semiconductor Memory Market: Dynamics

4.1. Semiconductor Memory Market Trends

4.2. Semiconductor Memory Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.2.4. Challenges

4.3. PORTER’s Five Forces Analysis

4.4. PESTLE Analysis

4.5. Application Roadmap

4.6. Regulatory Landscape

5. Asia Pacific Semiconductor Memory Market Size and Forecast by Segmentation (Value in USD Million) (2024-2032)

5.1. Asia Pacific Semiconductor Memory Market Size and Forecast, By Product Type (2024-2032)

5.1.1. Terrestrial

5.1.2. Aerial

5.1.3. Mobile

5.1.4. Short-range

5.2. Asia Pacific Semiconductor Memory Market Size and Forecast, By Component (2024-2032)

5.2.1. Lasers

5.2.2. Inertial navigation system

5.2.3. Camera

5.2.4. GPS/GNSS receiver

5.2.5. Microelectromechanical system (MEMS)

5.3. Asia Pacific Semiconductor Memory Market Size and Forecast, By Application (2024-2032)

5.3.1. Corridor mapping

5.3.2. Seismology

5.3.3. Exploration and detection

5.3.4. Others

5.4. Asia Pacific Semiconductor Memory Market Size and Forecast, By End-User (2024-2032)

5.4.1. Archaeology

5.4.2. Mining

5.4.3. Transportation

5.4.4. Defense & Aerospace

5.4.5. Forestry & Agriculture

5.5. Asia Pacific Asia Pacific Managed Security Service Market Size and Forecast, by Country (2024-2032)

5.5.1. China

5.5.2. S Korea

5.5.3. Japan

5.5.4. India

5.5.5. Australia

5.5.6. ASEAN

5.5.6.1. Indonesia

5.5.6.2. Vietnam

5.5.6.3. Laos

5.5.6.4. Brunei

5.5.6.5. Thailand

5.5.6.6. Myanmar

5.5.6.7. Philippines

5.5.6.8. Cambodia

5.5.6.9. Singapore

5.5.6.10. Malaysia.

5.5.7. New Zealand

5.5.8. Taiwan

5.5.9. Rest of Asia Pacific

6. Company Profile: Key Players

6.1. Leica Geosystems Inc. (Hexagon)

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.3. Financial Overview

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

6.2. 3D Laser Mapping Inc.

6.3. Quanergy Systems, Inc.

6.4. Aerometric Inc.

6.5. Raymetrics S.A.

6.6. Faro Technologies Inc.

6.7. Optech Inc. (Teledyne Technologies)

6.8. RIEGL Laser Measurement Systems GmbH

6.9. Airborne Hydrography AB

6.10. Saab Group

7. Key Findings

8. Industry Recommendations