Window Coverings Market: Industry Analysis and Forecast (2024-2030) Trends, Statistics, Dynamics

Window Coverings Market size was valued at US$ 41.81 Bn. in 2023 and the total revenue is expected to grow at 7.6% through 2024 to 2030, reaching nearly US$ 69.83 Bn. by 2030.

Format : PDF | Report ID : SMR_1022

Window Coverings Market Overview

Windows are a crucial component of buildings because they allow for ventilation and if needed visual communication with the outside world, which makes living in an enclosed place possible. By adjusting how sunlight, sound, and air pass through the window, window coverings assist in changing the window's characteristics. enhancing the comfort of the indoor area. Window coverings are primarily categorised as blinds, shades, and shutters and come in a range of materials, colours, textures, and styles that make them suitable for usage in homes, businesses, and institutions. These elements have a beneficial impact on the market for window coverings during the anticipated era of growth.

Window coverings are essentially an add-on for the basic windows, allowing the basic windows to be customised as needed. Window coverings are now necessary to maintain the comfort of the interior spaces of the building due to the rising and rising temperatures in metropolitan areas. Window treatments are not only necessary but also play a significant role in contemporary interior design. The key driver of the window covering market's explosive growth in the anticipated term is the expanding demand for homes and businesses.

To get more Insights: Request Free Sample Report

Window Coverings Market Dynamics:

Booming Real Estate Industry – During the forecast period, market growth is probably encouraged by the rising real estate sector. For Example. over the projected period, it is expected that the U.S. market will continue to have a leading position among all markets for window coverings. In the near future, it's anticipated that demand for blinds will increase across the nation due to the rising popularity of built, modular, and prefabricated homes.

Over the years, the Indian real estate industry has expanded significantly. The Indian residential market is anticipated to grow significantly over the next few years with support from the government, according to the India Brand Equity Foundation (IBEF). For instance, the Pradhan Mantri Awas Yojana (PMAY) programme, launched by the Government of India (GoI) in June 2015, aims to construct 20 million homes nationwide (across metropolitan regions) by 2022. The GoI provided the initiative/scheme with financial support as of August 26th, 2021, in the amount of about 31 billion.

Technological Advancements driving growth - In the upcoming years, recent changes in the textile industry, particularly in Asian countries, are likely to encourage the entry of new players. For instance, the GoI suggested a plan for the creation of mega textile parks in India in its Budget 2021–22 in February 2021 in order to support the local textile industry and draw substantial investments. Such government assistance is likely to result in the inexpensive availability of labour and raw materials from the perspective of production.

Numerous competitors in the home furnishings industry have recently increased their efforts to take advantage of the market potential, driven by rising customer interest in cutting-edge blinds. For instance, the Swedish furniture retailer IKEA announced in February 2021 that it would be introducing their new Gun rid curtains, which purify the air. A photocatalyst mineral was used in the fabric to reduce the chance that harmful emissions would enter a home by decomposing pollutants during the day. In collaboration with institutions in Asia and Europe, IKEA created the GUNRID technology.

- Government Regulations – Various restrictions governing corded window coverings have been implemented in recent years, particularly in Canada. Over the past three decades, a department of the Canadian government called Health Canada has been striving to reduce the hazards related to corded blinds in Canada. This effort was motivated by the rising number of child fatalities from this risk. Health Canada published new standards for corded window blinds in May 2019 with the goal of reducing the size of loops and the length of cords on blinds (both ready-made and bespoke) marketed across Canada. Governments in underdeveloped nations are anticipated to enact similar laws in the upcoming years to safeguard kids from this potential risk. To remain competitive in the fiercely competitive market sector, it is crucial from a manufacturing perspective to adapt to such new requirements.

Window Coverings Market Segment Analysis:

By Type, the Window Coverings Market is segmented as Blinds & Shades, Shutters and Curtains. Blinds and Shades dominates the Window Coverings Market with the market share of 41.4% in 2023 as blinds are among the most affordable window coverings available, which makes them a great option for homes or rental flats. Aluminum and stock vinyl mini-blinds can be purchased for as little as $5 for a 2-by-4-foot window. Globally, the market for full light-cancelling blinds is being driven mostly by the rising popularity of home theatre systems in North America and Europe.

Blackout roller blinds offer the high degrees of seclusion and darkness required for media room windows with their smooth and modern designs. The most well-liked light-cancelling roller blinds on the market are made by Graber Light and include blackout roller shades, crown blackout roller shades, and horizons blackout spring roller shades.

Curtains have the market share of 39.8% in 2023 as the popularity of high-tech products like remote-controlled or solar-blocking drapes is rising. On the other hand, traditional craftsmanship is gaining a lot of value in the curtain industry. Additionally, the window curtain market is dominated by DIY users. The extensive availability of window curtain products and how simple it is to install them are driving the market expansion. Several manufacturers have created specialised distribution channels to satisfy the demands of the curtain market. Shutters have the market share of 18.8% in 2021.

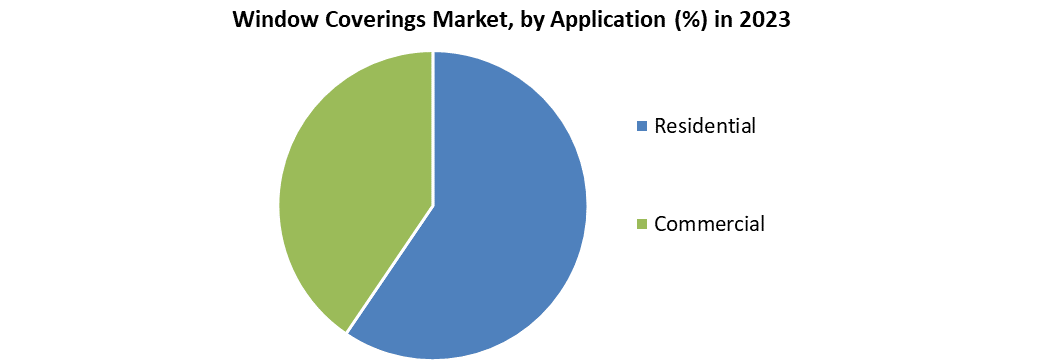

By Application, the Window Coverings Market is segmented as Residential and Commercial. Residential has the market share of 55% in 2023 as rising urbanisation in developing nations like China and India as well as an increase in the number of households are driving this segment. In addition, the FMCA reports that more than 5.5 million existing homes and over 800,000 new homes were sold in the United States in 2020.

Commercial has the market share of 45% in 2023 as investments in the standardisation of IT infrastructure and product advances also boost the demand for new construction. Due to their enhanced insulating abilities, simplicity of use, and efficient use of space, sliding and insulated profiles are now in demand as replacements.

Window Coverings Market Regional Insights

North America has the market share of 32.9% in 2023. The demand for curtains and drapes for interior spaces is primarily supported by the rise in smart home construction and the penetration of smart technology in American and Canadian households. Smart home gadgets are becoming more common in most American households, according to a Value Penguin poll of 1,000 people performed in September 2020. According to MMR Study, 65 % of Americans own a smart gadget at home, and they use it for a variety of market share of purposes.

Europe has the market share of 28.5% in 2023. The market for window coverings in Europe is expanding as a result of the increased demand for natural and environmentally friendly goods. The U.K., Germany, and France are Europe's top importers of eco-friendly or natural curtains and drapes.

Asia Pacific has the market share of 24% in 2023 due to the region's expanding disposable income and rising standard of living, particularly in China and India. To remain competitive in the market, industry players are using a variety of techniques. The majority of market players favour new product releases as the most frequent strategic activity. The low-end and mid-end category continues to be dominated by Chinese and Indian high-volume vendors. Middle East and Africa has the market share of 8.6% followed by South America with the market share of 6% in 2023.

In the report, Porter’s Five Forces model is used which gives us help to design the business strategies in the market. It tells us about our competition and the buyers which are the 2 most influencing factors for our company. It tells that how buyers are will or will not gain more bargaining powers than the suppliers and also the difficulty level for another company to enter the industry or for a company to exit it.

The report also has PESTEL analysis, which gives an overview of the whole business and its strategies. Political angles help in analysing the role of govt. in the shaving industry and economics obviously influence it to the core. Social and Environmental analysis helps in understanding the future of the company and hance helps in making decisions for the future. Technological factors help in analysing the production aids that we can give to the company. And legal analysis helps in smooth functioning without any legal hindrance.

Window Coverings Market Scope

|

Window Coverings Market |

|

|

Market Size in 2023 |

USD 41.81 Bn. |

|

Market Size in 2030 |

USD 69.83 Bn. |

|

CAGR (2024-2030) |

7.6% |

|

Historic Data |

2018-2022 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

|

Segment Scope |

By Type

|

|

|

By Application

|

|

|

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Window Coverings Market Key Players

- Hillarys

- Springs Window Fashions

- Hunter Douglas

- Budget Blinds

- Advanced Window Blinds

- Stevens (Scotland) Ltd

- Aluvert blinds

- Aspect Blinds

- Liyang Xinyuan Curtain

- ALL BLINDS CO., LTD

- Hillarys

- TOSO

- Tachikawa Corporation

- Ching Feng Home Fashions

- Nichibei

Frequently Asked Questions

The North America is expected to hold the highest share in the Window Coverings Market.

The market size of the Window Coverings Market by 2030 is expected to reach at US$ 69.83 Bn.

The forecast period for the Window Coverings Market is 2024-2030

The market size of the Window Coverings Market in 2023 was valued at US$ 41.81 Bn.

- Scope of the Report

- Research Methodology

- Research Process

- Window Coverings Market: Target Audience

- Window Coverings Market: Primary Research (As per Client Requirement)

- Window Coverings Market: Secondary Research

- Executive Summary

- Competitive Landscape

- Stellar Competition matrix

- Key Players Benchmarking: by Product, Pricing, Investments, Expansion Plans, Physical Presence, and Presence in the Market.

- Mergers and Acquisitions in Industry: M&A by Region, Value, and Strategic Intent

- Market Dynamics

- Market Drivers

- Market Restraints

- Market Opportunities

- Market Challenges

- PESTLE Analysis

- PORTERS Five Force Analysis

- Value Chain Analysis

- Global Window Coverings Market Segmentation

- Global Window Coverings Market, by Type (2023-2030)

- Blinds & Shades

- Shutters

- Curtains

- Global Window Coverings Market, by Application (2023-2030)

- Residential

- Commercial

- Global Window Coverings Market, by Region (2023-2030)

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

- Global Window Coverings Market, by Type (2023-2030)

- North America Window Coverings Market Segmentation

- North America Window Coverings Market, by Type (2023-2030)

- Blinds & Shades

- Shutters

- Curtains

- North America Window Coverings Market, by Application (2023-2030)

- Residential

- Commercial

- North America Window Coverings Market, by Country (2023-2030)

- US

- Canada

- North America Window Coverings Market, by Type (2023-2030)

- Europe Window Coverings Market Segmentation

- Europe Window Coverings Market, by Type (2023-2030)

- Europe Window Coverings Market, by Application (2023-2030)

- Europe Window Coverings Market, by Country (2023-2030)

- Asia Pacific Window Coverings Market Segmentation

- Asia Pacific Window Coverings Market, by Type (2023-2030)

- Asia Pacific Window Coverings Market, by Application (2023-2030)

- Asia Pacific Window Coverings Market, by Country (2023-2030)

- South America Window Coverings Market Segmentation

- South America Window Coverings Market, by Type (2023-2030)

- South America Window Coverings Market, by Application (2023-2030)

- South America Window Coverings Market, by Country (2023-2030)

- Middle East & Africa Window Coverings Market Segmentation

- Middle East & Africa Window Coverings Market, by Type (2023-2030)

- Middle East & Africa Window Coverings Market, by Application (2023-2030)

- Middle East & Africa Window Coverings Market, by Country (2023-2030)

- Company Profiles

- Key Players

- Hillarys

- Springs Window Fashions

- Hunter Douglas

- Budget Blinds

- Advanced Window Blinds

- Stevens (Scotland) Ltd

- Aluvert blinds

- Aspect Blinds

- Liyang Xinyuan Curtain

- ALL BLINDS CO., LTD

- Hillarys

- TOSO

- Tachikawa Corporation

- Ching Feng Home Fashions

- Nichibei

- Key Players

- Key Findings

- Recommendations