Paper and Pulp Market 2025–2032: Market Size, Share, Market Opportunity & Forecast with Packaging Substitution, Sustainability Mandates, and Structural Shifts

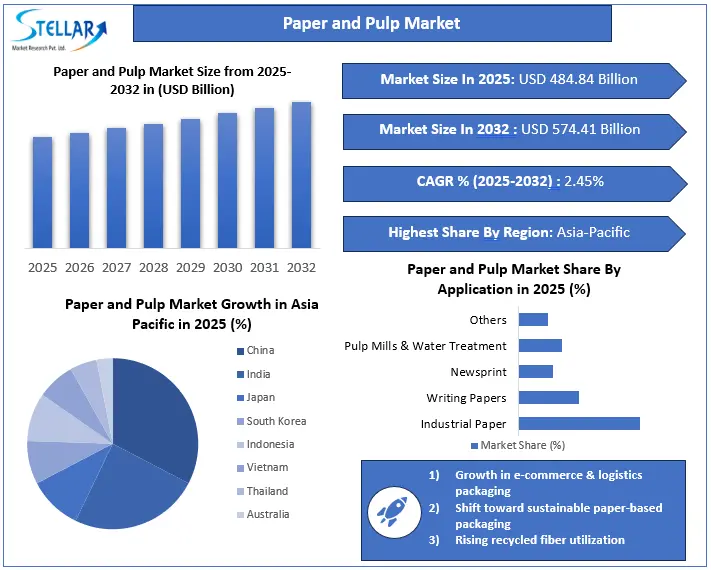

The Global Paper and Pulp Market is projected to grow from USD 484.84 Billion in 2025 to USD 574.41 Billion by 2032 at a CAGR of 2.45%, supported by rising demand for sustainable packaging, paper-based substitutes for plastics, hygiene products, and regulatory-driven shifts toward recyclable and biodegradable materials across global markets.

Format : PDF | Report ID : SMR_1817

Paper and Pulp Market Overview

The global Paper and Pulp Market is entering a structurally mature but strategically resilient phase, expanding from USD 484.84 Billion in 2025 to USD 574.41 Billion by 2032 at a CAGR of 2.45%. While headline growth appears modest, the market’s resilience is anchored in packaging-led demand, recycled fiber penetration, and regulatory-driven material substitution away from plastic.

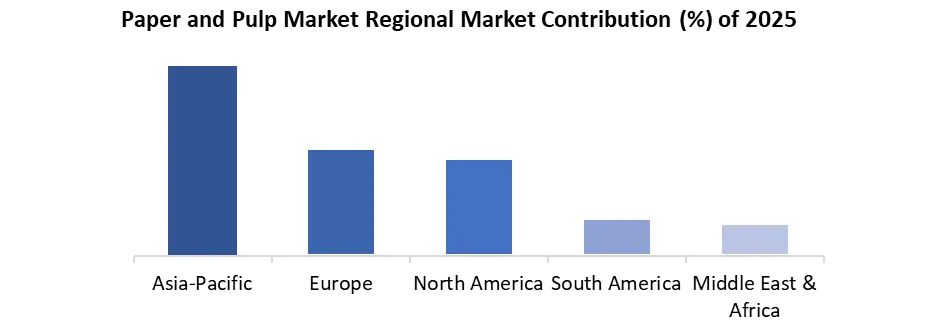

Asia-Pacific dominates global production and fiber utilization, accounting for over 40–54% of global output, while Europe and North America increasingly function as technology, recycling, and value-added paper hubs.

The market is undergoing a structural rebalancing — away from declining printing and newsprint grades toward corrugated board, carton board, tissue paper, and market pulp, which together now represent over half of global demand.

However, long-term competitiveness is increasingly constrained by high energy intensity (up to 5,000 MJ/ton), water consumption (7–30 m³/ton), and tightening environmental compliance, accelerating mill consolidation, capacity rationalization, and investments in energy-efficient and recycled fiber-based production models.

Key Highlights:

- The Asia-Pacific paper and pulp market accounts for Nearly 54% of global output, supported by strong capacity expansion and rising regional demand.

- Paper and cardboard account for over 40% of total European packaging waste, reflecting strong recycling penetration and regulatory enforcement.

- Paper manufacturing remains resource-intensive, consuming up to 5,000 MJ of energy and 7–30 m³ of water per ton.

Segment diversification supports market stability, with tissue paper demand growing at nearly 8% annually and market pulp supplying over two-thirds of global fiber requirements, strengthening long-term supply flexibility.

To get more Insights: Request Free Sample Report

Market Trend: Sustainable Packaging Replacing Plastic

The structural shift toward paper-based packaging as a substitute for plastic, driven by regulatory mandates and recycling targets. In 2023, the European Union generated 79.7 million tonnes of packaging waste, with paper and cardboard accounting for 40.4%, compared with 19.8% for plastic. The dominance of paper as the preferred sustainable packaging material.

Regulatory frameworks further reinforce this transition. The EU has mandated an 85% recycling rate for paper and cardboard packaging by 2030, significantly higher than targets for plastic. In the United States in 2023 recycling performance supports similar conclusions, with corrugated board recycling exceeding 96% and overall paper and paperboard packaging recycling reaching 80.9%.

Paper and Pulp industry include:

- Accelerating material substitution pressure on plastic.

- Strengthening of the circular economy paper industry.

- Increased reliance on recycled fibers, reinforcing the recycled fiber impact on the Paper and Pulp market.

Driver: E-Commerce and Logistics Expansion

The expansion of global e-commerce and logistics activity is a key driver of demand for paper and pulp products, particularly in packaging and industrial paper segments. In 2024, U.S. e-commerce sales reached USD 1,192.6 billion, reflecting continued growth in online retail penetration. The increasing number of packaging cycles per transaction, supported by automated warehousing and last-mile delivery infrastructure, is sustaining long-term demand for corrugated board and industrial paper grades.

Expanding logistics infrastructure including automated warehouses and last-mile delivery networks has increased packaging cycles per transaction, sustaining long-term demand for Paper and Pulp products.

Opportunity: Growth Driven by Packaging & Industrial Demand

The Paper and Pulp industry offers significant growth potential, fueled by increasing global demand for packaging and industrial paper. In 2024, global paper and paperboard production grew by 4%, highlighting resilient market dynamics and ongoing expansion opportunities. Wood pulp output rose by 3%, ensuring a reliable supply of raw material to support packaging innovation and industrial applications worldwide. Global fiber furnish utilization continues to expand across all major regions, reflecting a broad-based growth opportunity. These trends position packaging and industrial paper as the primary drivers of long-term market growth.

- Packaging-led growth: Rising e-commerce, logistics, and retail packaging are driving long-term demand for industrial paperboard and packaging grades globally.

- Sustainable fiber utilization: Expansion in recovered paper usage and stable wood pulp supply enables circular and eco-friendly production models.

- Global investment potential: Widespread production and trade integration across regions provide opportunities for scaling operations and penetrating new markets.

Restraint: Energy, Water, and Environmental Compliance Costs

Despite favourable demand fundamentals, the Paper and Pulp market is constrained by high operating costs. Paper manufacturing is energy-intensive, with total energy requirements reaching 5,000 MJ per ton of paper, largely due to drying processes. Water consumption remains substantial, ranging from 7 to 30 m³ per ton, depending on product grade.

Environmental compliance further increases costs through:

- Wastewater treatment and effluent monitoring

- COD and BOD management

- Greenhouse gas reporting and emissions control

Paper and Pulp Market Segmentation Analysis

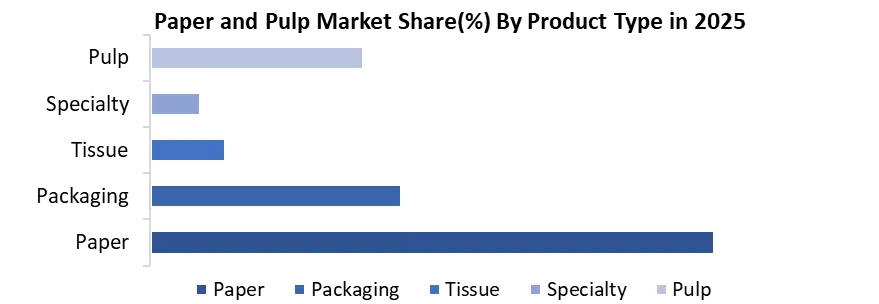

pulp and paper market is primarily driven by packaging-driven growth, expanding logistics and e-commerce activity, and accelerating sustainable packaging demand. Packaging grades represent well over half of total paper and paperboard output, reflecting their structural importance across industrial and consumer supply chains. Tissue paper demand is expanding at high-single-digit rates, supported by rising hygiene awareness and population growth. Market pulp supplies the majority of virgin fiber requirements, while non-wood pulp contributes a low-double-digit share of alternative fiber inputs, reinforcing sustainable fiber sourcing and circular economy sourcing and expansion of the pulp & paper chemicals market, including kraft pulp, bleaching agents, sizing agents, and bio-based paper chemicals.

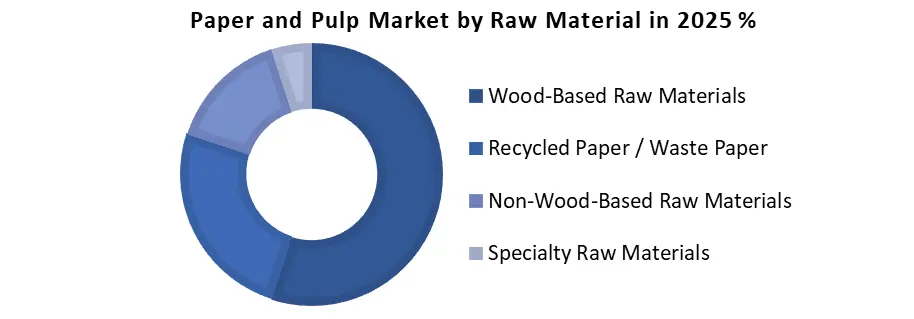

By Raw Material: The Paper and Pulp Market is segmented into wood-based, non-wood-based, recycled paper, and specialty raw materials. Wood-based pulp dominates due to its strength and print-quality advantages. Non-wood fibers and recycled paper are increasingly adopted to diversify supply and support sustainability objectives, while specialty materials serve niche and value-added paper applications.

Regional Insights: Production Dynamics and Growth Drivers

- Regional dominance and scale: Asia-Pacific remains the global volume engine, accounting for over 40% of global fiber furnish utilization, driven by capacity expansion, export-oriented production, and rising domestic consumption.

- Europe functions as the regulatory and recycling benchmark, where paper and cardboard already account for 40.4% of total packaging waste, supported by an 85% recycling target by 2030. This positions Europe as a leader in circular paper systems rather than capacity expansion.

- North America represents a technology and efficiency-led market, characterized by high recycling rates (corrugated board recycling exceeding 96%) and continuous investments in automation, energy efficiency, and mill modernization.

- Together, these regions define a three-pillar global structure:

Asia-Pacific (scale) → Europe (compliance & circularity) → North America (efficiency & margin protection).

Demand structure and resilience: Packaging and industrial paper grades represent over half of total paper and paperboard demand, reinforcing their dominance within the global market. This demand structure is supported by over 60 years of continuous cross-regional trade in paper and pulp, underscoring the long-term structural resilience of packaging-led growth.

Recent Developments in Paper and Pulp Market

|

Company |

Country |

Recent Development |

Strategic Implication |

|

Georgia-Pacific Corporation |

United States |

USD 800 million capital investment at Alabama River Cellulose Mill to expand production by ~300 tons/day with energy-efficient pulping technologies |

Reduces energy & water consumption, supports sustainability targets, and optimizes cost efficiency |

|

International Paper |

United States |

Planned closure of Savannah and Riceboro mills by 2025, affecting nearly 1,100 jobs |

Aligns operations with growing packaging demand, reduces operational costs |

|

Atlantic Packaging |

United States / Canada |

New manufacturing facility in Hamilton, Ontario focusing on sustainable packaging solutions including recycled paperboard and corrugated board |

Strengthens regional supply chain, reduces lead times, and enhances competitiveness in B2B and retail packaging |

|

Mondi Group |

United Kingdom / Europe |

Commissioned €400 million paper machine at Št?tí mill, Czech Republic for sustainable packaging papers |

Expands eco-friendly packaging offerings, supports circular economy initiatives, and increases European market share |

Strategic Outlook

The Paper and Pulp Market is no longer a pure volume-driven industry. Growth through 2032 will be determined by packaging exposure, recycling efficiency, regulatory compliance, and cost discipline. Players aligned with corrugated packaging, tissue paper, market pulp, and recycled fiber systems will outperform, while producers heavily exposed to printing and newsprint face continued structural decline.

Strategic focus areas include mill modernization, circular economy integration, energy and water efficiency investments, and selective capacity expansion in Asia-Pacific, defining the next phase of competitive leadership.

Paper and Pulp Market Scope:

|

Paper and Pulp Market |

|||

|

Report Coverage |

Details |

||

|

Base Year: |

2025 |

Forecast Period: |

2026-2032 |

|

Historical Data: |

2020 to 2025 |

Market Size in 2025: |

USD 484.84 Billion |

|

Forecast Period 2026 to 2032 CAGR: |

2.45% |

Market Size in 2032: |

USD 574.41 Billion |

|

Paper and Pulp Market Segment Analysis |

By Product Type |

Paper Printing & Writing Paper Coated Paper Uncoated Paper Newsprint Packaging Paper Kraft Paper Unbleached Kraft Bleached Kraft Sack Kraft Paper Carton Board Corrugated Board Tissue Paper Specialty Paper Thermal Paper Greaseproof Paper Security Paper Pulp Market Pulp Integrated Pulp Specialty Pulp (Dissolving pulp, fluff pulp) |

|

|

By Raw Material |

Wood-based Hardwood Pulp Softwood Pulp Non-Wood-based Agricultural Residue Bagasse Wheat Straw Rice Straw Recycled Paper/Waste Paper Bamboo Cotton Rags Jute |

||

|

By Application |

Newsprint Industrial Paper Writing Papers Pulp Mills and Water Treatment Others |

||

|

By End User |

Education & Publishing FMCG Healthcare E-commerce & Retail Industrial Manufacturing Government & Security Institutions Others |

||

Paper and Pulp Market key Players:

- Georgia-Pacific Corporation (United States)

- Kimberly-Clark Corporation (United States)

- International Paper (United States)

- WestRock (United States)

- Packaging Corporation of America (United States)

- DS Smith (United Kingdom)

- Atlantic Packaging (United States)

- Mondi Group (United Kingdom)

- Procter & Gamble (United States)

- Kemira (Finland)

- Nine Dragons Paper Ltd. (China)

- Oji Holdings Corporation (Japan)

- Nippon Paper Industries Co., Ltd. (Japan)

- Svenska Cellulosa Aktiebolaget (Sweden)

- Sappi Limited (South Africa)

- Ruchira Papers Ltd. (India)

- JK Paper Ltd. (India)

- ITC(India)

- Century Pulp & Paper (India)

- Satia Industries Limited (India)

- West Coast Paper Mills Ltd. (India)

- Seshasayee Paper & Boards Ltd. (India)

- Tamil Nadu Newsprint and Papers Ltd. (TNPL) (India)

- Andhra Paper Limited (India)

- RP Paper Impex (India)

- Fedrigoni S.p.A. (Italy)

- Stora Enso Oyj (Finland)

- UPM-Kymmene Oyj (Finland)

- Metsä Group (Finland)

- Smurfit Kappa (Ireland)

Frequently Asked Questions

The shift toward sustainable packaging is the dominant trend, supported by regulatory recycling targets and higher recycling efficiency of paper and cardboard compared with plastic.

Asia-Pacific leads due to large-scale capacity expansion, rapid urbanization, strong packaging demand, and rising consumption across industrial and e-commerce applications.

Key challenges include high energy intensity, substantial water consumption, and increasing environmental compliance costs related to emissions and wastewater treatment.

Packaging paper, tissue paper, market pulp, and non-wood pulp segments support resilience through diversified demand across hygiene, logistics, and sustainable fiber sourcing.

1. Paper and Pulp Market Introduction

1.1. Study Assumptions and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global Paper and Pulp Market: Competitive Landscape

2.1. SMR Competition Matrix

2.2. Competitive Landscape

2.3. Key Players Benchmarking

2.3.1. Company Name

2.3.2. Headquarter

2.3.3. Product Portfolio

2.3.4. End-User

2.3.5. Total Company Revenue (2025)

2.3.6. Certifications

2.3.7. Global Presence

2.4. Market Structure

2.4.1. Market Leaders

2.4.2. Market Followers

2.4.3. Emerging Players

2.5. Mergers and Acquisitions Details

2.6. Recent Developments

2.7. Market Positioning & Share Analysis

2.7.1. Company Revenue, Paper and Pulp Revenue, and Market Share (%)

2.7.2. SMR Competitive Positioning

2.8. Strategic Developments & Partnerships

2.8.1. Mergers, acquisitions, and joint ventures

2.8.2. Expansion into emerging markets

2.8.3. Strategic alliances with OEMs or system integrators

2.8.4. Investments in new production facilities

2.8.5. Sustainability initiatives and green product launches

3. Paper and Pulp Market: Dynamics

3.1. Paper and Pulp Market Trends

3.2. Paper and Pulp Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.2.4. Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

4. Technological Advancements & Product Innovation

4.1. Innovations in Chemical and Mechanical Pulping

4.2. Sustainable Manufacturing Technologies in the Paper Industry

4.3. Automation, AI, and Industry 4.0 in Paper Production

4.4. Development of Biodegradable and Eco-Friendly Paper Products

4.5. Advances in Recycling Technologies and Pulping Processes

5. Global Pricing Analysis (2020–2025)

5.1. Global Price Trends by Type

5.2. Raw Material Cost Structure and Production Economics

5.3. Regional Price Variations and Demand Impact

5.4. Price Sensitivity Across Developed and Emerging Economies

5.5. Pricing Strategies for Sustainable and Eco-Friendly Paper Products

6. Supply Chain & Manufacturing Insights

6.1. Key Raw Material Sources (Wood Pulp, Recycled Fiber, Alternative Fibers)

6.2. Global Manufacturing Clusters and Industrial Corridors

6.3. Production Processes and Quality Control Practices

6.4. Import Dependency and Trade Flow Analysis

6.5. Supply Chain Risk Assessment and Mitigation Strategies

7. Distribution & Procurement Channels

7.1. Global Procurement Practices of FMCG, Packaging, and Industrial Buyers

7.2. Distributor and Dealer Network Analysis

7.3. Digital B2B Platforms and E-Procurement Trends

7.4. Aftermarket and Small Mill Supply Chain Dynamics

8. Policy & Regulatory Environment

8.1. Global Paper & Pulp Manufacturing Standards and Certifications

8.2. Environmental Regulations and Compliance Frameworks

8.3. Extended Producer Responsibility (EPR) and Plastic Reduction Policies

8.4. Intellectual Property and Design Protection in Specialty Papers

9. Paper & Pulp Industry’s Role in the Circular Economy

9.1. Circular Economy Principles in the Paper Industry

9.2. Innovations in Paper Recycling and Circular Manufacturing

9.3. Environmental and Economic Benefits of Circular Practices

9.4. Global Circular Economy Initiatives and Best Practices

9.5. Role of Government and Industry Partnerships

10. Impact of Digitalization on Paper Consumption

10.1. Shift Toward Digital Media and Demand Implications

10.2. Consumer Behavior: Printed vs. Digital Content

10.3. Digital Transformation in Paper Manufacturing

10.4. Role of Paper in a Digital and Sustainable Economy

10.5. Long-Term Outlook for Paper Consumption

11. Socioeconomic Impact of the Paper & Pulp Industry

11.1. Employment Generation and Skill Development

11.2. Community Development and Rural Economic Impact

11.3. Corporate Social Responsibility (CSR) Initiatives

11.4. Local Supply Chain Development

12. Challenges in Scaling Paper & Pulp Production

12.1. Capital Investment and Technology Costs

12.2. Raw Material and Supply Chain Disruptions

12.3. Competitive Pressures and Global Trade Challenges

12.4. Regulatory and Environmental Compliance Risks

12.5. Workforce Availability and Skills Gap

13. Consumer Attitudes Toward Paper Substitutes

13.1. Paper vs. Plastic: Consumer Perception Analysis

13.2. Sustainability Awareness and Purchasing Decisions

13.3. Impact of Digital Substitutes on Paper Demand

13.4. Influence of Social Media and ESG Communication

14. Investment Landscape & Funding Trends

14.1. Global Investment Opportunities in the Paper Industry

14.2. Foreign Direct Investment (FDI) Trends

14.3. Private Equity and Venture Capital Activity

14.4. Government Incentives and Policy Support

14.5. Mergers & Acquisitions Analysis

15. Water Usage & Resource Management

15.1. Water Consumption in Paper Production

15.2. Water Recycling and Reuse Technologies

15.3. Wastewater Treatment and Regulatory Compliance

15.4. Innovations in Water-Efficient Manufacturing

15.5. Environmental and Cost Implications

16. Growth of the Global Paper Recycling Industry

16.1. Global Paper Recycling Market Overview

16.2. Role of Recycling in Reducing Virgin Fiber Dependency

16.3. Key Recycling Markets and Industry Players

16.4. Regulatory Frameworks and Waste Management Policies

16.5. Future Growth Outlook

17. Global Trade & Export Dynamics

17.1. Global Paper & Pulp Trade Flows

17.2. Key Exporting and Importing Regions

17.3. Demand Trends in North America and Europe

17.4. Competitive Positioning in the Global Market

17.5. Trade Barriers and Export Challenges

18. Paper and Pulp Market: Global Market Size and Forecast by Segmentation (by Value USD Bn and Volume in Tons) (2025-2032)

18.1. Paper and Pulp Market Size and Forecast, by Product Type (2025-2032)

18.1.1. Paper

18.1.1.1. Printing & Writing Paper

18.1.1.1.1. Coated Paper

18.1.1.1.2. Uncoated Paper

18.1.1.2. Newsprint

18.1.1.3. Packaging Paper

18.1.1.3.1. Kraft Paper

18.1.1.3.1.1.Unbleached Kraft

18.1.1.3.1.2.Bleached Kraft

18.1.1.3.1.3.Sack Kraft Paper

18.1.1.3.2. Carton Board

18.1.1.3.3. Corrugated Board

18.1.1.4. Tissue Paper

18.1.1.5. Specialty Paper

18.1.1.5.1. Thermal Paper

18.1.1.5.2. Greaseproof Paper

18.1.1.5.3. Security Paper

18.1.2. Pulp

18.1.2.1. Market Pulp

18.1.2.2. Integrated Pulp

18.1.2.3. Specialty Pulp (Dissolving pulp, fluff pulp)

18.2. Paper and Pulp Market Size and Forecast, by Raw Material (2025-2032)

18.2.1. Wood-based

18.2.1.1. Hardwood Pulp

18.2.1.2. Softwood Pulp

18.2.2. Non-Wood-based

18.2.2.1. Agricultural Residue

18.2.2.1.1. Bagasse

18.2.2.1.2. Wheat Straw

18.2.2.1.3. Rice Straw

18.2.2.2. Recycled Paper/Waste Paper

18.2.2.3. Bamboo

18.2.2.4. Cotton Rags

18.2.2.5. Jute

18.2.3. Non-Wood-based

18.3. Paper and Pulp Market Size and Forecast, by Application (2025-2032)

18.3.1. Newsprint

18.3.2. Industrial Papers

18.3.3. Writing Papers

18.3.4. Pulp Mills and Water Treatment

18.3.5. Others

18.4. Paper and Pulp Market Size and Forecast, by End-Use (2025-2032)

18.4.1. Education & Publishing

18.4.2. FMCG

18.4.3. Healthcare

18.4.4. E-commerce & Retail

18.4.5. Industrial Manufacturing

18.4.6. Government & Security Institutions

18.4.7. Others

18.5. Paper and Pulp Market Size and Forecast, by Region (2025-2032)

18.5.1. North America

18.5.2. Europe

18.5.3. Asia Pacific

18.5.4. Middle East and Africa

18.5.5. South America

19. North America Paper and Pulp Market Size and Forecast by Segmentation (by Value USD Billion and Volume in Tons) (2025-2032)

19.1. North America Paper and Pulp Market Size and Forecast, by Product Type (2025-2032)

19.1.1. Paper

19.1.1.1. Printing & Writing Paper

19.1.1.1.1. Coated Paper

19.1.1.1.2. Uncoated Paper

19.1.1.2. Newsprint

19.1.1.3. Packaging Paper

19.1.1.3.1. Kraft Paper

19.1.1.3.1.1.Unbleached Kraft

19.1.1.3.1.2.Bleached Kraft

19.1.1.3.1.3.Sack Kraft Paper

19.1.1.3.2. Carton Board

19.1.1.3.3. Corrugated Board

19.1.1.4. Tissue Paper

19.1.1.5. Specialty Paper

19.1.1.5.1. Thermal Paper

19.1.1.5.2. Greaseproof Paper

19.1.1.5.3. Security Paper

19.1.2. Pulp

19.1.2.1. Market Pulp

19.1.2.2. Integrated Pulp

19.1.2.3. Specialty Pulp (Dissolving pulp, fluff pulp)

19.2. North America Paper and Pulp Market Size and Forecast, by Raw Material (2025-2032)

19.2.1. Wood-based

19.2.1.1. Hardwood Pulp

19.2.1.2. Softwood Pulp

19.2.2. Non-Wood-based

19.2.2.1. Agricultural Residue

19.2.2.1.1. Bagasse

19.2.2.1.2. Wheat Straw

19.2.2.1.3. Rice Straw

19.2.2.2. Recycled Paper/Waste Paper

19.2.2.3. Bamboo

19.2.2.4. Cotton Rags

19.2.2.5. Jute

19.3. North America Paper and Pulp Market Size and Forecast, by Application (2025-2032)

19.3.1. Newsprint

19.3.2. Industrial Papers

19.3.3. Writing Papers

19.3.4. Pulp Mills and Water Treatment

19.3.5. Other

19.4. North America Paper and Pulp Market Size and Forecast, by End-Use (2025-2032)

19.4.1. Education & Publishing

19.4.2. FMCG

19.4.3. Healthcare

19.4.4. E-commerce & Retail

19.4.5. Industrial Manufacturing

19.4.6. Government & Security Institutions

19.4.7. Others

19.5. North America Paper and Pulp Market Size and Forecast, by Country (2025-2032)

19.5.1. United States

19.5.2. Canada

19.5.3. Mexico

20. Europe Paper and Pulp Market Size and Forecast by Segmentation (by Value USD Billion and Volume in Tons) (2025-2032)

20.1. Europe Paper and Pulp Market Size and Forecast, by Product Type (2025-2032)

20.2. Europe Paper and Pulp Market Size and Forecast, by Raw Material (2025-2032)

20.3. Europe Paper and Pulp Market Size and Forecast, by Application (2025-2032)

20.4. Europe Paper and Pulp Market Size and Forecast, by End-Use (2025-2032)

20.5. Europe Paper and Pulp Market Size and Forecast, by Country (2025-2032)

20.5.1. United Kingdom

20.5.2. France

20.5.3. Germany

20.5.4. Italy

20.5.5. Spain

20.5.6. Sweden

20.5.7. Austria

20.5.8. Rest of Europe

21. Asia Pacific Paper and Pulp Market Size and Forecast by Segmentation (by Value USD Billion and Volume in Tons) (2025-2032)

21.1. Asia Pacific Paper and Pulp Market Size and Forecast, by Product Type (2025-2032)

21.2. Asia Pacific Paper and Pulp Market Size and Forecast, by Raw Material (2025-2032)

21.3. Asia Pacific Paper and Pulp Market Size and Forecast, by Application (2025-2032)

21.4. Asia Pacific Paper and Pulp Market Size and Forecast, by End-Use (2025-2032)

21.5. Asia Pacific Paper and Pulp Market Size and Forecast, by Country (2025-2032)

21.5.1. China

21.5.2. S Korea

21.5.3. Japan

21.5.4. India

21.5.5. Australia

21.5.6. Indonesia

21.5.7. Malaysia

21.5.8. Vietnam

21.5.9. Taiwan

21.5.10. Rest of Asia Pacific

22. Middle East and Africa Paper and Pulp Market Size and Forecast by Segmentation (by Value USD Billion and Volume in Tons) (2025-2032)

22.1. Middle East and Africa Paper and Pulp Market Size and Forecast, by Product Type (2025-2032)

22.2. Middle East and Africa Paper and Pulp Market Size and Forecast, by Raw Material (2025-2032)

22.3. Middle East and Africa Paper and Pulp Market Size and Forecast, by Application (2025-2032)

22.4. Middle East and Africa Paper and Pulp Market Size and Forecast, by End-Use (2025-2032)

22.5. Middle East and Africa Paper and Pulp Market Size and Forecast, by Country (2025-2032)

22.5.1. South Africa

22.5.2. GCC

22.5.3. Egypt

22.5.4. Nigeria

22.5.5. Rest of ME&A

23. South America Paper and Pulp Market Size and Forecast by Segmentation (by Value USD Billion and Volume in Tons) (2025-2032)

23.1. South America Paper and Pulp Market Size and Forecast, by Product Type (2025-2032)

23.2. South America Paper and Pulp Market Size and Forecast, by Raw Material (2025-2032)

23.3. South America Paper and Pulp Market Size and Forecast, by Application (2025-2032)

23.4. South America Paper and Pulp Market Size and Forecast, by End-Use (2025-2032)

23.5. South America Paper and Pulp Market Size and Forecast, by Country (2025-2032)

23.5.1. Brazil

23.5.2. Argentina

23.5.3. Chile

23.5.4. Colombia

23.5.5. Rest Of South America

24. Company Profile: Key Players

24.1. Georgia-Pacific Corporation (United States)

24.1.1. Company Overview

24.1.2. Business Portfolio

24.1.3. Financial Overview

24.1.4. SWOT Analysis

24.1.5. Strategic Analysis

24.1.6. Recent Developments

24.2. Kimberly-Clark Corporation (United States)

24.3. International Paper (United States)

24.4. WestRock (United States)

24.5. Packaging Corporation of America (United States)

24.6. DS Smith (United Kingdom)

24.7. Atlantic Packaging (United States)

24.8. Mondi Group (United Kingdom)

24.9. Procter & Gamble (United States)

24.10. Kemira (Finland)

24.11. Nine Dragons Paper Ltd. (China)

24.12. Oji Holdings Corporation (Japan)

24.13. Nippon Paper Industries Co., Ltd. (Japan)

24.14. Svenska Cellulosa Aktiebolaget (Sweden)

24.15. Sappi Limited (South Africa)

24.16. Ruchira Papers Ltd. (India)

24.17. JK Paper Ltd. (India)

24.18. ITC(India)

24.19. Century Pulp & Paper (India)

24.20. Satia Industries Limited (India)

24.21. West Coast Paper Mills Ltd. (India)

24.22. Seshasayee Paper & Boards Ltd. (India)

24.23. Tamil Nadu Newsprint and Papers Ltd. (TNPL) (India)

24.24. Andhra Paper Limited (India)

24.25. RP Paper Impex (India)

24.26. Fedrigoni S.p.A. (Italy)

24.27. Stora Enso Oyj (Finland)

24.28. UPM-Kymmene Oyj (Finland)

24.29. Metsä Group (Finland)

24.30. Smurfit Kappa (Ireland)

25. Key Findings

26. Analyst Recommendations

27. Paper and Pulp Market: Research Methodology