TMT Steel Market Global Industry Analysis and Forecast (2026-2032)

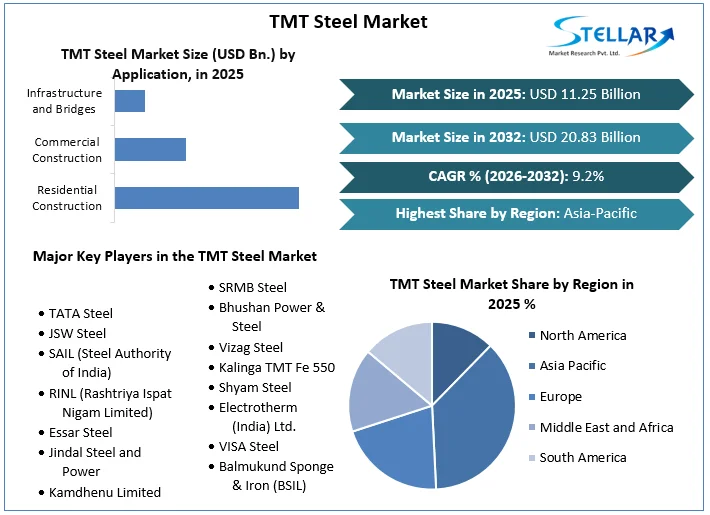

The Global TMT Steel Market Size is expected to grow at 9.2% CAGR from 2025 to 2032, from USD 11.25 Billion to 20.83 Billion.

Format : PDF | Report ID : SMR_1545

TMT Steel Market Overview:

The market for thermo mechanically treated (TMT) steel has continued to be significant in the construction sector as a necessary component for strengthening concrete structures. The high mechanical qualities, corrosion resistance, and earthquake resistance of TMT steel contribute to its widespread use. TMT steel, which combines a strong outer layer with a flexible inner core to enable high tensile strength and ductility, is made from mild steel bars that have undergone heat treatment and rapid cooling. This makes it the perfect material for absorbing loads and extending the lifespan of construction projects such as buildings, bridges, dams, and others. Its standing as a desirable building material is further cemented by its capacity to withstand corrosion and deform under stress. With numerous producers supplying TMT steel bars in various grades, each of which indicates different yield strengths, the market is still competitive.

Prices might change depending on market developments, demand dynamics, and raw material costs. In order to guarantee structural integrity, compliance with quality standards and rules is essential. Some manufacturers are looking into more sustainable production techniques as environmental worries grow. The TMT steel market is still evolving as a result of ongoing R&D initiatives to improve product quality and accommodate shifting consumer demands. Industry publications and reliable news sources provide useful updates on the state and developments of the TMT steel market for the most recent information.

To get more Insights: Request Free Sample Report

TMT Steel Market Dynamics:

The crucial part that TMT steel plays in the expanding construction industry is one of the main factors fuelling the market's expansion. The outstanding qualities of thermo-mechanically treated (TMT) steel, such as its greater strength, ductility, and corrosion resistance, are in line with the demanding specifications of contemporary construction projects. TMT steel has been a popular option, particularly in earthquake-prone areas, due to its capacity to effectively withstand seismic pressures and improve structural longevity. Additionally, the demand for TMT steel has been steadily supported by rising urbanization, infrastructure development, and the construction of commercial and residential areas worldwide. The demand for durable construction materials keeps rising as governments and private businesses engage in constructing and updating infrastructure, which further fuels the expansion of the TMT steel market.

The market has expanded as a result of ongoing research and development projects targeted at boosting the mechanical qualities of TMT steel, streamlining production procedures, and raising its sustainability profile. Manufacturers are making investments in environmentally friendly manufacturing techniques, such as cutting production-related carbon emissions and energy use.

TMT Steel Market Opportunities:

The market for TMT steel is poised with sizable potential that match the changing dynamics of the construction and infrastructure industries. Notably, a strong opportunity is provided by the growing demand for environmentally friendly building materials. By producing TMT steel with less of an impact on the environment and in line with eco-friendly construction techniques, manufacturers may profit from this trend. Another exciting prospect arises from the rise of smart city projects and creative architectural designs, as TMT steel's mechanical qualities meet the needs of contemporary building methods and the incorporation of cutting-edge technologies. Rapid urbanization and industrialisation in emerging economies are leading to significant infrastructure development and a strong demand for building supplies like TMT steel.

Collaboration in research has the potential to reveal novel approaches that would improve the characteristics and uses of TMT steel. Additionally, the emphasis on updating and restoring old buildings to suit contemporary requirements opens up a specialized market where TMT steel's strengthening qualities can be used. These possibilities show how TMT Steel has the capacity to stay on the cutting edge of the changing building industry.

TMT Steel Market Restraints:

The construction industry's growth trajectory of the TMT steel market is impacted by a number of limitations. The fluctuation in raw material costs, notably those of iron ore and scrap metal, which directly affects the price of producing TMT steel, is one important limitation. Variations in these input prices may result in unclear pricing that could be detrimental to both manufacturers and consumers. When businesses compete for market share, the competitive environment may exacerbate price pressures. Regulations and compliance requirements also pose a constraint since they demand investments in quality assurance and control methods in order to comply with strict quality standards. The capital-intensive nature of steel manufacturing and the requirement for ongoing technological advancements may put financial burden on producers, particularly smaller players.

Investments in sustainable practices are required as a result of environmental issues, particularly the carbon footprint of steel production. The need for innovative thinking and smart planning to overcome obstacles and ensure sustainable growth within the TMT steel market is highlighted by these combined restrictions.

TMT Steel Market Segment Analysis:

By Diameter Type: A crucial factor that controls the load-bearing capacity and applicability of TMT steel bars in various construction scenarios. Tiny diameter TMT bars, which typically have a diameter between 6 and 12 mm, are widely used in residential and light commercial construction because they may be used to build thinner structural components such walls, residential beams, and tiny columns due to their relatively lower load-bearing capacities. The load-bearing capacity and adaptability of medium diameter TMT bars, which range from 12mm to 20mm, are balanced. They are widely used in a variety of applications, including building materials like slabs, columns, and beams for both residential and commercial structures. They are a popular option for a variety of structural requirements due to their versatility.

Construction of industrial complexes, bridges, dams, and large-scale infrastructure projects that require exceptional strength and durability is dependent on these bars. This segmentation by diameter type enables stakeholders to make informed decisions that are in line with certain structural requirements. It also provides a nuanced understanding of how TMT steel bars serve to varied construction needs throughout the residential, commercial, and industrial sectors.

By Grade Type: Analysing the TMT steel market through the lens of different grades provides valuable insights into the diverse applications and structural demands met by each grade. Fe415 grade TMT steel, known for its minimum yield strength of 415 MPa, is commonly utilized in residential and light commercial construction. Its malleability and strength make it suitable for smaller structural components such as residential columns, beams, and slabs. Fe500 grade TMT steel, boasting a higher minimum yield strength of 500 MPa, finds extensive use in both residential and commercial projects. Its versatile nature allows for applications ranging from building foundations and columns to mid-sized beams and slabs. Fe550 grade TMT steel, characterized by a minimum yield strength of 550 MPa, stands as a preferred choice for heavy-duty projects demanding substantial load-bearing capacity.

It is an essential component of building industrial structures, bridges, and other substantial infrastructure projects. The grade-based segment analysis emphasizes the specific application of each grade in diverse construction settings, ensuring that structural integrity and safety standards are satisfied while optimizing materials for particular project requirements.

By Application: TMT steel is used to make columns, beams, slabs, and foundations in residential building. It can also be used in commercial projects to reinforce buildings like hotels, shopping malls, and office buildings. Moving on to infrastructure, TMT steel is essential for building bridges, flyovers, and highways because of its durability and capacity to handle huge loads. In seismic zones, where it improves the robustness of structures against seismic forces, TMT steel's earthquake-resistant qualities make it vital. TMT steel aids in the construction of factories, storage facilities, and manufacturing facilities in industrial environments. TMT steel is crucial in rehabilitation and retrofit projects, where it strengthens old structures to meet contemporary safety standards, in addition to traditional construction.

TMT Steel Market Regional Insight:

The Asia-Pacific region, which includes nations like China and India, is a significant market driver for TMT steel. TMT steel is in high demand due to rapid urbanization, industrialization, and significant infrastructure projects. Key growth factors include urban growth, commercial development, and transportation infrastructure. Moreover, earthquake-resistant TMT steel is a critical material choice for construction due to the seismic vulnerabilities of several places in this region.

The market for TMT steel in North America, which includes the United States and Canada, is impacted by ongoing urban renewal initiatives, commercial real estate development, and the requirement to replace deteriorating infrastructure. The utilization of TMT steel in many applications is consistent with the demand for resilient and sustainable building materials. The demand for TMT steel reinforcement of existing structures is also fuelled by retrofit and modernisation projects.

The strict construction codes, emphasis on retrofitting and refurbishment, and attention on sustainability are characteristics of the European TMT steel market. The demand for TMT steel is driven by the development of contemporary commercial and residential projects as well as the repair of old buildings. The recyclable and long-lasting characteristics of TMT steel fit in well with Europe's drive to environmentally friendly construction.

The ambitious infrastructure projects fuelled by efforts at economic diversification result in a high demand for TMT steel in the Mideast area, which includes nations like the UAE, Saudi Arabia, and Qatar. Mega-construction projects like shopping malls, five-star hotels, and urban developments have a big impact on the market. Extreme weather patterns and seismic activity in the area further highlight the value of adopting high-quality TMT steel for structural resistance.

|

TMT Steel Market Scope |

|

|

Market Size in 2025 |

USD 11.25 billion |

|

Market Size in 2032 |

USD 20.83 billion |

|

CAGR (2026-2032) |

9.2% |

|

Historic Data |

2020-2025 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2032 |

|

Segment Scope |

By Diameter Type

|

|

By Grade Type

|

|

|

By Application

|

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

TMT Steel Market Key Players:

- TATA Steel

- JSW Steel

- SAIL (Steel Authority of India)

- RINL (Rashtriya Ispat Nigam Limited)

- Essar Steel

- Jindal Steel and Power

- Kamdhenu Limited

- SRMB Steel

- Bhushan Power & Steel

- Vizag Steel

- Kalinga TMT Fe 550

- Shyam Steel

- Electrotherm (India) Ltd.

- VISA Steel

- Balmukund Sponge & Iron (BSIL)

Frequently Asked Questions

The global TMT Steel Market is studied from 2025 to 2032.

Asia Pacific region held the highest share in 2025.

The CAGR for TMT Steel Market is 9.2%.

The segments covered in the market report are by diameter, by grade, by application and region.

1. TMT Steel Market: Research Methodology

2. TMT Steel Market: Executive Summary

3. TMT Steel Market: Competitive Landscape

3.1. Stellar Competition Matrix

3.2. Competitive Landscape

3.3. Key Players Benchmarking

3.4. Market Structure

3.4.1. Market Leaders

3.4.2. Market Followers

3.4.3. Emerging Players

3.5. Consolidation of the Market

4. TMT Steel Market: Dynamics

4.1. Market Trends by Region

4.1.1. North America

4.1.2. Europe

4.1.3. Asia Pacific

4.1.4. Middle East and Africa

4.1.5. South America

4.2. Market Drivers by Region

4.2.1. North America

4.2.2. Europe

4.2.3. Asia Pacific

4.2.4. Middle East and Africa

4.2.5. South America

4.3. Market Restraints

4.4. Market Opportunities

4.5. Market Challenges

4.6. PORTER’s Five Forces Analysis

4.7. PESTLE Analysis

4.8. Value Chain Analysis

4.9. Regulatory Landscape by Region

4.9.1. North America

4.9.2. Europe

4.9.3. Asia Pacific

4.9.4. Middle East and Africa

4.9.5. South America

5. TMT Steel Market Size and Forecast by Segments (by Value USD and Volume Units)

5.1. TMT Steel Market Size and Forecast, By Diameter Type(2025-2032)

5.1.1. 6mm to 12mm

5.1.2. 12mm to 20mm

5.1.3. 20mm and above

5.2. TMT Steel Market Size and Forecast, By Grade Type (2025-2032)

5.2.1. Fe415 Grade

5.2.2. Fe500 Grade

5.2.3. Fe550 Grade

5.3. TMT Steel Market Size and Forecast, By Application (2025-2032)

5.3.1. Residential Construction

5.3.2. Commercial Construction

5.3.3. Infrastructure and Bridges

5.4. TMT Steel Market Size and Forecast, by Region (2025-2032)

5.4.1. North America

5.4.2. Europe

5.4.3. Asia Pacific

5.4.4. Middle East and Africa

5.4.5. South America

6. North America TMT Steel Market Size and Forecast (by Value USD and Volume Units)

6.1. North America TMT Steel Market Size and Forecast, By Diameter Type(2025-2032)

6.1.1. 6mm to 12mm

6.1.2. 12mm to 20mm

6.1.3. 20mm and above

6.2. North America TMT Steel Market Size and Forecast, By Grade Type (2025-2032)

6.2.1. Fe415 Grade

6.2.2. Fe500 Grade

6.2.3. Fe550 Grade

6.3. North America TMT Steel Market Size and Forecast, By Application (2025-2032)

6.3.1. Residential Construction

6.3.2. Commercial Construction

6.3.3. Infrastructure and Bridges

6.4. North America TMT Steel Market Size and Forecast, by Country (2025-2032)

6.4.1. United States

6.4.2. Canada

6.4.3. Mexico

7. Europe TMT Steel Market Size and Forecast (by Value USD and Volume Units)

7.1. Europe TMT Steel Market Size and Forecast, By Diameter Type(2025-2032)

7.1.1. 6mm to 12mm

7.1.2. 12mm to 20mm

7.1.3. 20mm and above

7.2. Europe TMT Steel Market Size and Forecast, By Grade Type (2025-2032)

7.2.1. Fe415 Grade

7.2.2. Fe500 Grade

7.2.3. Fe550 Grade

7.3. Europe TMT Steel Market Size and Forecast, By Application (2025-2032)

7.3.1. Residential Construction

7.3.2. Commercial Construction

7.3.3. Infrastructure and Bridges

7.4. Europe TMT Steel Market Size and Forecast, by Country (2025-2032)

7.4.1. UK

7.4.2. France

7.4.3. Germany

7.4.4. Italy

7.4.5. Spain

7.4.6. Sweden

7.4.7. Austria

7.4.8. Rest of Europe

8. Asia Pacific TMT Steel Market Size and Forecast (by Value USD and Volume Units)

8.1. Asia Pacific TMT Steel Market Size and Forecast, By Diameter Type(2025-2032)

8.1.1. 6mm to 12mm

8.1.2. 12mm to 20mm

8.1.3. 20mm and above

8.2. Asia Pacific TMT Steel Market Size and Forecast, By Grade Type (2025-2032)

8.2.1. Fe415 Grade

8.2.2. Fe500 Grade

8.2.3. Fe550 Grade

8.3. Asia Pacific TMT Steel Market Size and Forecast, By Application (2025-2032)

8.3.1. Residential Construction

8.3.2. Commercial Construction

8.3.3. Infrastructure and Bridges

8.4. Asia Pacific TMT Steel Market Size and Forecast, by Country (2025-2032)

8.4.1. China

8.4.2. S Korea

8.4.3. Japan

8.4.4. India

8.4.5. Australia

8.4.6. Indonesia

8.4.7. Malaysia

8.4.8. Vietnam

8.4.9. Taiwan

8.4.10. Bangladesh

8.4.11. Pakistan

8.4.12. Rest of Asia Pacific

9. Middle East and Africa TMT Steel Market Size and Forecast (by Value USD and Volume Units)

9.1. Middle East and Africa TMT Steel Market Size and Forecast, By Diameter Type(2025-2032)

9.1.1. 6mm to 12mm

9.1.2. 12mm to 20mm

9.1.3. 20mm and above

9.2. Middle East and Africa TMT Steel Market Size and Forecast, By Grade Type (2025-2032)

9.2.1. Fe415 Grade

9.2.2. Fe500 Grade

9.2.3. Fe550 Grade

9.3. Middle East and Africa TMT Steel Market Size and Forecast, By Application (2025-2032)

9.3.1. Residential Construction

9.3.2. Commercial Construction

9.3.3. Infrastructure and Bridges

9.4. Middle East and Africa TMT Steel Market Size and Forecast, by Country (2025-2032)

9.4.1. South Africa

9.4.2. GCC

9.4.3. Egypt

9.4.4. Nigeria

9.4.5. Rest of ME&A

10. South America TMT Steel Market Size and Forecast (by Value USD and Volume Units)

10.1. South America TMT Steel Market Size and Forecast, By Diameter Type(2025-2032)

10.1.1. 6mm to 12mm

10.1.2. 12mm to 20mm

10.1.3. 20mm and above

10.2. South America TMT Steel Market Size and Forecast, By Grade Type (2025-2032)

10.2.1. Fe415 Grade

10.2.2. Fe500 Grade

10.2.3. Fe550 Grade

10.3. South America TMT Steel Market Size and Forecast, By Application (2025-2032)

10.3.1. Residential Construction

10.3.2. Commercial Construction

10.3.3. Infrastructure and Bridges

10.4. South America TMT Steel Market Size and Forecast, by Country (2025-2032)

10.4.1. Brazil

10.4.2. Argentina

10.4.3. Rest of South America

11. Company Profile: Key players

11.1. TATA Steel

11.1.1. Company Overview

11.1.2. Financial Overview

11.1.3. Business Portfolio

11.1.4. SWOT Analysis

11.1.5. Business Strategy

11.1.6. Recent Developments

11.2. JSW Steel

11.3. SAIL (Steel Authority of India)

11.4. RINL (Rashtriya Ispat Nigam Limited)

11.5. Essar Steel

11.6. Jindal Steel and Power

11.7. Kamdhenu Limited

11.8. SRMB Steel

11.9. Bhushan Power & Steel

11.10. Vizag Steel

11.11. Kalinga TMT Fe 550

11.12. Shyam Steel

11.13. Electrotherm (India) Ltd.

11.14. VISA Steel

11.15. Balmukund Sponge & Iron (BSIL)

12. Key Findings

13. Industry Recommendation