Starch-based Bioplastics Market - Global Industry Analysis and Forecast (2025-2032)

The Starch-based bioplastics Market size was valued at USD 18.36 Bn. in 2024 and the total Global Starch-based bioplastics revenue is expected to grow at a CAGR of 11.3 % from 2025 to 2032, reaching nearly USD 43.24 Bn. by 2032.

Format : PDF | Report ID : SMR_1706

Starch-based Bioplastics Market Overview

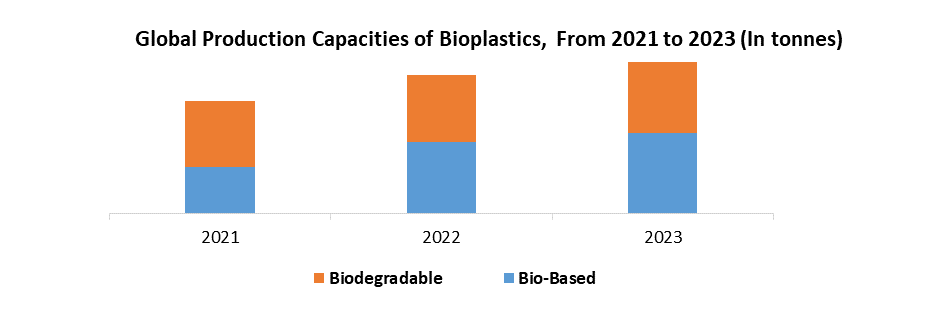

Starch-based plastics are complex blends of starch with compostable plastics such as PLA, PBAT, PBS, PCL, and PHAs. The blending of starch with plastics improves water resistance, processing properties, and mechanical properties. The SMR comprehensive analysis covers essential aspects including profit margins, trends, revenue/sales, employee demographics, wages, and more. SMR research data indicates a robust trend in the bio-based polymers market, with a production capacity of 2.1 million tons in 2020 and an expected growth to nearly 2.13 million tons by 2030. The profit margins of key players are crucial indicators of market competitiveness.

The report analyzing profit margins by regions and segments provides insights into market dynamics and potential areas for improvement and investment. Trends in the starch-based bioplastics market include the shift towards sustainable alternatives to traditional plastics, driven by environmental concerns and regulatory initiatives. The trend is reflected in increasing revenue and sales figures as more industries adopt bioplastics for consumer goods, agriculture, electronics, medical applications, toys, and automotive components. Rising environmental concerns and regulatory pressures are driving the demand for eco-friendly alternatives such as starch-based bioplastics.

Technological advancements are enhanced performance and functionality that are increasing the scope of applications beyond packaging to sectors like automotive, agriculture, consumer goods, and textiles. Additionally, stringent government regulations favoring bioplastics contribute to a favorable market environment. Starch-based bioplastics, which offer sustainable solutions to reduce plastic pollution and suit changing consumer preferences in numerous industries, have the potential for further use as production methods improve and pricing becomes more competitive with regular plastics.

To get more Insights: Request Free Sample Report

Starch-based bio plastics Market Dynamics

Environmental Concerns and Growth of Starch-Based Bioplastics

Growing environmental awareness and concerns about plastic pollution are driving demand for eco-friendly alternatives like starch-based bioplastics. Derived from renewable plant-based starches, these bioplastics offer advantages such as renewability and biodegradability, aligning with sustainability goals and regulations. The growing demand is evident across various applications including packaging, textiles, and consumer goods, as consumers actively seek eco-friendly products. The usage of Starch-based bio plastics is increasing because of government restrictions, such as the European Union's ban on single-use plastics, which underscore the importance of these materials in reducing the amount of plastic waste that ends up in landfills and the environment.

Recent European Union (EU) regulations, such as Directive 2019/904, have mandated the banning of certain single-use plastic items such as cotton bud sticks, cutlery, plates, and straws by 2021. Additionally, the EU's adoption of the first-ever European Strategy for Plastics in a Circular Economy in 2018 has significantly accelerated bioplastics production. As a result, the EU has emerged as the world's leading consumer of bioplastics. That regulatory framework has spurred businesses to innovate and invest in bioplastics manufacturing to meet the increasing demand for sustainable alternatives to traditional plastics within the European market.

Biodegradable films made from Starch-based bioplastics represent promising Opportunities for growth

Biodegradable films offer a sustainable alternative to traditional plastic. It mitigates plastic pollution and meets consumer demand for eco-friendly packaging. Their versatility extends to applications like food wrapping, agricultural mulch for crop enhancement, and compost bags for organic waste collection. These films address environmental concerns provided to the consumer preferences, and serve diverse purposes, making them a pivotal solution in combating plastic waste and promoting sustainability. The opportunity underlines the profitable prospects in the sustainable materials industry and underlines how important Starch-based bioplastics are to satisfying changing customer needs and encouraging environmental responsibility.

Processing Challenges Hinder Starch-Based Bioplastics

Developing efficient processing technologies for starch-based bioplastics is a major industry challenge impacting the Starch-Based Bioplastics market in multiple facets. Inefficient processing methods contribute to higher production costs, reducing price competitiveness against traditional plastics and impeding market adoption. Additionally, inconsistent product quality stemming from inefficient processing can lead to performance issues and customer dissatisfaction. Also, current processing technologies are expected to lack scalability for large-scale production and regulating the market's capacity to meet increasing demand.

Starch-based Bioplastics Market Segment Analysis

By Technology, According to SMR research, Injection Molding with the largest market share in 2024. It Holds XX% of the Starch-based bioplastics Market Share. Among the many perfectly shaped bioplastic products that are produced with injection molding are dishes, cups, electronic device housings, and automobile components. A key factor in enabling effective high-volume production processes is automation. The high level of automation simplifies processes, which raises output and lowers labor expenses. In addition, the automation of well-established procedures improves total cost-effectiveness and gives injection molding a competitive advantage in the Starch-based bioplastics market.

Cost reduction is a significant driver behind the widespread adoption of injection moulding technology. The combination of automation and well-established processes not only optimizes production efficiency but also minimizes material wastage, leading to lower production costs per unit. Also, injection molding offers the potential for relatively higher profit margins compared to other segments within the industry. Its efficiency, coupled with the established nature of the process, allows manufacturers to capitalize on economies of scale and achieve favorable returns on investment. Overall, injection molding emerges as a preferred choice for bioplastic manufacturers seeking both efficiency and profitability in their operations.

Starch-based Bioplastics Market Regional Analysis

The Asia Pacific region is expected to hold the xx% of Starch-based Bioplastics Market share. Technological developments and the entry of new startups encourage innovation and competition, which results in cost-competitive production and a wider variety of bioplastics with improved qualities. In recent years, Asia Pacific has witnessed remarkable developments in the bioplastics sector, particularly with Thailand and Malaysia emerging as key players in establishing themselves as bioplastics production hubs. Both countries have attracted significant investments and engaged in strategic joint ventures to bolster their position in the market.

Meanwhile, China continues to lead the region, contributing more than half of its production volume and placing a strong emphasis on research and development initiatives. One of the region's key advantages lies in its cost structure and availability of starch as a primary feedstock, which helps keep raw material costs relatively low compared to other regions. Also, intense competition in the market poses challenges, potentially impacting profit margins. Nevertheless, companies that focus on innovation and niche applications are poised to capitalize on the region's skilled workforce and the growing market opportunities, thereby securing higher margins in the competitive landscape.

Starch-based Bioplastics Market Competitive Landscape

Leading industry players are investing extensively in R&D to improve starch-based bioplastics, such as BASF's biodegradable bio-based films and Metabolix's Mirel bioplastics, which are more heat resistant. Startups are contributing as well by concentrating on different starch sources for particular uses, such as corn and cassava. By providing affordable alternatives, extending uses beyond packaging to industries such as consumer goods and automotive, and encouraging bioplastics' standing as an environmentally friendly substitute for conventional plastics, these developments are expected to drive market growth.

- TotalEnergies made its debut in sustainable packaging materials in June 2022 when it introduced biodegradable polylactic acid bioplastics to take the place of traditional plastics in food packaging applications.

- Sulzer's specialized, innovative production technique was chosen by Natureworks LLC in January 2022 to manufacture polylactic bioplastics, which would be utilized in compostable food packaging applications.

- Biobag International Inc., a producer of starch-based bioplastics, was bought by Novamont in January 2021. The acquisition increased the company's capacity to produce compostable starch-based bioplastics for packaging and waste collection applications.

|

Starch-based bioplastics Market Scope |

|

|

Market Size in 2024 |

USD 18.36 Bn. |

|

Market Size in 2032 |

USD 43.24 Bn. |

|

CAGR (2025-2032) |

11.3 % |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

|

By Technology Injection Molding Blow Molding Extrusion Others |

|

By Application Agriculture Automotive Building & Construction Electronics Textile Consumer Goods |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key Player in the Starch-based bioplastics Market

- BASF

- Toray Industries

- Cardia Bioplastic

- BioBag International

- Biotec International

- CPR Corp

- National Starch and Chemical

- Novamont

- Braskem

- GreenHome

- Corbion

- Biome Bioplastics

- NatureWorks

- green dot bioplastics

- Yield10 Bioscience Inc.

- Plantic Technologies

- Naturtec

- natureplast

Frequently Asked Questions

Growing environmental concerns, stringent regulations promoting sustainable practices, technological advancements enhancing bioplastics' performance, and expanding applications beyond packaging are key drivers of market growth.

Investors can explore opportunities across the market value chain, including companies involved in bioplastics production, composting and waste management infrastructure development, and sustainable feedstock production methods. Investing in innovative technologies and companies addressing market needs can yield significant returns in this rapidly evolving sector.

The Market size was valued at USD 18.36 Billion in 2024 and the total Market revenue is expected to grow at a CAGR of 11.3 % from 2025 to 2032, reaching nearly USD 43.24 billion.

The segments covered in the market report are By Technology and Application.

1. Starch-based Bioplastics Market: Research Methodology

2. Starch-based bioplastics Market: Executive Summary

3. Starch-based bioplastics Market: Competitive Landscape

4. Potential Areas for Investment

4.1. Stellar Competition Matrix

4.2. Competitive Landscape

4.3. Key Players Benchmarking

4.4. Market Structure

4.4.1. Market Leaders

4.4.2. Market Followers

4.4.3. Emerging Players

4.5. Consolidation of the Market

5. Starch-based bioplastics Market: Dynamics

5.1. Market Driver

5.1.1. Increasing Consumer Awareness

5.1.2. Innovation in Product Offerings

5.2. Market Trends by Region

5.2.1. North America

5.2.2. Europe

5.2.3. Asia Pacific

5.2.4. Middle East and Africa

5.2.5. South America

5.3. Market Drivers by Region

5.3.1. North America

5.3.2. Europe

5.3.3. Asia Pacific

5.3.4. Middle East and Africa

5.3.5. South America

5.4. Market Restraints

5.5. Market Opportunities

5.6. Market Challenges

5.7. PORTER’s Five Forces Analysis

5.8. PESTLE Analysis

5.9. Strategies for New Entrants to Penetrate the Market

5.10. Regulatory Landscape by Region

5.10.1. North America

5.10.2. Europe

5.10.3. Asia Pacific

5.10.4. Middle East and Africa

5.10.5. South America

6. Starch-based bioplastics Market Size and Forecast by Segments (by Value Units)

6.1. Starch-based Bioplastics Market Size and Forecast, by Technology (2024-2032)

6.1.1. Injection Molding

6.1.2. Blow Molding

6.1.3. Extrusion

6.1.4. Others

6.2. Starch-based bioplastics Market Size and Forecast, by Application (2024-2032)

6.2.1. Agriculture

6.2.2. Automotive

6.2.3. Building & Construction

6.2.4. Electronics

6.2.5. Textile

6.2.6. Consumer Goods

6.3. Starch-based bioplastics Market Size and Forecast, by Region (2024-2032)

6.3.1. North America

6.3.2. Europe

6.3.3. Asia Pacific

6.3.4. Middle East and Africa

6.3.5. South America

7. North America Starch-based bioplastics Market Size and Forecast (by value Units)

7.1. North America Starch-based bioplastics Market Size and Forecast, by Technology (2024-2032)

7.1.1. Injection Molding

7.1.2. Blow Molding

7.1.3. Extrusion

7.1.4. Others

7.2. North America Starch-based bioplastics Market Size and Forecast, by Application (2024-2032)

7.2.1. Agriculture

7.2.2. Automotive

7.2.3. Building & Construction

7.2.4. Electronics

7.2.5. Textile

7.2.6. Consumer Goods

7.3. North America Starch-based bioplastics Market Size and Forecast, by Country (2024-2032)

7.3.1. United States

7.3.2. Canada

7.3.3. Mexico

8. EuropeStarch-based bioplastics Market Size and Forecast (by Value Units)

8.1. Europe Starch-based bioplastics Market Size and Forecast, by Technology (2024-2032)

8.1.1. Injection Molding

8.1.2. Blow Molding

8.1.3. Extrusion

8.1.4. Others

8.2. Europe Starch-based bioplastics Market Size and Forecast, by Application (2024-2032)

8.2.1. Agriculture

8.2.2. Automotive

8.2.3. Building & Construction

8.2.4. Electronics

8.2.5. Textile

8.2.6. Consumer Goods

8.3. Europe Starch-based bioplastics Market Size and Forecast, by Country (2024-2032)

8.3.1. UK

8.3.2. France

8.3.3. Germany

8.3.4. Italy

8.3.5. Spain

8.3.6. Sweden

8.3.7. AustriaValue

8.3.8. Rest of Europe

9. Asia Pacific Starch-based bioplastics Market Size and Forecast (by Value Units)

9.1. Asia Pacific Starch-based bioplastics Market Size and Forecast, by Technology (2024-2032)

9.1.1. Injection Molding

9.1.2. Blow Molding

9.1.3. Extrusion

9.1.4. Others

9.2. Asia Pacific Starch-based bioplastics Market Size and Forecast, by Application (2024-2032)

9.2.1. Agriculture

9.2.2. Automotive

9.2.3. Building & Construction

9.2.4. Electronics

9.2.5. Textile

9.2.6. Consumer Goods

9.3. Asia Pacific Starch-based Bioplastics Market Size and Forecast, by Country (2024-2032)

9.3.1. China

9.3.2. S Korea

9.3.3. Japan

9.3.4. India

9.3.5. Australia

9.3.6. Indonesia

9.3.7. Malaysia

9.3.8. Vietnam

9.3.9. Taiwan

9.3.10. Bangladesh

9.3.11. Pakistan

9.3.12. Rest of Asia Pacific

10. Middle East and Africa Starch-based bioplastics Market Size and Forecast (by Value Units)

10.1. Middle East and Africa Starch-based bioplastics Market Size and Forecast, by Technology (2024-2032)

10.1.1. Injection Molding

10.1.2. Blow Molding

10.1.3. Extrusion

10.1.4. Others

10.2. Middle East and Africa Starch-based bioplastics Market Size and Forecast, by Application (2024-2032)

10.2.1. Agriculture

10.2.2. Automotive

10.2.3. Building & Construction

10.2.4. Electronics

10.2.5. Textile

10.2.6. Consumer Goods

10.3. Middle East and Africa Starch-based bio plastics Market Size and Forecast, by Country (2024-2032)

10.3.1. South Africa

10.3.2. GCC

10.3.3. Egypt

10.3.4. Nigeria

10.3.5. Rest of ME&A

11. South America Starch-based bio plastics Market Size and Forecast (by Value Units)

11.1. South America Starch-based bioplastics Market Size and Forecast, by Technology (2024-2032)

11.1.1. Injection Molding

11.1.2. Blow Molding

11.1.3. Extrusion

11.1.4. Others

11.2. South America Starch-based bioplastics Market Size and Forecast, by Application (2024-2032)

11.2.1. Agriculture

11.2.2. Automotive

11.2.3. Building & Construction

11.2.4. Electronics

11.2.5. Textile

11.2.6. Consumer Goods

11.3. South America Starch-based bioplastics Market Size and Forecast, by Country (2024-2032)

11.3.1. Brazil

11.3.2. Argentina

11.3.3. Rest of South America

12. Company Profile: Key players

12.1. BASF

12.1.1. Company Overview

12.1.2. Financial Overview

12.1.3. Business Portfolio

12.1.4. SWOT Analysis

12.1.5. Business Strategy

12.1.6. Recent Developments

12.2. Toray Industries

12.3. Cardia Bioplastic

12.4. BioBag International

12.5. Biotec International

12.6. CPR Corp

12.7. National Starch and Chemical

12.8. Novamont

12.9. Braskem

12.10. GreenHome

12.11. Corbion

12.12. Biome Bioplastics

12.13. NatureWorks

12.14. green dot bioplastics

12.15. Yield10 Bioscience Inc.

12.16. Plantic Technologies

12.17. Naturtec

12.18. natureplast

13. Key Findings

14. Industry Recommendation