Sports Nutrition Market: Global Industry Analysis and Forecast (2024-2030), Technology Trends

Sports Nutrition Market size was valued at US$ 47.08 Bn. in 2023 and the total revenue is expected to grow at a CAGR of 8.5% through 2024 to 2030, reaching nearly US$ 83.35 Bn

Format : PDF | Report ID : SMR_330

Sports Nutrition Market Overview:

Sports nutrition is the nutrition for athletes. It is a quantitative science that has a significant impact on performance. Sports nutrition entails much more than a high-protein diet, and no one item can improve athletic performance. Nutrition can help athletes perform better. The greatest approach to stay healthy is to have an active lifestyle and exercise programme, as well as eat well. Having the energy you need to complete a race or simply enjoy recreational sports and activities is made possible by a healthy diet.

Though sports nutrition market forecasting through 2027 is based on real output, demand and supply of 2020, 2020 numbers are also estimated on real numbers published by key players as well all-important players across the world. Market forecasting till 2027 is done based on past data from 2016 to 2019 with the impact of global lock down on the market in 2020 and 2021.

To get more Insights: Request Free Sample Report

COVID-19 Influences on the Sports Nutrition Market:

Due to COVID-19-related lockdowns, temporary closures of gyms, fitness centers, and health clubs resulted in a sales loss in 2020. Due to the COVID-19 pandemic, fitness establishments such as Flywheel Sports, Town Sports International, and 24-Hour Fitness have filed for bankruptcy. The sports nutrition Market is expected to increase in response to rising demand for sports nutrition products with functional components, as well as rising demand for online sales channels.

Sports Nutrition Market Dynamics:

Maximum performance necessitates proper nutrition and diet. Sports nutrition products can help you get the most out of your training, recover faster between workouts and competitions, maintain and achieve your target body weight, lower your risk of injury, and perform consistently. A major factor driving the sports nutrition market is athletes' adoption of sports nutrition supplements due to its benefits. Besides, among fitness fanatics and active lifestyle customers, the use of sports nutrition products is fast growing. These items are being used by consumers to help them boost energy and muscular mass while also aiding in weight loss. Furthermore, lifestyle disorders such as obesity are becoming more common.

Millennials and elderly folks are increasingly interested in sports nutrition formulations that will help them acquire energy, strength, and muscle health. Supplements are also becoming more popular among gym-goers. Whey supplements were consumed by 40% of gym-goers in India in 2019, according to MuscleBlaze. Furthermore, as more people participate in sports activities and events, fitness enthusiasts are using supplements to improve their endurance, strength, and stamina.

Biking, running, and walking were chosen by 44.9 percent of respondents in a poll done by New Hope Network, a media firm, in April 2020. Walking grew by 18% in the last 15 days of March 2019, according to Garmin GPS tracking data, but it increased by 36% in the same period in 2020. Globally, the growing consumer base for sports nutrition products is boosting sports nutrition market growth potential.

Growing demand for Plant Proteins drives the Sports Nutrition Market

Plant proteins are becoming more popular in a variety of disciplines, including sports nutrition. While the general trend in plant proteins is being driven by consumer interest in a sustainable, healthy lifestyle for mainstream and active lifestyle consumers, the sports performance consumer is also looking for performance benefits due to the buzz around celebrity plant-based athletes. Pea protein is a rising star in the world of plant-based sports nutrition, and it is frequently mixed with proteins like sunflower seed, pumpkin seed, and chia seed to achieve the best amino acid balance.

Sports Nutrition Market Segment Analysis:

The Sports Nutrition Market is segmented by Product Type, Application, Formulation, Consumer Group, Consumer Group by Activity, and Distribution Channel.

Based on the Product Type, the sports nutrition market is segmented into Sports Supplements, Sports Drinks, Sports Foods, Meal Replacement Products, and Weight Loss Products. Sports Supplements segment is expected to hold the largest market shares of xx% by 2030. This is due to the increased consumption of protein supplements such as whey protein and the availability of other plant proteins such as soy, spirulina, pumpkin seed, hemp, rice, and pea. Besides, the

market is expected to rise as sportsmen and gym-goers consume more proteins for muscle building. Moreover, the segment's growth is expected to be driven by the availability of a wide range of protein supplements at shops such as Walmart, Amazon, and Vitamin Shoppe. These are the factors that are expected to drives the growth of the Sports Supplements segment in the Sports Nutrition market during the forecast period 2024-2030.

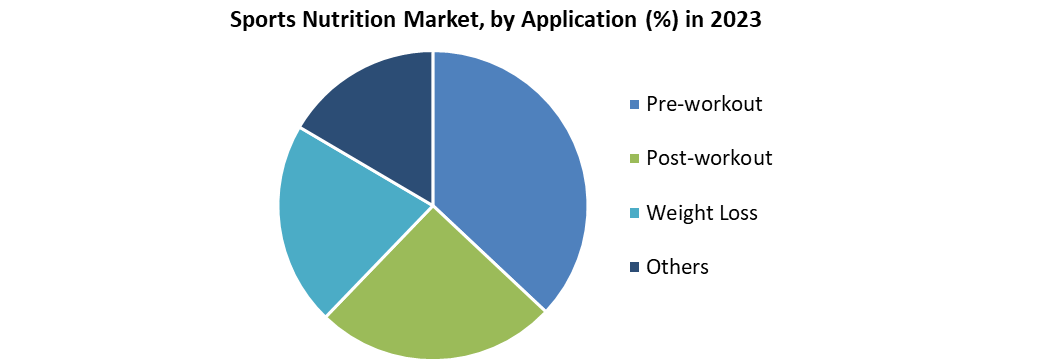

Based on the Application, the sports nutrition market is segmented into Pre-workout, Post-workout, Weight Loss, and Others. Post-workout segment is expected to grow rapidly at a CAGR of xx% during the forecast period 2024-2030. Repairing damaged muscles, enhancing muscle gain, recuperation, and maintaining muscular mass are all advantages of post-workout supplements. The post-workout segment is expected to grow due to the numerous benefits of post-workout supplements as well as increased awareness of post-workout supplements. Post-workout supplements including branched-chain amino acids, glutamine, and casein are gaining popularity around the world as people become more aware of their benefits.

Based on the Distribution Channel, the market is segmented into Brick and mortar, and E-commerce. Brick and mortar segment is expected to grow rapidly at a CAGR of xx% during the forecast period 2024-2030. In 2021, the brick and mortar distribution channel segment accounted for almost 75.0% of total sales. In brick and mortar establishments, such as specialty stores, small retail stores, fitness institutes, grocery stores, and general discount stores, a wide range of products are readily available. Customer loyalty programs and membership incentives are also available in brick-and-mortar establishments. All of these factors contribute to the significant revenue share in the sports nutrition market.

E-commerce segment is expected to grow rapidly at a CAGR of xx% during the forecast period 2021-2027. In 2020, the COVID-19 widespread and the resulting lockdowns boosted E-commerce. In addition, e-commerce merchants such as Amazon are diversifying into sports nutrition to capitalize on the industry's rapid growth. Discounts on a variety of supplements is one of the major factors driving consumers to buy sports nutrition products online.

Sports Nutrition Market Regional Insights:

North America region is expected to dominate the Sports Nutrition market during the forecast period 2024-2030. North America region is expected to hold the largest market shares of xx% by 2030. This is due to increased demand from the United States. High supplement adoption and improved health and wellness awareness are expected to drive market growth. Furthermore, the market's growth is expected to be boosted during the forecast period by the presence of a large number of companies and the diverse strategies employed by these firms.

Europe region is expected to grow rapidly at a CAGR of 7.7% during the forecast period 2024-2030. Sports Nutrition Market growth is being driven by increased sports engagement and rising public and private sector activities in the Europe region. For example, Westomatic launched a contactless sports nutrition drink dispenser in January 2021, which will help to reduce the spread of COVID-19. High consumer uptake in the United Kingdom, Germany, and France is expected to boost market growth during the forecast period.

Asia Pacific region is expected to grow rapidly at a CAGR of xx% during the forecast period 2024-2030. Consumers in the Asia-Pacific region, notably in India and China, are turning to sports nutrition food as a simple way to quench hunger and deliver nutrients after sports or exercise. Besides, these products can be enjoyed anywhere without the need for preparation, saving time. Demand for sports food, particularly energy and protein bars, is increasing as a result of the increased snacking trend among the country's health-conscious customers.?

Recent Trends in Sports Nutrition Market:

Support for Focus and Performance Due to Mental Illness: Due to the high prevalence of anxiety and despair during the lockdown, there has been a public discussion regarding the relevance of mental health to overall health. Exercise, a balanced diet, and stress management techniques have all been recommended for public health. Besides, some customers are looking for supplements that can improve their energy and attention. Sports nutritional supplements that contain these benefits (especially pre-workout items) have the added benefit of promoting a focused workout for maximum performance.

Support for Sleep in Recovery and Wellness: The growing emphasis on holistic wellness has drawn attention to the need of good sleep. Sleep aids have been gaining popularity, particularly functional beverages designed to assist people unwind before bedtime. In sports nutrition, a substance that also provides sleep support appeals since it aids workout recovery by promoting deep, restful sleep. Melatonin, L-theanine, and chamomile are among the ingredients used in sleep aids.

The objective of the report is to present a comprehensive analysis of the Sports Nutrition Market to the stakeholders in the industry. The report provides trends that are most dominant in the Sports Nutrition Market and how these trends will influence new business investments and market development throughout the forecast period. The report also aids in the comprehension of the market dynamics and competitive structure of the market by analyzing market leaders, market followers, and regional players.

The qualitative and quantitative data provided in the Sports Nutrition Market report is to help understand which market segments, regions are expected to grow at higher rates, factors affecting the market, and key opportunity areas, which will drive the industry and market growth through the forecast period. The report also includes the competitive landscape of key players in the industry along with their recent developments in the Sports Nutrition Market. The report studies factors such as company size, market share, market growth, revenue, production volume, and profits of the key players in the market.

The report provides Porter's Five Force Model, which helps in designing the business strategies in the market. The report helps in identifying how many rivals are existing, who they are, and how their product quality is in the Market. The report also analyses if the Sports Nutrition Market is easy for a new player to gain a foothold in the market, do they enter or exit the market regularly if the market is dominated by a few players, etc.

The report also includes a PESTEL Analysis, which aids in the development of company strategies. Political variables help in figuring out how much a government can influence the Market. Economic variables aid in the analysis of economic performance drivers that have an impact on the Market. Understanding the impact of the surrounding environment and the influence of environmental concerns on the Sports Nutrition Market is aided by legal factors.

Sports Nutrition Market Scope:

|

Sports Nutrition Market |

|

|

Market Size in 2023 |

USD 47.08 Bn. |

|

Market Size in 2030 |

USD 83.35 Bn. |

|

CAGR (2024-2030) |

8.5% |

|

Historic Data |

2018-2022 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

|

Segment Scope |

By Product Type

|

|

By Application

|

|

|

By Formulation

|

|

|

By Consumer Group

|

|

|

By Consumer Group by Activity

|

|

|

By Distribution Channel

|

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Sports Nutrition Market Key Players

- Iovate Health Sciences

- Abbott

- Quest Nutrition

- PepsiCo

- Cliff Bar

- The Coca Cola Company

- MusclePharm

- The Bountiful Company

- Post Holdings

- BA Sports Nutrition

- Cardiff Sports Nutrition

- Atlantic Multipower UK Limited

- GlaxoSmithKline PLC

- Olimp Laboratories

- Ultimate Nutrition Inc.

- PowerBar Europe GmbH

Frequently Asked Questions

North America is expected to hold the highest share in the Sports Nutrition Market.

Iovate Health Sciences, Abbott, Quest Nutrition, PepsiCo, Cliff Bar, and The Coca Cola Company are the top key players in the Sports Nutrition Market.

Sports Supplements segment hold the largest market share in the Sports Nutrition market by 2030.

The market size of the Sports Nutrition market is expected to reach US $83.35 Bn. by 2030.

The market size of the Sports Nutrition market was worth US $47.08 Bn. in 2023.

Chapter 1 Scope of the Report

Chapter 2 Research Methodology

2.1. Research Process

2.2. Global Sports Nutrition Market: Target Audience

2.3. Global Sports Nutrition Market: Primary Research (As per Client Requirement)

2.4. Global Sports Nutrition Market: Secondary Research

Chapter 3 Executive Summary

Chapter 4 Competitive Landscape

4.1. Market Share Analysis, By Region, 2023-2030(In %)

4.1.1. North America Market Share Analysis, By Value, 2023-2030 (In %)

4.1.2. Europe Market Share Analysis, By Value, 2023-2030 (In %)

4.1.3. Asia Pacific Market Share Analysis, By Value, 2023-2030 (In %)

4.1.4. South America Market Share Analysis, By Value, 2023-2030 (In %)

4.1.5. Middle East and Africa Market Share Analysis, By Value, 2023-2030 (In %)

4.2. Market Dynamics

4.2.1. Market Drivers

4.2.2. Market Restraints

4.2.3. Market Opportunities

4.2.4. Market Challenges

4.2.5. PESTLE Analysis

4.2.6. PORTERS Five Force Analysis

4.2.7. Value Chain Analysis

4.3. Global Sports Nutrition Market Segmentation Analysis, 2023-2030 (Value US$ MN)

4.3.1.1. Global Market Share Analysis, By Product Type, 2023-2030 (Value US$ MN)

4.3.1.1.1. Sports Supplements

4.3.1.1.2. Sports Drinks

4.3.1.1.3. Sports Foods

4.3.1.1.4. Meal Replacement Products

4.3.1.1.5. Weight Loss Products

4.3.1.2. Global Market Share Analysis, By Application, 2023-2030 (Value US$ MN)

4.3.1.2.1. Pre-workout

4.3.1.2.2. Post-workout

4.3.1.2.3. Weight Loss

4.3.1.2.4. Others

4.3.1.3. Global Market Share Analysis, By Formulation, 2023-2030 (Value US$ MN)

4.3.1.3.1. Tablets

4.3.1.3.2. Capsules

4.3.1.3.3. Powder

4.3.1.3.4. Softgels

4.3.1.3.5. Liquid

4.3.1.3.6. Gummies

4.3.1.4. Global Market Share Analysis, By Consumer Group, 2023-2030 (Value US$ MN)

4.3.1.4.1. Children

4.3.1.4.2. Adult

4.3.1.4.3. Geriatric

4.3.1.5. Global Market Share Analysis, By Consumer Group by Activity, 2023-2030 (Value US$ MN)

4.3.1.5.1. Heavy Users

4.3.1.5.2. Light Users

4.3.1.6. Global Market Share Analysis, By Distribution Channel, 2023-2030 (Value US$ MN)

4.3.1.6.1. Brick and mortar

4.3.1.6.2. E-commerce

4.4. North America Sports Nutrition Market Segmentation Analysis, 2023-2030 (Value US$ MN)

4.4.1.1. North America Market Share Analysis, By Product Type, 2023-2030 (Value US$ MN)

4.4.1.1.1. Sports Supplements

4.4.1.1.2. Sports Drinks

4.4.1.1.3. Sports Foods

4.4.1.1.4. Meal Replacement Products

4.4.1.1.5. Weight Loss Products

4.4.1.2. North America Market Share Analysis, By Application, 2023-2030 (Value US$ MN)

4.4.1.2.1. Pre-workout

4.4.1.2.2. Post-workout

4.4.1.2.3. Weight Loss

4.4.1.2.4. Others

4.4.1.3. North America Market Share Analysis, By Formulation, 2023-2030 (Value US$ MN)

4.4.1.3.1. Tablets

4.4.1.3.2. Capsules

4.4.1.3.3. Powder

4.4.1.3.4. Softgels

4.4.1.3.5. Liquid

4.4.1.3.6. Gummies

4.4.1.4. North America Market Share Analysis, By Consumer Group, 2023-2030 (Value US$ MN)

4.4.1.4.1. Children

4.4.1.4.2. Adult

4.4.1.4.3. Geriatric

4.4.1.5. Global Market Share Analysis, By Consumer Group by Activity, 2023-2030 (Value US$ MN)

4.4.1.5.1. Heavy Users

4.4.1.5.2. Light Users

4.4.1.6. Global Market Share Analysis, By Distribution Channel, 2023-2030 (Value US$ MN)

4.4.1.6.1. Brick and mortar

4.4.1.6.2. E-commerce

4.4.1.7. North America Market Share Analysis, By Country, 2023-2030 (Value US$ MN)

4.4.1.7.1. US

4.4.1.7.2. Canada

4.4.1.7.3. Mexico

4.5. Europe Sports Nutrition Market Segmentation Analysis, 2023-2030 (Value US$ MN)

4.5.1. Europe Market Share Analysis, By Product Type, 2023-2030 (Value US$ MN)

4.5.2. Europe Market Share Analysis, By Application, 2023-2030 (Value US$ MN)

4.5.3. Europe Market Share Analysis, By Formulation, 2023-2030 (Value US$ MN)

4.5.4. Europe Market Share Analysis, By Consumer Group, 2023-2030 (Value US$ MN)

4.5.5. Europe Market Share Analysis, By Consumer Group by Activity, 2023-2030 (Value US$ MN)

4.5.6. Europe Market Share Analysis, By Distribution Channel, 2023-2030 (Value US$ MN)

4.5.7. Europe Market Share Analysis, By Country, 2023-2030 (Value US$ MN)

4.5.1.7.1. UK

4.5.1.7.2. France

4.5.1.7.3. Germany

4.5.1.7.4. Italy

4.5.1.7.5. Spain

4.5.1.7.6. Sweden

4.5.1.7.7. Austria

4.5.1.7.8. Rest Of Europe

4.6. Asia Pacific Sports Nutrition Market Segmentation Analysis, 2023-2030 (Value US$ MN)

4.6.1. Asia Pacific Market Share Analysis, By Product Type, 2023-2030 (Value US$ MN)

4.6.2. Asia Pacific Market Share Analysis, By Application, 2023-2030 (Value US$ MN)

4.6.3. Asia Pacific Market Share Analysis, By Formulation, 2023-2030 (Value US$ MN)

4.6.4. Asia Pacific Market Share Analysis, By Consumer Group, 2023-2030 (Value US$ MN)

4.6.5. Asia Pacific Market Share Analysis, By Consumer Group by Activity, 2023-2030 (Value US$ MN)

4.6.6. Asia Pacific Market Share Analysis, By Distribution Channel, 2023-2030 (Value US$ MN)

4.6.7. Asia Pacific Market Share Analysis, By Country, 2023-2030 (Value US$ MN)

4.6.1.7.1. China

4.6.1.7.2. India

4.6.1.7.3. Japan

4.6.1.7.4. South Korea

4.6.1.7.5. Australia

4.6.1.7.6. ASEAN

4.6.1.7.7. Rest Of APAC

4.7. South America Sports Nutrition Market Segmentation Analysis, 2023-2030 (Value US$ MN)

4.7.1. South America Market Share Analysis, By Product Type, 2023-2030 (Value US$ MN)

4.7.2. South America Market Share Analysis, By Application, 2023-2030 (Value US$ MN)

4.7.3. South America Market Share Analysis, By Formulation, 2023-2030 (Value US$ MN)

4.7.4. South America Market Share Analysis, By Consumer Group, 2023-2030 (Value US$ MN)

4.7.5. South America Market Share Analysis, By Consumer Group by Activity, 2023-2030 (Value US$ MN)

4.7.6. South America Market Share Analysis, By Distribution Channel, 2023-2030 (Value US$ MN)

4.7.7. South America Market Share Analysis, By Country, 2023-2030 (Value US$ MN)

4.7.1.7.1. Brazil

4.7.1.7.2. Argentina

4.7.1.7.3. Rest Of South America

4.8. Middle East and Africa Sports Nutrition Market Segmentation Analysis, 2023-2030 (Value US$ MN)

4.8.1. Middle East and Africa Market Share Analysis, By Product Type, 2023-2030 (Value US$ MN)

4.8.2. Middle East and Africa Market Share Analysis, By Application, 2023-2030 (Value US$ MN)

4.8.3. Middle East and Africa Market Share Analysis, By Formulation, 2023-2030 (Value US$ MN)

4.8.4. Middle East and Africa Market Share Analysis, By Consumer Group, 2023-2030 (Value US$ MN)

4.8.5. Middle East and Africa Market Share Analysis, By Consumer Group by Activity, 2023-2030 (Value US$ MN)

4.8.6. Middle East and Africa Market Share Analysis, By Distribution Channel, 2023-2030 (Value US$ MN)

4.8.7. Middle East and Africa Market Share Analysis, By Country, 2023-2030 (Value US$ MN)

4.8.1.7.1. South Africa

4.8.1.7.2. GCC

4.8.1.7.3. Egypt

4.8.1.7.4. Nigeria

4.8.1.7.5. Rest Of ME&A

Chapter 5 Stellar Competition Matrix

5.1.1. Global Stellar Competition Matrix

5.1.2. North America Stellar Competition Matrix

5.1.3. Europe Stellar Competition Matrix

5.1.4. Asia Pacific Stellar Competition Matrix

5.1.5. South America Stellar Competition Matrix

5.1.6. Middle East and Africa Stellar Competition Matrix

5.2. Key Players Benchmarking

5.2.1. Key Players Benchmarking By Application, Pricing, Market Share, Investments, Expansion Plans, Physical Presence and Presence in the Market.

5.3. Mergers and Acquisitions in Industry

5.3.1. M&A by Region, Value and Strategic Intent

Chapter 6 Company Profiles

6.1. Key Players

6.1.1. Abbott

6.1.1.1. Company Overview

6.1.1.2. Source Portfolio

6.1.1.3. Financial Overview

6.1.1.4. Business Strategy

6.1.1.5. Key Developments

6.1.2. Iovate Health Sciences

6.1.3. Abbott

6.1.4. Quest Nutrition

6.1.5. PepsiCo

6.1.6. Cliff Bar

6.1.7. The Coca Cola Company

6.1.8. MusclePharm

6.1.9. The Bountiful Company

6.1.10. Post Holdings

6.1.11. BA Sports Nutrition

6.1.12. Cardiff Sports Nutrition

6.1.13. Atlantic Multipower UK Limited

6.1.14. GlaxoSmithKline PLC

6.1.15. Olimp Laboratories

6.1.16. Ultimate Nutrition Inc.

6.1.17. PowerBar Europe GmbH

6.2. Key Findings

6.3. Recommendations