Smoking Accessories Market- Global Industry Analysis and Forecast (2025-2032)

The Smoking Accessories Market size was valued at USD 68.32 Bn. in 2024 and the total Smoking Accessories revenue is expected to grow at a CAGR of 4.8 % from 2025 to 2032, reaching nearly USD 99.42 Bn. by 2032.

Format : PDF | Report ID : SMR_1745

Smoking Accessories Market Overview:

Smoking accessories include, pipes, cigarette holders, cigarette papers, cigarette lighters, and other items associated with smoking, electronic cigarettes, and other 'stop smoking' products. ENDS are manufactured to look like conventional combusted cigarettes, cigars, or pipes. Some resemble pens or USB flash drives. Larger devices, such as tank systems or mods, bear little or no resemblance to cigarettes. The products have reusable parts, or they are disposable and only used once before they are thrown away. Herbal cigarettes are gaining popularity throughout the globe as a substitute for tobacco products, particularly cigarettes, and are generally believed to be healthier or safer than tobacco cigarettes. Additionally, numerous companies promote herbal cigarettes as a safe alternative thanks to their composition of safe herbal drugs. There is insufficient convincing evidence that herbal cigarettes have a positive effect on public health

The Smoking Accessories Market report provides a comprehensive understanding of the analyzed market. It includes an introduction to the market, its size, growth rate, and key trends. The smoking accessories market is segmented based on product type, distribution channel, and region. The competitive analysis also highlights the strengths and weaknesses of major competitors, allowing clients to understand the competitive positioning of companies operating in the market.

To get more Insights: Request Free Sample Report

Smoking Accessories Market Dynamics:

Driving Forces and Trends in the Smoking Accessories Market

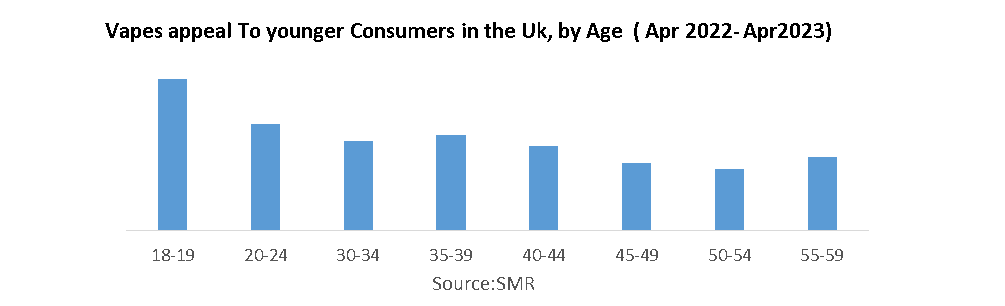

Vaporizers and waterpipes high demand and the adoption of the accessories is driving the Smoking Accessories Market. Vaporizers are also highly used by consumers as they are considered to be less harmful, thanks to the fact that they do not produce damaging toxins. Vaping involves breathing in an aerosol that contains several chemicals, including nicotine and flavoring, through an e-cigarette or vape. Vaping is growing in popularity among teenagers. Continued innovation and product diversity in smoking accessories also drive the Market. Additionally, water pipes have become centerpieces of cafés and restaurants, especially in countries such as South Africa, China, India, and the U.S. Rise in income levels and urbanization is also a key driver for the growth of the smoking accessories market.

Government Regulations and Market Impact

The smoking accessories market is related to tobacco consumption and smoking habits, in resulting many rules and regulations imposed by different governments around the globe. The regulations govern the consumption and marketing of smoking products, which have a significant impact on the market. In addition, many countries are banning smoking products, which harms the development of the market. In Addition, some governments have enacted strict regulations for broadcasting smoking advertisements. Hence, the factors are expected to restrict market growth through the forecast period.

Smoking Accessories Market Segment Analysis:

By Product Type, Vaporizer is also known as a vape. Vaporizers held the highest market share in 2024 for the Smoking Accessories Market. Vaping devices are popular among teens and are now the most commonly used form of nicotine among youth in the United States. In China, more than 90% of the world’s vaping devices are manufactured. Zhang steered clear of domestic sales, resisting the temptation of a gargantuan market with 300 million smokers who converted to vaping. Disposable vapes such as the Elf Bar typically contain much higher volumes of nicotine liquid than earlier versions of e-cigarettes, including those from Juul. And they’re easier to use, just open the box and start puffing.

Consumer-products and vaping wholesaler Supreme Plc announced a deal to supply Elf Bar and Lost Mary to several major British supermarket and convenience store chains. Supreme says on its Elf Bar product webpage that about 2.5 million of them are sold weekly in the UK. The company expects to generate 40 million pounds (USD 50.4 million) in revenue from the products for the year ending in March 2024.

- Vaping is popular among teens. Under U.S. Food and Drug Administration (FDA) regulations designed to protect the health of young Americans, minors can no longer buy e-cigarettes in stores or online.

Smoking Accessories Market Regional Analysis:

North America held the highest market share in 2024 for the Smoking Accessories Market. The 12,400 tobacco and smoke shops in the US sell cigarettes, cigars, tobacco, pipes, and other smokers’ supplies and accessories. Cigars, cigarettes, tobacco, and smokers’ accessories account for 84% of industry sales. For some firms, e-cigarettes and vaporizers are accounting for an increasing percentage of sales (as much as 30%). Some shops also sell packaged alcoholic beverages (liquor, beer, wine), groceries, and fuel. The legalization of recreational cannabis has increased the demand for marijuana smoking accessories in the region. The rising demand for tobacco cessation aids, such as e-cigarettes and smokeless tobacco, is also likely to contribute to the market’s growth.

Various countries' import and export bans on smoking products have also reduced the consumption of cigarettes and smoking accessories. Governments in countries like India and Austria have banned smoking in public places.

- Global Smoking Accessories Exporters & Suppliers directory, there are 2,583 active Smoking Accessories Exporters in the globe exporting to 2,763 Buyers.

- AIR FRANCE accounted for maximum export market share with 1,217 shipments followed by ATTN SOCIETE AIR FRANCE with 1,105 and CELESTICA M SDN BHD at the 3rd spot with 779 shipments.

Smoking Accessories Market Competitive Landscape:

- In January 2023, Dopeboo, an online headshop based in the United States, Unveiled an enhanced assorted of exclusive smoking accessories. The updated collection features a variety of products, including bongs, pipes, dab rings, vapes, and more. Dopeboo sources top brands such as Grav, Puffco, Marley Naturals, Freeze Pipe, and others to offer a diverse and premium selection to its customers.

Smoking Accessories Market Scope:

|

Smoking Accessories Market |

|

|

Market Size in 2024 |

USD 68.32 Bn. |

|

Market Size in 2032 |

USD 99.42 Bn. |

|

CAGR (2025-2032) |

4.8 % |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Product Type Vaporizers Rolling Paper & Cigarette Tubes Lighters Filter & Paper Tip Others |

|

By Distribution Channel Online Offline |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Smoking Accessories Market Key Players:

- British American Tobacco PLC

- S.T. Dupont

- H. Upmann

- La Gloria Cubana

- Vector Group Ltd

- Scandinavian Tobacco Group A/S

- Altria Group Inc

- Japan Tobacco Inc

- British American Tobacco PLC

Frequently Asked Questions

The regulations govern the consumption and marketing of smoking products is restrain for the Smoking Accessories market growth.

The Market size was valued at USD 68.32 Billion in 2024 and the total Market revenue is expected to grow at a CAGR of5.4.8% from 2025 to 2032, reaching nearly USD 99.42 Billion.

The segments covered in the market report are By product and Distribution Channel.

1. Smoking Accessories Market: Research Methodology

1.1. Research Data

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Assumptions

2. Smoking Accessories Market: Executive Summary

2.1. Market Overview

2.2. Market Size (2024) and Forecast (2025 – 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments and Regions

3. Smoking Accessories Market: Competitive Landscape

3.1. Stellar Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Product Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2024)

3.2.7. Profit Margin

3.2.8. Market Share

3.2.9. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

3.4.1. Strategic Initiatives and Developments

3.4.2. Mergers and Acquisitions

3.4.3. Collaborations and Partnerships

3.4.4. Product Launches and Innovation

4. Smoking Accessories Market: Dynamics

4.1. Market Trends by Region

4.1.1. North America

4.1.2. Europe

4.1.3. Asia Pacific

4.1.4. Middle East and Africa

4.1.5. South America

4.2. Market Drivers

4.3. Market Restraints

4.4. Market Opportunities

4.5. Market Challenges

4.6. PORTER’s Five Forces Analysis

4.6.1. Intensity of the Rivalry

4.6.2. Threat of New Entrants

4.6.3. Bargaining Power of Suppliers

4.6.4. Bargaining Power of Buyers

4.6.5. Threat of Substitutes

4.7. PESTLE Analysis

4.7.1. Political Factors

4.7.2. Economic Factors

4.7.3. Social Factors

4.7.4. Technological Factors

4.7.5. Legal Factors

4.7.6. Environmental Factors

4.8. Technological Roadmap

4.9. Value Chain Analysis

4.10. Regulatory Landscape

4.10.1. Market Regulation by Region

4.10.1.1. North America

4.10.1.2. Europe

4.10.1.3. Asia Pacific

4.10.1.4. Middle East and Africa

4.10.1.5. South America

4.10.2. Impact of Regulations on Market Dynamics

5. Smoking Accessories Market Size and Forecast by Segments (by Value USD Million)

5.1. Smoking Accessories Market Size and Forecast, By Product Type (2024-2032)

5.1.1. Vaporizers

5.1.2. Rolling Paper & Cigarette Tubes

5.1.3. Lighters

5.1.4. Filter & Paper Tip

5.1.5. Others

5.2. Smoking Accessories Market Size and Forecast, By Distribution Channel (2024-2032)

5.2.1. Online

5.2.2. Offline

5.3. Smoking Accessories Market Size and Forecast, by Region (2024-2032)

5.3.1. North America

5.3.2. Europe

5.3.3. Asia Pacific

5.3.4. Middle East and Africa

5.3.5. South America

6. North America Smoking Accessories Market Size and Forecast (by Value USD Million)

6.1. North America Smoking Accessories Market Size and Forecast, By Product Type (2024-2032)

6.1.1. Vaporizers

6.1.2. Rolling Paper & Cigarette Tubes

6.1.3. Lighters

6.1.4. Filter & Paper Tip

6.1.5. Others

6.2. North America Smoking Accessories Market Size and Forecast, By Distribution Channel (2024-2032)

6.2.1. Online

6.2.2. Offline

6.3. North America Smoking Accessories Market Size and Forecast, by Country (2024-2032)

6.3.1. United States

6.3.2. Canada

6.3.3. Mexico

7. Europe Smoking Accessories Market Size and Forecast (by Value USD Million)

7.1. Europe Smoking Accessories Market Size and Forecast, By Product Type (2024-2032)

7.2. Europe Smoking Accessories Market Size and Forecast, By Distribution Channel (2024-2032)

7.3. Europe Smoking Accessories Market Size and Forecast, by Country (2024-2032)

7.3.1. UK

7.3.2. France

7.3.3. Germany

7.3.4. Italy

7.3.5. Spain

7.3.6. Sweden

7.3.7. Austria

7.3.8. Rest of Europe

8. Asia Pacific Smoking Accessories Market Size and Forecast (by Value USD Million)

8.1. Asia Pacific Smoking Accessories Market Size and Forecast, By Product Type (2024-2032)

8.2. Asia Pacific Smoking Accessories Market Size and Forecast, By Distribution Channel (2024-2032)

8.3. Asia Pacific Smoking Accessories Market Size and Forecast, by Country (2024-2032)

8.3.1. China

8.3.2. S Korea

8.3.3. Japan

8.3.4. India

8.3.5. Australia

8.3.6. Indonesia

8.3.7. Malaysia

8.3.8. Vietnam

8.3.9. Taiwan

8.3.10. Bangladesh

8.3.11. Pakistan

8.3.12. Rest of Asia Pacific

9. Middle East and Africa Smoking Accessories Market Size and Forecast (by Value USD Million)

9.1. Middle East and Africa Smoking Accessories Market Size and Forecast, By Product Type (2024-2032)

9.2. Middle East and Africa Smoking Accessories Market Size and Forecast, By Distribution Channel (2024-2032)

9.3. Middle East and Africa Smoking Accessories Market Size and Forecast, by Country (2024-2032)

9.3.1. South Africa

9.3.2. GCC

9.3.3. Egypt

9.3.4. Nigeria

9.3.5. Rest of ME&A

10. South America Smoking Accessories Market Size and Forecast (by Value USD Million)

10.1. South America Smoking Accessories Market Size and Forecast, By Product Type (2024-2032)

10.2. South America Smoking Accessories Market Size and Forecast, By Distribution Channel (2024-2032)

10.3. South America Smoking Accessories Market Size and Forecast, by Country (2024-2032)

10.3.1. Brazil

10.3.2. Argentina

10.3.3. Rest of South America

11. Company Profile: Key players

11.1. British American Tobacco PLC

11.1.1. Company Overview

11.1.2. Product Segment

11.1.2.1. Product Name

11.1.2.2. Product Details (Price, Features, etc.)

11.1.3. Financial Overview

11.1.3.1. Total Revenue

11.1.3.2. Segment Revenue

11.1.3.3. Regional Revenue

11.1.4. SWOT Analysis

11.1.5. Strategic Analysis

11.1.6. Recent Developments

11.2. S.T. Dupont

11.3. H. Upmann

11.4. La Gloria Cubana

11.5. Vector Group Ltd

11.6. Scandinavian Tobacco Group A/S

11.7. Altria Group Inc

11.8. Japan Tobacco Inc

11.9. British American Tobacco PLC

12. Key Findings

13. Industry Recommendations

13.1. Strategic Recommendations

13.2. Future Outlook