Probiotics in Animal Feed Market: Global Industry Analysis and Forecast (2024-2030) by Source, Livestock, Form, and Region.

Probiotics in Animal Feed Market size was valued at US$ 5.65 Bn. in 2023 and the total revenue is expected to grow at a CAGR of 8.8% through 2024 to 2030, reaching nearly US$ 10.21 Bn.

Format : PDF | Report ID : SMR_401

Probiotics in Animal Feed Market Overview:

Probiotics are regarded growth and health stimulators and are widely utilised in animal feed, particularly in the production of pigs and poultry. Probiotics are sometimes described as "a live microbial feed additive that benefits the host animal by improving its intestinal equilibrium." Probiotics are helpful bacteria that dwell in the intestines. Animals' gastrointestinal systems are home to billions of these bacteria (as well as some yeast). These beneficial gut bacteria keep the internal environment in check, preventing sickness and promoting good health. These probiotics in animal feed market report is provided with the segment analysis, based on the source, livestock, form and region.

To get more Insights: Request Free Sample Report

COVID-19 Influences on the Market:

As a result of the lockdown in several countries during the pandemic, the probiotics in animal feed market has met few difficulties during shipping and distribution. However, in response to increased farmer demand, government rules relevant to the business were adopted in most countries, resulting in a boost in growth opportunities in the dry form of probiotics in the animal feed segment. When lockdowns in various countries are lifted and the pandemic has calmed a bit, advanced probiotics in livestock feed distribution facilities are likely to be more widely used in poultry, swine, and other livestock species.

Probiotics in Animal Feed Market Dynamics:

Driving Factor: Compound feed production has increased.

Compound feeds are in high demand in Asia Pacific, North America, and Europe, due to strong demand for meat and meat products and a growing awareness of the necessity of protein-rich diets among consumers worldwide. According to the Food and Agriculture Organization (FAO), demand for food goods would increase by 60% by 2050, while demand for animal protein will increase by 1.7 percent every year. China, the United States, Brazil, Mexico, Spain, India, and Russia are the world's leading feed producers. These countries' demand for chicken and red meat has been increasing, contributing to the probiotics in animal feed market's growth.

Restraining Factor: Probiotics in animal feed products are subject to international quality standards and legislation.

There are five agencies that regulate the use of various additives in feed products: the US Food and Drug Administration (FDA), the US Center of Veterinary Medicine (CVM), the World Health Organization (WHO), the European Commission (EC), the European Food Safety Authority (EFSA), the Australian Pesticides and Veterinary Medicines Authority (APVMA), the Natural Health Product Directorate (NHPD), and the National Health Surveillance Agency (ANVISA). These organizations regulate the use of various chemicals and additives in the feed processing industry.

Opportunities: The feed industry is advancing technologically and introducing innovations

Innovation in the feed industry has been a major focus, particularly in the area of additives, where regulatory organizations, such as the European Food Safety Authority (EFSA) and the Food and Drug Administration (FDA), are constantly researching and identifying sustainable feed additives. Feed manufacturers are offering the best ingredients and technologies to generate unique additive combinations in order to meet the growing demand. Based on the findings of the field tests, 70% of feed manufacturers have started combining different feed additives in order to reap the benefits of the combined results. The increased reliance on additives industry innovations has resulted in an increase in the number of on-farm testing sessions.

Challenges: Development of new probiotic strains involves high R&D costs

The high cost of hiring qualified professionals, large investments in R&D activities, and investments in laboratories and research equipment create barriers to the market development for probiotics in animal feed. The scientific validation regarding the use of probiotics in their applications makes this market a success. Due to the health benefits associated with probiotics, it is difficult for manufacturers to make an adequate return on their initial investments. The strategies of major key players such as Du Chr. Hansen (Denmark) and DowDuPont (US) have focused on building strong technology bases to gain competitive advantages, which has created a barrier for other players in the probiotics in animal feed market.

Probiotics in Animal Feed Market Segment Analysis:

Based on the Livestock, the market is segmented into Ruminants, Poultry, Swine, Aquaculture, Pets, and Other livestock. Poultry segment is expected to hold the largest market share of xx% by 2030. The consumption of poultry meat has increased over time due to its lower fat content than beef and veal. Antibiotics as feed additions to assist cattle and poultry grow faster have been banned by the US Food and Drug Administration (USFDA). As a result, major firms are concentrating their efforts on supplying high-quality probiotics in livestock feed, such as poultry. These are the factors that are expected to drives the growth of the Poultry segment in the Probiotics in Animal Feed market during the forecast period 2024-2030

Based on the Source, the probiotics in animal feed market is segmented into Bacteria, and Yeast and Fungi. Bacteria segment is expected to grow rapidly at a CAGR of xx% during the forecast period 2024-2030. Some of the most often employed bacterial strains in the animal feed industry are Lactobacilli, Streptococcus thermophilus, and Bifidobacterium. The high profitability is ascribed to many health benefits, such as improved intestinal health, increased production, and animal immunity.

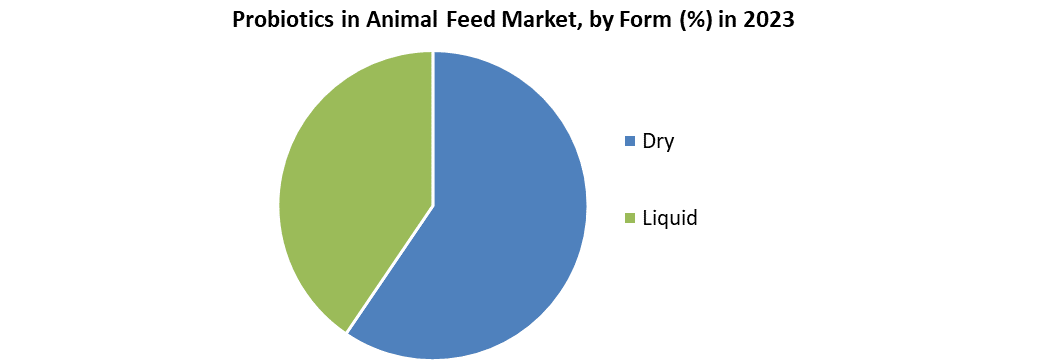

Based on the Form, the probiotics in animal feed market is segmented into Dry, and Liquid. Dry form segment is expected to grow rapidly at a CAGR of xx% during the forecast period 2024-2030. Probiotics that are dry rather than liquid are favoured since they are easier to transport and have a longer shelf life. These are commonly found in cow, swine, and poultry feed. Liquid probiotics also have a larger risk of contamination due to their higher moisture content, which might result in undesired culture.

Probiotics in Animal Feed Market Regional Insights:

Asia Pacific region is expected to dominate the Probiotics in Animal Feed market during the forecast period 2024-2030.

Asia Pacific region is expected to hold the largest probiotics in animal feed market shares of xx% by 2027. Livestock farmers have been under constant pressure to provide the highest possible yield with the fewest possible inputs. As a result, probiotics in animal feed increase overall animal performance while also protecting against dangerous diseases. Due to steady demand for chicken products, rising rates of meat consumption due to increasing population, and increased understanding about the benefits of probiotics in animal feed, China and India are key income contributors in this region.

North America is expected to grow rapidly at a CAGR of xx% during the forecast period 2024-2030.

This is due to factors such as rising consumer demand for healthy foods and a high demand for probiotics in the food and beverage industry in the North America Region. In this region, the United States is the major consumer of animal feed probiotics. Revenue growth is being aided by factors such as increasing demand for processed beef products and the launch of natural probiotic supplements by several significant producers.

Europe is expected to be the fastest growing region in the global market during the forecast period 2024-2030.

This is due to tight quality and cleanliness rules in the livestock and food industries, as well as increased awareness of the health benefits of employing probiotics in animal feed in the Europe region.

The objective of the report is to present a comprehensive analysis of the Probiotics in Animal Feed Market to the stakeholders in the industry. The report provides trends that are most dominant in the Probiotics in Animal Feed Market and how these trends will influence new business investments and market development throughout the forecast period. The report also aids in the comprehension of the Probiotics in Animal Feed Market dynamics and competitive structure of the market by analyzing market leaders, market followers, and regional players.

The qualitative and quantitative data provided in the Probiotics in Animal Feed Market report is to help understand which market segments, regions are expected to grow at higher rates, factors affecting the market, and key opportunity areas, which will drive the industry and market growth through the forecast period. The report also includes the competitive landscape of key players in the industry along with their recent developments in the Probiotics in Animal Feed Market. The report studies factors such as company size, market share, market growth, revenue, production volume, and profits of the key players in the Probiotics in Animal Feed Market.

The report provides Porter's Five Force Model, which helps in designing the business strategies in the market. The report helps in identifying how many rivals are existing, who they are, and how their product quality is in the Market. The report also analyses if the Probiotics in Animal Feed Market is easy for a new player to gain a foothold in the market, do they enter or exit the market regularly if the market is dominated by a few players, etc.

The report also includes a PESTEL Analysis, which aids in the development of company strategies. Political variables help in figuring out how much a government can influence the Market. Economic variables aid in the analysis of economic performance drivers that have an impact on the Market. Understanding the impact of the surrounding environment and the influence of environmental concerns on the Probiotics in Animal Feed Market is aided by legal factors.

Probiotics in Animal Feed Market Scope:

|

Probiotics Market |

|

|

Market Size in 2023 |

USD 5.65 Bn. |

|

Market Size in 2030 |

USD 10.21 Bn. |

|

CAGR (2024-2030) |

8.8 Percent |

|

Historic Data |

2018-2022 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

|

Segment Scope |

by Source

|

|

by livestock

|

|

|

by Form

|

|

|

Regional Scope |

North America- United States, Canada, and Mexico

Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Probiotics in Animal Feed Market Key Players

- Du Chr. Hansen (Denmark)

- Koninklijke DSM N.V. (Netherlands)

- DuPont (US)

- Evonik Industries (Germany)

- Land O'Lakes (US)

- Mitsui & Co., Ltd. (Japan)

- Ohly (Denmark)

- Lesaffre (France)

- Alltech (US)

- Novozymes (Denmark)

- Calpis Co., Ltd. (Japan)

- Unique Biotech (India)

- Pure Cultures (US)

Frequently Asked Questions

Asia Pacific is expected to hold the highest share in the Probiotics in Animal Feed Market.

Du Chr. Hansen (Denmark), Koninklijke DSM N.V. (Netherlands), DuPont (US), Evonik Industries (Germany), and Land O'Lakes (US) are the top key players in the Probiotics in Animal Feed Market.

Poultry segment hold the largest market share in the Probiotics in Animal Feed market by 2030.

The market size of the Probiotics in Animal Feed market is expected to reach US $10.21 Bn. by 2030.

The market size of the Probiotics in Animal Feed market was worth US $5.65 Bn. in 2023.

Chapter 1 Scope of the Report

Chapter 2 Research Methodology

2.1.Research Process

2.2.Global Probiotics in Animal Feed Market: Target Audience

2.3.Global Probiotics in Animal Feed Market: Primary Research (As per Client Requirement)

2.4.Global Probiotics in Animal Feed Market: Secondary Research

Chapter 3 Executive Summary

Chapter 4 Competitive Landscape

4.1.Market Share Analysis, By Region, 2023-2030(In %)

4.1.1.1.North America Market Share Analysis, By Value, 2023-2030 (In %)

4.1.1.2.Europe Market Share Analysis, By Value, 2023-2030 (In %)

4.1.1.3.Asia Pacific Market Share Analysis, By Value, 2023-2030 (In %)

4.1.1.4.South America Market Share Analysis, By Value, 2023-2030 (In %)

4.1.1.5.Middle East and Africa Market Share Analysis, By Value, 2023-2030 (In %)

4.2.Market Dynamics

4.2.1.Market Drivers

4.2.2.Market Restraints

4.2.3.Market Opportunities

4.2.4.Market Challenges

4.2.5.PESTLE Analysis

4.2.6.PORTERS Five Force Analysis

4.2.7.Value Chain Analysis

4.3. Global Probiotics in Animal Feed Market Segmentation Analysis, 2023-2030 (Value US$ MN)

4.3.1.1.Global Market Share Analysis, By Source, 2023-2030 (Value US$ MN)

4.3.1.1.1.Bacteria

4.3.1.1.2.Yeast and Fungi

4.3.1.2. Global Market Share Analysis, By Livestock, 2023-2030 (Value US$ MN)

4.3.1.2.1.Ruminants

4.3.1.2.2.Poultry

4.3.1.2.3.Swine

4.3.1.2.4.Aquaculture

4.3.1.2.5.Pets

4.3.1.2.6.Other livestock

4.3.1.3. Global Market Share Analysis, By Form, 2023-2030 (Value US$ MN)

4.3.1.3.1.Dry

4.3.1.3.2.Liquid

4.4. North America Probiotics in Animal Feed Market Segmentation Analysis, 2023-2030 (Value US$ MN)

4.4.1.1.North America Market Share Analysis, By Source, 2023-2030 (Value US$ MN)

4.4.1.1.1.Bacteria

4.4.1.1.2.Yeast and Fungi

4.4.1.2. North America Market Share Analysis, By Livestock, 2023-2030 (Value US$ MN)

4.4.1.2.1.Ruminants

4.4.1.2.2.Poultry

4.4.1.2.3.Swine

4.4.1.2.4.Aquaculture

4.4.1.2.5.Pets

4.4.1.2.6.Other livestock

4.4.1.3. North America Market Share Analysis, By Form, 2023-2030 (Value US$ MN)

4.4.1.3.1.Dry

4.4.1.3.2.Liquid

4.4.1.4. North America Market Share Analysis, By Country, 2023-2030 (Value US$ MN)

4.4.1.4.1.US

4.4.1.4.2.Canada

4.4.1.4.3.Mexico

4.5. Europe Probiotics in Animal Feed Market Segmentation Analysis, 2023-2030 (Value US$ MN)

4.5.1.1. Europe Market Share Analysis, By Source, 2023-2030 (Value US$ MN)

4.5.1.2.Europe Market Share Analysis, By Livestock, 2023-2030 (Value US$ MN)

4.5.1.3.Europe Market Share Analysis, By Form, 2023-2030 (Value US$ MN)

4.5.1.4.Europe Market Share Analysis, By Country, 2023-2030 (Value US$ MN)

4.5.1.4.1.UK

4.5.1.4.2.France

4.5.1.4.3.Germany

4.5.1.4.4.Italy

4.5.1.4.5.Spain

4.5.1.4.6.Sweden

4.5.1.4.7.Austria

4.5.1.4.8.Rest Of Europe

4.6. Asia Pacific Probiotics in Animal Feed Market Segmentation Analysis, 2023-2030 (Value US$ MN)

4.6.1.1.Asia Pacific Market Share Analysis, By Source, 2023-2030 (Value US$ MN)

4.6.1.2.Asia Pacific Market Share Analysis, By Livestock, 2023-2030 (Value US$ MN)

4.6.1.3.Asia Pacific Market Share Analysis, By Form, 2023-2030 (Value US$ MN)

4.6.1.4.Asia Pacific Market Share Analysis, By Country, 2023-2030 (Value US$ MN)

4.6.1.4.1.China

4.6.1.4.2.India

4.6.1.4.3.Japan

4.6.1.4.4.South Korea

4.6.1.4.5.Australia

4.6.1.4.6.ASEAN

4.6.1.4.7.Rest Of APAC

4.7. South America Probiotics in Animal Feed Market Segmentation Analysis, 2023-2030 (Value US$ MN)

4.7.1.1. South America Market Share Analysis, By Source, 2023-2030 (Value US$ MN)

4.7.1.2.South America Market Share Analysis, By Livestock, 2023-2030 (Value US$ MN)

4.7.1.3.South America Market Share Analysis, By Form, 2023-2030 (Value US$ MN)

4.7.1.4.South America Market Share Analysis, By Country, 2023-2030 (Value US$ MN)

4.7.1.4.1.Brazil

4.7.1.4.2.Argentina

4.7.1.4.3.Rest Of South America

4.8. Middle East and Africa Probiotics in Animal Feed Market Segmentation Analysis, 2023-2030 (Value US$ MN)

4.8.1.1Middle East and Africa Market Share Analysis, By Source, 2023-2030 (Value US$ MN)

4.8.1.2.Middle East and Africa Market Share Analysis, By Livestock, 2023-2030 (Value US$ MN)

4.8.1.3.Middle East and Africa Market Share Analysis, By Form, 2023-2030 (Value US$ MN)

4.8.1.4.Middle East and Africa Market Share Analysis, By Country, 2023-2030 (Value US$ MN)

4.8.1.4.1.South Africa

4.8.1.4.2.GCC

4.8.1.4.3.Egypt

4.8.1.4.4.Nigeria

4.8.1.4.5.Rest Of ME&A

Chapter 5 Stellar Competition Matrix

5.1.1.Global Stellar Competition Matrix

5.1.2.North America Stellar Competition Matrix

5.1.3.Europe Stellar Competition Matrix

5.1.4.Asia Pacific Stellar Competition Matrix

5.1.5.South America Stellar Competition Matrix

5.1.6.Middle East and Africa Stellar Competition Matrix

5.2.Key Players Benchmarking

5.2.1.Key Players Benchmarking By Application, Pricing, Market Share, Investments, Expansion Plans, Physical Presence and Presence in the Market.

5.3.Mergers and Acquisitions in Industry

5.3.1.M&A by Region, Value and Strategic Intent

Chapter 6 Company Profiles

6.1.Key Players

6.1.1.Haifa Group

6.1.1.1.Company Overview

6.1.1.2.Source Portfolio

6.1.1.3.Financial Overview

6.1.1.4.Business Strategy

6.1.1.5.Key Developments

6.1.2.Du Chr. Hansen (Denmark)

6.1.3.Koninklijke DSM N.V. (Netherlands)

6.1.4.DuPont (US)

6.1.5.Evonik Industries (Germany)

6.1.6.Land O'Lakes (US)

6.1.7.Mitsui & Co., Ltd. (Japan)

6.1.8.Ohly (Denmark)

6.1.9.Lesaffre (France)

6.1.10.Alltech (US)

6.1.11.Novozymes (Denmark)

6.1.12.Calpis Co., Ltd. (Japan)

6.1.13.Unique Biotech (India)

6.1.14.Pure Cultures (US)

6.2. Key Findings

6.3. Recommendations