Malaysia Ethanolamine Market Industry Overview, Size, Share, Growth Trends, Research Insights and Forecast (2025–2032)

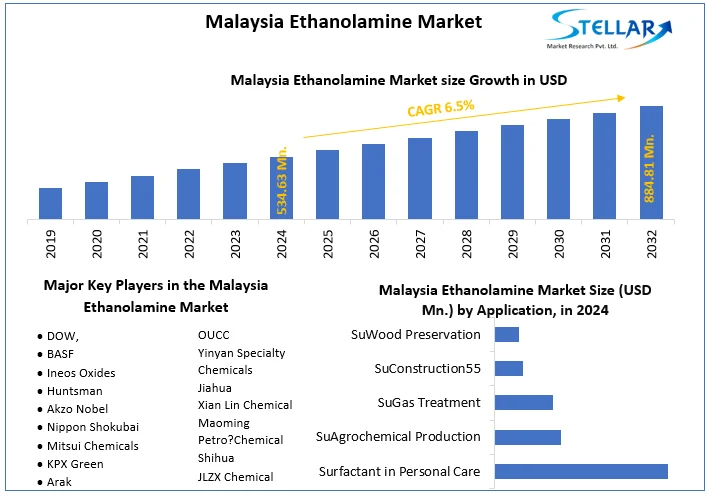

The Malaysia Ethanolamine Market size was valued at USD 534.63 Mn. in 2024 and the total Malaysia Ethanolamine revenue is expected to grow at a CAGR of 6.5% from 2025 to 2032, reaching nearly USD 884.81 Mn. in 2032.

Format : PDF | Report ID : SMR_1705

Malaysia Ethanolamine Market Overview

The comprehensive report provides a meticulous analysis of critical components, including market divisions, prospects, competitive landscape, and corporate profiles. Detailed insights are offered from diverse perspectives, considering factors like end-use industry and product categorization. Evaluation of major market players includes various attributes such as product portfolios, financial standings, and strategic approaches. SWOT analysis and competitive threats are outlined for top players and shaping subsequent marketing strategies.

The market outlook section examines growth catalysts, constraints, and trends, incorporating Porter's 5 Forces Framework and macroeconomic scrutiny. The competitive landscape segment details recent developments and industry presence. This report on the Malaysia Ethanolamine Market offers strategic insights for stakeholders and helps informed decision-making.

Additionally, Ethanolamines, synthesized from ammonia and ethylene oxide serve varied purposes like surfactants, cement grinding, and gas treatment. Agricultural and construction sectors drive market growth. The concerns arise in healthcare thanks to environmental and health implications, posing constraints. Gas treating claims about xx% of ethanolamine consumption, with substantial usage in diverse sectors including personal care, agriculture, pharmaceuticals, and pulp and paper.

To get more Insights: Request Free Sample Report

Malaysia Ethanolamine Market Dynamics:

Malaysia Ethanolamine Market Driver:

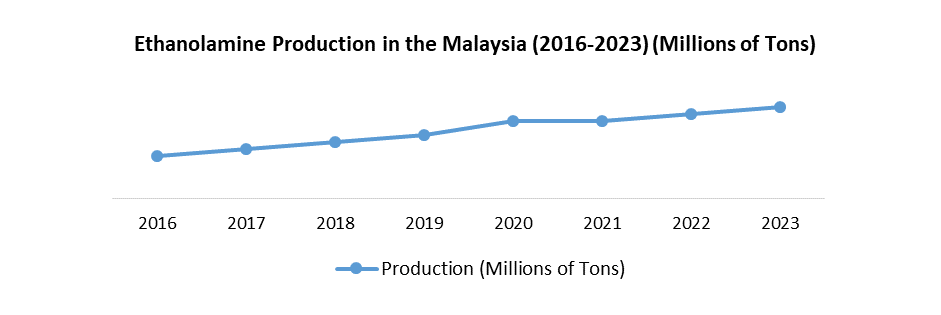

The Malaysia Ethanolamine Market witnesses rising demand thanks to its versatile applications across industries. From personal care products for surfactants to agriculture for herbicides, and construction for gas treatment, ethanolamines play a vital role. With Malaysia's increasing industries and the upward trajectory of ethanolamine, demand is inevitable. Technological advancements in the Malaysia Ethanolamine Market promise expanded production methods and enhanced applications, fostering the market growth. Innovations in production processes or novel applications within various industries optimize ethanolamine utilization leading to a more efficient market landscape and potentially greater demand.

Additionally, Regulatory support in Malaysia for green technologies or domestic chemical production bolsters the Ethanolamine Market. Also, Government policies favoring such initiatives if synchronized with ethanolamine production or usage, stimulate market growth and foster a more sustainable industry landscape, aligning with global trends toward eco-friendly solutions

The Malaysia Ethanolamine Market is influenced by the growth of key end-use sectors like construction, textiles, and oil & gas industries. As these sectors increase, the demand for ethanolamines, integral to various processes within them is expected to rise accordingly, driving market dynamics. Malaysia Ethanolamine Market holds export potential and is contingent upon production capacity and regional demand. With adequate resources, Malaysia emerges as an ethanolamine exporter, thereby influencing market size and contributing to the country's economic growth through international trade.

Malaysia Ethanolamine Market Segment Analysis

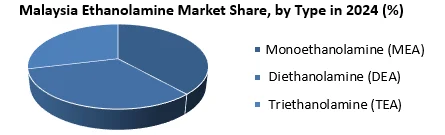

Based on Type, the Monoethanolamine (MEA) segment held the largest market share of about 60% in the Malaysia Ethanolamine Market in 2024. According to the STELLAR analysis, the segment is expected to grow at a CAGR of 6.6 % during the forecast period. Rapid technological advancements and increasing adoption of smart devices with data connectivity propel the dominant position of a segment in the Malaysia Ethanolamine Market.

In the Malaysia Ethanolamine Market, Monoethanolamine (MEA) is poised for dominance thanks to its versatility. MEA boasts a broad spectrum of applications particularly in personal care products like shampoos, soaps, and detergents, positioning it favorably compared to other ethanolamines (DEA and TEA) across various industries in Malaysia. MEA finds significant application in agriculture within the Malaysia Ethanolamine Market, particularly in herbicides and pesticides. Its efficacy in these products underscores its importance in agricultural practices, contributing to the efficiency and effectiveness of pest management strategies in crop cultivation.

Additionally, In Malaysia's Ethanolamine industry, Monoethanolamine (MEA) is integral to gas treatment processes within the construction sector. MEA's function in gas treatment improves its significance in construction applications, ensuring the efficiency and effectiveness of gas treatment processes crucial for various construction projects in the country. MEA extends its utility beyond common sectors in the Malaysia Ethanolamine Market. With applications in metal cleaning, pharmaceutical formulations, and textile processing, MEA demonstrates its versatility. Its multifaceted properties make it a valuable component across diverse industries, contributing to the robustness of Malaysia's ethanolamine market.

In the Malaysia Ethanolamine Market, MEA stands out for its cost-effectiveness compared to DEA and TEA, making it advantageous for manufacturers and users in a price-sensitive market. With many established industrial processes already reliant on MEA, transitioning to alternative ethanolamines poses challenges, maintaining inertia for MEA use.

|

Malaysia Ethanolamine Market Scope |

|

|

Market Size in 2024 |

USD 534.63 Million |

|

Market Size in 2032 |

USD 884.81 Million |

|

CAGR (2025-2032) |

6.5% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

By Type

|

|

By Application

|

|

Leading Key Players in the Malaysia Ethanolamine Market

- DOW,

- BASF

- Ineos Oxides

- Huntsman

- Akzo Nobel

- Nippon Shokubai

- Mitsui Chemicals

- KPX Green

- Arak Petrochemical Company

- OUCC

- Yinyan Specialty Chemicals

- Jiahua

- Xian Lin Chemical

- Maoming Petro?Chemical Shihua

- JLZX Chemical

Frequently Asked Questions

Stringent regulation and Rising costs are expected to be the major restraining factors for the Malaysia Ethanolamine market growth.

The Malaysia Ethanolamine Market size was valued at USD 534.63 Million in 2024 and the total Malaysia Ethanolamine revenue is expected to grow at a CAGR of 6.5% from 2025 to 2032, reaching nearly USD 884.81 Million By 2032.

1. Malaysia Ethanolamine Market Executive Summary

1.1 Study Assumption and Market Definition

1.2 Scope of the Study

1.3 Emerging Technologies

1.4 Market Projections

1.5 Strategic Recommendations

2. Malaysia Ethanolamine Market Trends

2.1 Market Consolidation

2.2 Adoption of Advanced Technologies

2.3 Pricing and Reimbursement Trends

3. Malaysia Ethanolamine Market: Dynamics

3.1.1 Market Driver

3.1.2 Market Restraints

3.1.3 Market Opportunities

3.1.4 Market Challenges

3.2 PORTER’s Five Forces Analysis

3.3 PESTLE Analysis

3.4 Regulatory Landscape

3.5 Analysis of Government Schemes and Initiatives for the Malaysia Ethanolamine Industry

4. Malaysia Ethanolamine Market: Market Size and Forecast by Segmentation (Value) (2024-2032)

4.1 Malaysia Ethanolamine Market Size and Forecast, by Type (2024-2032)

4.1.1 Monoethanolamine (MEA)

4.1.2 Diethanolamine (DEA)

4.1.3 Triethanolamine (TEA)

4.2 Malaysia Ethanolamine Market Size and Forecast, by Application (2024-2032)

4.2.1 Surfactant in Personal Care

4.2.2 SuAgrochemical Production

4.2.3 SuGas Treatment

4.2.4 SuConstruction55

4.2.5 SuWood Preservation

5. Malaysia Ethanolamine Market: Competitive Landscape

5.1 STELLAR Competition Matrix

5.2 Competitive Landscape

5.3 Key Players Benchmarking

5.3.1 Company Name

5.3.2 Service Segment

5.3.3 End-user Segment

5.3.4 Revenue (2024)

5.3.5 Company Locations

5.4 Leading Malaysia Ethanolamine Companies, by market capitalization

5.5 Market Structure

5.5.1 Market Leaders

5.5.2 Market Followers

5.5.3 Emerging Players

5.6 Mergers and Acquisitions Details

6. Company Profile: Key Players

6.1 DOW

6.1.1 Company Overview

6.1.2 Business Portfolio

6.1.3 Financial Overview

6.1.4 SWOT Analysis

6.1.5 Strategic Analysis

6.1.6 Scale of Operation (small, medium, and large)

6.1.7 Details on Partnership

6.1.8 Regulatory Accreditations and Certifications Received by Them

6.1.9 Awards Received by the Firm

6.1.10 Recent Developments

6.2 DOW,

6.3 BASF

6.4 Ineos Oxides

6.5 Huntsman

6.6 Akzo Nobel

6.7 Nippon Shokubai

6.8 Mitsui Chemicals

6.9 KPX Green

6.10 Arak Petrochemical Company

6.11 OUCC

6.12 Yinyan Specialty Chemicals

6.13 Jiahua

6.14 Xian Lin Chemical

6.15 Maoming Petro?Chemical Shihua

6.16 JLZX Chemical

7. Key Findings

8. Industry Recommendations

9. Terms and Glossary

10. Malaysia Ethanolamine Market: Research Methodology